|

Building Equity Value

Agency value: past, present & future

The influence of external forces vs. proactive management

By Craig Niess

A confluence of factors impacts the value of every insurance agency. And while the specific external or internal factors may have changed over time, one truth has remained constant: An agency with effective leadership, planning, accountability and execution can drive agency value regardless of the external market conditions. Although agencies are unable to influence external market factors, they do maintain control over the internal factors and can proactively influence their growth and value, enabling them to adapt to the ever-changing economic landscape.

In this article, we will present a high-level overview of the major external factors that have impacted agency value in the past and present and will discuss how to manage your agency value in the future.

The past

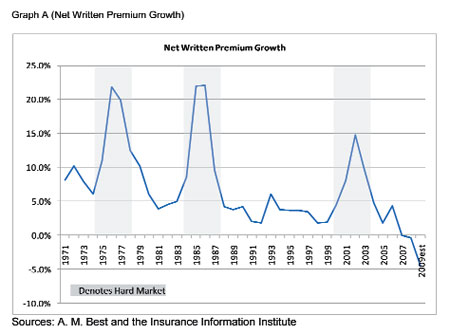

In the past 40 years, we have witnessed three hard market cycles: 1975-1978, 1984-1987, and 2000-2003 (see graph A on page 106). During these periods, many agencies rode the easy money wave as rates, revenues and agency values increased despite the fact that most agencies operated with a “business as usual mentality.”

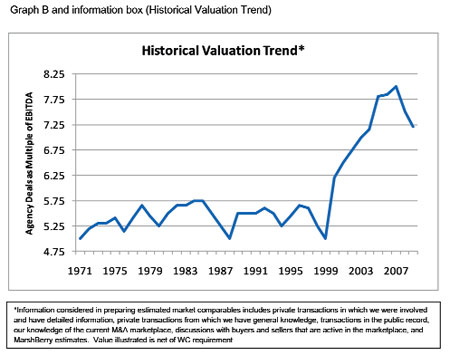

Additionally, in 1999, the Gramm-Leach-Bliley Act deregulated the insurance market and brought an influx of buyers into the insurance space. A swarm of banks, public brokers and private equity concerns entered the market, hungry to establish a foothold in the insurance space. This increased demand drove up the value multiples that were paid for agencies and, once again, complacent owners saw the value of their agencies increase due to external economic forces.

The past as we knew it came to a screeching halt when we entered into a recession in December 2007. A convergence of many factors including the credit crunch, the housing slump and a contraction of the labor market put the brakes on the U.S. economy. Since 2007, most insurance agencies have focused on ways to survive the current market malaise. The emphasis on surviving has redirected time, people and resources as many agencies are focusing on where they are, instead of where they are going. Only those agencies with keen foresight will use the opportunities afforded by the current market to position themselves to survive now and thrive in the future.

The present

The dynamics of the current merger & acquisition market have driven down the multiples paid to agencies (see graph B on page 106). This is due to many factors including fewer buyers and less acquisition capital. The gush of private equity money that flooded the market several years back has slowed to a trickle. Public broker stocks are trading at low historical multiples, which decrease the multiples they are willing to pay for agencies. Banks, by and large, are exiting the space or simply holding onto their foundation agencies while stripping the entity of its capital. Fewer buyers + more sellers = lower pricing.

The rate environment and the economic recession have severely impacted top-line growth and agency value during the past 24 months. The first quarter 2009 decline in Real GDP growth (-6.4%) was the worst since the first quarter of 1982. The three-year decline in total P-C Net Written Premiums was the first three-consecutive-year decline since the Great Depression. Combine persistent high unemployment with a dearth of business start-ups, sprinkle in steep reductions in rate and exposures, cover it all with a veil-thin topping of new business production and you have a recipe for disaster for insurance agencies.

For the year ending 2008, the average privately held agency saw the enterprise value fall approximately 6.7% from year-end 2007. As we await year-end 2009 financials for independent agencies to assess continued value trends, we recently created a bank-agency value index as a comparison point. As we looked at bank-agency platforms (many of whom operate more like an agency than a bank) for the 12 months ended June 30, 2009, the average total return on prior year value of the bank-agency was a negative 10.2%. While total revenue slipped 4.3%, the value of the intangible assets (“book-of-business value”) declined by 18.8% due to both a drop in earnings and falling multiples. This mid-year performance review quantifying negative bank-insurance returns foreshadows what we expect will be a second straight year of diminishing agency value for year-end 2009.

|

|

| |

|

To add insult to injury, P-C insurance supply continues to exceed marketplace demand. Combining the supply-demand environment with minimal 2009 CAT losses and expected company surplus increases means that we will not see an overall rate hardening in the first nine months of 2010. Capturing market share remains a key focus for companies to drive returns. Well—market share and modifying agency compensation plans. According to research by Ward Group, approximately 40% of insurance companies will revamp agency compensation plans via increased premium volume requirements, adding growth requirements, eliminating contingent plans, etc.

For most agencies, value deflation in 2009 will be impacted by a sharp reduction in “other income” (contingent income, miscellaneous income and investment income). The macroeconomic environment in 2010 will not get any better.

The key difference between the best and the worst performers relative to value enhancement will be a direct result of reactive vs. proactive management. Over the past 24 months, many agencies implemented short-term cost saving initiatives in hopes of preserving profitability but, instead, destroyed organic growth and long-term sustainability. Servicing staff hiring freezes, wage freezes and a moratorium on producer reinvestment was hastily implemented in order to improve short-term margin. Many had to do this to survive–and rightfully so. However, this strategy, when implemented as short-term cuts vs. long-term strategic controls, has instead set the table for valuation freefalls for many. Despite these initiatives, profitability still slipped due to revenues declining faster than expenses could be cut.

The real assets of an insurance agency walk out the front door every single night. And these assets need the proper corporate direction, goals and tools to succeed. Simply put, they need to understand the rules of the game. Once the leadership spigot turns off and it is visible to the entire staff that the parent is not supporting long-term growth and opportunity, poor performance is followed by key employee and account attrition which is then followed by a mass exodus. The harsh reality is that too many agencies and brokerages that are implementing short-term plans to try to preserve margin without a strategy to maximize long-term value appreciation are managing wasting assets.

In conjunction with internal controls, leading agencies continue to hire, train, deploy capital, drive growth, embrace accountability and realize long-term equity enhancement. The top 25% of insurance agencies are performing well, despite the external environment and will continue to reinvest, thrive and perpetuate at a fair market value. In short, peak-performing agencies control their own value vs. letting the marketplace control them. Those executives who are choking the life out of their insurance agency will sell via auction bidding processes, thus letting outsiders determine their worth.

The future

For the vast majority of agencies, value is inextricably tethered to the external dynamics of the marketplace. According to the data in the graph above, historically, agency value tracks lockstep with the fluctuations of the P-C Net Written Premium volume. And while this is good news during hard markets, it is unwelcome news during soft and declining markets.

But, the reality is that hard markets are the anomaly, and soft markets the norm. Those complacent agency owners who sit back and wait for the next hard market to come and buoy their agency value will not survive, as their value will be determined by external forces. Those who focus on what they can control will determine their value in the market place (see graph C above).

It’s been said that the best indicator of future performance is past performance. Should total net written P-C premiums continue to decline once again in 2010, independent agencies may be headed for a third straight year of declining value.

Conclusion

As the world around us continues to change and evolve, so too does the insurance marketplace. But change can be good. The operating environment under which thousands of agencies thrived over the last several decades will not be the same model necessary to survive in the future.

The minority of agencies will sustain value by proactively managing revenue and earnings through education, change, planning and accountability. For the majority, macro economic factors such as the economy, the regulatory environment, premium rates and the prevailing merger & acquisition dynamics will drive internal value. Most agencies allow forces beyond their direct control to dictate the value of the agency. But unlike investments in GM, Coca-Cola, or AIG stock, the agency investment is in our direct control.

The author

Craig Niess is a consultant at Marsh, Berry & Company. He can be reached at (440) 392-6584 or at craig@marshberry.com.

|