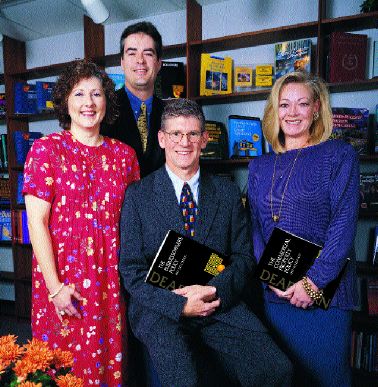

Dan Tromblay (right), Dearborn vice president, insurance products & services, meets with Rough Notes executives Sam Berman (left), vice president and chief operating officer, and Bob Ammerman, vice president.

![]() or more than a decade, and some say even longer, various sectors of the financial services industry--banks first, then securities firms and later the insurance industry--had been lobbying Congress to bring forth a law that would break down the barriers that prevented these sectors from moving into each other's territories. The major stumbling block was the Glass-Steagall Act, a Depression-era law that kept those barriers firmly in place. Financial services firms argued that, in the growing global economy, the U.S. financial services industry was at a distinct disadvantage when competing with other nations where banks, insurers and securities firms were historically and naturally intertwined. Last November, their voices were heard, and financial services modernization became law.

or more than a decade, and some say even longer, various sectors of the financial services industry--banks first, then securities firms and later the insurance industry--had been lobbying Congress to bring forth a law that would break down the barriers that prevented these sectors from moving into each other's territories. The major stumbling block was the Glass-Steagall Act, a Depression-era law that kept those barriers firmly in place. Financial services firms argued that, in the growing global economy, the U.S. financial services industry was at a distinct disadvantage when competing with other nations where banks, insurers and securities firms were historically and naturally intertwined. Last November, their voices were heard, and financial services modernization became law.

It was not an easy victory. However, with pressure from the financial services sectors, with unprecedented compromise on the part of politicians, and finally with President Clinton's signature, the Glass-Steagall Act became a thing of the past. Banks can now move into the insurance arena and securities, insurers can move into banking and securities, and securities firms can compete with the other two industries. By all accounts, it is a change of monumental importance to the American economy.

But all change comes with a price tag. In this case, the price tag promises to be a steep one. There will be regulatory issues to be resolved. With the boundary lines removed and with banks, insurers and securities firms moving into each other's turfs, what about the existing regulatory agencies? There are 50 state insurance departments that traditionally have regulated the insurance industry; likewise, there are 50 state banking departments; there is the SEC that regulates the securities industry, plus state securities agencies; and, there is the Federal Reserve and the Office of the Comptroller of the Currency, among other agencies to worry about. Until everything is sorted out, there could be a regulatory Tower of Babel in the immediate future.

There are other uncertainties. It's all well and good to say that financial services firms can cross borders, but are the participants in those firms ready to deal with products and services with which they are unfamiliar? What does a banker know about the operations of the insurance industry? What does an insurance executive know about the intricacies of banking or the securities business?

The new financial services modernization law requires an educational process, and one firm that can trace its history in the education business back five decades is positioning itself to take advantage of the opportunity.

Dearborn, a Kaplan Professional Company based in Chicago, and a leading provider of licensing training and continuing education for securities, insurance and real estate professionals, is well-positioned to be a "total education and training solution." According to Daniel Tromblay, vice president, insurance products and services, the company is moving quickly and decisively to enhance its offerings and meet the changing needs of professionals in the brave new world of full and open financial services.

Chris Jones, insurance marketing manager for Dearborn, notes that the company plans to continue expanding its partnership with The Rough Notes Company.

Chris Jones, insurance marketing manager for Dearborn, notes that the company plans to continue expanding its partnership with The Rough Notes Company.

"The insurance landscape is changing, and the path to success now winds through unfamiliar terrain," he says. "Companies are faced with selling increasingly complex products, which create complicated pre- and post-licensing education needs. Faced with these challenges, we want companies to know that they can turn to Dearborn for a complete licensing, CE and firm element solution."

Dearborn traces its heritage in the insurance educational training business to R&R Newkirk, an Indiana-based company that was started 50 years ago. In 1985, a British publishing firm acquired the business and moved R&R Newkirk's headquarters to Chicago. The British firm decided to spin off the financial services publishing business in 1990, and several parties employed in the firm decided to take it over, renaming it Dearborn. In 1998, the New York-based Kaplan, a provider of educational and career services and a subsidiary of The Washington Post Company, acquired Dearborn. Dearborn joined the Kaplan Professional unit, providing educational and training solutions to companies and individuals in the financial services, insurance, real estate, health, law and information technology industries.

"Becoming part of Kaplan was the best thing that could have happened to us," says Tromblay. "Combining our expertise with Kaplan's has enabled us to be on the cutting edge of new, evolving technologies, to enhance our existing offerings, and to expand into new markets."

Dearborn has aggressively pursued strategic alliances as one way to expand its services. Its newest such alliance is with The Rough Notes Company. Dearborn is distributing select Rough Notes property and casualty courses, co-branded with the Dearborn name. These select courses provide professionals with quality educational content as well as continuing education credit.

"We were looking for a strategic alliance that would fill out our property and casualty line," says Tromblay. "Our partner had to be a nationally recognized source for the highest quality materials. When I visited the Rough Notes exhibit at a trade show last June, I knew this company shared our philosophy and commitment."

Anne Shropshire, associate publisher for Dearborn, and Jeanne Silvis, director of compliance, were instrumental in getting state-by-state approval for the Rough Notes/Dearborn materials and making the alliance work.

"Every state has its own licensing laws for insurance agents and brokers," says Silvis. "In addition, they have rules for license renewal. For license renewal, virtually all states require the agent or broker to demonstrate that he/she has satisfactorily completed a number of hours of continuing education. We work very carefully with state insurance departments to understand their requirements for continuing education. We show each state our printed materials and our classroom training courses."

The Dearborn/Rough Notes courses have received state approval, so that agents can earn these critical continuing education credits.

So, now that Dearborn has rounded out its insurance training and continuing education program on the property and casualty side, what's next for the firm?

Says Chris Jones, insurance marketing manager for Dearborn: "We'll be getting the word out about our partnership with Rough Notes in a number of ways, including advertising, our catalogs and eventually with our Web sites. And we have plans to continue expanding our partnership. Together we'd like to develop a course for individuals seeking pre-licensing training in property and casualty insurance."

"Also," adds Tromblay, "we are expanding our delivery of products and services to include online training. In addition to textbook self-study, traditional classroom instruction and CD-ROMs, we now offer pre-licensing and continuing education programs online at www.dearborn.com, allowing companies to take advantage of the power and convenience of the Internet. The programs include online exams with instant grading, a grade book that tracks all scores, and e-mail capability to send transcripts and grades anywhere, anytime. Providing products and services in all kinds of media is critical for any education and training company seeking to be a total solution for its clients." *

©COPYRIGHT: The Rough Notes Magazine, 2000