On the facing page: Kermit Smith, (left) president and chief operating officer of Atlantic Mutual Companies, and Klaus Dorfi, chairman of the board and chief executive officer.

An old-line East Coast mutual insurer established in 1842, with its roots firmly in the ancient business of insuring ships and their cargo, might be forgiven if it weren't leading the pack in product, service, and technological innovations as we move toward the 21st century. That's clearly not the case with Atlantic Mutual Insurance Company and its affiliates. Based in New York, with a nationwide network of field offices and a cadre of overseas partners, this respected member of the old guard not only is pushing the envelope in technology but also is crafting fresh new ways to provide premier products and services in its designated markets. In this article we'll find out just how this venerable insurer is positioning itself for the new millennium while at the same time honoring its commitment to the values on which it was founded more than 150 years ago.

The organization known as the Atlantic Mutual Companies consists of Atlantic Mutual Insurance Company; Centennial Insurance Company; Atlantic Specialty Insurance Company, which deals in the alternative risk market; Atlantic Lloyd's Insurance Company of Texas; Atlantic Companies Holding Corporation; and Atlantic Mutual of Bermuda Limited, a captive carrier. Founded as an insurer of marine hull and cargo risks, with the distinction of being the oldest mutual marine underwriter in the country, Atlantic Mutual today maintains a strong presence in that market; while over the years it also has developed expertise in a diversity of carefully chosen areas of property and casualty insurance.

Proud history

"Atlantic Mutual wrote only marine insurance for its first 100 years," explains chairman and chief executive officer Klaus Dorfi. "We insured the hull of the Titanic and some of its cargo. In fact, we're the only surviving U.S. carrier that insured the Titanic." Earlier than that, Dorfi adds, Atlantic worked with the government to insure Union shipping during the Civil War. In the 1930s and 1940s the company added fire, inland marine, and casualty coverages, and it became a multi-line insurer during the 1950s. Here, Dorfi notes, Atlantic Mutual again made history, this time by issuing what the company believes is the first commercial package policy, consisting of property and liability coverage on a stationery store in Philadelphia.

Today, he says, commercial package, workers compensation, other commercial lines and ocean cargo account for some 75% of the Atlantic Mutual Companies' gross premium volume of $750 million, with the remaining 25% in high-premium personal lines written through a package policy called the Atlantic Master Plan and a companion product, the Distinctive Home Policy.

Diverse products and services

On the commercial side, Atlantic Mutual offers specialized products and services for a variety of risks: electronics, financial institutions, food industries, merchants, metalworkers, office buildings, plastics, printers professional services, and wholesalers. The company also creates programs for trade associations and other groups that incorporate property and casualty coverages plus loss control and claims services. In personal lines the company also pursues professional associations whose members are physicians, dentists, CPAs, architects, attorneys, realtors, school administrators, and financial services professionals, among others.

The Special Accounts division, available to risks that generate minimum premium of $300,000 in casualty coverages, offers primary general liability, automobile liability and physical damage, workers compensation, umbrella, property, and inland marine coverages. Umbrella capacity is $25 million. Programs for these accounts include incurred loss retrospective rating plans, modified paid loss retrospective rating plans, self-insured retention programs, large deductibles, captive programs, excess workers compensation, adjustment retention programs, participating plans, and guaranteed cost programs.

Atlantic Risk Services, a wholly owned subsidiary formed in 1997, provides customized alternative risk management products and services to a wide range of commercial customers. ARS offers risk funding programs, claims management and managed care services, loss analysis, captive formation, and actuarial support.

Atlantic Mutual of Bermuda, Ltd., also formed in 1997, is a licensed property and casualty insurer that acts as a rent-a-captive to accommodate individual entities or groups interested in a risk management program that can provide short-term or long-term benefits of risk sharing and investment options. "Our rent-a-captive is for use by large casualty clients that are looking for a vehicle to capture some investment income on the frequency portion of the account; it's an alternative for large, more sophisticated risks," Dorfi says.

Responsive and equitable

What is Atlantic Mutual's operating philosophy? "We try to be the premier company in our core business areas," Dorfi responds. "As a mutual company, we're committed to safeguarding the interests of our policyholders. We want to be responsive and equitable in claims handling; we strive to underwrite to the customer's needs and don't issue commodity policies; we believe strongly in risk management; and we work hard to develop best practices standards and procedures."

Atlantic Mutual is "somewhat unusual, in that we're a national/international operation, but with a strong regional focus," Dorfi comments. "We probably have a more sophisticated, complex global strategy than most companies our size. Our larger commercial clients have international operations, and we provide strong international coverages on domestic policies. To serve these clients' needs, we have service partners worldwide, and we're licensed in both Canada and the United Kingdom."

Committed to agents

With a carefully selected force of some 1,000 independent agents, Atlantic Mutual is firmly committed to the independent agency system as its only mode of distribution. "For us, it's really not a choice to consider alternative sales channels," Dorfi declares. "The agent is an integral part of the service we provide the policyholder. The agent is a business partner; he or she is a part of our distribution system and a part of our strategy. We need a strong professional agent to explain very complex products that are not commodities, and to match those products to the client's needs. Both our commercial policyholders and those with high-premium personal lines coverage need professional advice, and we believe that is best provided by independent agents."

What do the Atlantic Mutual Companies look for in an independent agent? "We seek professionalism, business competence, and the ability to become familiar with our complex products," responds Atlantic Mutual president Kermit Smith. "We're looking for a mutual commitment, not a brokerage approach. We want an agent who has a perpetuation plan in place and is looking to grow, not just maintain the status quo. The agent should be reputable, financially sound, and have a strong track record. We're committed to the independent agency system and to our agents, and likewise we look for agents who are committed to the kind of company we are, as opposed to companies that use multiple distribution channels. We believe that both agents and companies must carefully choose their long-term partners."

How does Atlantic Mutual view its relationships with agents? "We have excellent relationships with our agents," Smith asserts. "We have a good reputation for being supportive of agents." He continues, "We have different types of relationships with different agents. In our Network program we have 250 members who are the most willing to participate in the kind of relationship I've described. In return for their commitment to us, these agents enjoy incentive compensation opportunities and special service arrangements. Not all of our agents are large enough to belong to the Network; our goal is to help every one of them achieve Network status."

"We're a national/international operation with a strong regional focus."

"We're a national/international operation with a strong regional focus."

--Klaus Dorfi

Contracts with Network agents are renewed based on compliance with the program's criteria. For Atlantic, a vital part of the Network program, Smith points out, is developing stronger long-term relationships with agents. In addition to large-volume producers, he notes, "We also look for specialty relationships to match our core competencies. For example, some producers represent us only for marine business. These relationships are not based exclusively on volume."

A significant benefit for Network agents is the insurer's Atlantic Agency Reinsurance Companies (AARCs). Initiated in 1996 and covered under Bermuda captive regulations, AARCs are funded with capital from Atlantic, plus agent investment. Atlantic is an equal partner with each agent who participates in an AARC. Agents not only receive the standard commission on business they place in the AARC but also are eligible for dividends; and they further have the potential to benefit, through part ownership, from capital appreciation of the AARC itself.

Technology leader

In the realm of automation, Dorfi notes, Atlantic Mutual prides itself on being a leader in converting to client-server technology. "In the last two years alone, we've spent $25 million on new systems," he says. "We've rebuilt both our personal and commercial lines systems, and we have a claims system that's state of the art." Further, he notes, "Our increased use of technology is helping us achieve significant reductions in expenses." The insurer, he adds, also is working on achieving the most efficient, effective interface with its agents. Atlantic Mutual's computer and processing operations are based in Roanoke, Virginia, and manned by a staff of 600. "We have a national reach with centralized processing through strong technological connections," Dorfi explains, "but our sales and service operations are local--and they rely heavily on the involvement of our agents."

Kermit Smith says the company seeks a strong commitment from its agents but provides them with a strong commitment in return.

Kermit Smith says the company seeks a strong commitment from its agents but provides them with a strong commitment in return.

Atlantic Mutual also takes a positive view of the Internet and its potential to help the company produce more business through the independent agency system. "In the future, we will use the Net to communicate and do business with independent agents," Dorfi declares. "Our major current focus is developing state-of-the-art programs and procedures to help us achieve success through our agents."

An excellent example is the Commercial Insurance Division's introduction last year of InsurePoint, a joint Internet venture Web site with Bolton & Co., a full-service broker based in South Pasadena, California (See story in June issue, page 22). InsurePoint, the nation's first full-service electronic storefront for business insurance, targets smaller, growing high-tech companies with simple applications, two-day turnaround on quotes, and secure payment via the Internet. Independent agents, Atlantic Mutual emphasizes, are included as an integral part of the transaction. InsurePoint also offers on-line claims reporting, loss prevention information, renewals, instant transaction confirmation, and online access to service personnel and consultants. Now available in California, Oregon, New Jersey, and Georgia, the program eventually will be expanded nationwide.

How is Atlantic Mutual responding to Y2K, the technological challenge that has business and industry worldwide scrambling for solutions? "We recognize the severity of the Year 2000 problem and the need for agents to upgrade their computer systems," Dorfi observes. "We're offering our agents technology loans, with forgiveness in return for business commitments. It's a win-win situation: our agents need to upgrade their systems; we can help them and at the same time acquire more business."

The insurer also is working with the Independent Insurance Agents of America and automation vendors to support the Big I's Countdown 2000 program designed to help agents achieve compliance on a timely basis. On its own, Dorfi says, Atlantic Mutual is sending material to its policyholders to raise the Year 2000 issue from a loss control perspective. The insurer itself, he notes, began to deal with the Year 2000 problem five years ago and expects its own internal processing systems to be fully Year 2000 compliant by the end of 1998.

A word from the agency side

To the agents with whom we spoke, Atlantic Mutual richly deserves its reputation as a stable, focused insurer with high standards and a strong commitment to the independent agency system. Phil Lieberman, CPCU, CLU, owner of Spectrum Insurance Group in Parsippany, New Jersey, has been in the insurance business since 1960. His agency operates in New Jersey, metropolitan New York, and eastern Pennsylvania and has premium volume of about $40 million, of which some 90% is in commercial lines, with a specialty in restaurants. Spectrum represents 14 major insurers and, Lieberman notes, prides itself on the high level of trust and solid relationships it enjoys with its markets--including Atlantic Mutual, which it has represented since 1991. What made the idea of working with Atlantic so appealing? Lieberman responds: "We were interested because of their reputation, the kind of people they were--focused on the agent--the quality of their products, and their claims operation. Over the years, they have grown to become one of our major carriers." Spectrum, a Network agency, places business for two sponsored metalworkers programs and a nationally sponsored cosmetics, toiletries and fragrances program with Atlantic, as well as a significant amount of restaurant business.

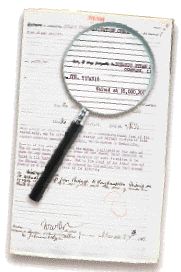

The original Atlantic Mutual policy which insured the Titanic for $5 million.

The original Atlantic Mutual policy which insured the Titanic for $5 million.

"Atlantic's philosophy is to focus on agents as true partners," Lieberman says. "They have an excellent reputation for their products and claims handling; they're the 'Tiffany' of insurance companies in that regard." Because Atlantic is very discriminating in its selection of agents, he adds, "There's a value to the franchise. Not everyone can represent Atlantic; they're different from their competitors."

"We became a Network agent fairly quickly," Lieberman explains, "because Atlantic saw our commitment and integrity." He moved up through the local and regional ranks of the insurer's producer advisory council and eventually became chairman, which also entitled him to serve a one-year term on the board of directors. He found the experience tremendously valuable. "It speaks well for Atlantic Mutual that an agent is able to attend board meetings and make a presentation on behalf of the entire field force," he says.

As a Network agent, he was invited to join Clipper Reinsurance, one of the Atlantic Agency Reinsurance Companies, and now serves as vice president of that entity. "We've only represented Atlantic Mutual for seven years, but we've enjoyed a rapidly growing relationship with them, plus the opportunity to be involved with upper management," Lieberman notes. "Having served in various positions, I've had the opportunity to get to know Atlantic Mutual very well. To a person, they are uniquely committed to agents as strategic partners and as essential elements of the company's success."

Expressing many of the same sentiments is John Wright, CPCU, CIC, of Johnson Kendall Johnson, Inc., in Newton, Pennsylvania, a regional brokerage that operates in all 50 states and writes annual premium of about $45 million. JKJ's clients include health care facilities such as skilled nursing homes and retirement homes, for which the firm has some proprietary programs; and workers compensation programs with large deductibles and self-insurance. Through an affiliate, the brokerage arranges employee benefit programs for self-insured risks. A "micro-niche," Wright says, is international companies doing business in the United States, where JKJ handles their domestic insurance needs. Captive management and self-insurance services are provided through dedicated underwriting, loss control, and claims handling units.

Johnson Kendall Johnson has represented Atlantic Mutual since 1986, and it uses the carrier as a market for standard commercial property and casualty business as well as marine hull and cargo. JKJ's relationship with Atlantic, Wright points out, is multifaceted. "We have a traditional relationship through their regional office, where we sell their products and provide service to our clients. We also have a relationship with the Special Accounts division, which handles retention-driven business with large deductibles and self-insurance needs. These clients require much more customized services than the business we place through the regional office. Atlantic Risk Services provides loss control and claims service for these risks."

What factors motivate Johnson Kendall Johnson to place business with Atlantic Mutual? "We have confidence that service delivery will be consistent," Wright responds. "If not, we can address it and get a response. It's also a matter of scale: it's much more efficient to be transacting business with Atlantic and get very focused service and service benchmarks, rather than dealing with companies where the programs change every week. Our service people actually urge us to use Atlantic." At JKJ, "We also appreciate our technological links with Atlantic, especially on claims," Wright adds. "We can check their system for claim status, and on any claim over $10,000, we can check the reserve status weekly. We don't have to leave voice mails and wait two weeks for a callback."

Wright and his colleagues also place a high value on the knowledge and experience of the people with whom they deal at Atlantic. "Our biggest struggle with companies in general is the lack of experience and the lack of reference points, especially in claims and loss control," Wright comments. "Many stock insurers re-engineered these departments, and in the process they lost a lot of experienced people. Atlantic Mutual has maintained a much stronger talent level."

As a Network agency, JKJ belongs to Endeavor Captive, an Atlantic & Agency Reinsurance Captive, and is very pleased with the results. "It's a way to participate in the profitability of the business we put into the captive," Wright observes. "It's also an opportunity to have communication with and access to the senior management of Atlantic Mutual. This offers us more potential for creating an even stronger relationship with Atlantic."

A great source of satisfaction, Wright says, is that "we've been able to integrate the way Atlantic Mutual works with the way we work--we don't have to go outside the box. We're trying to eliminate day-to-day paper transactions; the client doesn't care about them, and we want to spend more time on services that are more important to the client. Atlantic is ahead of the curve; they're setting up a strong Internet connection. We're very excited because it will mean less paper transfer, and we'll be able to communicate claims and loss control information quickly. We've invested heavily in technology, and we're trying to establish efficient communication linkages with both our clients and our companies."

Wright has been involved with the producer advisory council of Atlantic Mutual, as well as those of other companies. "I think what Atlantic brings to the table, in contrast to other companies, is that they listen hard to feedback from agents. Senior management wants to know when something's wrong, and we have access to them. Any agent can call the president or chairman. Atlantic Mutual has the strongest commitment to the independent agency system; they see us as their primary partner, not just one of several distribution channels."

The feeling is mutual

There's no doubt about it: Atlantic Mutual has made a strong commitment to the independent agency system and to the agents who are its business partners--and those agents fulfill their part of the bargain with a high degree of loyalty plus the quality business the insurer seeks. In terms of tradition, stability, and integrity, Atlantic Mutual is every inch the old-line East Coast mutual; in terms of technological innovation and state-of-the-art services for today's complex risks, it's clearly ready to chart its course for the 21st century. *

©COPYRIGHT: The Rough Notes Magazine, 1998