MARKETING

First Media's accessible experts are the

"go-to" team in media liability

By Elisabeth Boone, CPCU

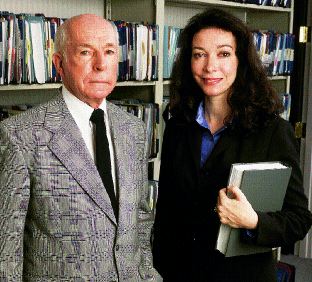

Larry Worrall is chief executive officer/chairman of First Media Insurance Specialists, Inc. His daughter, Michelle Tilton, is executive vice president.

Have you ever listened to a "shock jock" radio show, read a newspaper article that named names, or watched a TV "news magazine" program's exposé and wondered, "How can they get away with that?"

The answer is, sometimes they don't. And when a broadcaster, producer or publisher crosses the line into libel or defamation, the price can be high. Even if a lawsuit is dismissed, the legal expenses incurred to defend it may be in the tens of millions.

Here are just a few examples of how free speech can be expensive:

Big Mouth, Big Claim. During a call-in morning radio show that was broadcast to a mid-sized market, a grade school student said that his school's principal and a teacher were having an affair. When the student went on to identify his school and the individuals on air, the station management realized they had a problem on their hands. After being sued by both the principal and the teacher, the station settled with both plaintiffs after summary judgment was denied. The combination of settlement and legal expense was over $100,000.

Youth Hostel Hostilities. A publisher of world travel guides was sued for defamation by the proprietor of a youth hostel in Europe. Reason: Its guide warned young women to stay away from the plaintiff's hostel because of the proprietor's voyeuristic tendencies. After years of jurisdiction skirmishes the case was finally dismissed--but legal expenses exceeded $300,000.

Stealth Reporters Slapped with Suit. In a widely publicized action, a national television network was sued after it sent two female reporters undercover with wig cams to investigate complaints about the meat handling practices of a major supermarket chain. The broadcast, which aired during sweeps week, was blamed for a significant drop in the supermarket's stock. Ultimately a jury found the network, its parent company, and several employees liable for trespass, fraud, and breach of an employee's loyalty and returned a verdict of more than $5.5 million in punitive damages. A district court reduced the award to $315,000; all parties appealed to the circuit court. Ultimately the network prevailed, but the legal expenses exceeded $2 million.

These are just a few of the horror stories cited by media liability insurance pioneer Larry Worrall, chief executive officer and general counsel of First Media Insurance Specialists, Inc., of Kansas City. Worrall, whose career spans nearly 40 years in media liability, heads up a team of experienced litigators, underwriters, and claims specialists. He formerly supervised the libel claim department at Employers Reinsurance Corporation and then served as chairman, president, and chief executive officer of Media/Professional Insurance Agency, Inc., which he co-founded in 1979. During his tenure at Media/Professional, Worrall supervised landmark cases such as Sharon vs. Time and Westmoreland vs. CBS.

"I've trained just about everybody out there," Worrall comments with a chuckle. Asked what constitutes the media with respect to media liability, he offers a lengthy list: advertisers, advertising agencies; publishers of books, newspapers, magazines, and audio and video materials; radio and television networks; cable TV companies; and movie and TV producers.

"The primary exposures within these classifications are intellectual property claims and defamation, including invasion of privacy," Worrall explains. "While we cover both copyright infringement and defamation in our policies, those two torts are completely separate; they're not even close. Newspapers, radio, and television are exposed to claims for invasion of privacy and defamation and ordinarily do not have intellectual property exposures, whereas intellectual property claims such as trademark and copyright infringement are the primary exposure of advertising agencies and advertisers. Book publishers are exposed to both."

Book publishers also can be exposed to claims from readers who attempt to follow instructions in a book and suffer injuries as a result. "For instance, say a teacher performs a chemistry experiment according to directions in a textbook and there's an explosion that injures students," Worrall says. "The general liability policy doesn't cover the ideas expressed in a book. This creates a gap, because the media liability policy typically covers only defamation or intellectual property liability arising from ideas expressed. My partner and I developed an endorsement called contextual errors and omissions that covers the publisher for bodily injury and property damage."

Violence backlash

In the wake of the Columbine school shootings and similar incidents where violent song lyrics, movies, and video games have been cited as contributing causes, publishers of such materials are facing new and costly exposures, Worrall observes. "Plaintiffs may have no one else to sue, because often the people who commit these crimes don't have insurance. The courts are finding ways to allow cases against some of these defendants to proceed to trial. Historically, everything except shouting 'Fire!' in a crowded theater was protected by the First Amendment. But increasingly courts are finding an exception in movies, stories, and video and computer games that incite violence and are holding that a publisher is not necessarily protected based on historical precedents."

Web site warnings

What about electronic communications? Worrall identifies some key trends in this rapidly expanding arena that can give rise to liability claims. "Small daily and weekly newspapers ordinarily would never have a libel claim, but when they create Web sites, they also create a new exposure," Worrall comments. "Often their Web sites are designed by technical people who do not have journalism backgrounds. While a small daily newspaper may not do any investigative reporting and its stories are fairly innocuous, the fact that it has a Web site would alert a prudent media liability underwriter to look at the Web site to see whether or not the applicant was using any photos or music that might violate somebody's copyright or their music license, such as ASCAP. The publishers of smaller papers are often naive when it comes to their Web sites, so we review them carefully, especially with respect to intellectual property exposures with which the publisher may not be familiar."

In a series of actions known as the Tasini cases, freelance writers sued The New York Times Company, Knight-Ridder, and other large newspaper chains for copyright violations. The newspapers had taken from their archives stories written by the freelancers and posted them on the papers' Web sites, sometimes linking the freelancers' material to other freelancers' stories. The plaintiffs' legal theory was that when they signed their contracts with the publishers, they did not agree that their stories would be used in a context other than that in which they were originally published. The posting and linking of these stories therefore constituted use without permission.

"The publisher would have a right to post a freelancer's story on its Web site if the story was presented exactly as originally published, including photographs and advertisements," Worrall explains. "But the publisher did not have permission to take that story out of the context of its original publication and link it with other material online." The court found in favor of the class plaintiffs; damages have not yet been assessed. Worrall estimates the defendants' legal expenses thus far have reached between $10 million and $15 million, and that the final tally, including damages, could go as high as $25 million to $30 million. "There is an estimated $150 million to $200 million of insurable media liability business, so with a $30-million impact and relatively few companies that specialize in this niche, there is a very significant exposure that will cause premiums to rise," he comments.

Rates and coverages

"Most companies write media liability on admitted paper, filing rates for the various classifications, and the filings permit the insurer's underwriters to deviate substantially by using a system of debits and credits," Worrall says. "For example, a debit would be applied to an insured that conducts extensive investigative reporting."

Media liability risks require broad coverages, and Worrall believes First Media's policy offers the best solution. "The named peril form used by our competitors is inadequate for today's exposures," he declares. "Our open peril form is designed to cover claims brought by creative libel plaintiffs who attempt to circumvent media defendants' First Amendment protections."

First Media's Media Advantage Policy(TM) provides comprehensive coverage for authors, broadcasters, cablecasters, film, program, and theatrical producers, media associations, multimedia companies, and publishers. First Media also has developed special Advantage policies for newspaper publishers, advertisers, and advertising agencies. The policies were reviewed by industry experts such as in-house counsel and risk managers for media companies, insurance brokers, and media lawyers. Among the coverage features of the Advantage policies are:

* Open perils coverage for acts that are not enumerated in the policy

* Contextual errors and omissions

* Content of the insured's Web site

* Punitive and exemplary damages

* Claims worldwide

* Publishing and broadcasting claims made by former employees

* Acts of leased employees, agents, and independent contractors

* Liability assumed under contract for media furnished by the insured

* Negligent supervision of an employee performing his/her duties

* Choice of coverage forms: defense costs with limits or in addition to limits

Under the Advantage policies, the insured controls the decision to correct or retract a statement deemed libelous, and the insured is able to protect confidential sources and the materials those sources provide. "Our claims lawyers have extensive journalism and media law backgrounds and try to assist insureds in any way they can, whether before a claim arises or after a trial or appeal is over," Worrall says.

Market outlook

What's going on in the market for media liability insurance? "Since September 11, premiums for media liability have gone up at least 20%," Worrall says. "In the wake of the Tasini cases, insurers were in the process of increasing their rates, because at that point carriers were just marginally profitable. This is a class of business that really has to be underwritten carefully," he continues. "You have to have experienced underwriters who know what they're doing. Historically, the business that comes to us from the large brokers has not been underwritten. We have to look at the insured's loss experience and make informed judgments on how to price the risk and select appropriate deductibles. For smaller insureds, a majority of claims fall under the retention and are viewed as just a cost of doing business. Most media liability losses come from the business produced by large brokers," Worrall remarks. "As specialists in our niche, we provide experienced underwriting and claims handling that brokers and their clients aren't likely to find when dealing directly with an insurer."

Complex ... fast paced ... constantly changing ... That accurately describes today's market for media liability coverage. At First Media, such challenges are everyday fare, and Worrall and his colleagues are ready to tackle them with carefully crafted coverages and decades of specialized expertise. *

For more information:

First Media Insurance Specialists, Inc.

Phone: 800-753-7545 New York: 631-462-3551 Toronto: 416-995-4826

Web site: www.firstmediainc.com