TECHNOLOGY

Advanced Automation helps agencies understand that

customer service alone will not build their business

By Nancy Doucette

|

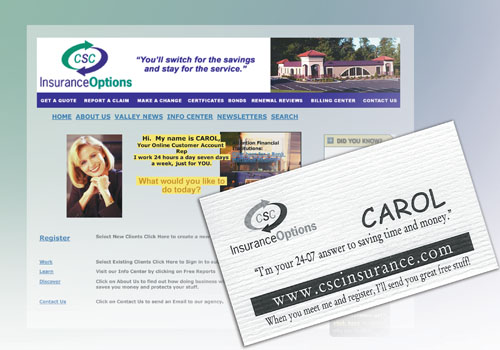

CAROL is just four years old. She’s the newest employee at CSC Insurance Options in Belle Vernon, Pennsylvania. She’s never absent, tardy, or away from her desk. She makes it possible for CSC’s customers to communicate with the agency at their convenience via a secure connection. She provides other added value to customers as well.

CAROL—an acronym for “Customer Account Representative OnLine”—is an ASP product that Advanced Automation, Inc., in Dallas, Texas, rolled out in 2000. CSC Insurance Options is one of a growing number of agencies to move in the direction of offering customers 24/7 service, which is the centerpiece of CAROL. But thanks to the guidance of Advanced Automation’s CAROL facilitator Tom Baker, agencies that adopt CAROL learn that there’s more to 24/7 service than providing customers with access to policy data.

“It’s important that the agency thinks about how providing 24/7 service fits into its mission and vision of protecting customers,” Baker points out. During the 12-month CAROL implementation process, he encourages the agency to re-evaluate what it is actually providing customers. “Most agencies start out thinking they are in a service business but the fact is, an agency is in the protection business,” he says.

“The implementation process not only walks the agency through how to use CAROL but also helps the agency begin to move into e-business and use the Internet as a communication tool with and for their customers so that CAROL can accomplish a number of different goals beyond 24/7 service,” Baker points out. The implementation process also includes online classes on site administration and CSR training. The “classes” are live, Web-based presentations that Baker offers from his Dallas office. The sessions are recorded so that the agency can go back at a future date, 24/7, and review a particular session.

Baker explains to the agency how CAROL can take on the tasks of collecting information and answering frequently asked questions, thus freeing up the agency’s staff so that they can spend time quoting new business, account rounding, or conducting annual insurance reviews—the tasks important to an agency that’s in the protection business.

Baker says he worked principally with Dean Mathies, network administrator for CSC, to determine what the agency wanted to say at its new Web site, which provides a brief introduction of CAROL beside “her” picture. Baker explains that CAROL includes enough boilerplate text so that an agency could go live with little or no tweaking of the content. “We don’t want an agency to have to spend hours coming up with content for every page just in order to go live,” he says. However, the agency can edit or change whatever they want at their CAROL Web site. CAROL includes a content manager to assist the agency in its editing efforts as well as a full online training program and online resources. And should the agency need help beyond that, Baker is always available by phone.

“The CAROL system is easy enough to figure out even if you’re not an IT person,” he points out. “If all you’re doing is modifying the boilerplate information, it’s as easy to work with as Word.”

Mathies notes that like most innovative agencies, CSC tries to anticipate its customers’ needs. As part of that process, he says, earlier this year he found himself thinking about how his banking habits have changed since online banking became available. “I don’t go into a bank if I can avoid it,” Mathies says. “That got me thinking about the insurance-related tasks that customers can do when it’s convenient for them. That’s the ability we want to provide for our customers.” That said, though, it is equally important to CSC to maintain contact with the customers, which is why the agency decided on CAROL. “The purpose of CAROL is for the customer to have access to the people who have the information. CAROL doesn’t put policy data into the customer’s hands. Customers may not know what to do with that type of information,” he notes.

CSC is phasing in CAROL for its customers, beginning with the personal lines customers. The agency is using a number of ways to get the word out about this new customer service capability. Amy Vollmer, CSC’s personal lines team operations manager, says the agency has business cards for CAROL and a card is enclosed with any type of written correspondence that’s mailed to personal lines customers. The agency is e-mailing customers about CAROL as well. Additionally, the cards are included with the Welcome Kit that the agency gives to new customers. An electronic sign in the CSC parking lot also announces CAROL as CSC’s new employee. The sign includes the agency’s Web site address as well.

Customers can request quotes or certificates, submit changes or claims, or check the status of a previously submitted transaction. Mathies emphasizes that the communication is not an e-mail. “E-mail is not secure,” he explains.

“Customer correspondence is written immediately to an SQL database over a secure SSL connection. The agency logs into that same database and pulls the customer correspondence from there. The agency management system can be updated by cutting and pasting the customer correspondence into the activities. The agency’s response to the customer correspondence is part of the activities as well.”

Kathy Jakela, customer service supervisor for CSC, adds: “CAROL provides our customers 24/7 communication capability through our Web site. When customers register, they set their own personal password. All their correspondence through CAROL is secure. Most of our customers work outside the home during the day so they may not be able to contact us during our regular office hours. CAROL is always available and we can follow through with what the customer wants the next business day, if not sooner.”

Mathies says an anticipated byproduct of CAROL is more time in a CSR’s day. Using quotes as an example, he explains that the customer can complete a quote request form through CAROL. The CSR can then prepare the quote and respond to the customer in one step as opposed to the more familiar process of the customer calling the CSR to request the quote; this one process could save a CSR 15 to 20 minutes per quote. CAROL’s “required” fields ensure that the CSR does not receive incomplete quote requests. The CSR then prepares the quote and calls the customer back. CAROL will take care of the information gathering, but the CSR will still have the personal contact with the customer to discuss the quote with the customer. With one less step in the process, Mathies predicts CSRs will find they have more time.

They’ll also have more time in their day if they don’t have to keep doing the same tasks over and over. How many times a day does a bank call wanting to verify insurance? Mathies says the agency can put a form at its site that can manage those requests. When a call comes in from a bank, the CSR can direct the caller to the Web site from which the bank can download the form, complete it, and forward it to the agency. The CSR doesn’t have to take time away from more pressing customer service work to manage these requests. They can be handled in a manner that better suits the CSR’s workflow.

Tom Baker points out that the next version of CAROL will take the password-protected communication between the agency and its customers to a new level. “Each customer will have his or her own homepage,” he says. “So if the agency needs a form signed by the customer, the agency asks the customer to go to the online CSR and get the document that’s waiting for them. The customer can then download the form, sign it, and fax it back to the agency.” CAROL also includes automated renewal reviews and “Did You Know” reminders that focus on additional lines of coverage that may be of interest to a customer or prospect visiting the site.

He acknowledges that embracing technology is an evolutionary process, noting how answering machines, fax machines, voice mail, and e-mail, have changed the way we communicate. “If the agency just begins to incorporate CAROL into the way it does business, the process will progress without problems.”

Getting customers to the place where they go to CAROL first begins gradually, whenever the agency is on the phone with a customer, he recommends. For instance, if a customer calls to report a car change, Baker suggests that the CSR ask if the customer is at a PC. If so, the CSR takes the customer through the online change form. Of course if the customer prefers not to go through the process, that’s fine too. “But as the agency begins to just incorporate CAROL into the way it does business, the customer may move in that direction as well because the message is reinforced every time the customer calls,” he says. “And gradually, just as we all did with fax, voice mail, and e-mail, it becomes how the agency does business with its customers—and how the customer does business with the agency.”

One of the value-added services that is part of CAROL, Baker notes, is the online workshop that the agency can offer clients. Advanced Automation will make the same technology available to agencies—at no additional charge—that it uses for the online training that’s part of the implementation process. “Imagine an agency going to its commercial clients and telling them: ‘We have a workers comp expert on staff and we’re going to offer a workshop on reducing your workers comp premium. It’s a live workshop that’s going to come right to your desk. It’s free. We’re bringing this to you because you’re one of our customers.’”

Baker explains that the agency would create the workshop and send an invitation to those customers they’d like to attend. At the appointed time, the customer would log in and attend the workshop. He says Advanced Automation has a conference line that it makes available to the agency at no charge that the agency can use for the audio. “The agency is offering something unique to its clients and differentiating itself from other agencies,” he points out.

Baker suggests that agencies also think about facilitating an online brown bag lunch once a month for personal lines clients. One idea is to invite personal lines clients to join in a 20-minute workshop on financial planning or retirement planning. “Even if the customer never attends one of those workshops,” he notes, “the very fact that the agency is offering it sets it apart from the competition.”

Another CAROL feature that Baker says sets the product apart is the ability to submit checks online. “Suppose the agency writes a new account and has to wait for the customer to mail the check. We’re providing virtual check software that enables a customer to handle this payment online immediately. This capability makes sure the agency gets paid and can reduce collection problems. The customer fills out the pertinent information through CAROL, the agency prints the check, and deposits it with their bank.”

While many agencies have a Web site, Baker urges them to consider whether their Web site is making money for them. “There are three words that are important to the success of an agency site: revenue, retention, and profitability,” he maintains. “If a tool in your agency doesn’t build retention, revenue or profitability, it doesn’t belong there.

“We want agencies to have more than just a Web site, more than just a 24/7 service tool,” Baker explains.

“CAROL provides a Web solution that is going to help agencies build retention via value-added services; it’s going to build profitability by helping CSRs save time each day; and it’s going to help build revenue by giving CSRs the opportunity to do more cross-selling.” *

For more information:

Advanced Automation, Inc.

Contact: Greg Arnold, VP Sales

Phone: (877) 704-1480

E-mail: Greg@AdvancedAutomationInc.com

Web site: www.advancedautomationinc.com