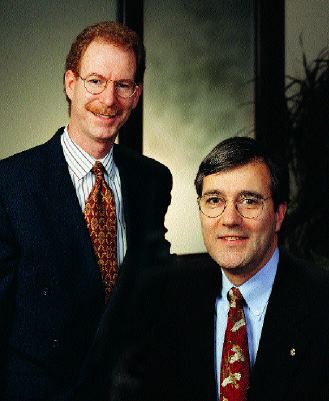

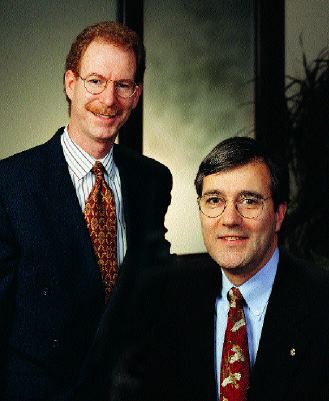

Thomas F. Mulligan (left), senior vice president, underwriting and marketing of Western World Insurance Group; and Andrew S. Frazier, CPCU, president and chief executive officer

In the tradition of diversifying to meet the needs of the marketplace, Western World again has capitalized on its core competencies with the formation of a new division: Westco Programs. Headquartered in suburban Franklin Lakes, New Jersey, the Western World Insurance Group was formed in 1964 and carries the A.M. Best rating of A+ VIII (superior).

In the tradition of diversifying to meet the needs of the marketplace, Western World again has capitalized on its core competencies with the formation of a new division: Westco Programs. Headquartered in suburban Franklin Lakes, New Jersey, the Western World Insurance Group was formed in 1964 and carries the A.M. Best rating of A+ VIII (superior).

Westco Programs was founded in January 1998, to bring a new focus to association and affinity group program business. The executive in charge of Westco Programs is Tom Mulligan, senior vice president of underwriting and marketing. Tom states that, "While the name may be new, Westco Programs has over 35 years of underwriting expertise behind it in specialty, general, and professional liability classes. We want to be the carrier for agents, affinity groups, or associations that need tailored solutions for unusual general liability or professional exposures, and who place a high value on personalized attention and program protection."

The core of Western World's business consists of small to medium-sized E&S accounts with an emphasis on professional exposures. These are distributed through authority granted to select agents located throughout the U.S. Capitalizing on the expertise gained from its core of business, Western World has often expanded its product offerings.

Western World began expanding in 1981 with the formation of the Stratford Insurance Company. Stratford is licensed throughout the U.S. and has become the foundation for entry into the local and intermediate commercial auto liability and physical damage market.

Further diversification was accomplished through the purchase of Tudor Insurance Company in 1984. Tudor provides the facility for a substantial professional liability (A&E, D&O, E&O) and specialty professional (large, unusual, and hard-to-place E&O) market presence.

In 1996, the Specialty Brokerage Division of the Group was added, which targets complex, hard-to-place, primary business driven by severity of loss exposure. The Specialty Brokerage Division has grown substantially over the past two years.

According to Andrew Frazier, CEO of Western World Insurance Group, "The Group's strategy is to maximize our exposure to loss cost driven opportunities by increasing our product offerings and methods of distributing them. Westco Programs represents an important element of this strategy."

Westco Programs takes a fresh look at program business to more fully understand the needs of associations and producers. Western World hired a marketing firm, Rockwood Marketing Services, to help create its message. Rockwood's survey work yielded common complaints from agents centered on a number of themes:

* "We can't get the carrier to listen."

* "Our program is too small to warrant their attention."

* "Program department personnel are constantly changing."

* "My exclusivity wasn't protected."

* "Takes too long to get answers."

"Our team committed itself to service standards and the work ethic that have helped Western World Insurance Group to prosper," says Jack Hamilton, program manager for Westco. A simplified Program/ Association summary questionnaire was developed with the internal commitment to answer all agency inquiries within 48 hours.

"The Group's strategy is to maximize our exposure to loss cost driven opportunities by increasing our product offerings and methods of distributing them."

"The Group's strategy is to maximize our exposure to loss cost driven opportunities by increasing our product offerings and methods of distributing them."

Andrew Frazier says Westco Programs plays an important role in implementing Western World's strategy.

In creating the ad series and brochure for Westco Programs, Rockwood and Westco recognized that producers and association representatives understand their risks better than anyone. They need a partner who will listen and tailor innovative solutions in a collaborative manner. Westco Programs can provide individual technical and management attention while protecting the producer's exclusivity.

Westco is willing to look at programs that other carriers might not consider. The program may be for a class that is difficult to underwrite and price, or that may not currently generate a significant premium volume. The Westco team takes pride in a number of start-up operations brought to the market. Miscellaneous professional and other difficult liability exposures are a specialty. Existing programs with these characteristics are also of particular interest, and opportunities in other lines of insurance are welcome. The division was created to assess and design tailored solutions for these exposures and it remains the single focus. Examples are:

* Professional and unusual commercial general liability

* Hard-to-price classes where published rates are not available

* Unique client needs requiring manuscripted coverages

* New and unique risks that are not currently recognized in the marketplace

Westco Programs has successfully provided solutions for such diverse exposures as bail enforcement officers and foster care/adoption agencies (see sidebar).

Western World Insurance Group has never rested on its past accomplishments. It has taken its strengths and expanded into new lines and services. Westco Programs is another step in adapting to service niche markets. Underserved affinity groups with difficult general liability and professional liability exposures now have a new growth partner. *

To obtain an information kit or Program Questionnaire:

Westco Programs

Tom Mulligan, Sr. V.P.

400 Parson's Pond Drive

Franklin Lakes, NJ 07414-2600

Phone (201) 847-7941

Fax (201) 847-7961

The author

Glenn Clark is president of Rockwood Programs, Inc., a subsidiary of E. W. Blanch Holdings.

Child Welfare Insurance Brokers, Inc., an agency specializing in child caring organizations, contacted Westco to work on a program to insure foster parents. The normal homeowners policy considers the foster child an "insured." The homeowners policy then excludes bodily injury to an "insured." This is normally not a problem for a parent, but for a foster parent it is a significant problem because foster children or their representatives can certainly sue.

A unique policy was constructed to cover the exposures of the foster parent without duplicating coverage already provided under the typical homeowners, thereby making it more affordable. Child Welfare Insurance Brokers reports that the policy has been very well received by many foster parent associations.

Westco depended heavily on the knowledge of Child Welfare Insurance Brokers in the development of the policy. Both the technical construction and the marketing concepts built into the policy were a direct result of working with them, rather than depending just on the knowledge base at Western World Insurance Group.

The 1998 Crittenden poll of Excess and Surplus Lines agents ranked Western World Insurance Company as the top rated E&S carrier in the United States. They were listed as #1 or #2 in each of the following categories:

* Speedy response to inquiries

* Timely in quoting premiums

* Technical competence and expertise

* Efficient and fair payment of claims

©COPYRIGHT: The Rough Notes Magazine, 1999