MARKETING AGENCY OF THE MONTH

Large agency formed through merger of equals;

entrepreneurship spurs growth

By Dennis H. Pillsbury

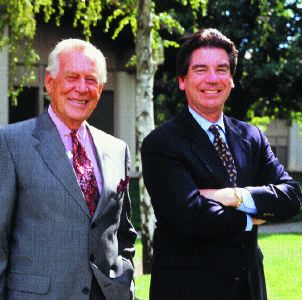

Tom Williams (left), chairman and chief executive officer of InterWest Insurance Services, and Bill O'Keefe, executive vice president.

InterWest Insurance Services, Inc., Sacramento, officially traces its history back some 80 years, but it was formed in October of 1992. The agency brought together three mini-giants in Northern California in a merger of equals--Noack & Dean Insurance Agents and Brokers had been around for more than 60 years and was the largest agency in Sacramento; Lindo, Hanna and Abbott Insurance Agency had more than 80 years of service and was the largest in Chico; and Insurance Associates of Redding, with 80 years of service, was one of the largest in Redding. Later, in March of 1996, Insurance Center of Merced merged into InterWest.

Tom Williams, who joined Noack & Dean as president a year before the 1992 merger, served as moderator for the negotiations. Today, he serves as chairman and chief executive officer of InterWest. Tom had brought more than 20 years of experience in the insurance business to Noack & Dean--experience that emphasized his entrepreneurial spirit and penchant for getting things done.

"Our vision was to align ourselves with the biggest and best in the trade in various communities in the big valley of Northern California," Tom says. "The top people from each of the agencies serve on our nine-member board."

He entered the insurance business in the early 1970s as a property claims adjuster and quickly assumed management responsibilities with the adjustment firm. He was recruited by a southern-based property/casualty insurer and, in two years, rose to marketing vice president. In the mid-1970s, he started his own independent insurance agency from scratch and developed it into a southeastern regional agency writing more than

$55 million in premium in nine southeastern states. In 1980, Tom followed Horace Greeley's advice and headed west to serve as president and major stockholder of Los Angeles-based Insurersgroup, an international network of independent agencies that merged with Merrill Lynch's ISU International in 1984. Tom served as president of ISU after the merger. Under his direction, ISU expanded from California to more than 500 franchise locations in more than 460 cities in the United States and Canada. Tom also is the creator of the Dynamics of Selling, a sales and marketing training tool that is endorsed by both the CIC and IIABA.

Bill O'Keefe attributes much of the agency's success to the new blood the agency has been able to attract. "We have some very young stockholders and encourage people coming on board to become owners so they are aligned with our becoming more successful."

Bill O'Keefe attributes much of the agency's success to the new blood the agency has been able to attract. "We have some very young stockholders and encourage people coming on board to become owners so they are aligned with our becoming more successful."

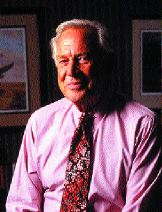

Tom had developed his respect for entrepreneurship in his first career--the military. He served as a psychological warfare and propaganda officer in the Special Forces Green Berets. He was decorated for his service in the Korean War and also had numerous assignments in strategic locations throughout the world. "You learned to align yourself with creative, bright people," Tom says of his experience with the Green Berets. "Then you just let them go."

He has brought the same model to InterWest, where "we've turned the chart upside down. The leader's role is to support the entrepreneurs," Tom maintains. "That entrepreneurship is a major part of our strength. We know the valley better than anyone. But there are subtle differences between areas. Our entrepreneurs live and work in those areas and bring an understanding of those unique differences to the table.

"We orchestrate that," he continues. "Each division and branch has a charge to operate profitably and they have virtually complete authority to do so. The rewards stay local as well. In the 10 years we've been in business, we've never had a branch or division not make a profit."

Today, InterWest employs 235 people. Its corporate headquarters in Sacramento houses the corporate staff plus some of the captive and niche-focused operations. The agency also has a second office in that city which houses the agency's largest division, the Capital Division, in a 31,000 square foot space. Other locations are in Redding, Chico, Merced, Watsonville, San Jose, Santa Barbara and Modesto. InterWest has also opened an East Bay office. The agency writes in excess of $300 million in premium. Revenues for this year will exceed $35 million. It now ranks as the 54th largest agency in the Business Insurance list of leading agencies and brokers.

"We've made a conscious decision to stay in second-tier cities where we can be the largest," Bill O'Keefe, executive vice president, points out. "We see ourselves as a valley operation. We work the periphery of the Bay Area but do not intend to open full-service offices in California's larger cities."

The Eco System

"You can't just sell and service insurance and be successful as an insurance agency today," says Tom. "We've created an eco system around InterWest so we can surround our clients with needed services." These include: program development, management consulting, PEO services, risk management and safety consulting, payroll administration, claims management, and alternative markets. "It's all part of providing a broader range of support to our clients."

Some of these services are outsourced, like PEOs, where InterWest has appointments with several PEO service firms. Others are handled internally, like alternative markets. InterWest runs several agency captives.

Generalists with specialties

Tom notes that the agencies that have joined together to become InterWest "began their journey as generalists. We started out serving the people and businesses in the valley and, as a result, we insure a wide variety of businesses and individuals. We fully intend to continue to provide excellent products and services to those people.

Tom Williams developed his respect for entrepreneurship when he served in the Special Forces Green Berets. "You learned to align yourself with creative, bright people," Tom says, and "then you just let them go."

Tom Williams developed his respect for entrepreneurship when he served in the Special Forces Green Berets. "You learned to align yourself with creative, bright people," Tom says, and "then you just let them go."

"At the same time," Tom continues, "we've looked at those areas where we have an expertise and developed those specialty areas. We have many producers who specialize. In order to rapidly grow, our producers recognize that the best way to do that is to find two or three specialty areas and work those. It also makes it easier for our Eco System to support that effort. When we have significant numbers in a particular specialty, we can support those sales efforts with risk control and other services." The agency has two full-time risk control consultants who work the specialty areas. "We also have two former workers compensation claims examiners who can work with clients," Tom adds. "This workers comp expertise has helped us build one of the largest State Fund books. We're able to provide better communication between carrier and client."

Among the specialty areas for which InterWest is known are health clubs, social service organizations, banks, financial institutions, and property managers. "Construction is probably our largest specialty," Bill points out.

Perpetuation plan assures continued independence

The agency established an ESOP in 1995 that owns just under 30% of the company. It also has close to 30 shareholders. "We've built our pyramid behind the two or three gray heads in the company," Bill says. "We have some very young stockholders and encourage people coming on board to become owners so they are aligned with our becoming more successful. Every one of our stockholders works for the organization.

"That's been a real big part of our ability to attract and retain top producers and support staff. We're not owned by a bank or some other outside organization, and they know we won't be selling to someone outside," Bill continues. "It's a great source of comfort for our people. We have made a conscious, philosophical decision to remain independent. Everything we have done is in line with that goal."

It has been this new blood that has really been responsible for the growth and success. "We pulled together about $10 million in revenues with the mergers," Tom says. "Reaching $35 million was achieved through internal development. We see the training and mentoring of new producers as the critical ingredient for our continued success and growth," Tom says. And that growth has been impressive. The agency's stock value, which is calculated every year, has grown by more than 30% annually for the past several years. Revenues have grown by an average of 25% each year and profit growth has been ahead of revenue growth in each of those years.

"We have a nine-member board that is responsible for policymaking," Tom continues. The board includes people from each of the regions. "The Executive Leadership team basically runs the agency." The team includes the division managers from each of the three regions plus the CFO and Tom. "By having all regions represented, it gives us a chance to cross-pollinate," Tom adds. "They'll discuss ideas that are working in their region and see if they're applicable elsewhere. We're very fortunate to have division managers who are somewhat unique in that they are very good sales people as well as being effective managers. They're also willing to accept and embrace the fact that growth means they will be managing more and selling less."

InterWest has the tools to continue to grow and the vision and leadership to succeed. As Tom points out, one of his primary roles is as the "keeper of the vision." Their emergence as a dominant force in the northern California region makes them a perfect choice for this month's Marketing Agency of the Month. *