Walter J. Gdowski (left), president and CEO of The Rough Notes Company and C.R. (Rob) Ekern, president of C.R. Ekern & Company. The Rough Notes Company sponsored the Consultative Brokerage Summit. C.R. Ekern & Co. is the Summit's founder and developer.

The idea behind the 2nd annual Consultative Brokerage Summit, held in Phoenix in March, was to bring together leading brokers, risk managers, insurance company executives, alternative market specialists and other experts to talk about the ways brokers can grow by adding value to their client relationships. For two days, more than 100 professionals discussed strategies that brokers can implement to become "consultative" rather than "transactional" brokers.

The conference was founded and developed by C. R. Ekern & Company and sponsored by the Rough Notes Company.

Kenneth H. Pinkston, vice chairman of Willis Group, Ltd., who served as keynote speaker at the conference, said, "A broker needs to be considered a partner with the client, in the same way the client's attorney or CPA is a partner." Pinkston provided the following illustration (shown in the box below) to illustrate what is happening in dealings between brokers and clients.

In the past (#1) the most important element was the relationship, followed by the conducting of the transaction, Pinkston said. Advice was least important. Then (#2) advice began creeping forward in importance but was still secondary. Now we are moving into a time, he said, when advice is paramount. "The relationship is still very important. However, if you have a great relationship but can't provide the advice, that won't be enough to keep the client."

William N. Failor, senior vice president of Marsh USA, offered further insights on where the broker-client relationship is heading, and what brokers can do to provide value-added services. One of the critical issues brokers face, he said, is how to price some of their services. "The advice and counsel brokers provide is intellectual property, and no industry is worse than we are at determining what intellectual property is worth."

On the subject of fee-based pricing, Failor suggested that brokers start by asking, "What do I need as a return on investment to keep the agency open?" One approach to determining fees, he said, is to determine the cost of providing services--such as by the number of hours involved and establishing an hourly rate. The next step, he suggested, would be to tie fees to performance--such as a setting a base fee of $100,000 which would rise to $150,000 if certain objectives are met.

Greg Sidler, of Caliper, addressed the issue of hiring and managing sales people, drawing on Caliper's widespread experience in testing insurance industry people. One measure of the accuracy of Caliper's testing is that 94% of the time when it recommends against the hiring of a sales person, and that person is hired against their recommendation, the employee will not work out.

Greg Sidler, of Caliper, addressed the issue of hiring and managing sales people, drawing on Caliper's widespread experience in testing insurance industry people. One measure of the accuracy of Caliper's testing is that 94% of the time when it recommends against the hiring of a sales person, and that person is hired against their recommendation, the employee will not work out.

Sidler said that assuming the right person is hired, the most important factor in determining the person's success will be the support he/she receives from his/her manager. "Once a person is hired," he said, "there's no such thing as a self-starter."

Nancy Carini, of Conning & Company, provided more of a macro-perspective, using Conning studies of the commercial insurance market as the basis of a forecast of what's to come. Among her observations:

--Prices are slowly moving up, but there will be no sudden changes. A Conning study predicts increases this spring of 3.9% in workers comp, .6% in general liability, .8% in commercial property and 1.5% in commercial auto. Overall, however, Carini said, "Prices are jelling, rather than hardening."

--Price increases in the traditional market could lead to a growth in market share for the alternative market. (Currently 34% of commercial premiums is written in the alternative market.) Middle market business (50 to 1,000 employees) would be affected most by any increase in alternative market business, Carini predicted. That's because the alternative market has already soaked up 80% of the larger (national) accounts, whereas only 20% of the middle market business is currently in the alternative market.

Nancy Carini of Conning & Co. predicted that growth in the small commercial accounts market would outpace that of the mid-market and large market over the next five years.

Nancy Carini of Conning & Co. predicted that growth in the small commercial accounts market would outpace that of the mid-market and large market over the next five years.

Commenting further on marketplace dynamics, Carini noted that small to mid-sized brokers are shifting their focus to try to sell larger accounts, while large and national brokers are focusing downward on selling smaller accounts. "With the economy probably cooling down in the next five years, the growth area will be small commercial accounts," she predicted, while "the middle market and large markets will stand still."

The Summit Conference also included breakout sessions focusing on specific ways that brokers can add value in client relationships. At those sessions, discussed under the headings that follow, questions were encouraged, and presenters supplemented their Powerpoint presentations with anecdotes based on everyday market experience.

The environmental coverage market

While the overall theme of the Brokerage Summit was more about finding creative approaches to managing risk than it was about identifying hot growth markets, sometimes the "consultative approach" leads brokers conveniently to hot products. According to three experts on a summit panel titled "Environmental Insurance Production: The Hidden Profit," the market for environmental coverage is growing 20% per year as opposed to a 3% growth rate for the overall property/casualty market.

One thing that makes this market so exciting, according to figures provided by panelist Julie Cully, development coordinator for Zurich U.S. Environmental, is that "70% of new environmental business is being written on first-time buyers--there are no incumbents to fight for the business." Within the pollution market, she said, "Anything related to real estate is hot. Banks provide a good entrée to the business because they require an environmental assessment in order to lend money on properties."

Zurich Environmental also is experiencing growth among traditional contractors accounts, she said.

Cully, who was formerly a broker, was joined on the panel by David J. Dybdahl, director of Mid America Environmental for Aon, and Robert Reiser of Kemper Environmental. Reiser, whose company has grown from zero to $103 million in environmental premiums in two years, said sales opportunities could arise out of a buy-sell situation when the two parties disagree on the size of the environmental liability exposure. "You can get a larger price for the seller and make sure the sale doesn't fall apart by stepping in and providing environmental coverage.

Colleges and universities are often candidates for coverage when they have property bequeathed to them, said Reiser. In one situation, he said, "Princeton University received a generous gift of property from an alum, and then it cost $7 million to clean up the site."

Both Kemper Environmental and Zurich Environmental are open brokerage markets for environmental coverage.

David Dybdahl, who has served on the Environmental Protection Agency's Contractor Indemnification Technical Review Panel, agreed with Cully that the market has become a whole lot broader than handling the obvious hazardous materials exposures. To dismiss the need to consider coverage because a company doesn't handle hazardous materials, he said, "puts the agent in the cross hairs."

And for agents who need further evidence that the environmental market is within the range of broad spectrum of risks, Zurich's minimum premiums are $5,000; Kemper's are $5,000 for environmental consultants and $10,000 for contractors.

Dybdahl suggests a sales approach for environmental coverages which is similar to what is used on other lines of business. "GL policies have auto and workers comp exclusions, so buyers purchase separate policies to fill the gap. Standard policies exclude pollution coverage, so the pollution insurance can be purchased to fill the gap."

The Bermuda market: offshore solutions for onshore risks

Pink sands ... brisk Atlantic breezes ... lush, meticulously tended gardens ... does this describe an island paradise or the site of a sophisticated and rapidly growing worldwide insurance market?

The answer is both: Welcome to Bermuda, where seasoned insurers, reinsurers, and brokers stand ready to craft creative solutions to meet the needs of onshore risks. In a presentation titled The Bermuda Market: What It's All About, three veterans of the market sought to debunk the myths surrounding Bermuda and explained the options available to U.S. agents and their clients who need alternatives to the traditional domestic market. Providing information were Roy Fellowes, managing director of HSBC Gibbs Harnett & Richardson, Ltd., a member of the HSBC Group; Paul Miller of XL Insurance, Ltd.; and Michael Hoffman, Chubb Atlantic Indemnity, Ltd.

The Bermuda market, Fellowes remarked, "is the classic story of David and Goliath," with Bermuda in the role of David and London as the mighty Goliath. "Over the last 10 to 12 years, Bermuda has established itself as a player in both insurance and reinsurance," he said. In fact, "In premium volume, Bermuda is larger than Lloyd's. In 1998, London generated premium of over $10 billion, whereas Bermuda produced $26.5 billion."

Pointing to hardening in the U.S. market for workers compensation, health care, and first-party property risks, Fellowes strongly recommended that agents and brokers investigate the alternatives available in Bermuda. "Spend half an hour with your clients talking about the Bermuda insurance market," he advised. "If you don't, someone else will." If clients show interest, "Bring them to Bermuda and introduce them to the market." The market, he noted, is accessible only through a Bermuda broker.

Roy Fellowes, managing director of HSBC Gibbs Harnett & Richardson, Ltd., encourages brokers to establish relationships with the Bermuda market.

Roy Fellowes, managing director of HSBC Gibbs Harnett & Richardson, Ltd., encourages brokers to establish relationships with the Bermuda market.

Myths about the Bermuda market persist, said Paul Miller of XL, an offshore insurer. "Bermuda is often seen as a high-excess, difficult-placement market," he asserted. "At XL we now write primary D&O, professional E&O, general liability, product recall, and EPLI, and we offer primary quota share placements on property. We're expanding our offerings to meet clients' needs, and we're becoming more flexible." In the growing EPLI arena, he notes: "Risk management is key. Know your clients' procedures, and be sure to get them in writing. We'll work with you and your client to develop a policy that truly addresses the client's exposures." In professional liability and E&O, "XL is willing to meet the need for additional capacity. Some markets are beginning to pull out because of losses in managed care and health care liability." As a result of these and other emerging trends, Miller sees an "increasing flight to quality" on the part of U.S. brokers and their clients. "XL is no longer 'the alternative market'; we're now one of the markets brokers need to consider," he said.

Assistant Vice President Michael Hoffman, who is underwriting manager-excess liability at Chubb Atlantic, described a variety of ways his company can meet the specialized needs of U.S.-based agents and clients who can't find workable solutions in the domestic market.

Chubb Atlantic, a Bermuda-based subsidiary of Chubb Corporation, offers both direct and reinsurance programs for a wide range of risks, including property, casualty, professional liability, financial institutions, punitive damages, liquidated damages, finite risk, residual value, and penalty premium protection. Limits of up to $50 million are available, and forms and policy wording can be tailored to meet clients' specific needs. Rated A++ by Best's, Chubb Atlantic has a diverse client list: financial institutions, technology, consumer goods, service providers, retailers, manufacturers, law firms, and other institutions.

The Bermuda market, all three presenters emphasized, is increasingly becoming the "go-to" market for large and mid-sized risks that need coverages and services not available from traditional insurers. For those who may be reluctant to use this flexible and innovative facility, Roy Fellowes delivered the ultimate good news: "There is no Bermuda Triangle!"

Consulting with clients on business interruption

Whatever else your commercial clients may have accomplished through corporate reengineering, they may have vastly altered their business interruption exposures. Dale H. Kolisch, PE, ARM, of Schemer Engineering, brought home that point as part of a Summit presentation titled "Business Interruption: It's More Than Insurance."

Kolisch provided the example of a company that suffers a loss to one of its manufacturing plants and is forced to shut it down. Before corporate reengineering, he said, "That plant had a sister plant somewhere else in the U.S. making the same product and running at only 60% capacity. But does that sister plant exist today? Probably not.

John Love, of AH&T Technology Brokers, Leesburg, Virginia, explains the intricacies of providing D&O coverage for companies undertaking an initial public offering of stock.

John Love, of AH&T Technology Brokers, Leesburg, Virginia, explains the intricacies of providing D&O coverage for companies undertaking an initial public offering of stock.

Another reason why corporate reengineering should raise a red flag, he suggested, is that it often includes outsourcing. "The company now relies on a vendor to provide things it previously was producing in-house."

That creates a possible need for contingent business interruption coverage. The client also may have shifted from using multiple vendors to a single vendor.

"Are you getting to know these vendors," Kolisch asked brokers in the audience. "Do you know what kind of protection they have?"

Another increase in BI exposure has developed, Kolisch said, as a result of businesses adopting "just in time manufacturing and inventory." In the auto industry, for example, an order might come in every 90 seconds, so the component part has to be on hand so it can be shipped to the customer the same day.

Today's commercial clients also are increasingly vulnerable to utility interruptions, Kolisch pointed out. "Were we as dependent on telecommunications (phone fiber optic lines, satellite) five years ago as we are today?"

"What about electric power?," he continued. "I had a client who had a great cogeneration operation on their facility. It saved them a lot of money. I asked them one day, 'What happens if you lose that cogeneration operation?' The plant engineer thought about it and finally said, 'We'd have to shut the plant down. We can't buy enough power from the local utility. That was part of the reason we put in the cogeneration operation.'"

Kolisch urged brokers to bring new BI-related issues to the table, even if they go beyond what is normally thought of as BI exposures. For example, he said, "Let's say a dot-com company builds a warehouse throughout the summer, a highly automated operation to distribute products it's going to sell over the Internet. It is damaged during construction, so the warehouse isn't going to be there for the Christmas shopping season. Is that loss of market share or market share that just doesn't develop?"

John Dempsey, CPA, CFE, managing partner of Dempsey Myers & Company, a national accounting firm specializing in business interruption claims, explained some of the intricacies of the BI loss adjustment process. It involves a lot of fact-finding, subrogation, paperwork and negotiation. "All claims above $50,000 will be audited by the insurance company," he said.

Among the advice he passed along concerning claims on middle market accounts:

"Don't swallow the adjuster's statement that 'It's always done this way.'--It's not always done a certain way.

Rob Ekern describes today's consultative broker as a "gatekeeper of resources."

Rob Ekern describes today's consultative broker as a "gatekeeper of resources."

"Submit the claim as soon as possible following the loss. That's because the insurance company will take as long to audit the claim as the insured takes to submit it."

The number of firms that do accounting claims preparation work is on the rise, Dempsey said. They include not only the biggest national accounting firms but also Marsh. One of the reasons for this growth, he says, is that "coverage is written into the policy for fees." About 40% of the fees of Dempsey Myers are ultimately paid by an insurance company as part of the overall settlement.

Dempsey's firm has handled more than 600 business interruption claims. On one large claim stemming from Hurricane George, the client was a sugar cane operation in the Dominican Republic. It took a year and a half to settle, and while the negotiations were proceeding the insured received three advances from the insurance company totaling $65 million. "On the final day before the settlement was reached, there was an $8 million swing," Dempsey said.

Persistent negotiation pays off, he emphasized. "Somebody has to be the squeaky wheel to make sure your client gets what he deserves."

D&O for IPOs: Market on the move

Venture capital ... e-commerce ... initial public offerings. These are the terms that define the marketplace of the new millennium, and they also create attractive opportunities for agents who can identify and address the needs of companies that are planning an IPO--specifically with respect to directors and officers liability insurance. This complex process was described in detail by John Love, who specializes in commercial property/casualty insurance for technology-based clients of Armfield, Harrison & Thomas of Leesburg, Virginia. AH&T was named one of the top 10 U.S. D&O brokers in Watson Wyatt Consulting's annual survey.

"The market is moving at Internet speed," Love declared. "Netcentric business-to-business marketing is driving the economy; business-to-consumer marketing isn't getting funded." Calling 1999 "a banner year in venture capital," he noted that VC contributed $48.3 billion in investments and that fully 50% of IPOs were funded by venture capital.

What, exactly, is an IPO? Simply put, it's the process by which a privately owned company seeks to generate capital by offering shares of its common or preferred stock for sale to outside investors. For sheer stress and tension, Love remarked, it would be hard to find the equal of an initial public offering. "An IPO is probably the most grueling experience a company will ever go through," he said. "It causes executives more stress than health problems or divorce. People will change during the process."

John Cooney, president of CRC Insurance in Birmingham, Alabama, tells brokers the marketplace is headed for "a return to professionalism and commonsense business practices."

John Cooney, president of CRC Insurance in Birmingham, Alabama, tells brokers the marketplace is headed for "a return to professionalism and commonsense business practices."

Providing directors and officers liability to a company that is planning an IPO offers agents both a challenge and an opportunity, Love commented. Before entering this complex arena, he said, agencies should ask themselves a number of questions. First, do you currently handle any publicly traded clients? How many public companies are located within your sales territory? (Don't forget the Internet and affinity group endorsements.) Have you educated yourself about D&O forms, terms, and conditions? How will you approach markets: directly or through a wholesaler? What is your "edge": why should a prospect choose your agency instead of a competitor?

Next, Love advises, define your approach. Do you want to specialize in D&O or make it an adjunct to the main lines you're already selling? "Few brokerages do only D&O," he commented. "If you have a niche-food service, manufacturing--expand it nationally in D&O." Further, what size account and what industry(ies) do you want to pursue? (For example, just IPOs, single industry, small cap, venture capital-backed, strong financial performers, clients of a particular law firm, etc.)

AH&T strives to educate clients about D&O before, during, and after the sale, Love said. "Most of our deal flow comes from free educational seminars we do for law and accounting firms," he remarked. "These people are glad to talk to you; you're providing information they need and didn't know."

In the D&O arena, who you know is as important as what you know, Love emphasized. "I recommend you cultivate some 'best friends': law firms and accounting firms that target early-stage entrepreneurs, and venture capitalists and investment bankers who may be able to bring you in at a later stage."

Your marketing approach, Love explained, depends on whether you're dealing with a pre-IPO prospect for whom you currently write no lines of insurance or with a current client. In either case, he said, it's essential to emphasize that your agency's experience and reputation are secondary to your commitment to the client. "Make it personal," he advised: "I'm eager to protect you, and I'm excited to see you being successful."

Jane Calley of Brewer & Lord, LLP, Norwell, Massachusetts (left) discusses conference resources materials with Nancy Carini of Conning & Co.

Jane Calley of Brewer & Lord, LLP, Norwell, Massachusetts (left) discusses conference resources materials with Nancy Carini of Conning & Co.

An agency may have clients or prospects who aren't currently planning to launch an IPO, Love said--but meeting their needs now will give you the edge if and when they do take the step. "For private companies, E&O is more important than D&O," he observed, "but they'll need D&O when they go public. I educate them about that."

When dealing with a company that's planning an IPO, Love said, agents need to keep a few things in mind. "Executives are under severe pressure and strain; they may delegate things to people you don't know," he cautioned. "In turn, those people won't know who you are or that this [D&O] is being taken care of." In addition, he noted, "At least one external player will have another agent he/she wants to look at the program. Root this out. Expose the fallacies of the other agent's positioning." Finally, "Repricing and changes in the IPO date always happen." The bottom line? "Expect the unexpected."

International market--seizing control of growing opportunities

The way David Hokanson sees it, an individual broker's decision to participate or not participate in the international market is a pretty simple one. "Conservatively speaking, six of ten businesses today are global in scope," he says. "So if you're not in the international market, you're going to miss a lot of business."

Hokanson, who as president of Assurex Global Services, travels the world helping Assurex members set up international insurance programs, provided the Summit audience with a walk-through of four major coverage options for businesses with international exposures. Each option provides inherent advantages and drawbacks, Hokanson said.

Option #1, which Hokanson said was the most common arrangement, may provide various excess and DIC coverages. Its primary purpose is to provide coverge for employees traveling overseas (nonowned and hired auto, third party liability, foreign voluntary WC), the sale of products from the contract's home country, etc. Potential weaknesses of this option include: Premiums may not be tax deductible; premiums may not be collectible from local subsidiary; local service is lacking.

Option #2 is a totally localized program offered on a local admitted basis. It includes full negotiation of terms, rates and policy wording. This prevents a situation such as might occur in Mexico where statutory auto limits are $25,000 and a company with a $1 million umbrella could wind up with a $975,000 gap. The drawbacks of this option, Hokanson explained, include: limited loss engineering, a lack of volume discount; a lack of consistency in coverage from country to country.

Option #3 is a non-interactive combination of the first two options.

Option #4 is a controlled master program that features a combination of nonadmitted and local admitted programs. It features uniform coverage and central negotiation. Only the major international insurers will offer this option, Hokanson said.

David Hokanson, president of Assurex Global Services, explains four major coverage options for businesses with international exposures.

David Hokanson, president of Assurex Global Services, explains four major coverage options for businesses with international exposures.

The excess-surplus market: power tool for retailers

One of the most powerful tools available to retail producers is the excess-surplus market, which affords access to coverage forms and approaches that standard carriers can't provide. Between 1987 and 1998, the E-S market grew almost 45%, from $6.5 billion to $9.5 billion in U.S. direct written premium. In a presentation titled The Surplus-Excess Marketplace: Maximize Your Capabilities, two veteran surplus lines brokers outlined the dimensions of this eclectic marketplace, described the functions of several kinds of wholesalers, and offered advice on choosing and dealing with managing general agents, underwriting managers, program managers, Lloyd's brokers, and other intermediaries. Sharing their insights and expertise were Tim Pederson, president of Travis-Pederson & Associates, Inc., of Chicago; and John Cooney, president of CRC Insurance, Birmingham, Alabama.

Noting that the freewheeling, take-all-comers market of the past several years is finally coming to an end, Cooney said, agents and brokers can anticipate "a return to professionalism and commonsense business practices," such as disciplined underwriting. "If you're not ready, do it now," he cautioned. "Prepare your clients for the next phase of the marketplace." Pointing out that "there are great opportunities for independent retailers to compete with national brokerages," Cooney encouraged brokers to "choose a wholesaler based on your strengths as well as your weaknesses. You should know your wholesaler as well as you know your employees." As wholesalers, he emphasized, "We work for you. Your strengths and the strengths of the wholesaler can give you a killer advantage."

Because excess-surplus lines business is not subject to rate and form regulation, a common misperception is that the E-S market is a freewheeling, virtually unregulated insurance mega-mall. Nothing could be further from the truth, Pederson and Cooney emphasized. On the contrary, surplus lines carriers are regulated by the states, and business can be placed only by specialty licensed brokers with eligible companies. Before a risk can go into the E-S market, the retail producer must provide an affidavit stating that the standard market has rejected the risk. Surplus lines taxes are paid by the insured and remitted by the surplus lines broker. In terms of strength and stability, domestic surplus lines companies can point to a median Best's rating of A, compared with a median of A- for admitted carriers.

Tim Pederson (left), president of Travis-Pederson & Associates, Inc.; and John Cooney, president of CRC Insurance, explain the multifaceted role of excess-surplus lines brokers.

Tim Pederson (left), president of Travis-Pederson & Associates, Inc.; and John Cooney, president of CRC Insurance, explain the multifaceted role of excess-surplus lines brokers.

Why should retail producers use the surplus lines market? For several reasons, Pederson and Cooney suggested.

* Provides freedom from rate and form regulation.

* Serves as a "safety valve" for commercial lines customers during tightening or changing market cycles.

* Acting as an "incubator," develops and offers new products to insurance buyers, until (if ever) the products become mainstream coverages available through admitted carriers. Examples are employment practices liability, professional liability (e.g., architects and engineers), pollution liability, and cyber-liability.

* Provides markets where admitted carriers do not--for example, specialty coverages, geographic opportunities (e.g., home construction defects liability in California, where problems have arisen in the standard market).

* Helps retail producers provide better service to customers.

Based on their years of experience working with retail producers in the surplus lines market, Pederson and Cooney offered valuable guidance for retailers in the form of a comprehensive list of do's and don'ts.

At left: Arlene Uchigakiuchi and Eric Teragawachi of Mutual Underwriters in Honolulu, Hawaii, discuss the market with Larry France, editorial director of The Insurance Marketplace. At right: Walt Gdowski, president and CEO of The Rough Notes Company welcomes participants to the Summit.

At left: Arlene Uchigakiuchi and Eric Teragawachi of Mutual Underwriters in Honolulu, Hawaii, discuss the market with Larry France, editorial director of The Insurance Marketplace. At right: Walt Gdowski, president and CEO of The Rough Notes Company welcomes participants to the Summit.

Do

* Establish an ongoing working relationship with quality wholesalers.

* Qualify the wholesaler's interest and ability to help on any given account prior to submission.

* Discuss problems and prospects ahead of time if possible.

* Provide a complete submission, including the complete application.

* A new retail broker replacing an incumbent retailer for a given market must provide a broker of record letter signed by the insured.

* Determine which market(s) the wholesaler will use, and expect a response from each market so you can keep your client informed.

* If you approach two wholesalers on the same account, use the same underwriting information/submission for both.

* Last-minute deals can be great opportunities because needs tend to be defined; please call your wholesaler.

* Place your orders in writing, and get written confirmation of binding from the wholesaler.

* Ask your wholesaler what revenue opportunities he/she may recommend for your agency.

Don't

* Flood the market with duplicate submissions.

* Allow multiple wholesalers to approach the same markets. This will reflect badly on you and the insured in the eyes of most underwriters. Companies don't like to get in the middle between two good wholesaler brokers.

* Advance the premium for the insured; the brokerage market might not give it back if something goes wrong.

* Forget to call your wholesaler.

Alternative risk handling tools

A broker's work becomes consultative when the broker offers the client multiple options for handling risk and for financing the way that risk is managed. Two speakers at the Summit, one from the company side of the market and one from the brokerage side, provided a summary of nontraditional risk handling alternatives.

Dave Kuhn, vice president of Hartford Specialty's Western Region, focused on loss responsive plans including retrospective rating; compensating balance (used primarily with retrospective rating); various large deductible plans; and self-insured retentions. He listed five characteristics of large deductible plans which he described as advantages: "1) They provide cash flow; 2) they have lower frictional cost; 3) they have a flexible rating formula; 4) you can offer a buy-out on a deductible; and 5) they provide the advantages of self-insurance without having to go through some of the administrative issues and regulatory approval."

The disadvantages of a large deductible program, Kuhn said, are: "They appear complicated compared to a pure cost program; some financial security/letter of credit/bond will be needed; and there could be unpredictable loss payment because you're paying for losses as you go."

More than 100 professionals attended the 2nd annual Consultative Brokerage Summit.

More than 100 professionals attended the 2nd annual Consultative Brokerage Summit.

Kuhn explained another twist to a large deductible--the pre-funded large deductible: "It's just like a deductible except the losses are more predictable. You're pre-funding some amount of the losses and passing that money on to the carrier which holds it and the premium is discounted for the insurance company's investment income."

Phillip Stevens, who is responsible for rent-a-captive activities at Aon, said rent-a-captives can be an alternative to the high SIR or retrospective rating plan. Aon manages two rent-a-captives in Bermuda and one in the Cayman Islands, and they do business with independent agents--with the agent continuing to be the agent of record. If independent agents do establish a rent-a-captive program with Aon, Stevens said, "There's always a confidentiality agreement as well as a non-compete agreement ..."

Stevens explained that customers often come to a rent-a-captive "to put their toe in the water--testing to see whether a captive environment makes sense for them--without actually having to form one. For agents, Stevens said, agency rent-a-captives are a profit center because whether the captive is formed for homogenous risks or heterogeneous risks, "the agent is a recipient of the underwriting profits and investment income."

Stevens ran through some numbers as to how the rent-a-captive revenues are divided among the loss fund and the expenses for fronting, taxes, commissions, claims, reinsurance and management fees. In discussing the mechanism for risk retention and transfer, he emphasized, "Reinsurance underwriters want to see the client/shareholder have some skin in the game. They want to see the client suffer some loss and not just capitulate the program to an aggregate stop loss underwriter who's going to step in and drop down to a first dollar as soon as their rent-a-captive funds are depleted."

The rent-a-captive: A win-win for mid-market risks

Captive insurance, once available only to the likes of the Fortune 500, is becoming an increasingly attractive option for middle market clients and their agents. In a presentation titled Middle Market Captives: Solutions for a Changing Marketplace, John M. Foehl, Jr., of Tillinghast-Towers Perrin, described the various captive structures available and outlined the mechanism and advantages of the rent-a-captive, an affordable and profitable opportunity for mid-market business.

Left: Al Rhodes, president and senior actuary of Sigma Actuarial Consulting Group, Nashville, Tennessee, describes the software tools created by Specific Software Solutions to enhance the risk management services brokers provide their clients. Right: Alison Bowman, director of membership for the Council of Insurance Agents and Brokers, explains the membership criteria and the benefits of belonging to CIAB.

Left: Al Rhodes, president and senior actuary of Sigma Actuarial Consulting Group, Nashville, Tennessee, describes the software tools created by Specific Software Solutions to enhance the risk management services brokers provide their clients. Right: Alison Bowman, director of membership for the Council of Insurance Agents and Brokers, explains the membership criteria and the benefits of belonging to CIAB.

In its purest form, Foehl said, a captive insurer is an entity formed and owned by its policyholders for the sole purpose of insuring the parent's risks. A single-parent captive insures the exposures of only one entity and is used only by the very largest companies; a group captive insures the risks of several entities and tends to be used primarily for homogeneous exposures. The "new kid on the block," relatively speaking, is the rent-a-captive; and it's this approach, Foehl said, that's rapidly gaining popularity among middle market agents and their clients.

A rent-a-captive, he explained, is formed in the same manner as a traditional captive, but it's owned by a third party instead of by its policyholders. As its name implies, the rent-a-captive rents its capacity to provide insurance. The policyholders have no ownership or voting rights. This approach has three advantages that make it particularly attractive to middle market risks, Foehl noted: low or no startup costs, low annual operating costs, and flexibility. Recently, he said, "Rent-a-captive demand has exploded, because of commission cuts and also because of the growth of insurer Internet sites selling direct to customers." Agents who are feeling the squeeze can take their best business, put it in a rent-a-captive, and control the business. "It's perfect for agents whose clients can't afford to form their own captive and don't know how to go about forming a group captive," Foehl said.

Here's how a rent-a-captive works in practice:

* For a fee, the captive rents out its capital, surplus, and legal capacity to provide insurance.

* A fronting carrier issues policies, using current forms.

* The carrier cedes premiums to the rent-a-captive based on the amount of retention.

* The rent-a-captive acquires reinsurance for losses in excess of aggregate retentions.

* The renter must provide a letter of credit or establish a trust account against aggregate losses.

* Investment income is added to the trust account.

The rent-a-captive option is extremely appealing to both middle market clients and their agents, Foehl asserted. First, it provides stability and eliminates the uncertainty of the annual renewal process. Second, it offers the client a degree of control and influence that's not available in the traditional insurance market; the client is involved in the decision-making process and enjoys the benefits of coverage and service tailored for his/her business. Last, but by no means least, are the attractive financial incentives afforded by the rent-a-captive structure, which allow the client to participate in both underwriting profit and investment income.

For the agent or broker with profitable mid-market clients, building a partnership with a rent-a-captive is well worth the effort, Foehl said. First, it allows the agent to provide additional value to clients and aids in the transition to the role of risk manager. It's also an excellent way for the agent to solidify existing relationships with clients by allowing them to share in the control of their risks. What's more, it's a proven way for agents to create new sources of revenue in cooperation with the rent-a-captive.

Simply put, Foehl concluded, the middle market rent-a-captive is the quintessential win-win situation.

Employee benefits--a broadening array of opportunities

Eldon Oldre, a principal in CFG Insurance in Minneapolis; and John Kirwin, of Pointsure, a wholesaler subsidiary of Kemper, described for the Summit audience their respective ventures in employee benefits and human resources counseling. Oldre's agency has developed in-house expertise in benefits and HR. Arganbright's firm provides brokers with these services on an unbundled basis. From both of them, the message was clear: These services can dramatically boost a broker's value to the client.

Oldre began his career in the life business before founding his multiline agency in the mid-'70s. The agency's work in benefits consulting began when Minnesota passed a continuation of benefits law, followed on a national level by the passage of COBRA. CFG provided fee-based administration services enabling employers to comply with these laws.

Then, consolidation in the health care marketplace led the agency to offer additional value-added services. "In the health care marketplace there were three dominant HMOs and self-funded plans, so it was difficult for a broker to differentiate itself on the basis of product and pricing. We decided that we would put even more emphasis on providing value-added services. Clients kept telling us about their problems with hiring the right people, and other employee-related issues, so we began offering human resources-related services."

The agency provided, on a fee basis, aptitude and personality tests for employees and assistance in creating employee handbooks. Eventually, Oldre said, "Clients who did not have a professional HR staff began calling us with HR questions, so we established an HR hotline, utilizing an attorney we had on our staff. At first the hotline was free. Most clients did not use it, but those who did liked it. Then we began charging for it, and the use of the hotline increased."

Among the potential side benefits to this human resources counseling, Oldre said, "The hotline product has the potential for becoming a national product."

Oldre cautioned brokers who expand into human resources counseling to be prepared to pay a higher errors and omissions premium. Also, he said, not all clients will readily accept fees, especially if they can find someone who will provide a service at no cost.

For brokers who recognize the value of HR counseling services to their clients, but are looking for more outside help in providing them, John Kirwin, of Pointsure, explained how his company works with brokers--providing some of the same HR services which Oldre does and at least one different one. The latter is a hotline/action line designed to be utilized by employees, rather than the employer. Employees call to report problems at their place of employment, including sexual harassment, drug and alcohol abuse or unsafe work conditions.

Kirwin explained that the hotline grew out of concern for compliance with the 1998 Supreme Court ruling on sexual harassment. The ruling lists three actions which an employer must take to provide a preemptive defense in a sexual harassment claim. One of those actions is "to provide a means for employees to report incidents to a third party without fear of reprisal."

The phone calls can come from a victim or from someone else at the company who witnesses an offense. Kirwin said the utilization rate of the hotline is about 2%. The callers can remain anonymous, and a designated official at the employer company receives the confidential report on the call.

Pointsure's hotline service and other HR-related services it provides to brokers are designed to make the broker a more valued member of the client's team. "The HR department of a company, regardless of size, is the last department to get any resources," Kirwin said. "They're inundated by federal rules and state rules. We want to make sure we're adding value to that department and covering the overall risk management approach."

London Capacity: The Direct Approach

For most of the last 15 years, property/casualty capacity has been anything but a problem for U.S. agents and brokers. As segments of the domestic market begin to harden, however, producers may find themselves dealing with underwriters who are much less willing to compete for their business. No one expects the return of a mid-1980s-style capacity meltdown, but prudent agents are building bridges to new markets that can help ease the strain caused by a shrinkage of domestic capacity.

One such source is London, which as the world's oldest insurance market can't be called new, but which nonetheless is unfamiliar to many U.S. agents and brokers. Tony Harris, executive director of Willis, Ltd., outlined the dimensions and functions of the London market and described a number of ways in which its brokers and insurers can be valuable partners for U.S. producers. "Develop direct relationships now," he urged. "As the market hardens, these brokers will continue to provide you capacity." (Note: Except for Lloyd's syndicates, the London market is accessible only through London brokers.)

The Lloyd's market, Harris explained, consists of 122 syndicates and 160 Lloyd's brokers and has total capacity of $16.6 billion. Except in Kentucky and Illinois, Lloyd's is an approved surplus lines market. Lloyd's corporate capacity investors are primarily major insurers: ACE, AEGIS, CGU, Gerling Global, QBE, St. Paul, Terra Nova (Markel), and XL Capital. In addition to Lloyd's syndicates, the London market consists of 120 insurers and reinsurers, plus 39 marine protection and indemnity (P&I) clubs.

Why use the London market? Harris offered several compelling reasons:

* Quick response to submissions

* Ability to think "out of the box": no underwriting manual

* Willingness to develop new or unique wordings

* Able to commit R&D expenditure for the "right" accounts and programs

* Competitive revenue structure: higher commissions than are available in the U.S. standard market

The London market offers a wide variety of property and casualty programs:

* Personal lines: high-value homeowners for catastrophe-prone areas, including coastal properties

* Property: habitational, commercial, financial institutions

* General liability: slip and fall exposures (no manufacturing or products liability)

* Packages: property, GL, E&O, D&O, crime

* Employee benefits: AD&D, medical expenses

* Financial risks, including electronic and computer crime, Internet crime, and e-commerce risks

* Professional indemnity: lawyers, insurance brokers, MGAs; construction-related risks; miscellaneous E&O classes

* D&O liability

* Employment practices liability: all industries/businesses considered

What does the future hold for the London market? "Lloyd's syndicates are able to write all forms of coverage," Harris said, adding that a U.S. agent can go directly to a syndicate without using a Lloyd's broker. He also foresees greater use of electronic risk placement and the establishment of closer links between underwriters and production sources. *

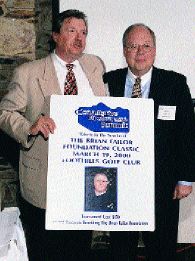

The Brian Failor Foundation Classic was held at the Foothills Golf Club in Phoenix, Arizona, to kick off the Consultative Brokerage

Summit 2000 in March.

Summit 2000 in March.

The event was organized to raise funds for the Brian Failor Foundation. Brian Failor is a young man who is heroically battling muscular dystrophy. The Foundation is a non-profit organization that supports a number of Brian's selected honorable causes and organizations.

Twenty-five participants, including presenters and sponsors, attended the event. Prizes were awarded for closest to the pin on a par three hole and for the longest drive on a par five hole.

Rob Ekern, founder and developer of the Consultative Brokerage Summit, left, and William Failor, Brian's father.

©COPYRIGHT: The Rough Notes Magazine, 2000