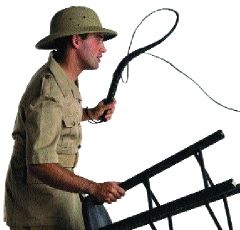

TAMING A FEROCIOUS MARKETPLACE

Technology can enhance your ability to operate in a global economy

By Tana Sabatino

Times are changing. One look at the daily news reports confirms this. Several major trends--market globalization, mergers and acquisitions, new distribution channels, and government regulation--demonstrate the changing ways we do business.

Technology plays an important role in supporting these changes in order to move forward. As we delve into each of these arenas, a random week's worth of news headlines has been selected as a benchmark.

* "Norwest and Wells Fargo Merger Complete"

* "Overseas Business Expansion May Have Long Term Rating Implications"

* "E-Trade's Destination Web Site Takes Top Honors"

* "Financials Weaken On Global Worries, Slower Growth"

* "Internet Advertising Surges"

* "Wall Street Votes, Too"

Do these headlines make you just a little bit nervous? Considering the broad picture they paint in such a short time, they should.

Globalization of the marketplace

The boundaries for our country's marketplace are no longer limited to our borders. Global economic changes, our ability to sell overseas, and the capacity for companies from other countries to enter the U.S. market are impacting the way we do business. For instance, U.S. insurers have become increasingly interested in overseas business expansion. This desire can have long-term implications for a company's strength. According to a press release published by Moody's Investors Services, "U.S. life insurers' increased interest in overseas business expansion may have long-term rating implications. Ratings are likely to play a greater role as these operations become more significant. The crisis in Asia demonstrates some of the most promising opportunities and the severest risks."

But the effect of globalization is not limited just to companies expanding in those markets. Reuters reported that "stocks of financial services companies on Tuesday weakened because of economic and political uncertainties abroad." Because of the increased investments made in overseas stocks, changes in those marketplaces directly affect how well our financial services organizations perform here.

New distribution channels

For instance, look at the problems life insurers are facing. Changing demographic trends, heightened competition across the financial services industry, and loss of consumer confidence caused by agent misconduct have continued to disrupt sales for the life insurance industry. Increasingly, U.S. life insurers are seeking ways to build alternative channels of distribution outside the career agency channel.

Direct marketing is becoming an important vehicle for insurers. The Internet is a strong contender for making a dent in this arena. Insurers are beginning to offer many basic products on the Internet--such as auto and home insurance, and traditional term and whole life insurance. But direct marketing opportunities are not limited to the World Wide Web. Telephone sales centers are also being created. And you may have noticed additional direct mail from an insurer appearing in your home mailbox.

Other distribution channels are also on the rise. An insurer providing the ability for insurance products to be sold through stock brokers, or use of your traditional financial planner is gaining momentum. Worksite marketing (selling products in the workplace), and target marketing also have gained new popularity. Anyone who belongs to a frequent flyer program with an airline has seen MCI's offer to obtain mileage by switching to its telephone service. This type of target marketing strategy is being used by insurers as well. College alumni associations, clubs, credit card users, magazine subscription holders--all potential groupings of consumers--offer opportunities to insurers to partner and sell insurance.

Mergers and acquisitions

As companies consider additional distribution channels, they realize one opportunity is to simply acquire a new company that offers complementary products and absorb its customer base. And based on recent news, this method is quite popular. Fourteen mergers appeared in a news search utilizing the Internet search engine provided by Yahoo for that week alone. Consider some of these recently announced mergers: Wells Fargo and Norwest merger completed; Norwich Union bought London & Edinburgh Insurance, the UK's sixth largest general insurance company; Bermuda-based Centre Re, a member of Zurich Financial Services, is to acquire disability income insurer, Massachusetts Casualty Insurance; and Allmerica is to tender for Citizens Corp.

The merger between Travelers and Citibank shook the marketplace. A bank and an insurer joining to become a single company? Is this possible? Will it work? Only time will tell, but other companies are not waiting to find out. Each week a large number of mergers and acquisitions are taking place. As a result, the number of companies in the marketplace is becoming smaller, while their size and diversification is growing.

The government

Legislative changes cannot be ignored. Changes in the global economy and laws put in place to support expansion have led to increased opportunities and increased competition for U.S. insurers.

At the same time, legislation may change the way we sell insurance here at home. If we think mergers are shaking things up, how about proposed legislation changes? An important issue likely to come up in the 106th Congress includes legislation that would allow banks to provide insurance and financial services. As a result, competition with other insurers isn't our only worry--now we must worry about competing with banks as well.

The role of technology

So we need to sell internationally, compete with international companies entering our marketplace, sell via alternative distribution channels, support mergers and acquisitions, and fight off banks from entering the marketplace, all in hopes of increasing sales in the future. This gets complicated. How can we manage? This is where technology comes in. In prior years, the pace of change like that we're experiencing today could not have been sustained. This is because technology wasn't available to support these changes, and manual processes can only extend so far.

Today, data warehousing, data mining, and automated document management are alternatives to better store, retrieve, and analyze information. Knowing your customer, understanding why someone is likely to buy a product, evaluating what works and what doesn't are all critical in today's marketplace.

And do not underestimate the power of the Internet. Spending on Internet advertising surged 97% in the second quarter of 1998. Only a year ago spending rose from $214.4 million to $423 million, according to PriceWaterhouseCoopers. Financial services providers made up the third largest segment of the advertiser marketplace. That's a startling figure. For those of you who didn't think an investment in the Internet is worthwhile, think again.

Here are some key news events surrounding the Internet: Freerealtime.com allies with Farsight Financial Services to provide online brokerage services; Silknet Software and e*biz team to provide customer-driven e-business solutions to financial services market; a new Internet Web site by the Hartford Financial Services Group allows corporate risk managers and their insurance agents to streamline and customize their invoicing systems; E Trade's destination Web site takes top honors; First Data Investor Services group to provide online mutual fund shareholder services to Princor.

What do these news events tell us? The Internet is being used for advertising, marketing, purchasing, trading, servicing--the whole business. It allows companies to reach out to potential consumers in ways never before possible. Selling globally? The Internet automatically gives you a global presence. In the next few years we will see the Internet playing an ever-increasing role in our business. Companies without products and services online will lose out on a large chunk of business.

The shake-up taking place in the insurance marketplace is only going to get worse before it gets better. Five years from now, the insurance market as we know it will be history. The road ahead is a bumpy one--so hang on. *

ACORD Conference '99 offers a Life Standards track that includes 14 workshops and sessions.

The author

Tana Sabatino is life group manager, OLifE, ACORD. |