|

| |

Companies/Brokers/MGAs

Do you have a new product or enhancement?

Click here to submit your information

—OR—

call 1-800-428-4384 to speak to

Eric Hall Executive Vice President - Advertising, National Sales Director |

|

| |

| INSURANCE MARKETPLACE SOLUTIONS |

|

| |

|

|

GOLF AND COUNTRY CLUBS

The Thanksgiving and Christmas holidays are over and the weather is dreadful. Now is the time to dream about the next fun-filled adventure. How about a day on the links in Fargo? Grab a bright orange ball and drive it towards the bright red circle in the snow. If snow golfing is not for you, how about visiting a golf course in Florida, Texas, Arizona or perhaps one at an international location?

Golf courses are not just large landmasses where participants hit a ball with a stick. They are expensive manicured real estate properties that can easily be damaged by weather and vehicles. That serene looking landscape also harbors significant property, liability, workers compensation, and inland marine exposures.

Before saying “fore,” consider the exposures that might be on the other side of that dog leg. |

| |

|

|

| |

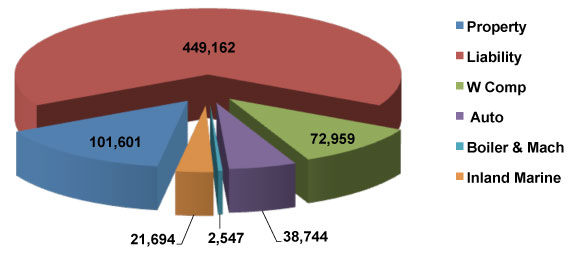

Golf and Country Club Premiums ($000)

The more than 11,000 golf and country clubs in the United States produce almost $687 million in premium. Most of it is for general liability but that statistic may be misleading. Many golf courses (especially public ones) have little or no property exposure, but the property exposures at private clubs may be extensive. Although inland marine represents only a small portion of the total premium, it may be particularly interesting to many clubs because of the greens coverage.

For more information:

MarketStance website: www.marketstance.com

Email: info@marketstance.com |

| |

|

|

| |

|

|

| |

|

|

Golf and country clubs have the potential for both loss frequency and loss severity, and location can be a significant factor. If a facility is located in proximity to good fire protection and emergency medical services, the potential for fire loss and injury claims likely will be lower than for a facility in a remote or rural location. If part of the golf course is close to a road, errant balls may strike neighboring residents or passing vehicles. Clubs and courses in residential areas must be concerned about theft and vandalism from neighborhood youth.

Golf courses and country clubs must implement risk management measures that match their particular characteristics and potential for loss. |

|

| |

|

|

|

| |

|

|

Here is a possible loss scenario:

The privately owned Shady Lane Golf Club is actively seeking more revenue. It decides to allow non-members to use the course on Mondays, Tuesdays and Wednesdays. As a result, the high school golf team starts practicing there after school. Three of the golf team members are in the locker room when horseplay ensues. Todd, the youngest member, slips on the tile floor, strikes his head, and must be airlifted to the hospital. His parents sue the school and the golf club for his injuries.

The school denies liability, citing sovereign immunity, and the golf club is left to face the lawsuit alone. |

|

| |

|

|

|

| |

|

|

Golf courses and country clubs have several significant exposures, according to Bob Battaglia, product manager at Philadelphia Insurance Companies. “Most facilities have large buildings, which along with the golf course grounds and outdoor equipment are exposed to damage from natural perils, be it wind, hail, fire, flooding, or lightning. Another exposure is vandalism that can result in damage to the golf course, buildings, and equipment. On the liability side, players and others may be injured when a golf cart overturns.”

Michael C. DeMarco, executive vice president, Preferred Club Program at Venture Programs, Inc., agrees and adds loss of revenue on the property side as well as liquor liability, food-related illnesses, drownings, and abuse and molestation as liability exposures that can also adversely impact a club’s operations if not properly controlled.

According to Joseph J. Dolce, executive vice president, national accounts at Venture Programs, Inc., other important liability concerns are “PGA/LPGA events and the liability that comes along with multiple vendors/contractors who take part in preparing the course, along with tens of thousands of people on the course during the event.”

Click here for the complete article … |

|

| |

|

| WHO WRITES GOLF AND COUNTRY CLUBS? |

|

|

|

| |

|

WHOLESALE BROKERS | INSURANCE COMPANIES

|

|

| |

|

|

|

|

|

| |

| |

This message was sent by The Rough Notes Company, Inc.,

11690 Technology Drive, Carmel, Indiana, 46032

1-800-428-4384

|