TECHNOLOGY

Riskclick streamlines carrier workflows, converts information

submitted in any format into a single, consistent digital file

By Nancy Doucette

James F. DeSocio is Chief Executive Officer for Riskclick.

"An insurer's first priority is to get information from the agent in a form that's consistent, accurate, and complete," says Jim DeSocio, CEO of Riskclick, a four-year-old provider of software to the property/casualty insurance industry. But that's not as easy as it sounds. Information comes in via e-mail, fax, phone, and hard copy. Additionally, once that information arrives at the insurer, it's stored in a variety of places. "As a result, insurers have a fragmented view of a transaction," he says.

"An insurer's first priority is to get information from the agent in a form that's consistent, accurate, and complete," says Jim DeSocio, CEO of Riskclick, a four-year-old provider of software to the property/casualty insurance industry. But that's not as easy as it sounds. Information comes in via e-mail, fax, phone, and hard copy. Additionally, once that information arrives at the insurer, it's stored in a variety of places. "As a result, insurers have a fragmented view of a transaction," he says.

DeSocio bases his insights on a survey that Riskclick conducted in late 2003 of some 350 mid-sized U.S. property/casualty insurers. Riskclick distilled the results of the survey into a White Paper titled "Four Bottom Line Issues Facing Property & Casualty Underwriters," and used the findings as an important part of its strategy and latest product offering.

After working with top-tier agents and brokers since it was established, Riskclick understands that it's unlikely that every agent will adopt a uniform method of communicating with carriers. So earlier this year, Riskclick enhanced its solution to include a "virtual envelope" that would facilitate transmitting information to the carrier in a variety of formats and then store it in such a fashion that underwriting consistency and productivity would follow. The virtual envelope was the result of that development effort, enabling a carrier to collect information submitted in any format into a single, consistent digital file, so that it can be managed throughout the transaction process.

"Riskclick started out by cementing its position with the top-end brokers," says Anthony Siggers, one of Riskclick's founders and chief technology officer. "The product enabled the brokers to service their clients, particularly the larger clients, more effectively and efficiently."

|

|

|

|

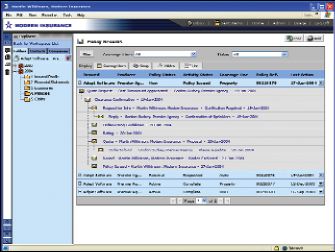

Starting at the top left, this sequence illustrates an agent's request for coverage on a new location for an existing client. The agent's request, which arrives at the carrier as a virtual envelope, incorporates data, documents, and smart forms. The large image shows the audit trail as the business is bound and the policy is issued. |

|

Daniel Stander, vice president, says feedback from these clients has been encouraging. According to one large broker, its customer-facing processes are 25% faster as a result of using the Riskclick platform--itself an influential factor in over $5 million of new business. An international broker network reported that Riskclick enabled the brokers to work more efficiently together--so much so that the network's international business grew by 30%. Another client reported that its claims processing time improved by 58%.

According to DeSocio, "Riskclick is going to take its core strengths--robust product, insurance intellectual property, and content knowledge--and build upon it," he says, as Riskclick's product line evolves to address the technology needs of U.S. P-C insurers and MGAs.

By working with some of the top-end brokers from around the world, Riskclick was introduced to a range of insurance companies. Operating in an arena of that magnitude has positioned Riskclick well for the next phase of its business plan. "From a product perspective, Riskclick has been stress-tested from every angle," Stander maintains. "From a technical perspective, from an architectural perspective, from the way in which we're able to scale and ensure reliability through our service operation--all that was taken to the extreme and enabled us to build out a world class solution and an unbeatable proposition."

"Riskclick helps information move more efficiently between the people and systems that need to be involved in transactions."

"Riskclick helps information move more efficiently between the people and systems that need to be involved in transactions."

--Anthony Siggers, Executive Vice President & Chief Technology Officer

The key to that is the Riskclick workflow engine. The workflow engine enables Riskclick to configure its platform to the precise needs of the client and do so in what Siggers says is a rapid and cost-effective manner. He explains that a client's precise needs are determined by having Riskclick consultants spend time with the client's users and managers to understand how they manage their processes. (See sidebar.)

The speed with which that configuration can happen is based on Riskclick's use of Web services. Siggers points out that Riskclick's Web services are certified by Microsoft and ACORD--an important detail because adhering to established standards and protocols streamlines communication between different programs. "Web services aren't solutions in themselves," he notes. "Web services are enablers."

By using Web services, applications that are coded in different languages can talk to each other. Essentially, the Web service is a wrapper that goes around a software application. It serves as a bridge between communicating applications. "Previously, integrating software applications would have been a costly hard-wiring exercise. Thanks to Web services, there's interoperability between applications," he explains.

Siggers explains that because the Riskclick software integrates with any existing document imaging or optical character recognition (OCR) solution, it can take a fax document, for example, and extract the data elements from the fax. So even if an ACORD form is handwritten and faxed in, the Riskclick software can read it. There's no need for the insurer to rekey the information. The representative at the carrier sees a screen that verifies the transmission and displays an electronic ACORD form with what the Riskclick software just read. The carrier representative compares the fax with the OCR document to make sure that the software did an accurate job and then moves the transaction along the underwriting process.

Equally important to this process is that the agent doesn't have to enter information into a company site. The agent continues to submit information in whatever format he or she chooses. "Riskclick helps information move more efficiently between the people and systems that need to be involved in transactions," Siggers notes. For the insurer already working with Riskclick, he says: "The overriding thrust isn't about the technology; it's about how that insurer services its agents." Insurers using this approach are more likely to become the agent's market of choice.

Once the information reaches the insurer, it is routed through a series of legacy systems--policy administration, rating, claims--which don't currently communicate with each other in an efficient manner. Often, information must be rekeyed, which slows down response time and leads to errors.

Ross Rosen, vice president of product marketing, says that these infrastructures that insurers have acquired over time act like "islands of automation." He says this lack of intuitive systems requires "lots of human beings pushing paper around and doing tasks manually.

"The Riskclick solution takes the reality of a carrier's existing IT landscape and ties it all together with collaborative tools to enable the carrier to use the best of its existing systems and to streamline its business processes."

Anthony Siggers elaborates: "Web services are the transport mechanisms on top of which you lay the ACORD Standards. That helps insurers move data in and out of legacy systems in a far more cost efficient manner than was ever possible before."

Jim DeSocio (standing) with Ross Rosen (left), Vice President, Product Marketing; and Adam Sandler, Senior Vice President, Business Development.

Jim DeSocio (standing) with Ross Rosen (left), Vice President, Product Marketing; and Adam Sandler, Senior Vice President, Business Development.

Riskclick moves the information by way of a structured workflow that "knows" what function is to occur at what point in the process. The system can handle any type of transaction: new business submission, renewal, endorsement, or claims. And should a transaction exceed a particular underwriting rule or guideline, the transaction can be routed to a manager for review. An audit trail develops as a transaction moves through the various systems.

Being able to bring exception-based underwriting into the real-time realm is a significant step, Siggers says. "What we've done is combine structured and unstructured information in one process," he explains. "But we've also combined different participants in the process--systems and people--to reflect how business is done today."

Any time the system routes a transaction to a manual underwriter for review, the underwriter can contact the agency on the spot to request more information. That contact will occur via the mechanism preset for that agency. The Riskclick software "knows" how to respond to that agent, thanks to a preset preference that's in place for each agency. It may be via an e-mail, fax, or surface mail but that detail is transparent to the insurer. The company representatives do their work in a consistent fashion and Riskclick transmits the information to the agency via the delivery mechanism that agency chose.

"In the past," Ross Rosen points out, "the goal was to automate as much as possible. But everything had to be so structured, you either automated it completely or you threw up your hands and it was all people-based.

"The Riskclick approach is able to deal with structured data and do exception-based underwriting so that when there's an exception, it can be referred to a person as quickly as it can get there," he continues. "So that brings a more real-time aspect to the transaction, while still keeping it in the system so it isn't put in an inbox somewhere where it takes a long time to get processed. We keep it in the business process."

Jim DeSocio points out that while Riskclick differentiates itself from the competition by offering a better exchange of information between insurers and agents, "the true beauty of Riskclick is its focus on insurance--our developers' understanding of insurance business processes, and the product's out-of-the-box insurance functionality--as well as the ability to get the solution up and running quickly and efficiently." *

Bringing a consistent workflow to MGAs

"MGAs are uniquely positioned to take advantage of the Riskclick product," says Adam Sandler, senior vice president of business development. "Similar to insurance companies, MGAs receive information from multiple sources, in multiple formats, and then they have to process that information in a consistent fashion internally."

RMS Insurance Brokerage, LLC, based in Garden City, New York, recently chose Riskclick so that the MGA, which specializes in the franchise food industry, could expand its business without adding additional resources. Prior to choosing Riskclick, RMS used a paper-based process.

Once all the underwriting information is input into the Riskclick workflow process, Sandler says RMS will be able to process renewals more efficiently. RMS will be able to pull the information electronically into a renewal application. It will include all the endorsements for that year. He explains that RMS will be able to edit and update that information with its agents or producers, provide quotes, and basically bind the risks in bulk.

Moving away from a paper-based process also enables MGAs such as RMS to track information more effectively. They can identify which agents are submitting good business, which aren't and clear risks automatically.

Sandler explains that Riskclick can help MGAs with the intricacies of rating as well. "We're giving MGAs the ability to rate risks in multiple ways."

"We don't expect every MGA to have the exact same workflow or the exact same information to capture," he continues. "But as we did with RMS, we meet with the MGA to understand its specific requirements and then map those requirements to the Riskclick suite. The configuration process takes only a matter of weeks."

For more information:

Riskclick

Web site: www.riskclick.com