INSURANCE MARKETPLACE SOLUTIONS

Children's Day Care Centers

Where are the children? Many are at day care…and usually that is a good thing. Well-run day care centers allow parents to pursue their careers without worrying about their children’s safety. They know their children are not only safe but are also playing and learning.

The day care industry offers parents many choices. Some centers accept babies, and some care for children with special needs. Some facilities provide care before and after school. Many are open only during standard business hours, and some have expanded to 24-hour facilities to accommodate third-shift workers.

The insurance industry knows that “one size fits all” programs don’t work for day care centers because this is not a “one size fits all” industry. There are many carriers and many options available. In underwriting this class, every carrier pays strict attention to detail because what the day care center does and how well it does it determines its acceptability and pricing.

GROWTH POTENTIAL

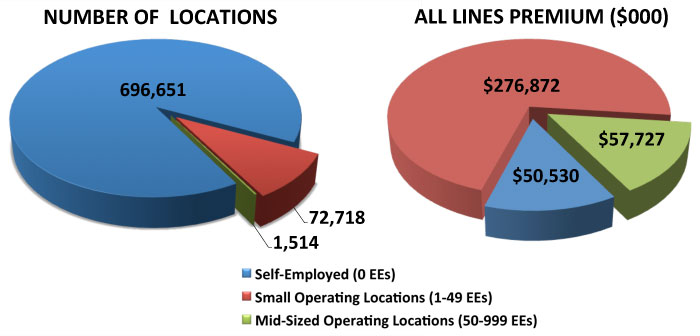

In-home operations continue to dominate the day care industry. The caregiver’s homeowners policy often can cover a home-based operation. In addition, there are over 70,000 small commercial operations that generate over $275 million in premium. It is anticipated that these small facilities will grow by at least 5.5% over the next two years and mid-sized operations will grow by a similar percentage.

For more information:

MarketStance website: www.marketstance.com

Email: info@marketstance.com

STATING THE OBVIOUS

Children must be protected, and they also need opportunities to learn and grow. Parents entrust their children to day care facilities expecting that the child not only will be safe but also will acquire new knowledge and learn valuable social skills. Babies demand constant care because they are vulnerable, and older children must be carefully supervised because they are active and curious.

THE HEART OF THE MATTER

Here is a possible scenario:

Mallory, a bright three-year-old, really enjoyed attending Premier Day Care Center. She loved her teachers, her classroom, and the playground equipment. There was a lot to do and constant activity.

Like most children, Mallory was very curious and liked to explore her surroundings. One day she went into the bathroom and decided to see what she could successfully flush down the toilet. She tried paper, but that was boring. Next she tried small blocks. Plastic soldiers and monkeys worked too. Her downfall was the stuffed bear. Despite multiple attempts to flush it, the bear just wouldn’t go down and the water kept pouring out.

Water flowed into the hallway and into two classrooms. Ken, a 70-year-old volunteer reader, slipped on the water in the hallway. His cries for help alerted Dawn, the director, who quickly responded. An ambulance took Ken to the hospital, and Mallory was put in a short time out where she considered her next experiment.

Dawn called her plumber. She then called her insurance agent to report serious water damage plus a bodily injury incident.

THE MARKETPLACE RESPONDS

The insurance market for child day care facilities is robust, but appetite varies by carrier. Some are interested only in in-home operations while others write only commercial facilities. Both admitted and non-admitted markets are available.

Carriers mentioned by our experts include Capitol, Essex, Great American, Landmark American, Northfield, Philadelphia, Scottsdale, USLI, West Bend, and Western World.

Dave Lehman, commercial underwriter at Roush Insurance Services, Inc., says, “We have binding authority for day care centers, in-home day care, before and after school programs, sick-child day care, and child care associated with hotels, clubs, YMCA/YWCAs, and churches. Operations that provide care for children with special needs can be considered on a submit basis. Drop-off centers at malls or other retail establishments can also be considered on a submit basis.”

“We provide coverage for licensed commercial child care centers, licensed centers located in schools, child care centers located in churches and at preschools, and before- and after-school programs,” says Cheryl Tamasitis, assistant vice president, commercial lines division at Philadelphia Insurance Companies. “We do not accept in-home child care centers, new ventures with no experience, drop-in only centers, babysitting services, or any unlicensed child care centers unless they are exempt from licensing, as are many facilities associated with religious organizations.”

Donna Brooks, commercial lines underwriter at Arlington/Roe & Co., Inc., says, “We consider anything from small in-home day care operations to large commercial day care centers. We’re willing to consider any facility as long as it meets our carriers’ criteria.”

Coverage for commercial day care centers is written primarily in package policies. For in-home operations, however, the liability coverage is monoline and property coverage is added to the homeowners policy.

Ms. Tamasitis explains that key exposures are “bodily injury, such as a child getting hurt as a result of negligence, slip and falls, playground injuries, and child on child injuries. Property damage is a concern, especially water damage.” In addition to children, Ms. Brooks adds, “Visitors and volunteers may slip and fall and be injured.”

According to Ms. Tamasitis, the claims frequency is from slips and falls, playground injuries, and water overflows from toilets. Mr. Lehman adds that claims often arise from “kids just bumping into things and injuring themselves.”

“Severity comes from various types of abuse, neglect, child on child injuries, and weather-related catastrophic events,” says Ms. Tamasitis.

Underwriting a child day care facility starts with completing an extremely detailed application. Details are essential because of the nature of the risk and also because each carrier that writes this coverage is specific about the kinds of exposures it is willing to consider. However, there are key factors that all carriers carefully analyze.

Mr. Lehman says that key underwriting criteria are “the number of children per employee, experience of the employees, procedures in place to handle emergencies, and physical hazards on the premises. We also review loss history closely.”

In addition to these criteria, Ms. Brooks says, “Licensing and quality of staff are critical in this class; background checks on all employees are essential. We need to know the ages of the children and whether the facility has any children with special needs. We must determine the facility’s policies with respect to distributing medications. Other criteria are the facility’s location and hours of operation.”

She expands on the physical hazards concern by asking these questions: “What is the condition of the building and property? Are they safe and well maintained? If there is a playground, is the equipment safe and well maintained and is the playground fenced? Is there a pool, and does it meet safety requirements? Does the facility own a van or other vehicle that it uses to transport children to and from their homes or on field trips?”

Ms. Tamasitis says, “A major red flag is less than one year in business with little or no child care experience. Other red flag items are expired or suspended licenses, deficiencies cited in state inspections, cancellation by previous carrier, and any gap in loss runs.”

The packages written for commercial day care facilities usually include general liability, property damage, and business income coverages. Many markets provide sexual/physical abuse coverage but often with separate limits. Professional liability is provided and basically covers the facility for incidents that arise from failing to properly supervise and monitor children and staff. Inland marine, crime, medical payments, auto, and umbrella coverages are also available.

Liability limits vary depending on the carrier and the specific exposure. Limits of $1 million/$2 million are common, but markets are available for limits in excess of $20 million.

Coverage comparisons between carriers can be difficult because some markets automatically include abuse coverage while others exclude it and then add it by endorsement. It is important for the agent to make sure that the coverages being compared are actually equal.

Certain activities may be excluded. At Philadelphia, Ms. Tamasitis explains, “We generally exclude gymnastics and martial arts if gymnastics involves anything except floor exercises and martial arts involves anything except blocking. Bounce houses are almost always excluded unless specific controls are in place. Abuse is always excluded if there are no controls in place. Also excluded are medical payments to attendees.” Other carriers have their own lists of excluded activities.

According to our experts, the recession has had a negative impact on the day care industry. They have observed revenue declining for two reasons. First, when parents are out of work, they often cannot afford to send their children to day care. Second, state funding for child care facilities is declining as states attempt to balance their budgets. The shrinking revenue has resulted in many centers closing, laying off staff, reducing hours, and eliminating programs.

The insurance market for child day care operations is fairly stable. According to Mr. Lehman, “The market seems to be hardening on the pricing side. Capacity and competition should remain unchanged for the remainder of the year.” Ms. Brooks agrees and says,” The market continues to be very competitive, and we don’t expect that to change anytime soon.”

Every day care center director knows that safe and effective child care requires attention to detail. Writing coverage for day care centers also requires attention to detail. Day care operators must be familiar with state regulations, and so should their insurance agent. Reputable, well-run day care centers want the best for each child in their care. Agents who are interested in providing coverage for day care centers should feel the same way about their clients.

WHO WRITES CHILDREN'S DAY CARE SERVICES?

MANAGING GENERAL AGENTS

Contributing to this article:

Arlington/Roe & Co., Inc.

8900 Keystone Crossing, Ste. 800

Indianapolis, IN 46240

Contact: Donna Brooks, Commercial Lines Underwriter

Email: dbrooks@arlingtonroe.com

Phone: (800) 878-9891

Fax: (888) 552-9891

Web site: www.arlingtonroe.com

Roush Insurance Services, Inc.

P.O. Box 1060

Noblesville, IN 46061-1060

Contact: Dave Lehman, Commercial Underwriter

Email: dave.lehman@roushins.com

Phone: (800) 752-8402, Ext. 12

Fax: (317) 776-6891

Web site: www.roushins.com

INSURANCE COMPANY

Contributing to this article:

Philadelphia Insurance Companies

One Bala Plaza, Ste. 100

Bala Cynwyd, PA 19004

Contact: Cheryl Tamasitis, Assistant Vice President, Commercial Lines Division

Email: ctamasitis@phlyins.com

Phone: (610) 668-7296

Fax: (866) 847-4048

Web site: www.phly.com

|