INSURANCE MARKETPLACE SOLUTIONS

Physicians Professional Liability

When your waiter makes a mistake, you might get chicken instead of beef. When your cell phone provider makes a mistake, your calls may be dropped. When your landscape gardener makes a mistake, your lawn may burn up and have to be replaced.

On the other hand, when your physician makes a mistake, you may sustain serious bodily injury as the result of receiving the wrong diagnosis, being prescribed the wrong drug, or having the doctor tell you there’s really nothing the matter with you when in fact there is. Misdiagnosed and untreated illnesses are not the only concern. Overtreatment likewise can cause serious harm, along with the inconveniences and costs. Every day a physician must, in very short intervals, make life-altering decisions.

Bold action based on solid reasoning is required of the physician, and similar bold action is required of the insurance professional who provides the physician’s professional liability coverage.

GROWTH POTENTIAL

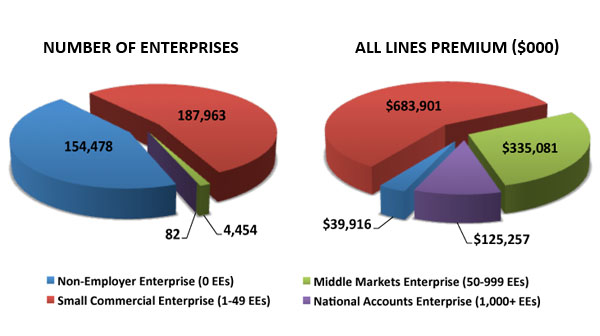

Physicians have always been (and continue to be) small businesses. While there are some national and regional physician business organizations, the vast majority (in terms of both number of enterprises and total premium) are small commercial or no-employee enterprises.

Note: The total premiums in the chart above are the all lines property and casualty premiums. They do not include professional liability premiums.

For more information:

MarketStance website: www.marketstance.com

Email: info@marketstance.com

STATING THE OBVIOUS

Physicians are trusted to make the right decisions every time. There is no room for error. They are paid to be perfect or, if not perfect, to act in a way that meets the medical community’s standards. However, these standards may change as science advances, and physicians are also expected to keep up to date through reading and continuing education.

THE HEART OF THE MATTER

Here is a possible scenario:

Millicent is an energetic and ambitious young woman who is rapidly moving up the corporate ladder. She starts most of her workdays at 5:00 a.m. and rarely ends before 8:00 p.m. She knows how important her health is and pencils in regular exams with her physician. As she heads out to catch a plane for a business trip, she calls her physician to discuss a current concern. She thinks it is a minor issue and asks him to just call in a prescription to a pharmacy near the hotel in the city where she will be staying.

Her physician listens carefully. Millicent expects him to quickly comply with her request. However, he is not her waiter, cell phone provider, or gardener. An incorrect decision on his part could derail Millicent’s meteoric rise in her career and result in a significant professional liability lawsuit.

He knows Millicent and decides to offer her some alternatives. She can schedule a visit with him when she returns. If she will be out of town for an extended time, he suggests that she make an appointment with a colleague of his in that city who can advise him of her condition. This will enable him to make an accurate diagnosis.

THE MARKETPLACE RESPONDS

In the past, the physicians professional liability market was one of the most volatile lines of property/casualty business. However, because of significant tort reform, better risk management by physicians, and improved underwriting, this line is relatively stable today.

The coverage is available in both the admitted and non-admitted markets. According to our experts, there are no particular geographic limitations.

Tony Armor, Commercial Underwriter, Business Development at Roush Insurance Services, Inc., says, “We are able to provide coverage for most types of skilled medical professionals. This includes family physicians, surgeons, anesthesiologists, OB/GYNs, and hard to place specialty practice needs. The key exposures are the legal and financial risks inherent in a patient’s claim of injury as a result of a physician’s negligence. In my experience, claims of the greatest frequency and severity occur with specialists such as OB/GYNs and surgeons. These professionals practice an invasive type of medicine that is more likely to result in patient injuries or complications.”

“We arrange coverage for all specialties, including medical directors,” explains Susan Posha, CIC, CPIW, Vice President at Arlington/Roe & Co., Inc. “We can place both standard (we may limit what states) and nonstandard/hard to place exposures (very broad availability). In addition to medical malpractice, key exposures related to a medical practice include privacy/Health Insurance Portability and Accountability Act (HIPAA) violations, employment practices liability, and compliance.”

Marie Myers, Vice President, Healthcare Division at Lexington Insurance Company, says, “Lexington can provide coverage to medical groups in virtually any medical and surgical specialty. The key exposure for physicians is the specialty and venue in which he or she practices medicine. Since Lexington arranges coverage for medical groups, other key exposures such as credentialing and supervising emanate from the legal entity that employs or contracts with physicians to provide professional services.”

Underwriters review this line very carefully. Ms. Posha explains, “Key underwriting criteria are the physician’s education, experience, scope and type of practice, and loss history. The major red flag is multiple claims.” Mr. Armor adds these criteria: “Certifications, board revocation or license suspensions, addictions and treatment for drug and/or alcohol abuse. Red flags include prior cancellations or non-renewals.”

“If prior policies are written on a claims-made basis, prior acts coverage is something to consider,” explains Mr. Armor.” For solo practitioners, coverage of substitute physicians (Locum Tenens) is available. Other options to consider are defense costs inside or outside limits of liability and medical legal expense reimbursement. Defense outside limits does not reduce the policy’s overall limits of liability. Our carriers provide limits from $250,000 to $1million per claim and aggregate limits up to $15 million.”

Ms. Posha says, “In addition to professional liability, physicians in a corporate practice should purchase general liability, package, employment practices liability, workers compensation, data privacy/security, and D&O.”

“Key elements of the Lexington Medical Group policy include professional liability, general liability, administrative proceeding defense costs, and incidental managed care errors and omissions liability. Lexington provides primary and excess liability limits up to $25 million,” according to Ms. Myers.

A common coverage gap our experts cite is prior acts or tail coverage, which is a concern whenever coverage is written on a claims–made basis. Mr. Armor explains, “If a physician changes carriers or decides to retire, this coverage is frequently overlooked. Most carriers readily provide this coverage.”

According to Ms. Posha, there is also the gap that occurs when there are changes in the status of a health center and its employees who have been deemed federal employees under the Federal Tort Claims Act. These health centers and employees lose important protections when their status changes, and that must be addressed in arranging future coverage.

Market capacity is strong. Ms. Myers says, “Even with declining direct written premiums and a number of mergers and acquisitions within this market, the physicians professional liability insurance market remains competitive with strong operating results. Healthcare providers have had strong incentives to align with regional or national healthcare systems. This trend will continue in 2012 and continue to threaten market share and reshape the medical professional liability business.”

Mr. Armor agrees that the market is competitive and adds, “One must simply take the time to shop around and find a knowledgeable agent to assist in finding the right product.”

Physicians professional liability is not written on a standard policy or coverage form. This means that retail agents must be aware of the differences in coverage when presenting alternatives to their customers. Ms. Posha explains, “Be sure you understand the difference between occurrence and claims-made coverage. Are defense costs inside or outside limits? Are defense costs capped? Watch for ’add-ons’ in the current coverage that may not be in the new coverage, especially if you are changing carriers. The physician may not need these add-ons, but make sure he or she knows that the new coverage does not include them. Be aware of extended reporting endorsement provisions. Be informed about patient data and privacy issues and HIPAA requirements. Effective risk management is the key to successfully underwriting physicians and surgeons professional liability and practice-related exposures.”

WHO WRITES PHYSICIANS PROFESSIONAL LIABILITY?

INSURANCE COMPANY

Contributing to this article:

Lexington Insurance Company

100 Summer St.

Boston, MA 02110

Contact: Marie Myers, Vice President, Healthcare Division

Email: marie.myers@chartisinsurance.com

Phone: (617) 330-4238

Website: www.lexingtoninsurance.com

MANAGING GENERAL AGENT

Contributing to this article:

Roush Insurance Services, Inc.

P.O. Box 1060

Noblesville, IN 46061

Contact: Tony Armor, Commercial Underwriter, Business Development

Email: tony.armor@roushins.com

Phone: (317) 776-6880 ext 17

Fax: (317) 776-6891

Website: www.roushins.com

WHOLESALE BROKER

Contributing to this article:

Arlington/Roe & Co., Inc.

8900 Keystone Crossing #800

Indianapolis, IN 46240

Contact: Susan Posha, CIC, CPIW, Vice President

Email: sposha@arlingtonroe.com

Phone: (317) 554-8676

Fax: (888) 552-9891

Website: www.arlingtonroe.com

|