Excess Flood Coverage

“It was not the weather event we expected.”

Isaac was only a Category 1 hurricane, but because of its slow movement, the water it produced caused much more damage than expected. The wind damage was minor, but there was major flood damage. The storm’s path moved through areas in the South where the ground was already so saturated that it could not hold any additional water. It then moved into the Midwest, which welcomed a possible drought-busting rainfall. However, the parched condition of the soil suggested that it might not be able to absorb the rain. This could lead to significant surface water flooding and flash flooding.

Flood claims from Isaac will be paid only if flood insurance is in place. The coverage available through the National Flood Insurance Program (NFIP) may be sufficient for some homeowners and businesses, but many others need protection beyond the program’s $250,000/$100,000 building/contents limits for residences and $500,000/$500,000 limits for commercial risks.

The private insurance market offers limits in excess of the maximum NFIP limits. It also offers coverage in excess of primary limits available in the private market. Many homeowners and business owners in Isaac’s path knew they might sustain flood damage. Those who had purchased excess flood coverage also knew they would have the funds to clean up, repair, or rebuild.

GROWTH POTENTIAL

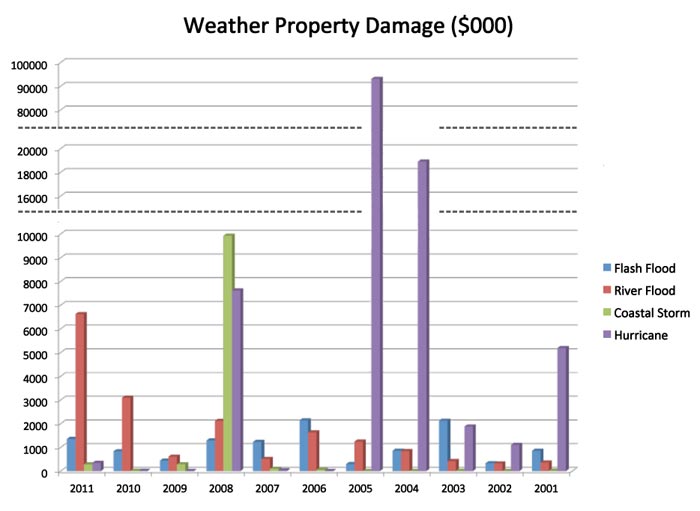

NOAA, National Weather Service

Office of Climate, Water, and Weather Services

www.nws.noaa.gov/om/hazstats.shtml

The information above reflects damage in the United States, Puerto Rico, Guam, and the Virgin Islands. Each year is current through at least the year following the event.

Flood damage occurs in all parts of the country. Flash floods can be particularly devastating because they often occur unexpectedly and in areas that do not appear to have much (or any) exposure to flooding. Between 2001 and 2011, the cost of inland flooding was almost $30 billion. During the same period, coastal storms (flood and wind) caused over $10 billion in property damage. Because of the $93 billion in damage that Katrina and other hurricanes caused in 2005, hurricane damage (flood and wind) was over $128 billion during the time period reflected in the chart.

STATING THE OBVIOUS

Commercial and residential property forms exclude flood damage. Primary flood coverage is available through the NFIP. However, it is available in only certain areas and is subject to a number of limitations and restrictions. Primary flood coverage is available through the private insurance market in areas not considered prone to flooding. Excess flood coverage is available in all areas, subject to each carrier's underwriting criteria and underlying limits.

THE HEART OF THE MATTER

Here is an actual loss scenario:

Broad Ripple is a popular entertainment district in Indianapolis that is located close to the White River. A dam on the river diverts water to the White River Canal, which flows through Broad Ripple and into downtown Indianapolis. The canal serves many purposes but was built primarily for the purpose of flood control. Floodgates can be opened to relieve pressure from the White River and prevent flooding downstream. The gates are usually kept open.

In May of this year, heavy rain caused many of Broad Ripple's streets to be flooded. At several intersections, vehicles could not get through the standing water. Many businesses had water in their basements and first floor areas, although there was no flooding in the rest of Indianapolis.

An investigation revealed that some of the floodgates were closed, which prevented water from flowing from the streets into the canal. Although most of the affected businesses were able to reopen within a few days, one was closed for months because of damage to its floors, walls, and furnishings.

THE MARKETPLACE RESPONDS

“Many private insurers offer excess flood protection, both for commercial and residential exposures. Carriers include Markel, Lloyd’s, Chubb, Lexington, Zurich, and Chartis. There is interest in the marketplace for both commercial and residential coverages,” according to Connie Masella, managing director, brokerage property, at Markel Corporation.

The underwriting appetite for excess flood varies significantly by carrier. Each has its own criteria and areas of interest.

Eric Nikodem, executive vice president and property division executive at Lexington, explains: “We evaluate the location-level information to determine the susceptibility to flood and establish a ‘normal loss expectancy’ (NLE). This includes identifying the location’s presence within or outside of a mapped flood area, in addition to examining location-level risk mitigation and preventive flood measures. These procedures are consistent for both commercial and residential flood underwriting.”

The Chubb Group of Insurance Companies writes excess flood coverage strictly for residential risks. Steven Berg, regional product manager for Chubb Personal Insurance, says: “To be eligible for our primary or excess flood policy, the insured must have a homeowners policy for the subject location written with us.”

The potential customer base for excess flood insurance is vast, Ms. Masella says. “Everyone whose asset values exceed the coverage available in the primary flood market should consider buying excess flood coverage. Almost everyone lives in a flood zone, and nearly a quarter of all flood claims are made in areas considered to be low or moderate in risk. In high-risk areas, there is a 25% chance of experiencing a flood during the term of a 30-year mortgage.”

The Biggert-Waters Flood Insurance Reform and Modernization Act was recently signed into law. It extends the NFIP for five years and makes some significant changes in the program. An example is how to adjust clean slab losses that could have been caused by either water or wind. We asked our experts how the new law will affect their excess flood writings.

Mr. Nikodem explains: “While we are cognizant of changes to the NFIP because the act impacts our clients, the process by which we underwrite excess flood is unchanged by revisions to the program.” He adds: “While the Biggert-Waters Act addresses how to apportion a loss deemed ‘indeterminate’ under the NFIP (i.e., whether the result of flood or wind, or the combination thereof), our policy contains a specific definition of flood, and a claim will be adjusted accordingly. Our underwriting of a given risk is specific to that risk’s attributes, and changes to the NFIP will not affect our policy or our underwriting of the peril of flood.”

“Excess flood carriers typically require insureds to purchase the maximum NFIP coverage available,” says Ms. Masella. “If there was no federal program, it would take some time for the primary market to respond and fill the gap. That would make purchasing excess flood more complicated. The wind/water slab claims criteria in the act serve to document what most insurers were likely already doing when claims were presented, where there was little or no evidence of what exactly caused a loss. When in doubt, the claim was split between applicable coverages/carriers, unless one of them clearly excluded concurrent causation. It is possible that markets will seek to enhance their concurrent causation language, though to date there does not seem to have been a movement in that direction.”

As with risk appetite, underwriting criteria for excess flood vary by carrier.

Mr. Berg explains that Chubb considers “the property’s physical location and proximity to the nearest source of flooding, along with the probability of a flood loss occurring to that property. The severity of flood loss and loss history of the area/zip-code/community must also be reviewed. Red flags are prior flood losses, a high PML location, and impending storms.”

According to Mr. Nikodem, location-level underwriting criteria include “FEMA flood mapping; distance to water; historical loss experience; mitigating criteria; deductible/retention; exposed values at sub-ground and ground level; and business continuity plans.”

Ms. Masella adds, “Risks on stilts, over water, or with a history of frequent loss would raise flags for excess carriers.”

Our experts serve different segments of the excess flood market, so we asked them to describe the components of their respective products.

Mr. Nikodem says: “We provide a broad range of coverage options that are specifically tailored toward our clients’ occupancies and industries, including direct physical loss, business interruption, extra expense, and time element. While we are able to provide limits in excess of $100 million, the limit we deploy for a specific risk is highly dependent upon location-level underwriting. For instance, in high-hazard flood areas (barring notable risk mitigation characteristics or extremely low non-levee embankments or NLEs), we generally will only deploy up to $10 million in limits.”

“On a personal and commercial basis, the coverage Markel provides is excess of NFIP or comparable underlying private insurance limits,” Ms. Masella explains. “In the commercial market, we will entertain limits of $1 million to $2.5 million in critical zones. In less risk-prone areas, we can offer $5 million to $10 million. In our personal market, the product is written on an admitted basis, and we will offer coverage up to $1 million.”

Chubb offers both primary and excess residential flood coverage with the following key components, according to Mr. Berg: “Replacement cost coverage for building and contents, additional coverage for real property in the basement, contents in the basement, additional living expenses and rebuilding to code, and limits up to $15 million for building and contents combined.”

For obvious reasons, geographic location is a major underwriting consideration in the excess flood marketplace.

Ms. Masella says: “The excess flood marketplace varies based on the risk’s location. Coastal risks exposed to wave wash and risks in A zones typically find smaller limits available. Many markets exclude these exposures altogether. Where coverage is available, the underlying limit requirements are generally no different for insureds that are eligible for NFIP.”

“Geography is obviously a key component of underwriting, as we undertake flood risk both on a coastal basis and on an inland waterway basis,” Mr. Nikodem notes. “ On the former, underwriting must include evaluating tropical storm exposure, whereas this risk is generally not the principal driver on the latter. Our capacity or the limit we provide can vary based on geographic location, but our approach is extremely account-specific.”

“Capacity and pricing vary among private flood markets,” says Mr. Berg. “Competition remains strong among the multiple carriers offering excess flood coverage. Our flood program does not have any capacity issues.”

Amy Tavera, Product Coordinator of Market American Insurance Company shares a change she has observed in the residential markets. “It appears that more of the high-value homeowners insurers now provide flood coverage bundled with their homeowners coverage. There has been little marketing regarding this option, so the public doesn’t appear to know about the opportunity to purchase flood coverage from a standard homeowners carrier.

“Not much has changed in the market in regards to personal lines excess flood coverage or capacity,” she remarks. “For 2013, we expect a very modest increase in requests for coverage, but that depends on the health of the economy and home sales. The same is true of the commercial market.”

“There is ample excess flood capacity available,” according to Mr. Nikodem. “However, there have been variations in the pricing of excess flood over the past few years, given the high number of unprecedented inland waterway losses and events. In addition, there is no single industry-wide, universally accepted flood model. As a result, brokers and insureds unfortunately experience more inconsistency around the pricing and evaluation of flood insurance.”

Our experts agree on one extremely important point: Flood coverage should be offered to every client because flood losses can and do occur outside of flood plains. The client can then make an informed decision on whether or not to purchase the coverage.

WHO WRITES EXCESS FLOOD COVERAGE?

INSURANCE CARRIERS

Contributing to this article:

The Chubb Group of Insurance Companies

15 Mountain View Road

Warren, NJ 07059

Contact: Steven Berg, Regional Product Manager for Chubb Personal Lines

Email: sberg@chubb.com

Phone: (908) 572-2684

Website: www.chubb.com

Lexington Insurance Company

100 Summer Street

Boston, MA 02110

Contact: Erik Nikodem, Executive Vice President & Property Division Executive

Email: erik.nikodem@chartisinsurance.com

Phone: (617) 330-4410

Website: www.lexingtoninsurance.com

Markel American Insurance Company

N14 W23800 Stone Ridge Dr.

Waukesha, WI, 53188

Contact: Amy Tavera, Product Coordinator

Email: atavera@markelcorp.com

Phone: (800) 236-2862 ext. 3336

Website: Markelamerican.com

MANAGING GENERAL AGENTS

Contributing to this article:

Markel Corporation

4521 Highwoods Parkway

Glen Allen, VA 23060

Contact: Connie Masella, Managing Director, Brokerage Property

Email: cmasella@markelcorp.com

Phone: (804) 273-1483

Website: www.markelcorp.com

|