National Specialty Insurance, a division

of West Bend Mutual, gives agents

a home for specialty risks

By Elisabeth Boone, CPCU

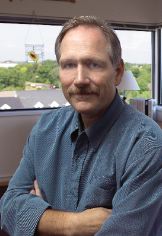

The NSI management team outside the Wisconsin state capital, located in Madison, which is home to National Specialty Insurance. Pictured from left: Gerald A. Olson, CIC, CPCU, Vice President; Gary L. Klein, Commercial Lines Underwriting Manager; William B. Hutchison, Vice President; Peter E. Hans, NSI Claims Manager and Legal Counsel; and Bonnie J. McCarty, Office Manager.

Suppose you represent a traditional Midwestern mutual carrier that operates in just six states, writing personal and commercial lines. When a hard-to-place risk--detective agency, day care center, martial arts academy--lands on your desk, it's most likely out of the mainstream for your company. Your choices are: reluctantly decline to quote, start scrambling to find an excess-surplus market--or call National Specialty Insurance, a dedicated division of your insurer that offers products and services for a select group of classes that most carriers won't insure.

The Midwestern mutual is West Bend Mutual Insurance Company of West Bend, Wisconsin. Established in 1894, the company writes business in Wisconsin, Indiana, Minnesota, Iowa, Illinois, and Michigan (through an affiliate, Michigan Insurance Company). National Specialty Insurance is a division of West Bend that was started in early 1999, just in time to help the insurer's agents navigate a rapidly hardening market.

Heading up National Specialty Insurance is a team of veteran professionals who formerly held management positions with Capitol Indemnity Corporation, a specialty lines insurer based in Madison, Wisconsin. Bill Hutchison and Jerry Olson are vice presidents of NSI; Gary Klein is commercial lines underwriting manager; and serving as claims manager and general counsel is Peter Hans.

What is NSI?

Although it handles risks that are usually shunned by the standard market, NSI is not an excess-surplus insurer--nor, in fact, is it an insurer at all. "National Specialty is a division of West Bend Mutual rather than a separate company," Hutchison explains, "and all the policies we issue are on West Bend paper. We are all West Bend associates, although we're based in Madison instead of West Bend."

In January of 1999, Hutchison says, he and Jerry Olson met with the executive team of West Bend Mutual. "We all decided that there was an opportunity to write profitable business that was outside the realm of West Bend's standard lines offerings," he says. "West Bend's officers wanted to get into specialty lines, but they realized they couldn't do it by trying to convert standard commercial lines underwriters into specialty underwriters. They needed to find people who were already experienced in that area."

Once they had the go-ahead from West Bend, Hutchison continues, he and Olson spent the next several months studying how West Bend operates and the classes of business it writes. They also reviewed rates and forms and evaluated the competition and its programs. "We already knew who our competition was because we'd been working in these markets for more than 10 years," Olson notes. "That was a big plus for us."

Hutchison is quick to credit West Bend's executive team with having the perspicacity to ask the right questions about how to thrive in a constricted market. "They could see that the market was going to change, and they were considering in advance what they could do to diversify and hold onto premium," he says. "We couldn't have had better timing for the creation of NSI. We opened for business just as the market was changing, which really threw a lot of business our way."

"From our experience in the niche market, we had a good understanding of some markets and had been successful in them. We were sure we could make money writing these classes and also offer a product that provided some value."

"From our experience in the niche market, we had a good understanding of some markets and had been successful in them. We were sure we could make money writing these classes and also offer a product that provided some value."

--Bill Hutchison

NSI issued its first policy in June of 1999, Hutchison says, "and by then we had added a couple of key people. Gary Klein is our property and casualty underwriting manager, and Bonnie McCarty came to NSI from West Bend to serve as office manager with responsibility for human resources and processing operations." In 2000, the NSI staff was enhanced by the addition of Peter Hans, another Capitol Indemnity veteran, as claims manager and legal counsel. "Underwriting specialty lines is one thing; the other side is the ability to handle the claims that arise," Hutchison says. "Since Peter joined us, all of our claims have been handled here in the NSI office. This allows us to coordinate our underwriting with our claims function."

Sharing resources

Some NSI functions are provided by West Bend, according to Hutchison. These include marketing, accounting, actuarial, administrative support, human resources, and computer operations.

NSI finished 1999 with a volume of $2.2 million, well above its prediction of $600,000. "We were really pleased with that accomplishment," Hutchison remarks, "and we thought we were well ahead of the curve." (To put that figure in perspective, in July of this year alone, NSI wrote $6.5 million of business.) "We were happy with the results of our first six months, but we saw clearly that there was much more business available," he notes. "The West Bend agency force responded positively to NSI and what we were offering, and they started a juggernaut that has continued to gain strength very rapidly."

Under NSI's original agreement with West Bend, Hutchison explains, if NSI was able to acquire sufficient premium volume from West Bend agents, NSI would remain an in-house facility and would not move into the wholesale market. "In 2001 we reached $22 million in written premium, and in 2002 we went to $41 million," he says. "This year we're on track to write $60 million, so we're able to maintain NSI exclusively for the use of West Bend agents. For 2004 we project $75 million, and in 2005 we'd like to hit $100 million." Since it opened its doors in 2000, NSI has steadily increased its staff and now employs some 57 persons at its Madison, Wisconsin, headquarters.

A win for agents

Having their own in-house specialty facility is a boon for West Bend agents in many ways, Hutchison observes. "NSI gives them West Bend paper, which is admitted with an A+ Best's rating, plus the company's payment plans and our knowledge of the company's operations and philosophy. Another advantage is that we pay a standard-lines commission, which is higher than the agents would earn if they had to go to the wholesale market." What's more, he says, "Our premiums are rolled in with the West Bend profit sharing plan, and our products are incorporated into the goals that the marketing department sets for the agents. Initially the agents were concerned about writing specialty lines business and risking their West Bend profit sharing," Hutchison comments. "They've found that the more business they write with us, the lower their loss ratios."

A key ingredient in the successful partnership of NSI and West Bend, Hutchison points out, is the insurer's strong relationship with its 450 agencies. "The relationship between West Bend and its agency force is something akin to a 1967 love fest," he says with a chuckle. "There's a mutual respect and admiration we'd never seen, and we've worked in over 35 states with more than 20,000 agents and brokers."

"West Bend has excellent communication with its agency force ... This effort has been very successful, and we're getting a great response from our agent partners."

"West Bend has excellent communication with its agency force ... This effort has been very successful, and we're getting a great response from our agent partners."

-- Jerry Olson

To a great extent, success in specialty marketing depends on two key factors: the specific markets selected and the expertise to underwrite them competently. Both of those factors had been carefully considered before National Specialty Insurance opened for business, Hutchison says. "From our experience in the niche market, we had a good understanding of some markets and had been successful in them. We were sure we could make money writing these classes and also offer a product that provided some value." Gerry Olson reviewed West Bend's production by liability class code, and where NSI and West Bend both had an interest, NSI either decided to forgo the class or made an agreement with West Bend to assume that program.

What's available

All of NSI's programs are available in West Bend's six states; however, commercial auto and workers compensation are not being written in Michigan.

Here's a look at NSI's programs and their key features.

* Child care programs for child care providers; family day care centers; drop-in centers; group child care centers; Head Start programs; before and after school programs; latchkey operations; preschools, and 24-hour child care centers. Coverages are premises liability; professional liability; medical payments of $10,000; abuse and molestation; building and/or contents; loss of income including tuition and fees; workers compensation (except in Michigan); auto including vans and buses, and umbrella.

* Personal appearance programs for barbers, electrologists, cosmetologists, beauty schools, booth rentals, manicurists, massage therapists, tanning salons, and estheticians. Coverages are premises liability; professional liability; medical payments of $10,000; building and/or contents; business income and extra expense; workers compensation, and umbrella.

* Special events programs for exhibitions, city celebrations, craft shows, hole in one contests, parades, campaign headquarters, haunted houses, and more. Coverages are premises liability, building and/or contents, inland marine, and crime. Liquor liability can be offered in conjunction with events in Illinois, Indiana, and Wisconsin.

* Sports and leisure programs for athletic camps, leagues, tourna-ments, health clubs, martial arts studios, YMCA/YWCA, hunting clubs, batting cages, and more. Coverages are premises liability; professional liability; abuse and molestation; medical payments of $5,000; employment practices liability; not-for-profit liability; workers compensation; inland marine; crime; building and/or contents; and auto including vans and buses.

* Social services programs for adult day care centers, homeless shelters, hospice centers, women's shelters, neighborhood centers, and telephone hotlines. Coverages are premises liability; professional liability; abuse and molestation; medical payments of $5,000; employment practices liability; not-for-profit liability; building and/or contents; workers compensation; auto including vans and buses; business income; inland marine, and crime.

* Detective and security programs for private detectives and investigators, security firms, process servers, and claims adjusters. Coverages are premises liability; professional liability; errors and omissions; property entrusted; medical payments of $5,000; employment practices liability; workers compensation; auto; building and/or contents; business income; inland marine, and crime.

* Alarm/sprinkler installation and monitoring programs for alarm installation and servicing; security system monitoring; locksmiths; and sprinkler and extinguishing system installation and service. Coverages are premises liability; professional liability; errors and omissions; medical payments of $5,000; employment practices liability; workers compensation; auto; building and/or contents; business income; inland marine, and crime.

* Employment practices liability programs for many types of businesses, including for-profit and nonprofit entities. The stand-alone claims-made policy carries limits between $250,000 and $2 million. Options are coverage for volunteers and an extended reporting period.

* Not-for-profit directors and officers programs for many types of entities: organizations, clubs, day care centers, community associations, and more. The stand-alone claims-made policy provides limits from $1 million each loss/$1 million aggregate to $5 million each loss/$5 million aggregate. The self-insured retention is $1,000 regardless of policy limits. Insureds include past and present directors, officers, trustees, employees, volunteers, and the entity.

* Fidelity and surety: contract payment and performance bonds; court and fiduciary bonds; license and permit bonds; official bonds; notary bonds, and ERISA.

NSI's programs tend to be geared toward smaller commercial risks. "Our average premium is about $2,000," Hutchison says. "We also have accounts with premiums up to $600,000. Almost everything we write has general liability coverage, either monoline or in conjunction with the package. Our EPLI and D&O are geared to the smaller account." Adds Klein, "In areas like child care and personal appearance, we're open to looking at large accounts as well as smaller ones."

NSI's minimum premium was recently set at $250, Hutchison notes. "If we're running a zero to 30% pure loss ratio on an account worth $250, as long as we can produce the business in an efficient fashion and make money, we won't turn it away," he asserts. "Every time I've seen a company increase its minimum premium to $5,000 or $10,000, it seems like in a short period of time they reverse that decision," Olson remarks. "Small premium accounts are really our bread and butter."

A view of the market

Of the classes for which NSI has programs, which are the most challenging in today's market? "The most difficult class right now is definitely residential facility business, whether or not it's skilled care," Hutchison responds. "The market has changed so much in this class of business that there's very little competition," Klein adds. "There are several factors working against us. One problem is that, on a national basis, this class has been a major concern for the reinsurers. Here in the Midwest I think these programs can still be written, and insurers can make money, so long as we can address the concerns of the reinsurers."

What's more, Klein continues, "We're being bombarded with submissions for this business because many national carriers have decided they'll no longer write these kinds of accounts. They'll look at the property, but liability is a whole different issue. At NSI, we've built a substantial volume of nursing home and assisted living business, and we got to the point where we didn't have enough employees to handle the influx of submissions. In May we called a moratorium on new residential facility business so we could slow our growth and gain time to regroup and retool."

Another challenging class, Hutchison observes, is special events. "It takes a fair amount of intuition to determine what information is needed about the risk and how to price it," he says. "Often we have less than24 hours to arrange coverage for an event. While we're on the phone with an agent, we're formulating questions and at the same time assessing whether we can write the event and for how much premium. I'd say the stress level in handling this class of business is somewhere between quoting standard insurance and playing 'The Price Is Right.' " If special events coverage were not available, Hutchison comments, "a lot of events wouldn't take place, and our society would be different. It's possible to write this class profitably--but on the other hand, one event can be devastating." Post 9/11, he adds, insurers are either reluctant or unwilling to insure events where more than 7,500 people are expected because of the potential for terrorism.

A third market niche that keeps NSI underwriters on their toes is contractors who install fire extinguishing systems. "It's a fairly tough class of business, particularly from a claims perspective," Hutchison says. "When the sprinkler system goes off in an office or a warehouse, the first allegation is that the contractor installed the system improperly. Damages can be enormous. We've made money in this class, but doing it correctly requires a significant amount of underwriting and claims expertise."

Tough risks and market constriction notwithstanding, Hutchison remarks, "In all of our programs, the level of competition isn't nearly as intense as in the standard market. In some cases we compete against admitted carriers' programs, and on others our competition is the nonadmitted market. Across the board, though, we encounter far less competition than we would on standard business."

A question of values

As experienced specialty underwriters, the NSI team is committed to scrupulous underwriting standards. "Our number one priority is making a profit," Jerry Olson asserts. "If we're not making money for West Bend, we shouldn't exist. We track our rates very carefully, increase them when necessary, and we evaluate each submission to be sure it meets our underwriting criteria. On the claims side, we're fortunate to have a dedicated staff that is experienced in the kinds of losses our programs generate."

Like West Bend, Hutchison adds, "our values at NSI are to operate with honesty and integrity. As Jerry said, we strive to achieve an underwriting profit by operating at a high level of efficiency. As part of this effort, we empower our associates to make decisions and give them opportunities for growth and advancement. There are 57 people here now. At this time next year there's likely to be 80, and by the end of 2005 there could be 125," Hutchison says. "Everyone at NSI can be part of something exciting and successful."

A key objective for NSI is to enhance the value of the West Bend franchise to its agents by producing profitable business. "Many agents today are becoming more focused in their marketing plans and are pursuing certain target or niche markets," Hutchison says. "At NSI, we offer West Bend agents the opportunity to become familiar with our programs and then go after those classes of business, rather than waiting for business to come to them."

Notes Olson: "West Bend has excellent communication with its agency force. We use e-mail bulletins, continuing education seminars, and West Bend Connect (the insurer's Internet site for agents), and we have the support of an outstanding group of field sales reps to showcase our programs to agents and remind them about our unique coverages. This effort has been very successful, and we're getting a great response from our agent partners."

Profitable, solidly underwritten niche programs ... attractive commissions ... strong company support--these are just some of the factors that make National Specialty Insurance a star performer, both for West Bend Mutual and its loyal agency force. *

For more information:

National Specialty Insurance

Web site: www.national-specialty.com