MARKETING

Unique, data-driven approach convinces clients and carriers to buy-in

By Dennis Pillsbury

Executives of J. Gregory Brown & Company: sitting (from left) are J. Gregory Brown, founder and chairman, and Everett R. Newman, Jr., CIC, president and COO; standing is Ronald M. Gwynn, senior vice president-business development.

J. Gregory Brown & Company (JGB), Inc., an agency with offices in Los Angeles, Torrance and Newport Beach, California, uses a unique approach to find potential target classes and convince insurance companies that they should want that business. This approach began two years ago when Greg Brown, the firm's founder and chairman, recruited Everett R. Newman, Jr., president and COO, to aggressively build the property/casualty business of what had been a predominately life-based business for more than 20 years.

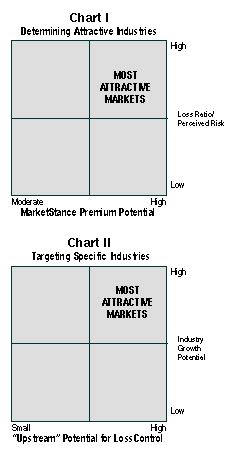

The process begins with data from MarketStance, a company in Middletown, Connecticut, that develops, markets and supports data-based products and services for the P&C industry. JGB uses the data to identify niche markets with significant premium potential coming from the middle and upper middle-sized accounts with high on average loss ratios. (See Chart I.)

The process begins with data from MarketStance, a company in Middletown, Connecticut, that develops, markets and supports data-based products and services for the P&C industry. JGB uses the data to identify niche markets with significant premium potential coming from the middle and upper middle-sized accounts with high on average loss ratios. (See Chart I.)

Once these markets are identified, JGB researches the particular industry to determine what insurance problems it has had and what external problems it faces. This allows the agency to determine whether a loss control program will produce cost savings for the businesses in the niche. If all those ingredients are there, JGB looks at other factors to whittle the group of niche markets down to a manageable size. Here, too, the agency uses MarketStance data on industry growth rates, breakdown of premium by-line and other key factors. (See Chart II.)

Everett Newman says, "This approach lets us focus on markets that can benefit from an upstream approach to mitigating or eliminating risk." In the workers compensation area, for example, J. Gregory Brown offers the Advantage CompensationSM program, which involves a complete assessment of eight critical management systems at a client company:

1. Accountability

2. Performance data

3. Performance feedback

4. Consequence management

5. Training

6. Orientation

7. Communication

8. Teamwork

Performance management consultants from J. Gregory Brown gather data through a series of interviews and questionnaires with a cross-section of employees and supervisors. The information is compared with loss analyses. A report is prepared for the company, listing its strengths, challenges and the consultants' recommendations.

Based on the findings, a service plan is prepared that sets forth the actions that need to be taken, the dates for these actions, and who is responsible. It takes approximately two to three years to completely instill a safety culture in a company, and that is only if top management is fully committed to the program. For that reason, JGB works only with companies that are willing to make that commitment.

The results, according to Senior Vice President Ron Gwynn, are "dramatic and unambiguous. Over a five-year period, clients who used this approach had loss ratios that were 20% better than the industry average for a savings of $43 million on

$215 million in premium."

A real life example

One of the markets on which JGB has chosen to focus is hotels. Listed above is the Marketstance information on the middle market (100-999 employees) accounts in this niche in southern California.

The data show that this is an important middle market, with 210 middle market hotels in the agency's current marketing area of southern California. A follow-up that looked at northern California, Arizona and Nevada, areas into which JGB intends to expand, showed that it was equally important in those areas. And the projections of payroll increases averaging 3% to 5% growth for the next five years indicate it is a growing industry, especially in the upper middle market range.

The average premium per account was a healthy $571,000 in 2000. With current market conditions, Ron says, "the average premium for all lines probably is in the $700,000 to $750,000 range. And, because workers compensation rates have skyrocketed since 2000, the average premium for comp alone for the lowest class size of 100 to 249 employees is nearly $200,000. This clearly is a market that is of interest to us from a statistical standpoint."

Founder and chairman Greg Brown recruited a number of property/casualty people to build that side of the business for what had been a predominately life-based agency for 20 years.

Founder and chairman Greg Brown recruited a number of property/casualty people to build that side of the business for what had been a predominately life-based agency for 20 years.

The next phase in determining the efficacy of a particular niche is to look at the key issues facing that industry and decide whether an approach can be developed that will significantly impact losses.

JGB found there were several key issues in the hotel arena, all of which could be improved by the Advantage Compensation program and its performance management consultants.

For example, a leading problem in the hotel business is employee turnover, which historically has averaged 42% a year. High turnover is a major contributing factor to workplace accidents, which increases workers compensation costs as well as recruitment and training costs. High turnover also reduces the level of quality and service provided to guests, which decreases repeat business. High turnover is even linked to increased costs from third-party liability claims. In short, high turnover hurts both top-line revenue and bottom-line profits.

To reduce turnover, JGB provides human resources consulting services to address communication issues, behavioral "life and work" issues, including career planning and enhancement. Some of these ideas are borrowed from the Marriott program--Career Path--since the Marriott chain exemplifies Best Practices for the industry and has the lowest turnover in the industry. "Whenever we go into a particular niche, we always investigate the Best Practices leaders in that industry and try to find out what they are doing to be successful," Everett notes. JGB also developed low-cost employee benefit plans for part-time and low-wage employees. The goal is to reduce turnover to under 25%, while at the same time improving morale, both of which help to reduce workers comp accidents.

Another issue for most hotels is a general need to reduce workplace accidents. JGB implements its Advantage CompensationSM program, which includes performance-based training, to accomplish the goal of bringing the experience mod to 80

or lower.

Risk management services are provided to deal with issues such as crisis management planning and execution, guest safety and security, and reducing slip, trip and fall hazards. Impact forecasting and disaster planning services are used to reduce the impact of natural perils. JGB also provides human resources consulting services and training to reduce the potential for discrimination and other employment-related claims.

Why Advantage Comp works

Advantage Compensation attacks the heart of the problem--unsafe acts by people. A study by one of the nation's largest writers of workers compensation insurance, Liberty Mutual, found that 92% of workplace accidents were the result of human error. The balance of 8% was the result of physical hazards (6%) and lack of effective training (2%). So, clearly, behavior modification that is designed to reduce or eliminate unsafe behaviors will have the greatest impact on workers compensation costs.

The concept was pioneered in the 1990s by a large regional California brokerage, Anderson and Anderson, which developed a workplace safety program based on behavioral risk management. The program employed consultants to conduct a behavioral risk assessment to identify and correct "upstream" behaviors in the workplace that were leading to "downstream" accidents. The first consultant hired was an associate of Ken Blanchard, author of The One Minute Manager.

Anderson & Anderson was acquired in 1997 by a multi-national company that discontinued the program. Starting two years ago, the management team that was responsible for the original Advantage Compensation program began joining Everett at JGB, where they have recreated and updated the program.

The concept is presented to potential clients who, Ron points out, "are happy to save money on workers compensation costs, especially in today's hard market. We fully explain that we will be doing an assessment of all their employees, running safety meetings, and implementing an enterprise-wide safety program. To accomplish this, we make it clear that they, the top management people, have to buy in to the concept and work with us. If they are still interested, we invite them into our office for a presentation that is a combination of video and Power Point and includes interviews with current clients who discuss the problems they had and what was done to fix them. About half of the potential clients accept the invitation."

Everett continues: "After the presentation, we know which prospects to pursue and which ones are not interested. We pay close attention to their reactions during the presentation. The approach in the presentation is on education, not selling insurance. We emphasize that this becomes a true long-term partnership. It takes two to three years for the program to become fully effective. About one third of the people who enter the 'Solution Spectrum,' as we call our presentation room, become clients. It's a very efficient way of marketing. We don't worry about X-dates because we're really not there to replace the client's current program. We're offering something new. Many of them come on board immediately through a broker-of-record letter."

JGB uses a similar approach

for commercial auto, where

behavior modification can greatly reduce accidents.

Convincing their insurers

JGB uses the MarketStance data in its presentation to its insurance company partners to convince them of the efficacy of the niche market being pursued. "The MarketStance data gives us a tremendous amount of credibility with the carrier," Ron says. "It allows us to be very precise in terms of the size of the market, the average size of each account, the premium potential and loss information."

Ron Gwynn has helped the agency recreate and update the Advantage Compensation program.

Ron Gwynn has helped the agency recreate and update the Advantage Compensation program.

"Once we have a company committed to the program, we use the MarketStance information to drill down to individual companies in the group," Everett adds. "We then implement our structured sales procedure to reach those companies. It begins with a mailer and then our associate producers, who are licensed brokers, call them and establish a relationship with the prospects." The associate producers are people who work only over the telephone and "pre-qualify potential clients by teaching them enough about the process to gauge their interest," Everett says. "About half of those we call show no interest, although that's going down due to the hard market."

Does it work?

Based on the fact that in the two years in which JGB has been marketing the Advantage Compensation program it has increased revenues by 400% to $8.5 million, one would have to say it is an unqualified success. It creates a long-term partnership that helps maintain good retention (only two of the 200 Advantage Comp clients left Anderson and Anderson).

And the cost-saving results for the client can be dramatic because the system focuses on all areas of risk and develops solutions to deal with them. For example, the LAX Hilton had workers compensation costs of $3 million annually, making it the worst in the chain. The interviews with the employees by the behavioral consultants found that there was a language and cultural barrier that was causing a serious morale problem--most of the supervisors were Filipino and spoke Tagalog, while most of the service workers were Mexican and spoke Spanish. Trilingual training materials were developed (they included English) and the cultural differences were explained so that all parties had a better understanding of the people with whom they were working. With clearer and more effective communication, critical conflicts decreased, morale and productivity increased and workplace accidents were reduced. After three years, the workers comp costs were down to $300,000! *

HOTELS, SIC CODE 701

for Los Angeles, Orange, San Diego, Riverside and San Bernadino Counties

| 100-249 e'ees | 250-499 e'ees | 500-999 e'ees | Total | |||||||||

| # of establishments | 120 | 64 | 26 | 210 | ||||||||

| Total employees | 19,946 | 23,243 | 18,598 | 61,787 | ||||||||

| Payroll total | $ 340,908,000 | $ 444,692,000 | $ 376,923,000 | $ 1,162,523,000 | ||||||||

| Sales total | 1,252,541,000 | 1,633,854,000 | 1,384,870,000 | 4,271,265,000 | ||||||||

| Value of structures | 1,410,192,000 | 1,839,499,000 | 1,559,176,000 | 4,808,867,000 | ||||||||

| All lines premium | 26,005,000 | 33,289,000 | 25,387,000 | 84,681,000 | ||||||||

| Average premium | 217,000 | 520,000 | 976,000 | 403,000 | ||||||||

| Property premium | 5,829,000 | 7,501,000 | 5,814,000 | 19,144,000 | ||||||||

| Liability premium | 11,967,000 | 15,404,000 | 11,968,000 | 39,339,000 | ||||||||

| Work comp premium | 6,455,000 | 8,230,000 | 5,973,000 | 20,658,000 | ||||||||

| Avg 5-year growth rate | 4.8% | 6.2% | 9.4% | 6.7% | ||||||||

| Expected growth in payroll | 4.0% | 4.0% | 4.0% | 4.0% | ||||||||

Est WC prem for 2002

| Prem pure rate $10.02/$100 | 34,090,800 | 44,469,200 | 37,692,300 | 116,252,300 |

| Prem blended rate $7/$100 | 23,863,560 | 31,128,440 | 26,384,610 | 81,376,610 |

| Premium estimate per hotel | 198,863 | 486,382 | 1,014,793 | 387,508 |

Step One: Analyze the market

JGB looks at the broad data for its marketing territory of California using MarketStance data to analyze the kind of insurance products they'll need. JGB also looks for

* Industries that are important or dominant in the region

* Industries that are growing

* Industries with problems that JGB can solve

* Industries that are of sufficient size to represent a market.

"Some industries can look good on the surface, but when you drill deeper you find there are problems," Ron elaborates. "For example, the school bus services industry looked like a great target, but we found that it was dominated by a few giants and the other 1,000 companies are little 'mom and pop' operations. That wasn't a market for us."

Once industries have been identified as attractive, JGB ranks them using the Boston Consulting Group and GE market analysis models.

Step Two: Identify a practice leader

"We must have the expertise to make a credible showing when we present our program to the industries," Ron explains. "We've compiled a matrix with all current producers on it to analyze our strengths and weaknesses so we can assign people in the best possible way to take advantage of their existing expertise or an expertise they could develop. We also hire practice leaders if we don't have the expertise in house."

Step Three: Define the key insurance and risk-related business issues

Accountants, lawyers, tax experts, operations people and current or ex-industry executives are brought in to brainstorm on the issues facing the industry. "We get in a room and go at it for five or six hours," Ron says. "We cover the wall with easel-sized sheets of paper filled with notes defining every possible issue we can think of in the industry--and then potential solutions to those problems."

"We really focus on identifying what are the leading loss cost drivers for an industry," Everett adds. "We don't look just at the symptoms, but at causes. What we're doing is custom-developing an array of insurance products and other types of consulting services that will solve that industry's particular risk-related and business issues."

Step Four: Market to the insurers

JGB compiles a presentation outlining the target industry's problems and their solutions. They then go to insurance companies that they have identified as having an interest in the particular business. "We prioritize the insurers based on our intelligence work identifying who are the key players for the niche market," Ron notes.

MarketStance data plays an important role in this phase. "Our conversations with the insurers are facilitated because we can define our markets with clarity in terms of average premium, premium by territory, loss ratio by line of coverage and more," Everett adds.

Step Five: Launching the program

The first four steps take about six months. However, "the process provides a real leg up when we get to this final stage," Ron points out. JGB starts with a direct mail campaign. We go back to the MarketStance data and use the industry, geographic territory and ideal customer parameters to do a select based on those criteria. Then we drill through that data to the D&B information beneath it to get the names of actual prospect companies." The list is cleaned through phone calls to verify the information and find out who handles the prospect's insurance. Then a mailing is sent that typically consists of a letter and a small brochure. Four to five days later, a JGB associate producer will call and establish a phone relationship. Once the associate producer has established the relationship, a producer will meet with the prospect to qualify and invite the potential client to the presentation room.