|

| |

Companies/Brokers/MGAs

Do you have a new product or enhancement?

Click here to submit your information

—OR—

call 1-800-428-4384 to speak to

Eric Hall Executive Vice President - Advertising, National Sales Director |

|

| |

| INSURANCE MARKETPLACE SOLUTIONS |

|

| |

|

|

Beauty and Barber Shops

How much would you pay for the perfect haircut? Barbers, beauticians and their customers deal with this question constantly. What is the price of perfection? Beauticians and barbers no longer simply cut hair. They are also asked to color, protect, and improve hair. Some hair is straightened, some curled and some extended. But the services rendered by shops and salons are no longer limited to just hair. Many also offer skin treatments, massages and tanning.

This industry is constantly changing as the owners work to meet the needs of their clients. Many salons have added the word spa to their name and encourage half or full day pampering getaways. However, this creates problems. How can the insurance industry properly address and respond to the exposures of an industry constantly in a state of flux?

|

| |

|

|

| |

| The Beauty and Barber Shop Marketplace |

| |

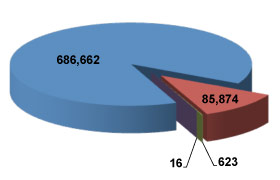

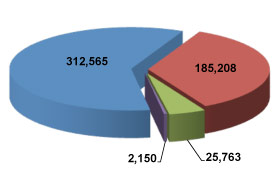

Number of Enterprises |

All Lines Premium ($000) |

|

|

|

This industry is a stronghold of the individual entrepreneur. Many shop owners act more as coordinators than retailers, with each stylist operating as an independent contractor. The shop owner provides space and support services, often including insurance, and the stylist rents booth space based on the terms of the contract. While this can create challenges, it also permits the shop owner to expand into a number of ancillary services, such as massage, manicures, etc., where each operator functions as an independent contractor under the shop owner's insurance. The more services provided, the more traffic generated and the more revenue potentially available to these independent contractors.

For more information:

MarketStance website: www.marketstance.com

Email: info@marketstance.com |

| |

|

| |

|

What services do cosmetologists provide? The answer depends on the particular salon. Some limit themselves to hair, but others offer additional services, such as nails and skin. Other expanded services include not only cosmetic treatments but also invasive ones, such as Botox, dermabrasion, permanent makeup and laser.

There is no “one size fits all” salon because owners are entrepreneurs who listen to their clients and are aware of the industry trends. Offering additional services allows a salon to attract and retain both customers and quality stylists. And these additional services often lead to even more expansion due to both client and stylist demands. From an insurance standpoint, however, one question remains. Exactly which services present general liability exposures and which present professional liability exposures? |

| |

|

| |

|

Consider this one possible claim scenario.

Margo loved her cigarettes. She read the warning labels and understood the dangers but continued to smoke...everywhere. Knowing of her addiction, Priscilla, her beautician, would have Margo come in after hours so she could smoke while getting her hair styled. Priscilla also liked to experiment with new products and services and decided to try a new chemical process on Margo’s hair. As she applied it, Margo lit another cigarette. Both were shocked when Margo’s hair caught fire! Priscilla quickly doused the flames but not before Margo’s hair and scalp were badly burned. When Margo sued Priscilla, she presented the claim to her professional liability carrier. This time Priscilla alone was shocked when the claim was denied because the treatment was experimental and not listed as covered under the policy. The carrier also argued that this was actually a general liability loss. Priscilla dutifully presented the claim to her general liability carrier who also denied it, stating that it was not covered because it was due to a professional service. |

| |

|

| |

Gabe Derzhavets, vice president of Roush Insurance Services, Inc., gives this overview of the industry. “In today’s era of ‘enhanced beauty,’ a modern beauty salon is not the same as it was 10 or 20 years ago. You do not have to live in Hollywood or be a movie star to understand the benefits of looking good and being healthy. Therefore, beauty salons are offering many more services than just cutting hair and doing manicures. Successful ventures derive much of their revenue by performing services that involve applying chemicals, lasers, blending products, selling supplements and offering tanning or bleaching.”

Chris Beshore, vice president of Insurtec, Incorporated sees change coming from another direction. “The beauty industry, specifically the tanning industry, is undergoing a change towards more corporate ownership and more ‘professional’ salons. This has led to more chains and fewer single location owners.”

The beauty industry has always been on the cutting edge of change. Fashions change and if a salon does not make appropriate changes, it will not survive. Being nimble is often the salon owner's secret of success. Many use independent contractors rather than employees. This allows for a steady flow of booth rental revenue plus profits from product sales. However, the better stylists will stay only if the salon is creative and offers services that attract additional customers and stylists.

The professional exposure is not limited to just the salon owner. According to Sean Brownyard, assistant vice president of SASSI Agency (A division of the W.H. Brownyard Corp.), “Salon owners, spa owners or any beauty professional providing professional services to their clients, including independent contractors working in salons or spas, need professional coverage." He points out that not all salon/spa coverage includes the independent contractors, so it is “important for them to secure their own professional liability coverage.”

The concern with independent contractors does not end with just hair stylists or manicurists. Kenneth Hegel, Jr., of Cosmetic Insurance Services (A division of Frenkel & Co., Inc.) explains, “If a high-end salon decides to bring in a physician or a registered nurse to do Botox injections a few times a week, it’s essential that either the salon owner or the physician or nurse be licensed to do the injections and also carry malpractice insurance. This is because in most instances the salon’s policy does not pick up that coverage for that particular exposure. Furthermore, the salon owner should get a certificate of insurance from that doctor or nurse, naming the salon as an additional insured in the event that the salon chooses to not purchase the coverage themselves.”

Professional coverage is available from both the admitted and nonadmitted markets. Mr. Derzhavets notes that the nonadmitted carriers typically offer more flexibility with rates and forms. Mr. Hegel states that any time there is a difficult exposure, such as Botox injections, usually only nonadmitted paper is available. Our experts agree that the overall professional liability market is good and that there are no real capacity issues. Some are seeing slight decreases on renewals while others have seen some increases. A variety of companies are making some marketing efforts into this industry so the soft market continues for the easier to place risks. Increases might be seen in the more difficult to place exposures and larger accounts.

Click here for the complete article … |

| |

| WHO WRITES BEAUTY AND BARBER SHOPS? |

|

|

| |

WHOLESALE BROKERS

PROGRAM ADMINISTRATORS |

| |

| |

|

|

|

|

|

|

| |

| |

This message was sent by The Rough Notes Company, Inc.,

11690 Technology Drive, Carmel, Indiana, 46032

1-800-428-4384

|