Mike Hunter is President of Agency Systems.

|

Mike Hunter is President of Agency Systems. |

Agency Systems offers agency management solution designed to enhance efficiency and increase productivity

By Virginia M. Bates

Agency Systems in Bryan, Texas, considers itself still to be an innovator after more than 20 years of creating agency automation solutions. The customer base consists of about 350 agencies with an average of seven to nine employees. Like many agency management systems with roots in the 1980s, Agency Systems, formerly known as Empire Systems, started off as an accounting engine; but given the opportunity to automate a large agency, Agency Systems wrote a front end for personal lines and commercial lines. Today the vendor has expanded its lines of business to include aviation, marine, and crime modules.

Agencies that choose Agency Systems often start with the Agency Apps module which is an inexpensive way to manage insurance-specific tasks while continuing to do accounting, general ledger, and payables either manually or with stand-alone software like QuickBooks or Peachtree. Agency Apps is priced at $495 for the one-time entry cost, or $550 with download. The monthly user fee is $69 for up to three users, with incremental payments for additional users. Mike Hunter, president of Agency Systems, points out that the modular approach works particularly well for these agencies when they want to add accounting and claims modules because they don’t have to go to another vendor, risk a data conversion, or deal with a retraining effort.

Agencies that opt for the benefits of full functionality in an agency management system find the Agency Systems product to be just the ticket. Using Agency Apps as its foundation, Agency Systems includes accounting, general ledger, accounts payable, and claims submission ability.

Users of both Agency Apps and Agency Systems can add Agency View for a one-time cost of $495 to allow policy change upload and direct bill inquiry directly to a carrier’s Web site. With Agency View, right-clicking any policy takes the user directly to the policy detail at the carrier’s Web site. Currently 70 carriers are available via Agency View. Direct “screen-to-screen” access to a client’s billing or claims history via the carrier’s Web site is not yet available.

Agency On-Line is Agency Systems’ ASP version with the simple pricing of $200 per user start-up cost with a monthly $100 user fee per month.

Carrier interface is an important part of the Agency Systems package of benefits to agency users. Personal lines download is appreciated by many of its users. However, some users choose not to use it. “We don’t upload into any carrier systems because I won’t do their work for them, and we don’t download because the carrier’s data can go into incorrect fields and change our database in a way we didn’t intend. We want our database nice and clean,” says Clare Marentette, Marentette Insurance in Windsor, Ontario.

Mike Hunter explains that Agency Systems does not yet data-push to the carriers because the demand from even the largest clients is minimal at this time. When they do implement data-push, it will be proprietary, rather than via IVANS’ Transformation Station. “Many of the carriers that our agencies use are smaller and/or are mutuals and they have told us they need a less pricey solution than Transformation Station. Since XML is written into our database, we offer a solution to those companies not able to justify the expense of third-party translation and transfer tools,” he explains.

Adding commercial lines download has been a top priority and commercial auto, workers comp, and businessowners download modules are now in the certification process. Wisely, Agency Systems has developed a test-program for download development (on certification, prior to starting download with a company). The program allows selected users to study screen shots of downloaded screens to verify that data elements traveled into the correct fields and didn’t overwrite other data, such as underwriting information that the carrier may download. “Our users’ databases are not infiltrated by download until we and they know it is safe,” explains Hunter. “We will do all that we can to preserve the detail that they have so carefully entered.”

Policy numbers in the download file do not have to match perfectly the policy numbers shown in Agency Systems. “This is a great feature,” Hunter continues. “Dashes and spaces are often used by the agency but not always by the company, and vice versa.” The Agency Systems download will automatically determine if the policy and client exist in the database and will create the client record if it does not. This could be a problem, though, if the unmatched download record actually pertains to an existing agency client that has a slight difference—such as middle initial—in the agency system that does not show up in the company system.

Agency Systems, however, has solved that problem because nothing in the download is created on the fly unless it passes a series of tests to ensure that duplicate data is not created. In the situation described above where the client could have a slight difference such as middle initial (or another example “John” rather than “Johnny” as the named insured), the program would require that that person also have the same address, phone number, and Social Security number. So there is no possibility that duplicate data could be entered.

In addition, the program allows a user to handle a questionable match manually. This is a sophisticated approach to download and eliminates large numbers of exceptions, so agencies can spend more time serving clients and less time cleaning up data.

Agency Systems uses Crystal Reports as its report engine. All system reports are exportable to Word, RichText, Excel or, of course, Crystal Reports, or others that a particular agency might prefer.

Agency Systems offers a sophisticated approach to download and eliminates large numbers of exceptions, so agencies can spend more time serving clients and less time cleaning up data. |

Users differ

“We haven’t had filing cabinets since 1992,” says Marentette. “We create one scanned image to reside on the hard drive and one to attach to Agency Systems. We use an image viewer product called ACDSee (from ACD Systems) to enhance the imaging capability that’s built into Agency Systems. The ACDSee program opens images much faster than the free Microsoft viewer that comes with Windows.” Lisa Roppolo, Evans, Ewing & Brady in Georgetown, Texas, is also a fan of imaging. “We image all mail as it comes in and have no paper at all in personal lines, except t-filed signature documents; same thing in commercial lines, except excess and surplus forms for which we still use an alpha file.” Other Agency Systems users are more traditional. “We still use alpha files and that will never change,” says Corey Jackson of Jackson Insurance in Sterling, Colorado, a one-year user of the system.

Agency Systems supports t-filing by automatically date- and time-stamping any activity and including the inputter’s initials. The most current note will appear to the right of the history screen for easy access. Activities and notes can be sorted by date or operator or first word—but not by activity code which many users of other systems have found helpful to use as a filter to locate a specific event or documentation item. Notes and activities in Agency Systems are not amendable after they have been entered and saved.

Letters and other documents can be changed unless the user specifically “locks” that item. “Lock” cannot be set as a universal setting, which leaves some E&O potential if a user overlooks locking a particular letter or document.

Default commissions can be set by line of business, individual producer, or transaction type (new or renewal). A billing wizard can set up both the commission split and a special invoicing format and breakdown. For instance, from the premium line, the policy fee and surplus lines tax can be calculated by a formula “behind the scenes.” This feature was developed for Agency Systems’ MGA users, but retail users are finding it useful as well because the number of their excess placements through surplus brokers has increased dramatically in the recent hard market. Once a payment is received, the agency can apply the payment, reconcile it with the invoiced amount, and adjust the invoice in a single step.

Non-Microsoft tools

Although Agency Systems is a 32-bit program that runs natively to Windows 98, NT, or Windows 2000/2003, it does not incorporate Microsoft tools into its program. That said, any user can utilize any Microsoft products that the agency likes in conjunction with Agency Systems. Network software options include Netware, Windows NT/2000 Server, or Small Business Server. The system supports Terminal Services and can accommodate remote users. The system does online faxing using any product the user prefers. Popular options are WinFax or E-Fax.The system recognizes the fax management software as another printer outlet to connect to the Fax Server in place.

Agency Systems chose Pervasive as its database provider. “Whereas you almost need a Microsoft-certified engineer to reindex data files, there are virtually no maintenance routines with Pervasive,” explains Hunter. It is a self-tuning database. Pervasive, also based in Texas, is used by many large enterprises, including Aegon Equity Group and MCI.

Agency Systems decided against incorporating Word into its system. Instead, Agency Systems uses a memo-writer that works a lot like Word according to Hunter. “With Word, everybody in the agency has to be on the same version of Windows 98, XP, etc.; plus Word takes so much more memory and can crank so slowly that we decided there was a better way,” he explains. Using Agency Systems, Bonnie Campa of The Independent Insurance Center in San Antonio, Texas, has set up and saved lots of letter templates that the agency has used in the past. She reports that she never could figure out how to save them as templates in the more complicated agency management system the agency used to have.

“Our system doesn’t include fancy tools like spreadsheets (which can be useful to an agency), but our tools cover most agency uses and are easy to use,” says Hunter. Many agencies like to use spreadsheets to track properties, schedules, or the status of responses in the marketing/placement process. This is still possible in Agency Systems by using stand-alone Word or Excel and attaching the document to the Agency Systems client.

|

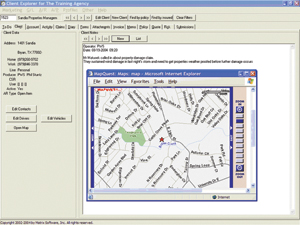

This is a view of Client Notes, summarizing the most recent contact with the client. MapQuest image reflects the location of the risk. |

Workflow considerations

Data integration within the system is not as robust as in some other systems. For instance, an ACORD change form can be completed and does create an automatic activity (without specific change detail which can be hand-typed into the activity), but the coverage detail screens have to be updated by hand. A change confirmation letter can be chosen from the document list, but it can’t be a “hands-free” automatic result of doing the change.

Proposals can be integrated into the system as merge-documents so that client information will prefill the proposal fields, but policy detail will not. Pleasantly, certain fields, like property values, add up on the fly as field entries are input. When text is too long to fit into a field, the font size is subtly reduced to make it fit. This last feature is very convenient for service look-ups but may be thorny when data mapping is done to facilitate upload to carriers, who define their field lengths by ACORD standards.

Submissions to carriers can include scanned images of loss runs, financial statements, or photos bundled electronically with applications created in Agency Systems. After creating the batch, the user must select a transmission option: print, fax, or e-mail. If the user selects “e-mail” and a carrier is indicated, the system will go to the Company Profile for the appropriate e-mail address. If the user hasn’t set up the Company Profile section of the system, the user can either set it up on the fly or can send the submission to him or herself in order to copy it to each relevant carrier. (The user could send it to the first carrier and copy to the others, but most agencies would like each carrier to get an original submission without indicating which other carriers are being approached.)

Of course, agencies with particular market focuses must consider their individual workflow needs. One agency in Oklahoma City left Agency Systems about two years ago. While they very much appreciated Agency Systems’ support team that tried to help, they needed the ACORD forms that they use such as binders, certificates of insurance, and applications, to pre-fill correctly. Although the policy detail did merge into those fields, the field lengths in the system were abbreviated so not all the characters “fit.” In addition, one particular mortgagee kept appearing on every certificate, whether that particular mortgagee was entered on that account or not. The agency used separate ACORD forms software for a while because they liked so many other features of Agency Systems, in particular the ease of its accounting module, but finally decided that a single-system solution was more desirable.

Service bar none

“Agency Systems has added me to their Instant Messenger so I can e-mail them and literally get an answer in three or four minutes,” glows Corey Jackson.

Ronnie Morris of the Joe Pratt Agency, Victoria, Texas, likes that his staff can be trained right at the agency at their own workstations. This is especially good when new staff members are hired, he says. The agency went live with Agency Systems 10 years ago. Back then, it was the price of the system that got Morris’s attention. Since then, it’s the service that’s been the attention-getter. “The economics involved do matter,” he says. “When we looked at prices, Agency Systems was half of what other vendors were charging. We started with them when they were just starting out. Now we would never leave them.”

Marty Bufkin of Bunkley Jones in Seymour, Texas, has a few tenured staff members who still relied on typewriters up until the time that Agency Systems was installed in September 2003. “The trainer was not only professional, but was a real gentleman and was very patient. I have found the whole company very practical and down-to-earth.” Bufkin already sees that the agency’s CSRs are not getting up to grab a paper file, but can do their work—generate an ID card, for example—right from the system.

Marty Bufkin knows why he bought Agency Systems and believes it has fulfilled its promise. “I bought an agency that was coasting and I wanted a system that could grow with me no matter how big we get—even if we open or buy a branch—and I got just what I bargained for!” *

The author

Virginia M. Bates is a management and technology consultant with background in all property and casualty lines and 20-plus years of experience in managing insurance operations. As co-founder of VMB Associates, Inc., based in Melrose, Massachusetts, she has worked with countless agencies and carriers on profitability, reducing E&O exposure, operations, marketing, carrier relationships, and successful technology strategies.

For more information:

Agency Systems

Web site: www.agencysystems.com