Independent wholesaler Burns & Wilcox brings

savvy and clout to difficult risks

By Elisabeth Boone, CPCU

David J. Price (left) is executive vice president/chief underwriting officer of Burns & Wilcox, Ltd., and Alan Jay Kaufman is chairman, president/CEO of Burns & Wilcox, Ltd., as well as H.W. Kaufman Financial Group, Inc.

When is a hard market not hard?

When you're a specialty wholesaler with the know-how and connections to handle the risks that standard carriers don't want.

For Burns & Wilcox, Ltd., a leading independent managing general agency based in Farmington Hills, Michigan, the current hard market is chock-full of opportunities--and the firm is wasting no time pursuing them. Even when competition is keen in the standard market, Burns & Wilcox thrives on securing coverage for tough risks, just as it's been doing for more than 30 years.

Originally known as Marketfinders, the MGA was established in 1969 by Herbert W. Kaufman, who began his career as an independent agent in the standard personal lines market. Today his son, Alan Jay Kaufman, is chairman, president, and chief executive officer of Burns & Wilcox and its parent, The Kaufman Group, which also owns such highly respected wholesale operations as Floyd West & Co., Rathbone, King & Seeley Insurance Services, Cravens, Dargan & Co., and Howard James/Burns & Wilcox Insurance Services. Each of these intermediaries has a working relationship with Burns & Wilcox and may share underwriting services. Another Kaufman Group unit, Illinois R.B. Jones, operates independently of Burns & Wilcox; this entity specializes in architects and engineers coverage and writes liquor liability insurance in the state of Illinois.

Other affiliates are Service General, a personal lines wholesaler; General Agents Service Co., which provides services to Burns & Wilcox's network of branch offices; Royal Premium Budget, Inc., a premium finance facility for independent agents; and Burns & Wilcox Re, a reinsurance intermediary for primary insurers, managing general agents, and alternative market groups.

Independently owned Burns & Wilcox is a force to be reckoned with. It has 30 offices in 21 states, employs about 800 people, and represents more than 250 domestic and international insurers, including Lloyd's of London. The wholesaler maintains relationships with some 28,000 retail agents and brokers in 49 states. In addition to pursuing growth through underwriting, Burns & Wilcox seeks expansion via acquisitions of wholesalers whose books of business complement its product offerings. In fact, it was by acquiring Casualty Underwriters that Burns & Wilcox obtained the services of its owner, David Price, who now holds the position of executive vice president and chief underwriting officer.

Independence = integrity

As the second generation of his family to manage Burns & Wilcox, Alan Jay Kaufman is committed to carrying on the tradition of independence that was valued so highly by his father, the late Herbert W. Kaufman. "Soon after my father entered the excess/surplus and specialty lines business, he realized he could not serve independent retailers with integrity and objectivity by owning both a retail agency and a wholesale brokerage," Kaufman says. "He sold 100% of his interest in the retail agency so he could devote himself completely to the wholesale operation. That was a very hard decision for him because he had to let go of the close relationships with clients and insurers he had developed over many years. Looking back, I think it was a wise and prudent decision that led to the great success he enjoyed."

Alan Jay Kaufman is the second generation of his family to manage Burns & Wilcox, following in the footsteps of his father, the late Herbert W. Kaufman.

Alan Jay Kaufman is the second generation of his family to manage Burns & Wilcox, following in the footsteps of his father, the late Herbert W. Kaufman.

"As one of the few remaining national wholesalers of our size, our products are in greater demand by those agents who prefer not to deal with intermediaries that are owned by insurers and whose judgment might be biased by their parent."

-- Alan Jay Kaufman

Independence from insurance company ownership, Kaufman believes, is another key way in which Burns & Wilcox distinguishes itself from competitors. "As one of the few remaining national wholesalers of our size, our products are in greater demand by those agents who prefer not to deal with intermediaries that are owned by insurers and whose judgment might be biased by their parent," Kaufman comments. "The industry climate is ideal for a customer-driven company like ours."

Mid-market focus

As an excess/surplus and specialty lines wholesaler, Burns & Wilcox arranges coverage for a wide variety of risks that because of geographic location, claims history, or complexity can't be written in the standard market. "Burns & Wilcox appeals to retail agents for what I would call middle market business," says David Price, executive vice president and chief underwriting officer. "We write property, casualty, commercial auto, umbrella, professional liability, and D&O, among others. We have a broad spectrum of classes of business. We're not a Fortune 500 broker; we rely on our underwriting skill primarily to write business that we have the talent for, and we can place the business through binding authorities. Because of our expertise, we have the pen to write business on behalf of our carriers; and if an agent requests it, we can bind coverage on an immediate basis."

At the same time, Price continues, Burns & Wilcox pursues brokerage business where the firm doesn't necessarily hold the pen. "We have a large number of brokerage facilities that we use extensively, so that we can support the retail agent on virtually every class of business that might come across his desk," Price explains. "We also offer some specialized programs that attract brokers to us because of the unique and exclusive nature of these products."

As noted earlier, Burns & Wilcox represents more than 250 insurers, both domestic and foreign. "We operate as an MGA for a great number of insurers," Price says, "but we work primarily with Scottsdale, Colony Insurance Company, the Markel Group, First Specialty, and United States Liability Insurance. We represent most of the large companies in our field."

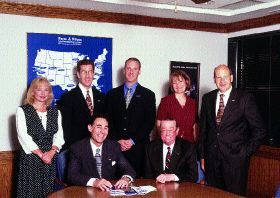

Burns & Wilcox professionals include: (sitting, from left) Alan Kaufman; David Price; (standing, from left) Mary M. Johnson, director of human resources; Jason R. Marx, vice president/operations; Daniel T. Muldowney, FLMI, vice president of finance/treasurer; Melanie M. Elias, director of claims; and William M. McCord, CPCU, ARe, ASLI, senior vice president and director of personal lines for Service General, a Burns & Wilcox affiliate.

Burns & Wilcox professionals include: (sitting, from left) Alan Kaufman; David Price; (standing, from left) Mary M. Johnson, director of human resources; Jason R. Marx, vice president/operations; Daniel T. Muldowney, FLMI, vice president of finance/treasurer; Melanie M. Elias, director of claims; and William M. McCord, CPCU, ARe, ASLI, senior vice president and director of personal lines for Service General, a Burns & Wilcox affiliate.

British by birth, Price has an extensive background in the London market and brings to Burns & Wilcox his considerable experience transacting business at Lloyd's. "From the very beginning Burns & Wilcox has had a presence in the London market, and over the last 10 years we've built that up to be probably our third largest source of business," Price remarks. "We have a number of binding authorities in the London market, covering everything from property business to employment liability, so we have access to a wide range of coverages there." Today Burns & Wilcox issues almost 20% of its policies through Lloyd's.

A hard market gets harder

How does Price characterize today's property/casualty market with respect to such factors as capacity and pricing? What about the impact of the 9/11 terrorist attacks? "Conditions in our opinion are getting harder," he responds, "and we see a continuing shrinkage of capacity across almost all lines. The events of 9/11 definitely affected reinsurance capacity, but underpricing in the overall market already was taking its toll on insurers. Now they're looking for ways to improve their bottom line with rate increases and restrictions in the classes of business they write. We're seeing this trend across the board and all over the country."

On the positive side, Price observes: "Because everyone is interested in profit margins now, rather than just underwriting for market share, insurers are coming to us because they realize we have well-underwritten, profitable books of business that they want to be part of. We are fortunate in being able to maintain strong markets in most areas of the country, where other MGAs might find that somewhat difficult."

Partnering with retailers

As mentioned earlier, Burns & Wilcox has a network of 30 branch offices in 21 states. How are these facilities organized to provide the services retail agents need? "Our branches are full-service extensions of our company," Kaufman replies. "An agent can approach any office and benefit from access to the underwriting expertise of our entire branch network, as well as our home office. The home office has a special risk division, and we maintain a staff of highly specialized underwriters to meet the needs of our branches. No matter where a retail agent is located, he or she can take advantage of the full range of services our company provides."

Retail agents can offer their clients premium financing through Burns & Wilcox's subsidiary Royal Premium Budget, Inc. "We offer this option throughout the country, and our retail agents appreciate having the opportunity to make premium financing available to their insureds," Kaufman says.

David Price, who owned Casualty Underwriters when it was acquired by Burns & Wilcox, was born in Great Britain. He has an extensive background in the London market and brings to Burns & Wilcox his considerable experience transacting business at Lloyd's.

David Price, who owned Casualty Underwriters when it was acquired by Burns & Wilcox, was born in Great Britain. He has an extensive background in the London market and brings to Burns & Wilcox his considerable experience transacting business at Lloyd's.

Retailers also have access to the facilities of Burns & Wilcox Re, a reinsurance intermediary located in Saddlebrook, New Jersey. "If an agent has an idea for a program, he or she can go to Burns & Wilcox Re for help in putting the program together," Kaufman explains. "Many agents would not otherwise be able to work directly with a reinsurance intermediary. This is another service that has proved highly successful with our agents."

What is the nature of Burns & Wilcox's relationship with the 28,000 or so retail agents with whom it does business? "We are not fully open brokerage; neither are we fully contracted," Price says. "We do qualify each agent who applies to us; we require that he or she be licensed, carry E&O coverage, and otherwise be reputable; and each agent must sign a brokerage agreement that addresses procedural matters such as when accounts are to be paid." Although the firm imposes no minimum volume requirement, Price says, "We do keep an eye on how much business an agent submits to us and how much of it we write."

Some wholesalers prefer to work with retail agents who are experts or specialists in a particular class of business, whereas other intermediaries are willing to entertain submissions from retailers who may need coverage on only an occasional basis. Where does Burns & Wilcox stand? "In many classes of business, such as trucking, we like working with agents who have specialized expertise," Price responds. "As for the retailer who says, 'I've never seen a risk like this before,' that's where we come in. Because of our nationwide operation and years of experience in the business, we very often have seen such a unique risk before and know where to find a market that will underwrite it."

Blueprint for growth

Looking ahead, Burns & Wilcox's management intends to continue pursuing a two-pronged growth strategy. "We've been successful growing both internally as well as by acquisitions," Kaufman declares. "We evaluate potential acquisitions carefully, based on our particular objective: expanding our geographic territory, obtaining a desirable book of business, bringing in underwriting talent, or acquiring markets we don't currently have. Earlier this year we purchased a leading MGA in Birmingham, Alabama, to strengthen our position in the southeastern market. At any given time we're probably looking at about 10 acquisitions, and out of those we may make one or two."

Growth simply for the sake of getting bigger plays no part in Burns & Wilcox's acquisition strategy. "We've acquired agencies with as few as three or four underwriters, as well as large firms with multiple branch offices," Kaufman says. "Size is not the criterion. We look at the quality of the underwriters and the quality of the seller's products and markets to see how it can enhance what we offer retail agents."

Another growth area, for Burns & Wilcox in particular and wholesalers in general, is the use of automation technology. "The wholesaler must be able to produce information for its carriers," Price says. "This information has become highly detailed, and it must be in a format that companies like. We must be able to meet that need for each of our carriers; otherwise we won't have the opportunity to use that carrier. We've committed significant resources to developing our IT capabilities so we can furnish our carriers with data and enhance our markets as a result. Smaller MGAs might not be able to afford a substantial investment in IT, so they might be receptive to the idea of merging with a larger partner such as ourselves so they can perpetuate their business."

Independent, stable, and competent, Burns & Wilcox is confident of its ability to meet the diverse needs of retail agents in a market that abounds with challenges.

How hard is the market? It's never too hard for Burns & Wilcox. *

For more information:

Burns & Wilcox

Phone: (800) 521-1918

Web site: www.burnsandwilcox.com