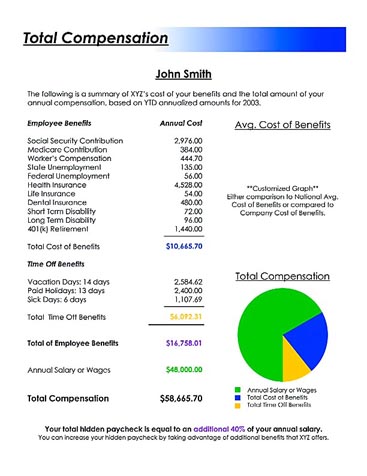

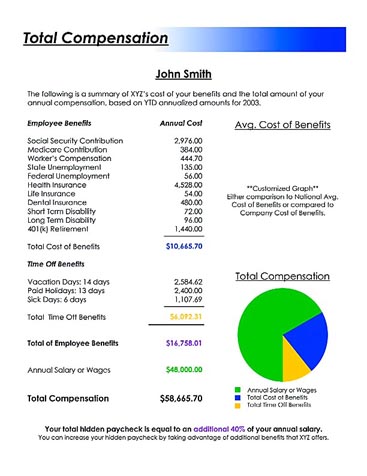

Part of an employee benefits statement

that 4myBenefits provides.

VALUE-ADDED SERVICE IS KEY

TO WRITING BENEFITS BUSINESS

Web-based service can help agents compete with the mega-brokers

By Len Strazewski

|

Part of an employee benefits statement |

Everyone is knocking on the same doors, selling the same employee benefits products and services to employee benefit managers, human resource directors and business financial managers. That’s what makes the business so competitive for independent agents and brokers who want to succeed as employee benefits specialists or augment their property/casualty book of business with life, health, vision, dental and supplementary benefit sales.

Service provides the competitive edge, says Bill Fowler, president of The Benefits Department, an employee benefits specialty brokerage with six employees and offices in Charlotte, North Carolina, and Orlando, Florida. But developing the resources to match the administrative services provided by the mega-brokers and the large employee benefits consulting companies takes a lot more than many small agents and brokers can provide, he adds.

“Employers—particularly large groups—expect much more than insurance quotes,” Fowler says. “They are looking for administrative and technical support and employee benefits communication expertise.”

Fowler should know. He founded his company nearly two years ago after taking early retirement from mega-broker Arthur J. Gallagher, Inc. In order to continue to compete with national brokerages, he knew he had to augment his own decades of experience with other service providers that can provide competitive resources.

For Fowler, one answer is an affiliation with 4myBenefits, Inc. (www.4mybenefits.com), in Cincinnati, Ohio, a human resources and employee benefits service company that provides Web-based employee benefits statements to employees and human resources administration tools through affiliations with other companies. 4myBenefits markets exclusively through agents and brokers and presently provides services to about 50 agents and brokers.

Having access to the administrative services provides a solid defense against bigger competitors, Fowler notes. “The key selling proposition for many of the big brokers is their ability to provide additional services and consulting. They really don’t compete exceptionally well on price alone. By being able to provide benefits statements and other services, we can take away their leverage with our clients. The services are also door-openers for new business, giving us something new to talk about and demonstrate.”

4myBenefits was founded four years ago by Gerald A. Peter, president of Gerald A. Peter & Associates in Cincinnati, an employee benefits specialist agent who started his career as a life agent with Prudential. The new company became a family affair with its Web technology platform developed by his son Jason. Another son, Justin, serves as vice president of marketing.

Trends

“Over the years, I have watched the evolution of the employee benefits business as it has become more and more based on service and regulatory compliance,” Gerald says. “It has become more and more difficult for agents to differentiate themselves and meet the growing needs of employers.”

Two other trends also figured into his inspiration: the explosion of new small businesses and the growing ability of the Internet to provide low-cost, high-efficiency online services. As the fastest growing category of employer, small businesses have human resource management needs that compare with larger employers. They need to comply with the same regulations and often compete for the same types of employees, Gerald says.

Peter’s own clients became the beta test platform for the initial 4myBenefits product, an online employee benefits statement and customized Web site for employers and their employees. Using Web-based graphics, the site is designed to help employees understand the total value of their benefits by depicting the cash value as a second paycheck stub. The site also features links to individual benefit providers, financial planners and retirement plan information as well as the statement graphics. It can also be customized to include links to other services provided by the employer, including recommended certified public accountants, attorneys and vendors.

Philip McKelvey, president of Voluntary Benefit Specialists in Cincinnati, was an early adopter of the services and has been offering the online benefits statement to his clients for about 18 months. His two-person agency specializes in worksite marketing of voluntary benefits such as life insurance, homeowners insurance, personal auto insurance and other products employees pay for through payroll deduction. McKelvey says the online benefits statement has helped him get recognition from employers and develop new enrollment opportunities for voluntary benefits.

“Employers are always looking for ways to help employees appreciate the value of their employee benefits, and the statements help communicate that value. The online service also provides a platform for enrollment in my voluntary benefits programs,” he says.

Last year, Gerald Peter returned to full-time management of his agency and was succeeded as chief executive officer of 4myBenefits by Lauren Patch, former president of Ohio Casualty Insurance Co. in Cincinnati. “He brings broad experience working with a national network of agents and brokers and can lead the national expansion of the company,” Peter says.

Patch also brings a renewed commitment to agents and brokers as the exclusive sales force for the company services and experience working with property/casualty agents for whom employee benefits is a minor portion of their business. He says the company plans to expand its producer network to more than 250 by mid-2005 and plans an extensive outreach to property/casualty agents as well as employee benefits specialists.

“Many property/casualty agents have an employee benefits specialist on staff, but need to find ways to increase this business and better market within this business niche,” Patch explains.

The online technology not only gives property/casualty agents the services that they need to provide their customers, but also creates broad cross-selling opportunities for voluntary and employee-paid benefits that the agents could not develop on their own.

New markets

Specifically, Patch cites a growing market for voluntary life insurance disability insurance, long term care insurance and personal property/casualty products such as homeowners and personal automobile insurance. The company also has an affiliation with specialty insurers that provide identity theft insurance, a hot new voluntary benefit product.

Patch also says the online service platform, which requires an up-to-date employee census and registration, may help agents facilitate workers compensation insurance sales by aggregating employment information that is generally dispersed throughout employer organizations.

In addition to the online employee benefits statement service, 4myBenefits has added an array of other human resources services that agents can offer individually or as a package to their clients for an additional per-employee/per-month fee.

The most recent addition, announced in August, is HR Wizard, a comprehensive employer compliance analysis program and toolkit. Employers complete a checklist of human resource policies and procedures and receive guidance on their compliance with various federal requirements.

While the service won’t transform an agent into a human resource consultant, it will add value to the agent/client relationship and point clients in directions of improvements, says Patch.

The new service also provides agents with a way to open lines of communication with human resource directors and financial executives who bear the responsibility for human resource management and employee benefits purchases, he notes.

The company also provides COBRA administration, one of the most common and demanding human resource compliance problems for employers with 20 or more employees. The Consolidated Omnibus Budget Reconciliation Act of 1985 requires employers to provide continuation of employee benefits, including group health, dental, vision insurance, employee assistance programs and flexible spending accounts (FSAs) for employees who are willing to pay the premiums.

Last March, 4myBenefits announced an alliance with CobraGuard, Inc., in Lenexa, Kansas (www.cobraguard.com), a COBRA compliance outsourcing company that manages, tracks and monitors employer compliance with the law and reconciles employee bills. 4mybenefits integrates its own online enrollment and employee benefits plan information with the CobraGuard proprietary product CobraTrack through a secure data feed, providing a seamless connection between the two services, according to Patch.

“Our systems work very well together and create efficiency in human resources departments they never had before,” he says. And as an outsourcing service company, CobraGuard does not compete with any of the affiliated brokers, he adds.

For agents and brokers without security licenses, the company also offers an affiliation with RolloverSystems, Inc., in Charlotte, North Carolina (www.rollovermarket.com), which provides an online tool to employees who plan to change their employment and need to roll-over defined contribution assets into Individual Retirement Accounts (IRAs).

These employees enter their retirement plan information into an online form linked to their online 4myBenefits Web site and can shop plan and securities quotes from leading financial institutions and securities brokerage companies, including Merrill Lynch, J.P Morgan Chase & Co., TD Waterhouse and Harrisdirect.

Patch says the company continues to add service affiliations and he expects to add the ability to provide credit checks to employers and other computer and financial security products to employees later this year. Also coming soon is more information on Health Savings Accounts (HSAs), the new health insurance savings vehicle created by recent Medicare reform legislation.

“Employers seem very interested in these new vehicles and I expect they will become an important option for employers. Administration of HSAs is likely to become a critical service need,” he says. *

The author

Len Strazewski has been covering employee benefits issues for more than 20 years and is employee benefits editor of Human Resource Executive magazine. He has an M.A. in Industrial Relations from Loyola University.