By Len Strazewski

The Affordable Care Act didn’t just change insurance requirements for employers and individuals. The comprehensive health insurance reform law also disrupted the way insurance agents and brokers design their businesses.

Not that agents have been isolated from market changes. Group health premiums have been increasing steadily for decades with plan designs evolving as employers attempted to cope with the increases.

But it took a federal law to really rock the insurance agency world.

Giangola Insurance Agency in Ashtabula, Ohio, was founded in 1955 and has been marketing health benefits and related products from its earliest days, says Joe Giangola Sr., CEBS, son of the founder Don Giangola Senior.

|

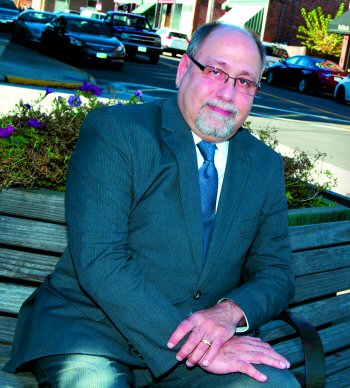

| From left: Joseph R. Giangola, CEBS; Gerald R. Giangola, CLU, ChFC; Suzanne M. Flannery, Customer Service Representative; Joseph R. Giangola Jr., Agent.

|

|

|

| “Everyone was getting information from different sources. We had to become the most reliable source.”

—Joe Giangola Sr., CEBS

Principal

|

|

|

| “Funding healthcare in retirement has become a critical aspect of financial management.”

—Gerry Giangola, CLU, ChFC

Head, Retirement Practice

|

|

|

| “People with families tend to be more sensitive to their health insurance needs and more ready to shop for their coverage.”

—Joe Giangola Jr.

Lead Producer, Individual Health Insurance

|

|

“My father was a career life insurance agent,” Joe recalls. “He created his own agency and in the 1960s and 1970s, the rest of the family joined the company to make us a true family-owned and operated independent agency.”

Changing to meet market needs has always been part of the firm’s standard operating procedure, Joe recalls. “In the 1980s, most employer health plans were fully insured with dental and vision care. The cost was about $39 for single coverage and $98 for family coverage and unless there was a sudden premium increase, employers were unlikely to change health plans.”

But as costs began to increase, employers began to lean on their agents for greater innovation and support. “Suddenly there was so much more work,” he says. “Not only did we have to work harder to market coverage and contain costs, a lot of administrative work shifted from the employer to the agency.”

Enrollment management, benefits communications, claims advocacy and consulting all became part of the firm’s value proposition and package of services.

The agency now has seven employees, four of whom are producers, including Joe’s two brothers Don and Gerald and his son Joey Giangola Junior. Group health benefits account for about 50% of agency revenues, life insurance and financial services about 30% and property/casualty insurance about 20%.

Joe Sr. takes the lead in group health benefits—a business that has changed dramatically since the passage of the ACA. Employers were hit with several compliance challenges, varying by their size and type.

Large employers—defined as those with 50 or more employees—inherited new tax filings as well as responsibilities for either providing benefits or contributing to individual insurance for employees. Smaller employers had more options than before, but more choices meant more confusion.

“Employers with fewer than 50 employees were hit the hardest and that was the bulk of our group health business,” he says. “Small employers are worried about the day-to-day management of their businesses. The owner or general manager is often the human resource manager, benefits manager and risk manager. They don’t have time to become compliance experts.”

Suddenly, the role of the agency changed from insurance sales to insurance education, Joe says. “Everyone was getting information from different sources. We had to become the most reliable source. We took our teaching role seriously.”

The agency began assisting their clients in navigating the new options and the new rules, helping them decide to eliminate group coverage, re-market coverage according to new plan designs, explore the public and private exchanges or attempt self-funding—which provides some relief from some of the new regulations.

Self-funding of health benefits, did not disappear under the federal regulations. Instead, more employers have turned to self-insurance, using the growing stop-loss insurance market to avoid ACA regulations, he says.

Today, most employers with 100 or more employees self-fund some of their health benefits and companies with as few as 20 employees have some risk sensitive options. “It all depends on the client’s ability and willingness to assume risk,” Joe says.

Joey Jr. joined the agency in 2009 after graduating from Walsh University in 2006 with a degree in corporate communications and briefly exploring careers in music and entertainment. His father recruited him into the family business to carve a new niche created by ACA, “but when you grow up in an insurance family, it seems like you’ve always been part of the family business,” he says.

Joey is the lead producer for individual health insurance, a business that is slowly replacing much of the very small group market. Some of the small employers that had been group health customers before ACA have chosen to stop providing group benefits after the reform law eliminated some of the plan design options that had been available.

Instead, their employees look to individual coverage to comply with the federal requirements. However, Joey says, the business has not exploded the way the agency hoped.

The business is growing, he says, but not quickly. Individual customers need to be educated about regulatory compliance, coverage and costs. “It depends upon the particular situation of the client. People with families tend to be more sensitive to their health insurance needs and more ready to shop for their coverage.

“But many individuals who perceive themselves as healthy would prefer to pay the tax penalties and go without insurance.”

The cost is a factor, he says, “but mainly it is a lack of knowledge about the system. So it’s been our goal to put the information where they need it, when they need it and make it as easy as possible to understand when they do.”

As a result, Joey has become the agency’s leader in multimedia education, using his communications and media training. Since joining the firm, he has been producing the agency’s educational program—launching an insurance topics blog and interactive video programming designed to help educate consumers about the ACA requirements and the options it has mandated.

Video topics include:

• The Best and Worst Ohio Health Insurance Plans

• Anthem Blue Cross/Blue Shield kicks Cleveland Clinic Out of the Network

• Four Secrets to Getting Approved for Individual and Family Health Insurance

• Thirteen Questions Answered about Ohio’s Health Insurance Exchanges

The agency also supports customer wellness efforts. Employers have a wide range of wellness programs available from health plans, Joe Sr. notes, but great health and lower costs don’t arrive overnight. Employees need to be trained and educated to improve their lifestyles.

“If we can, we want to try and help improve our customers’ health and reduce their need for medical insurance. That’s an area where we’ve tried to educate our clients as well,” Joey says.

The agency rounds out its benefits practice with a group and individual life insurance, executive benefits and retirement plan practice. Financial Advisor Gerald Giangola, CLU, ChFC, heads the retirement practice—which has also changed over the past few years. ACA, however, wasn’t the trigger for the evolution of this business niche.

Gerald says the agency maintained a thriving 401(k) defined contributions business until the 2007 recession. Faced with a shrinking economy and pressure to contain costs, many employers stopped contributing to retirement plans and, in some cases, abandoned them altogether to save administration costs. Today, the agency specializes in follow-up to group retirement benefits, including 401(k) rollovers, annuities, Individual Retirement Accounts, trusts and individual investments.

“The 401(k) plans for small employers of 10 to 15 employees are disappearing. Even some Fortune 500 companies are backing off on 401(k) contributions and passing along a lot of the administration fees to plan participants,” Gerald says. As a result, the employer-based retirement options have become insufficient for individuals.

Small employers are moving toward SIMPLE (Savings Incentive Match Plans for Employees) benefits or encouraging employees to fund their own Individual Retirement Accounts. The shift in focus puts more stress on individuals as they try to prepare for their future needs, Gerald says.

“I now get clients coming off of group retirement plans, 10 to 15 years out from retirement, but looking for more choices in funding their future,” he explains. Many are taking lump sum distributions from defined benefit plans or rollovers from 401(k) plans and need guidance in managing those assets.

Annuities are one option the agency can provide, as a way of guaranteeing retirement income and providing for day-to-day living expenses while other investments suffer from market fluctuations, he says.

Post-retirement health coverage is another important consideration for clients, Gerald says, and his advisory services often dovetail with Joey’s individual health insurance marketing as the agency accommodates clients making a transition from small group plans to early or pre-retirement. Healthcare options for individuals changing or leaving jobs include consulting on COBRA plans and Medicare supplement plans.

“Funding healthcare in retirement has become a critical aspect of financial management,” Gerald explains. “As individuals live longer, they need to consider that they may have to plan to live to 90 or 100 years old—with healthcare costs steadily increasing.

“A growing portion of our advisory practice focuses on assisting our clients in finding ways to prepare for those costs, which include paying for Medicare and Medicare supplement insurance, prescription drug insurance, and out-of-pocket expenses,” he says.

Long-term care (LTC) insurance increasingly enters the conversation, Gerald says. While LTC is not a huge seller, the agency attempts to educate clients about the growing needs for specialized care as individuals age with disabilities.

The agency provides several options, Gerald says, including traditional periodic premium LTC insurance, hybrid life insurance policies with long-term care payment options and single premium LTC policies.

The author

Len Strazewski is a Chicago-based writer, editor and educator specializing in marketing, management and technology topics. In addition to contributing to Rough Notes, he has written on insurance for Business Insurance, Risk & Insurance, the Chicago Tribune and Human Resource Executive, among other publications.