Smaller companies may not know they're vulnerable--

but without coverage, they stand to lose everything

By Rhonda Prussack

Rhonda Prussack is vice president and product manager for fiduciary liability at both National Union Fire, a member company of AIG, and the American International Companies' Small Business Underwriting Center.

Enron, Global Crossing, First Union ... these are just three of the many large companies that have made headlines lately for--among other things--huge class action lawsuits brought against them by employees alleging breaches of fiduciary duty with respect to their employee benefit plans. Suits alleging imprudent investing or misrepresentation by fiduciaries are now becoming commonplace. And ERISA (Employee Retirement Income Security Act), the federal body of law that governs most employee benefit plans, calls for fiduciaries of employee benefit plans to be personally liable to restore any damage caused a plan through their breach of duty.

The directors and officers of most big companies are protected against such personal liability, either through their company's indemnity1 or through a fiduciary liability policy. Virtually all large companies carry fiduciary liability insurance, and it's not uncommon for policy limits to exceed $100 million. Directors, officers, and owners of smaller businesses, however, generally are not so well protected. A sizable fiduciary liability suit can easily blow through a small company's cash and even force the company into bankruptcy, leaving the company's executives vulnerable to personal loss. Yet despite the increasing frequency and severity of fiduciary liability suits (from 2000 to 2001, the number of civil ERISA suits filed increased by almost 13%, from 9,124 to 10,2922), many small businesses either don't purchase fiduciary liability insurance, or purchase inadequate limits.

These are your customers: uninsured or under-insured executives of small and mid-sized businesses

and nonprofits.

The problem seems to lie with myths that have evolved over time, as a result of which employers think that because of certain practices, decisions, and insurance purchases, the companies and their owners and executives are insulated or immune from most claims related to 401(k) and other employee benefit plans. It's time these myths were dispelled.

The myths

1. "We have a fidelity bond, so we're protected." While ERISA requires bonding of fiduciaries of employee benefit plans, the bond covers only theft and protects only the plans. Fidelity bonds do not cover claims associated with decisions made regarding the choice of investment vehicles, expenses passed along to the plans, and other acts or decisions made by fiduciaries. There's no protection for the fiduciaries or administrators of the plans, or for the company itself.

2. "We also have an EBL (Employee Benefits Liability) rider on our general liability policy." The EBL rider generally provides coverage for administrative mistakes made in the day-to-day operations of a plan. Consider, for example, a suit arising out of the denial of an employee's medical claim, where the denial was caused by the employer's failure to submit the employee's enrollment application. While an administrative error or omission claim of this type is covered under the EBL rider, there is no coverage for a suit alleging a breach of fiduciary duty under ERISA. In fact, coverage for alleged ERISA violations is usually specifically excluded under such riders.

3. "We only offer our employees a 401(k) plan with a wide range of investment choices. We leave the investing up to them." While the safe harbor provisions in ERISA protect fiduciaries against certain suits brought by plan participants, there is no protection for suits alleging that fiduciaries failed to monitor investment performance, offered imprudent investment vehicles, misled employees about the safety of plan investments, or failed to educate employees about investments.

4. "We don't even have a pension or 401(k) plan. All we provide our employees is health insurance." Better hope that none of their employees' claims are ever denied, because the employer can be dragged into the ensuing suit. Even if the claim denial is ultimately upheld, the cost to defend the owner and the executives of the business could easily run into six figures.

5. "Our employees would never sue us--we're like family." Famous last words. There's very little loyalty among employees anymore, especially in an environment of job, wage, and benefit cutbacks. And it's not just employees that an employer has to be concerned about. The Department of Labor (DOL), which is in charge of ERISA enforcement, has the authority to sue companies and their executives on behalf of plan participants for breaches of fiduciary duty. They often target small companies, and they have been very successful. In 2001 alone, they investigated 4,862 businesses and recovered $648 million3 in penalties and damages.

After finding an individual fiduciary personally liable for losses to a benefits plan, the 9th Circuit Court of Appeals stated: "While we are not unsympathetic to his burden, we note that fiduciaries may be insured for this type of liability. It would appear that prudent fiduciaries would have their plan or employers secure such insurance."10

Who is a fiduciary?

Who is a fiduciary and what requirements does ERISA impose? "Fiduciary" is a functional title--anyone who exercises discretionary control over the management of the plan or the disposition of its assets is a fiduciary. For example, the person in human resources who assists employees only with enrollment and other administrative processes is not a fiduciary. However, if that same person is asked to sit in on a meeting and vote, for example, on whether to allow company stock as an investment option in the 401(k) plan, then that person is a fiduciary with respect to that decision. In a smaller company, the owner and the top executives typically make those types of decisions, and thus they are fiduciaries. In larger companies, there's often a pension committee comprised of various directors and officers of the company, who are charged with fiduciary responsibility for the plans. This arrangement will sometimes shield the CEO and top executives from liability; but more often than not, they're still named in fiduciary liability suits.

Fiduciary standard of care4

A fiduciary is required to:

* Discharge his or her duties with respect to a plan solely in the interest of participants and beneficiaries, and

* For the exclusive purpose of providing benefits to participants and their beneficiaries, and

* Defray reasonable expenses of administering the plan, and

* Operate with the care, skill, prudence, and diligence under the circumstances then prevailing that a prudent man acting in a like capacity and familiar with such matters would use in the conduct of an enterprise of a like character and with like aims ("the prudent man rule"), and

* Diversify plan investments so as to minimize the risk of loss, unless under the circumstances it is clearly prudent not to do so, and

* Act in accordance with the documents and instruments governing the plan insofar as such documents and instruments are consistent with the provisions of ERISA.

How many business owners or not-for-profit executives are professional investors? Courts have held that their responsibilities are equivalent to those of a professional investor as those responsibilities relate to their duties as fiduciaries. The law doesn't stop there. If one fiduciary breaches his or her duty, other fiduciaries also may be held liable. Here is the rule with respect to liability for breach of a co-fiduciary5:

If one fiduciary errs, others will be considered responsible as well if:

* They participated in the act, error, or omission

* They knew of the problem and did not make reasonable efforts to correct it.

Fiduciary claim trends

In 2000, the average defense of a fiduciary claim cost $124,0006. On top of that, the average indemnity payment per claim in 2000 was $1,200,000, up from $900,000 in 19997. Of course, these figures don't include the rash of litigation that's hit companies (and insurers) in the last 18 months, and the trend toward increasing indemnity payments is not expected to abate anytime soon.

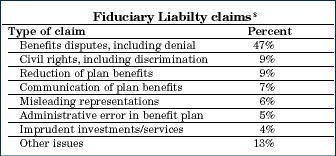

The Tillinghast - Towers Perrin 2000 Fiduciary Liability Survey Report also found the indices of fiduciary claims in the United States shown in the box at right.

Most severe ERISA liability claims are class actions, derivative suits, and government actions (Department of Labor and Pension Benefit Guaranty Corporation) related to:

* Perceived decreases in benefits

* Bad investment claims

* ESOPs (Employee Stock Ownership Plans)

* Lack of investment diversification

* Lack of prudence

* Failure to monitor investment performance

* Misrepresentation of facts

* Denial of benefits

* Conversions to cash balance plans9

* Increased cost sharing in welfare plans (e.g., medical plans, life insurance benefits)

* Systematic miscalculation of benefits (e.g., miscalculation of lump-sum distributions)

* Independent contractors/

temporary employees/leased employees seeking benefits

* Cutbacks in retiree welfare benefits

* Perceived interference with receipt of benefits

Claims against smaller businesses

Here are some suits recently seen:

* A doctor has been ordered to repay more than $120,000 to two 401(k) plans for which he was the trustee and has been sued for several hundred thousand dollars more. Among the allegations against him: making improper loans from the plans, failing to collateralize participant loans, failing to secure bonding for the plans, filing inaccurate 5500s, and failing to value plan assets at fair market value.

* Two orthopedic surgeons must restore $287,000 to their practice's money purchase pension plan following a suit by the DOL alleging that the surgeons, who were also the plan's trustees, failed to diversify plan assets, leading to significant losses to the plan.

* A small company was sued by a former employee, who alleged that the defendant breached its fiduciary duties by categorizing her illness as psychological in nature, thus limiting the disability benefits she would be entitled to. Defense costs alone were $47,000, and were paid by the insurer.

* A suit for discrimination and severance benefits was brought against a small company and its executives. The plaintiff alleged discrimination under ERISA and breach of fiduciary duty arising out of his termination from employment with the insured. The case settled for $100,000, and defense costs totaled more than $300,000.

Choosing a policy and carrier

Most fiduciary liability policies are "duty to defend" arrangements. Under such an arrangement, the insurer's duty to defend is greater than its duty to indemnify. Practically speaking, this means that when a claim comes in, the insurer will defend all counts in the claim, so long as at least one of the counts triggers coverage under the policy. (This is very different from a directors and officers liability policy, where the insurer typically will allocate defense expenses if there are uncovered causes of action.)

Look for these features in the policy:

* A definition of "claim" that includes both monetary and non-monetary or injunctive relief. Not all claims are for monetary relief. In many instances, the suit demands that a change be made to the plan or that a fiduciary be removed.

* Coverage for penalties assessed under Sections 502(i) and 502(l) of ERISA. While coverage for penalties generally is excluded under fiduciary liability policies, often an exception is made for these penalties, which are for prohibited transactions and for breaches of fiduciary duty, respectively. The 502(l) penalty, of particular importance, is assessed by the DOL in any fiduciary breach lawsuit in which the DOL is a participant. The penalty is 20% of the amount recovered either in a judicial proceeding or through a settlement. (Yes--there doesn't even have to be a finding of guilt for the penalty to be assessed!)

* Plan coverage. Coverage for most plans should be on a "blanket" or unlisted basis. There should be automatic coverage for welfare plans, and coverage should be available for non-qualified plans (such as supplemental executive retirement plans), as well as for qualified plans. There also should be automatic coverage for newly acquired plans, typically tied into some threshold (e.g., plans of newly acquired subsidiaries will be automatically covered provided that such subsidiaries have total assets of less than 10% of the total assets of the company).

* The ability to purchase "runoff" coverage in the event of a buyout or change in ownership of the company. Some policies allow the insured to purchase a multi-year coverage option for wrongful acts that occurred prior to a "change in control" event; for example, the company is merged with another entity. This type of coverage affords protection for prior acts, which are unlikely to be covered under the acquirer's policy. Note, however, that most insurers providing this option will quote it only at the time of the merger or acquisition, and not at inception of the policy.

* A carrier with strong ratings and lengthy experience. While this seems obvious, many purchasers of fiduciary liability insurance still shop just for price and will often jump at the low-ball number offered by an insurer new to the coverage or with less than stellar ratings. Just recently, many fiduciary liability and D&O policyholders were left wondering whether their claims would be paid when a carrier went from an A- rating to insolvent in the course of a year and a half.

What's the solution?

The first lines of defense are sound choices, prudent decisions, and scrupulous documentation. Employers should take fiduciary responsibilities seriously and periodically review the plan, its investments, and the expenses that are being charged to the plan. Employing third-party experts whenever possible is usually a good move. (It's hard to argue that the fiduciaries of an ESOP that owns the majority of a company are operating the plan solely for the benefit of the plan participants when the sole decision makers of the plan are the owner of the business and its top executive.)

Brokers and agents should help their clients understand why they should purchase fiduciary liability insurance. The fiduciaries of even the smallest 401(k) plan administered by an insurance company, bank trust department, or investment house carry no less responsibility than do the fiduciaries of larger, more sophisticated plans. Businesses that are expanding through mergers or acquisitions, that face unusual situations, sponsor ESOPs, or are not financially stable, generally will face higher premiums and the most restrictive policy terms.

Employers read the papers, and they are becoming educated about their exposure. They will understand why you are suggesting fiduciary liability insurance this renewal cycle--or sooner. *

The author

Rhonda Prussack is vice president and product manager for fiduciary liability at both National Union Fire Insurance Co. of Pittsburgh, Pennsylvania, a member company of American International Group, Inc. (AIG), and the American International Companies' Small Business Underwriting Center.

Footnotes:

1 "Hold harmless" arrangements provided by organizations to protect their directors and officers who are acting on behalf of the employers or the plans, and who are operating within the employers' guidelines for such arrangements.

2 Source: Administrative Office of the U.S. Courts.

3 Source: The Pension and Welfare Benefits Administration's Web site: www.dol.gov/pwba.

4 29 U.S.C. Sec. 18.

5 29 U.S.C. Sec. 18.

6 Tillinghast - Towers Perrin 2000 Fiduciary Liability Survey Report, Tillinghast - Towers Perrin, D&O Services, Chicago, Illinois.

7 Ibid.

8 Ibid.

9 A type of defined benefit pension plan that, on its surface, resembles a defined contribution plan, and that is often less costly to employers than a traditional pension plan. However, long-term employees often see retirement benefits lower than what would have been available under the previous pension plan.

10 Barker v. American Mobil Power Corporation, 64 F.3d 1397, 1404

(9th Cir. 1995).

For more information:

AIG Customer Care Center

Phone: (877) 867-3783, Ext. 201

E-mail: C3@aig.com.