|

| |

Companies/Brokers/MGAs

Do you have a new product or enhancement?

Click here to submit your information

—OR—

call 1-800-428-4384 to speak to

Eric Hall Executive Vice President - Advertising, National Sales Director |

|

| |

| INSURANCE MARKETPLACE SOLUTIONS |

|

| |

|

|

Mobile Home Parks

Fess Parker, who many of us remember best as Daniel Boone and Davy Crockett, died in March. His trademark coonskin cap created a rage in the sixties. When he left acting, he became part of a new movement in California by investing in three upscale mobile home parks.

There are many parts of the country where the terms upscale and mobile home may not seem to go together. However, in California, Florida, Texas, and other areas that attract retirees and snowbirds, the lower cost of manufactured housing has created a demand for upscale communities where manufactured home buyers can park and enjoy the good life.

|

| |

|

|

| |

|

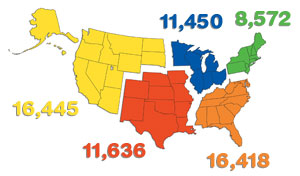

| Number of Enterprises |

Mobile home parks are found in every region of the country but the west and the southeast have the highest percentage in terms of sales, premium and number of enterprises. The top three states are California, with 7,423 enterprises; Florida, with 5,855; and Texas, with 3,209. The growth rate has slowed, with 25 states having positive growth between 2006 and 2008, but only 11 are projected to have positive growth between 2008 and 2010. These are Alabama, Idaho, Kentucky, Louisiana, Minnesota, Missouri, Ohio, Texas, Vermont, Washington and Wyoming.

For more information:

MarketStance website: www.marketstance.com

Email: info@marketstance.com

|

| |

|

|

| |

|

|

| |

|

|

Mobile home parks are “mini-villages” but without sovereign immunity. Park owners are responsible for upkeep of roads, sidewalks and any public areas. They are often also responsible for making utilities available to the residents. In addition, they are responsible for waste disposal when the community does not have access to the public sewer system.

Exposures increase as amenities are added. These include swimming pools, tennis courts, clubhouses, volleyball courts, and playgrounds. Mobile home park owners that own and rent out units represent yet another area of increased exposure. |

|

| |

|

|

|

| |

|

|

Here is a possible scenario:

Happy Homes is a mobile home park with 150 pads for rent. It has a children’s play area, clubhouse with swimming pool, sand volleyball pit, video game arcade, and laundry facility. Mandy allows her granddaughter Ashley and her friend, Paula, to play unattended at the playground. Paula falls off the slide and is taken to the hospital for treatment. Her family sues Happy Homes for her medical expenses and pain and suffering.

|

|

| |

|

|

|

| |

|

|

A number of markets actively write mobile home parks. Nautilus Insurance Group, Capitol Insurance Companies, Western World Insurance Group and Northfield were mentioned by David Toombs, vice president commercial underwriting at Arlington/Roe & Company. Linda Knight, senior underwriter at Burns & Wilcox Ltd., explains that a number of carriers write liability coverage for mobile home parks and named Scottsdale, Mount Vernon Fire, Markel and Philadelphia Insurance. Dave Adcock, commercial production manager at Atlantic Specialty Lines, Inc. places this business with Scottsdale, Colony, RSUI and Max Specialty. CNA offers a nationwide mobile home park program according to Chris Chiodetti, vice president, contracts at London American Risk Specialties.

Our experts agreed that most accounts are written on a nonadmitted basis but acknowledged that there are some admitted markets.

Ms. Knight explains, “The greatest frequency and severity of loss on this class of business is typically caused by a guest falling but vandalism is another concern. We also see claims for dog bites and assault. Having a swimming pool, playground or other amenities also increases the park owner’s chances of loss.”

According to Mr. Chiodetti, “Today’s manufactured housing parks can rival any upscale neighborhood in

America. Gone are the days where the phrase “grew up in a trailer park” has an unfortunate connotation. Many parks are set up exactly like a small community, complete with golf courses, clubhouses, swimming pools, lakes and docks, storage areas, dry cleaners, convenience stores, and possibly child care facilities.”

These amenities need to be evaluated. Mr. Toombs says, “Swimming pools, clubhouses, laundromats, game rooms, tennis court, playgrounds, restaurants, and stores are commonly found amenities that the same policy usually covers.” Mr. Adcock added walking trails, boat ramps, beaches and docks to the list of amenities and says, “all can and should be included in the GL coverage."

Click here for the complete article … |

|

| |

|

| WRITES COVERAGE FOR MOBILE HOME PARKS? |

|

|

|

| |

|

MANAGING GENERAL AGENTS

|

|

| |

|

|

|

|

|

| |

| |

This message was sent by The Rough Notes Company, Inc.,

11690 Technology Drive, Carmel, Indiana, 46032

1-800-428-4384

|