The networking, sharing of data, successful strategies and knowledge among each of the stakeholders involved is essential if insurance fraud is to be curtailed.

LESSONS IN LEADERSHIP

FIGHTING INSURANCE FRAUD:

THE COLLABORATIVE BATTLE

Inroads are being made, but lawmakers, insurers,

trade groups and others must band together

By Bernd G. Heinze, Esq.

|

The networking, sharing of data, successful strategies and knowledge among each of the stakeholders involved is essential if insurance fraud is to be curtailed. |

Fraud continues to have a pervasive impact on the insurance marketplace, notwithstanding the valiant efforts of various camps waging the battle on a number of important fronts. Whether it is fraud in the application/submission process for underwriters, or first- and third-party fraud on the claims side, the schemes and rackets have become more prevalent, sophisticated and highly organized—by individuals and co-conspirators alike.

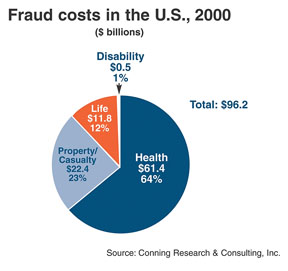

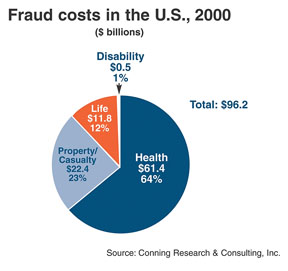

Current estimates place the cost of insurance fraud at between $80 billion and $100 billion per year or, to put it into a broader perspective, up to ` the cost of insured losses for U.S. catastrophes for the last three years combined (including the 9/11 attacks). Globally, it is estimated that property and casualty insurance claims professionals handle more than $300 billion in fraudulent claims payouts and expenses each year. Progress is being made in leveraging complementary resources in education and legislative initiatives, and in day-to-day awareness of issues that can adversely affect the loss ratio of any portfolio. However, a more innovative and broad-based initiative is needed to stem the growing tide of opportunistic actors who are taking valuable revenue and investment income out of the pockets of policyholders, shareholders, insurance and reinsurance carriers alike.

Status and costs of fraud

Despite legislative initiatives and new laws increasing the sentencing and financial penalties judges and juries can assess against these criminal perpetrators, and the establishment by 47 states of fraud bureaus, more financial and prosecutorial resources are necessary. Consider the following facts on insurance fraud’s impact:

• 10% - 15% of all property and casualty claims are fraudulent.

• 15% - 18% of all vehicle thefts are fraudulent.

• 25% of every premium dollar goes to pay for fraud.

• One of every 4 insurance applications contains an undetected fraudulent element.

• Each U.S. household pays $300 per year in additional premium attributable to fraud.

• Carriers spend an average of $650 million annually to detect and deter fraud.

• For the fraudsters who are caught and taken to trial (only about 2,123 persons in 2002), most did not make restitution, and they received an average sentence of only 5 years’ probation—or 60 days in jail to be served on weekends.

• The annual cost of insurance fraud could provide free prescription drugs for every American over age 65.

A recent study by Accenture found that 49% of those who commit fraud do so because they know they can probably get away without being caught; and 40% of the American public will refuse to report fraud, even though they are aware of someone’s having perpetrated the offense. The thought process of claimants who are not otherwise predisposed to committing a crime is that they are somehow “entitled” to overstate a claim, exaggerate their damages or injuries, or inflate the value of an insured location because they have paid premiums for many years without a claim, and now it is “their turn to do what everyone else is doing.”

On the workers compensation side, a recent survey by The Hartford Insurance Company found:

• One-third of companies with between 3 and 500 employees believe their employees commit some form of workers compensation fraud.

• 92% of these fraudulent claims involve exaggerating the extent of an injury.

The cost of workers compensation fraud alone now tops $5 billion per year, according to the National Insurance Crime Bureau (NICB), and comp fraud is being committed primarily by the 33%-plus of all workers who believe it is acceptable to stay home and collect benefits even though doctors have released them back to work, according to the Coalition Against Insurance Fraud. The U.S. Chamber of Commerce has found that over 25% of all workers compensation claims possess an element of fraud.

In the aftermath of hurricanes Charley, Frances, Ivan and Jeanne, the property market will also be dealing with a new onslaught of fraud. In a current scam in Florida, criminals purchase old satellite dish antennas and “rent” them to property owners who sustained catastrophic damage. The property owner then piles the “damaged” antenna onto the rest of the rubble until the property adjuster arrives to inventory the loss and pay the claim. Then, the criminals retrieve the “rental” and take it to the next neighborhood for a repeat performance.

Cyber crimes and identity theft are two of the latest efforts to defraud insurers, and with increasing use of e-commerce and the Internet to transact business, they will continue to provide fresh opportunities.

The value of technology

Anti-fraud and information technology have made substantial gains in implementing data mining, predictive modeling and computer mapping to detect potential fraud. By examining the data collected, carrier personnel can break each claim into its respective phases and then evaluate factors to determine where fraud may be found. These indicators are often crafted from an insurer’s own experience and complemented by industry results as maintained by the NICB, the Insurance Services Office (ISO) and the Property and Casualty Insurers Association of America (PCIAA), to name a few. The adage still holds true: “Past behavior is a good predictor of future behavior.”

Sophisticated software now available can sift through underwriting and claim repositories, corporate and individual names, aliases and “doing business as” or fictitious names, addresses, vehicle identification numbers, payments and even zip codes. This type of intelligence, when supplemented by substantive investigation, detection and prevention efforts, can help plot the trends, patterns and relationships that left unattended will play an integral role in allowing fraud to continue.

A number of medical fraud and staged automobile accident scams have already been uncovered by use of this technology. Rings of unscrupulous attorneys, physicians, physical therapy clinics and medical equipment providers have joined full-time employed conspirators making an average of $100,000 per person in untaxed income per year. However, their methods and motives are usually similar, can be tracked, and their trail uncovered by use of the use of data mining and predictive modeling. Further, when insurers, prosecutors and others share this data and turn it into knowledge, it will increase the success of prosecuting offenders.

The collaborative effort

What is missing in today’s approach to more fully identify, prevent and prosecute those who commit fraud and deception is a single, collaborative, coordinated and dedicated strategy among insurers, industry trade associations, law enforcement, prosecutors, state legislators and regulators, and the judiciary. Training to recognize and identify possible fraudulent conduct is a good start but remains inadequate to mount the full offensive now required. The networking, sharing of data, successful strategies and knowledge among each of the stakeholders involved is essential if insurance fraud is to be curtailed.

Prosecutors confronted with more serious crimes and limited resources must justify the effort required to take on the fraudsters. Insurers must rationalize the financial outlay required to give their claims professionals, underwriters and special investigation units the tools and confidence necessary to investigate and refer for prosecution those instances of fraudulent behavior. Finally, state legislatures must provide the judiciary the necessary laws and stronger sentencing guidelines to put fraudsters behind bars and keep them there.

Many will debate whether the return on investment justifies such a collaborative commitment. Given the pervasive impact and increasing cost that insurance fraud has on the marketplace, we can ill afford not to fully engage and commit the resources required to begin stemming the tide and putting to appropriate use all those dollars currently being lost to fraudulent conduct. *

The author

Bernd G. Heinze, Esq., is president and chief executive officer of Beacon Management Group, Inc., an international litigation manage-ment, claims admini-stration and audit facility, with offices in King of Prussia, Pennsylvania, and London, England. He is also executive director of the American Association of Managing General Agents (AAMGA). Heinze serves on the board of directors (secretary/treasurer) of the International Litigation Management Association. He also leads the Pennsylvania Delegation of the Business Advisory Counsel to the U.S. House of Representatives.