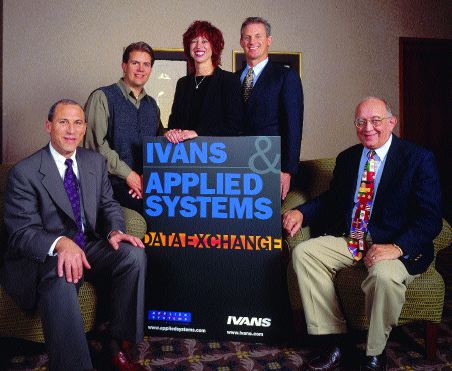

IVANS' and Applied Systems' executives who announced the operating agreement to the insurance industry include (seated left) Doug Johnston, executive vice president, company products and e-commerce for Applied Systems; (standing left) Pat Kellner, president, company products and e-commerce for Applied Systems; Anna England, vice president, e-business solutions for IVANS; Jim Kellner, chairman and chief executive officer for Applied Systems; and Carl Scheider, divisional vice president, chief technology officer for IVANS.

In the Bible story of Babel, construction efforts on a giant tower came to an abrupt halt when its creators suddenly could no longer communicate with each other. Without a common language, they could not coordinate their work and keep the project growing.

Two leading insurance industry technology companies are attempting to make sure that cautionary tale never applies to agents, insurers and the customers they share.

In October, IVANS, Inc., based in Greenwich, Connecticut, an e-business and technology integrator, and Applied Systems, Inc., based in University Park, Illinois, an agency management systems developer, announced a landmark operating agreement aimed at building a consolidated communications infrastructure for the insurance industry.

The proposed data communications system would allow both real-time online and mailbox-based transactions between agents using their own agency management systems and individual insurance company automated processing systems.

"It is important that we work together in the creation and deployment of new and exciting technologies that will forge new standards for SEMCI and e-commerce."

"It is important that we work together in the creation and deployment of new and exciting technologies that will forge new standards for SEMCI and e-commerce."

The system would not only create a single entry, multiple company interface for agents, but also would permit them to send data directly from their office databases to insurers and allow insurers to respond with online application approvals and final policies immediately using all of the data standards approved by ACORD.

The companies will launch the communications system in January with electronic commerce support for five product lines: workers compensation, business owners package, personal auto, homeowners and commercial auto insurance. However, the system will not be limited to insurance policy applications and issuance. The system also would permit online data and financial transactions with other industry partners, a resource that will help agents and insurers build electronic commerce on the Internet, says Dan R. Carmichael, IVANS chairman. "This operating agreement will provide the industry with a common platform using best-of-breed technologies to conduct EDI (electronic data interchange) transactions as well as real-time Internet transactions, ensuring that we are not creating separate channels and that the insurance industry is tightly integrated," he says.

Carmichael, president of IVANS since 1995, joined Ohio Casualty Insurance Co. as president in December but remains chairman of the technology company board. Robert R. Payne succeeds him as IVANS president and CEO.

"The operating agreement creates a communications platform that is a natural step in the technological evolution of the insurance industry."

"The operating agreement creates a communications platform that is a natural step in the technological evolution of the insurance industry."

Applied Systems Chairman and Chief Executive Officer James P. Kellner says the operating agreement signals a new era for both companies and the insurance industry which has lacked effective single-source data communications and an effective, secure platform for Internet-based electronic commerce. "IVANS brings to the relationship a long history of communications and data exchange management that has been critical to the success of our agency and company customers," he says. "It is important that we work together in the creation and deployment of new and exciting technologies that will forge new standards for SEMCI and e-commerce."

The proposed communication system will be built around a new agency/carrier/third-party data exchange that uses IVANS' network technology that has been developed over more than 15 years, and Applied Systems' transaction technology built for the company's agency management and insurance company processing systems.

"The operating agreement is a perfect fit for IVANS which has been developing and maintaining a range of network communications as an e-business integrator for the insurance industry and has a broad base of insurance company customer participation," says Carmichael.

"The new communication infrastructure will enable both companies and their agency partners to not only share data but also to process real-time insurance transactions."

"The new communication infrastructure will enable both companies and their agency partners to not only share data but also to process real-time insurance transactions."

IVANS has long been in the forefront of network design using industry data standards developed by ACORD, including the most recent AL3 standard for direct data communication and extensible markup language (XML) for Internet-based applications.

Carmichael notes that the company also manages multi-purpose data communication networks that include frame relay and other broadband data communication as well as digital subscriber line (DSL) high-speed Internet communication used by insurers, health care companies and other insurance industry vendors for proprietary communications.

The operating agreement also creates a communications platform that is a natural step in the technological evolution of the insurance industry, explains Anna England, vice president of e-business solutions in the IVANS Cincinnati, Ohio office.

"The insurance industry is moving along a technology migration path to e-business," England says. "Right now, there are various components of systems in place that are performing diverse insurance functions. Some agents and insurers are performing upload and download of application and policy information, for example.

"Many insurers also have proprietary Web sites for their agency communications. Many agencies are using third-party rating devices to price coverage with multiple insurers over the Internet," she continues.

"Whether you're a carrier or an agent, the common communication infrastructure will improve your overall efficiency ..."

"Whether you're a carrier or an agent, the common communication infrastructure will improve your overall efficiency ..."

Third-party entrepreneurs have attempted to create Internet portals that allow agents to communicate with a group of insurers hosted on a single site, but these Internet sites lacked data communication consistency, she says.

But what the industry has lacked is a seamless and efficient data exchange that can extract customer information from an agency management system based in agency offices and communicate the data directly into insurance company automation, she says.

"What we are doing is creating a true communications infrastructure, not just a portal. Companies and their agents will be able to communicate in real-time or through a convenient mailbox structure--whatever works for their interaction. The infrastructure will allow Internet communication applications as well as proprietary communications between agents, insurers and third parties.

In October, IVANS also announced an alliance with Microsoft Corp. to work together in application development for the insurance industry applications, including next-generation agency/company interface, Internet application hosting, report generation and other applications using Microsoft development products.

Applied Systems brings its latest agency management system and its new multi-insurer, multiline real-time transaction processing system, WARP Central. In May, Applied Systems demonstrated a pilot WARP system by simultaneously processing a range of transactions with three test insurers.

WARP uses XML to coordinate insurance customer information for policy rating, underwriting, policy issuance and billing and claims inquiry.

"WARP is breaking down the barriers of today's disconnected insurance distribution system and implementing a new era in insurance industry communication. With WARP, the new communication infrastructure will enable both companies and their agency partners to not only share data but also to process real-time insurance transactions," says Douglas W. Johnston, executive vice president of Applied Systems' company systems division.

Patrick J. Kellner, president of Applied Systems' company services and e-business division, says the marriage of the WARP Central system with IVANS communication and data management technology creates a robust platform that will increase efficiency on both sides of the agency/company relationship.

"Whether you're a carrier or an agent, the common communication infrastructure will improve your overall efficiency--not just by reducing the number of employees involved in each transaction but also by creating multiple product and service opportunities," he says.

The system will support added transactions including direct billing, policy information inquiries and claims status inquiries, increasing the level of service agents can offer their customers. Agents will be able to access their insurers at any time from any desk in their office, providing customer service at an extended range of hours.

Insurance companies also benefit by eliminating the re-keying of data for underwriting and policy issuance and also by increasing the efficiency of product distribution--making more products available at more hours to a wider group of agents.

Pat Kellner says the new system will reduce agency and company costs by 20% to 30% for existing functions and support future e-commerce functions.

"It's well documented. E-commerce saves money," he says.

Applied System's Johnston agrees. "The new infrastructure will provide more than just a secure connection between agents and their carriers. It will also be a platform for more functions shared by agencies, companies and their customers."

Applied Systems also announced in November a strategic partnership with Data Transit International to host the company's The Agency Manager system for virtual access. Agents will be able to enter and retrieve customer information into the Applied Systems TAM database from an Internet-connected computer to an outsourced host computer--eliminating the need for TAM in their own offices.

"An ASP environment is an ideal opportunity for the insurance industry to maximize its internal efficiency and to focus on its core competencies," notes Jim Kellner. "The ASP model lowers the total cost of ownership by removing the extensive costs in establishing and maintaining IT infrastructures," he says. *

The author

Len Strazewski is a Chicago-based freelance writer specializing in marketing, management and technology topics. In addition to contributing to Rough Notes, he has written on insurance for Business Insurance, the Chicago Tribune and Human Resource Executive, among other publications.

For more information:

IVANS

Cincinnati, OH

Contact: Anna England

Phone: (513) 943-8824

E-mail: anna.england@ivans.com

Applied Systems

University Park, IL

Contact: Doug Johnston

Phone: (800) 999-5368

E-mail: djohnston@appliedsystems.com