INSURANCE MARKETPLACE SOLUTIONS

Calm in the Midst of Chaos

Rudyard Kipling’s poem “If” starts:

“If you can keep your head when all about you

Are losing theirs and blaming it on you;

If you can trust yourself when all men doubt you,

But make allowance for their doubting too:

And it ends:

Yours is the Earth and everything that’s in it,

And—which is more—you’ll be a man, my son!

In the insurance industry, the months of December and January make these words particularly apropos. It is especially true this year as market hardening has begun and clients are being surprised by (and upset with) unaccustomed premium increases. This will be a difficult renewal year for many, and that means that some files will not be closed until well after the renewal date.

Do you feel like “Yours is the Earth” right now? If not, consider the following:

GROWTH POTENTIAL

Ours is a restless country. We are not (and never have been) satisfied with the status quo. We believe that things can always improve. Improvement comes incrementally, but that is never fast enough for us because we think a little more effort could make the improvement happen now.

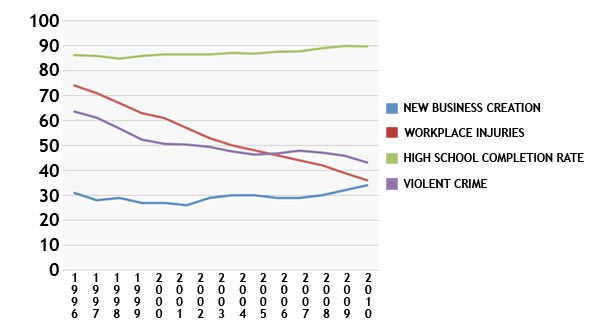

Here are a few examples of positive changes that have taken place since 1996:

Should we be satisfied with the 2010 numbers? Absolutely not! Keep in mind that the reason the numbers have steadily improved over the years is that Americans in 1996 weren’t satisfied either.

| The New Business Creation is based on The Kauffman index of Entrepreneurial Activity and is new business creation per 10,000 adults. www.kauffman.org |

|

The Workplace Injuries is based on the Bureau of Labor Statistics incident report of nonfatal injuries and illness per 1,000 workers. www.bls.gov/news.release |

| |

|

|

| The High School Completion rate is based on the report titled: Trends in High School Dropout and Completion Rates in the United States: 1972-2009 from the National Center for Education Statistics. The rate is based on high school completers per 100 18-24 year olds. www.nces.ed.gov |

|

The Violent Crime Rate is based on the Federal Bureau of Investigation Uniform Crime Report on violent crime per 10,000 inhabitants. www.fbi.gov |

STATING THE OBVIOUS

Warren Buffet observed:

“My wealth has come from a combination of living in America, some lucky genes, and compound interest. Both my children and I won what I call the ovarian lottery.”

Wealth is so much more than money, and many have discovered that fact in the past three turbulent years. While money is important because of the security it can provide, relationships are more important than ever. The incredible feeling of doing your best to help others achieve their best is better than any paycheck.

THE HEART OF THE MATTER

Here is a possible scenario:

Melanie and William have an idea. They both work long hours at their respective jobs, but each wants more. They agree that Melanie will continue to work her job while William attempts to start his own business. It is risky, but they research and discover a customer need that they believe they can fill. William slowly assembles the business plan. He performs a demographic study and develops a marketing plan. He then contacts investors to get the needed capital. The stage is set to launch, but there is one more piece of the puzzle…insurance.

William contacts various insurance agents who turn him down because his dream is a new venture. Many companies reject him without even a thought. Then, when all seems lost, one agent takes the time to listen. She understands that passion and determination because she, like William and Melanie, once had a similar dream. She wanted to be independent, help others, and fulfill her potential. With the passion of a true believer, she found an insurance carrier that would work with William.

With all the pieces in place, William launched his new company and Melanie will soon leave the safety net behind and join him. Success is not guaranteed but, then again, nothing really is.

THE MARKETPLACE RESPONDS

We celebrate the independent insurance agent this month. Walt Gdowski, president and CEO of The Rough Notes Company, Inc., is known in the industry as a strong advocate. Rough Notes magazine is 134 years old and The Insurance Marketplace is almost 50. Both publications are designed for (and used by) independent agents. Walt gives us his perspectives on the independent agency system. He also provides both the history of The Insurance Marketplace and a look into its future.

IMP: You and The Rough Notes Company are well known for your support of the independent agency system. What do you think are the system's key strengths?

WG: First, they are independent business people. Second, they are insurance agents. Like all business owners, independent agents want to grow their businesses, and the key to growth is relationships—with clients, insurance carriers, and in their communities. As entrepreneurs, independent agents understand the risks and insurance needs of personal and commercial accounts. As a business owner myself, I wouldn’t deal with anyone except an independent agent—someone I know and trust and feel comfortable sharing my financials with. As your personal and business assets grow, it becomes more important to protect them by working with an experienced independent agent.

In addition to arranging insurance, many independent agents also provide their clients with other services: risk management, worker safety programs, financial and retirement planning, and employee benefits. As a business owner, I can deal with a moderate increase in my property and casualty premiums. Where I need help is in controlling the skyrocketing costs of employee benefits. I turn to my independent agent for that help.

Read the entire interview here

2011 CONTRIBUTORS TO THE INSURANCE MARKETPLACE CYBERCAST

INSURANCE COMPANIES | MANAGING GENERAL AGENTS

PROGRAM ADMINISTRATORS | SURETY COMPANIES | WHOLESALE BROKERS

|