INSURANCE MARKETPLACE SOLUTIONS

Pet-related Services

Who will be waiting for you when you walk through your door tonight? For many of us, the most excited family member will be a pet. While our pets provide companionship, it has been determined that they also reduce our stress levels and increase our ability to tolerate pain. They can provide security and a sense of peace during chaotic situations. Is it any wonder that the pet-related services industry continues to show positive growth even during the current economic downturn?

Pet-related services discussed in this Cybercast are pet walking, pet sitting, kennels, pet day care facilities, trainers, and groomers. Although some veterinarians and veterinary clinics have pet boarding facilities, they will not be addressed here, nor will animal shelters and pet rescue operations.

GROWTH POTENTIAL

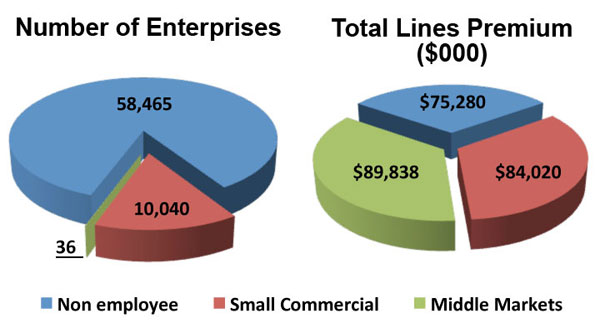

The pet-related services industry is growing. The information in this graph is based on 2010 data. MarketStance estimates that this industry will experience a 7% growth rate over the next two years. The growth in the non-employee class is estimated to be almost 8%. The fact that so many providers of pet-related services are individuals keeps this industry from gaining any significant national traction. Pet stores have tried to add some of these services, but the revenue from services is declining, not increasing. This suggests that pet stores are reducing theses services instead of increasing them. It appears that the majority of pet-related services will continue to be provided by individuals rather than becoming part of larger operations.

STATING THE OBVIOUS

A pet is an important part of its owner's life. When the pet must be left with a caregiver or service provider, the owner is concerned that the pet will be cared for properly. The owner also wants assurance that the pet will not damage the owner's property or the property of others, or cause injury to others. The expectation is that the caregiver entrusted with the pet's care will provide the same loving and responsible care as the pet's owner.

THE HEART OF THE MATTER

Here is a possible scenario:

Mandy is pet sitting the Martin family's three dogs and two cats while the family is on a two-week vacation. Her contract requires that she visit the home no fewer than three times during each day. On one of those visits, she must take the dogs on at least a one-mile walk. She must ensure that all of the pets have food and water in the amounts specified and also administer medication to the older cat.

On her morning visit, Mandy leashes the three dogs for their walk. Everything goes well until Charlie (the Great Dane) becomes overly excited and darts toward a woman walking past him. He is overjoyed to see her, jumps against her, and knocks her to the ground. Her outfit is ruined and she has difficulty standing. Mandy apologizes profusely as she helps her up.

Mandy receives a notice from the woman's lawyer three weeks later stating that she is expected to pay for the damage to the woman's clothing and the medical expenses she incurred.

Mandy submits this information to her homeowners insurance carrier. However, the insurer informs her that she is not covered for any of the damages because she was conducting a business and her policy does not have a business endorsement.

THE MARKETPLACE RESPONDS

Standard markets can provide coverage for pet service operations. The coverage can be written on businessowners policies or commercial package policies. It can also be written by attaching a business endorsement to a homeowners policy. This approach can satisfy many of the coverage concerns. However, there are unique exposures that standard policies may not cover. This Cybercast explores these exposures with specialists who are familiar with issues in the pet-related services industry.

Potential customers must be identified. David Springer, President, Programs Division at NIP Group, Inc., explains, "Most dog walkers and pet sitters are emerging businesses operated by individuals, and many of these people are not aware of the need to secure insurance." These individuals typically love animals. They may care for the animal at the animal's home or at the sitter's home. More and more, these micro-businesses are becoming aware of the need for insurance.

Mr. Springer explains, "Someone who goes into a customer's home to provide pet care services faces many of the same exposures as individuals and businesses that do housecleaning and provide other in-home services. A frequent cause of claims is when the pet sitter or dog walker loses keys. If a key can't be found, the lock may have to be replaced. The pet sitter may cause property damage or be accused of stealing items that belong to the pet's owner."

Additional exposures arise because the animal is a living creature. Mr. Springer says, "Because of weather, illness, car trouble, or other factors, the pet sitter or dog walker may not get to the customer's house in a timely manner, and the pet may be deprived of food and water or medicine. In other cases, it may injure itself, become ill, or cause damage to property."

Individuals who perform dog walking services also have liability exposures because they are responsible for controlling the animal. If a dog being walked bites or injures a third party in some other way, the dog walker could be found negligent and responsible for the damages.

Some pet service providers know they need insurance coverage but may not be aware of the need for specialized coverage. "Professional liability coverage is needed but may be overlooked", says Kelly Spencer, Program Manager, PetPro™. (PetPro is an all-lines insurance program developed by NIP Group for a wide variety of pet care providers. It is written on admitted paper.)

Ms. Spencer says, “Groomers do not have to be licensed, but there are a variety of training programs through which they can be certified. The best groomers (and the most desirable from an insurance standpoint) are highly trained and certified. A groomer’s training and experience is a major consideration in the underwriting process. We offer professional liability coverage for groomers and recommend that they buy it.”

Ms. Spencer emphasizes: “The major exposure for any pet care facility or pet care provider is injury to (or death of) an animal while in the facility’s care, custody, or control.” Groomers, trainers, and other pet service providers must have professional liability coverage, as well as veterinary expense coverage. Another major exposure is workers’ compensation for businesses large enough to have employees: slips, trips, and falls are common, as are bites and scratches.

The mandatory coverages for pet-related services operations are similar to those required for other service providers. Liability coverage is essential, as is property coverage for any location-based facility such as a doggie day care or boarding facility. Workers compensation coverage is required for facilities that have employees.

Inland marine coverage can be arranged for property such as groomers’ tools. Mobile groomers have specialized equipment. Dogwalkers and pet sitters may have leashes or crates they use for transport. Lost pet reward and recovery coverage is another important option to consider.

As an example of unique exposures, Ms. Spencer says, “Mobile groomers drive specially equipped vans to their customer’s location and wash and/or groom the pet in the van. Mobile groomers face essentially the same exposures as groomers who work in stores or kennels, but they also have auto-related exposures. Mobile groomers have customized vans with permanent fixtures that need to be covered in case of accident or theft. These businesses also need to ensure that they have downtime coverage and business income coverage in the event the equipment is vandalized or breaks down. And, they need protection in the case of loss or injury to the pet.””

Some of the coverages needed by pet service providers can be challenging to place. According to Mr. Springer, “One of the most difficult lines to place is workers comp. Many underwriters (particularly large company underwriters) are averse to it because of some nasty injuries due to scratches and bites. These underwriters tend to avoid workers comp and treat the rest of the business like a typical Main Street business. The risk in doing that is that standard commercial insurance doesn’t offer many of the coverages this class needs.”

Ms. Spencer offers an example of possible coverage gaps. “Looking at other carriers’ policies, we see a lot of bite exclusions and breed exclusions. Because we are specialists, our policy doesn’t have those exclusions. Our research and collaboration with pet industry specialists and legal experts has enabled us to properly underwrite these risks on an individual basis, eliminating the need to attach unnecessarily broad exclusions to policies.”

The pricing for pet-related services coverage is fairly consistent. Mr. Springer says, “There are not a lot of specialists that target these classes. There are some large national carriers willing to write these classes, although they don’t recognize one-person micro-businesses. These carriers also do not meet many of the unique exposure and coverage needs we’ve identified in our program. Using a standard business policy for this specialized market can result in coverage gaps, leaving clients unprotected.”

Ms. Spencer says, “More pet care facilities are expanding their reach, offering retail products and grooming as well as boarding or doggie day care. The agent needs to understand the exact kinds of operations a facility conducts so they can be underwritten appropriately. The new services may mean that a standard market might be less willing to write the coverage. It’s critical that brokers ask the right questions to properly identify the exposures for these risks. Inadequate underwriting can result in inadequate protection.”

The pet-related services market is growing. Mr. Springer offers this final observation: “Pet care facilities offer a unique opportunity to agents at a time when so many other businesses are not growing. This class of business has proved remarkably resistant to the effects of the recession, and this is a good time for retailers to become familiar with the operations and exposures of pet care facilities.”

WHO WRITES PET-RELATED SERVICES?

PROGRAM ADMINISTRATORS

Contributing to this article:

NIP Group, Inc.

900 Route 9, Woodbridge, NJ 07095

|