Marketing Agency of the Month

Humble, shared success

146 employees create an overwhelmingly successful team at RJF

By Dennis H. Pillsbury

|

|---|

| RJF’s management team (from left): Tim Fleming, CIC, CPCU, President of Business Development; Tom Nepper, Executive Vice President of Technology; Amy Peterson, Vice President of Finance; Bill Jeatran, Chief Executive Officer; Jim Johnson, CPCU, CIC, AAI, Director of Marketing & Business Development; and Jill Lowder, CIC, Vice President of Corporate Operations. |

Team selling has certainly been increasingly mentioned in the agency business. But very few agencies boast what RJF Agencies, Inc., Minneapolis, has—a 146-member team that is focused on helping clients solve their business issues.

RJF is the brainchild of Bill Jeatran, now chief executive officer of RJF, and Tim Fleming, now president, and, perhaps, a pint or two of Guinness. Bill and Tim were college roommates in the ’80s. They were studying abroad as part of a program at St. John’s University and were in Galway, Ireland. During a study break at a local pub, they decided that they wanted to go into business together.

|

|---|

| Frequent strategy meetings are conducted to assess clients’ risks and help them proactively manage those risks in a cost-effective manner. |

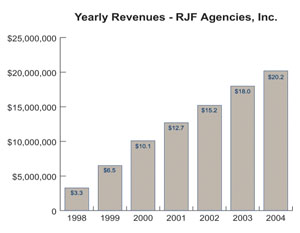

When they finished college, they both went to work for Aetna. The Charles Russell Agency became available in 1986 and Tim and Bill purchased the agency and changed the name to reflect the three owners—Russell, Jeatran and Fleming. At the time of the purchase, the agency had $97,000 in revenues. Today, the agency boasts more than $20 million in revenues. And that’s after RJF divested itself of about $2 million in personal lines business that was acquired by a former partner.

“From the very beginning,” Bill remembers, “we wanted the company to become a trusted advisor, helping clients deal with business issues. We determined that bidding minimizes our professionalism and chose to opt out. Instead, we focused on helping clients eliminate preventable risk and mitigate or transfer other risks. We worked to become an integral part of each client’s business plan. Our goal was and is to help our clients reduce their cost of organizational risk. Insurance is only one of the ways that we help them accomplish this goal.”

Putting revenue to work for clients

The first step in reaching this goal was growth so the agency would have the resources to bring in the people needed to provide strong risk management services. By 1998, the agency had reached more than $3 million in revenue and had a branch office in Wisconsin. The next year, the agency made a couple of small acquisitions to enhance its growth, particularly in commercial lines. Once these acquisitions were made, all agency growth through 2004 has been organic, helping RJF earn the distinction of being one of the “50 fastest growing private companies in Minnesota” by the Twin Cities Business Journal six times in the past seven years. When revenues passed the $10 million mark at the end of 2000, the management team decided to add personnel that would be involved in specific areas of risk management and other client services. The goal was to enhance the agency’s emphasis on risk mitigation and avoidance. “Over the past four years, we’ve added five loss control people, five in claims, two in human resource consulting, and three to serve as a management liability team,” Bill says.

And this year, the agency just added another risk management service by adding 20 employees in the occupational health nursing field to their team. “We just completed an equity partnership with an occupational health nursing company,” Bill says. “It’s a locally based nursing firm that will provide health risk assessments, wellness development and occupational health services for our clients. Less than 1% of health care spending is spent on prevention and that just doesn’t make sense. We believe we can significantly drive down costs in workers comp and group health by focusing on wellness. We just recently provided the assessment to one of our health care clients and found 16 undiagnosed diabetics. By managing their nutrition and wellness, we can definitely mitigate or eliminate future health care claims.

And this year, the agency just added another risk management service by adding 20 employees in the occupational health nursing field to their team. “We just completed an equity partnership with an occupational health nursing company,” Bill says. “It’s a locally based nursing firm that will provide health risk assessments, wellness development and occupational health services for our clients. Less than 1% of health care spending is spent on prevention and that just doesn’t make sense. We believe we can significantly drive down costs in workers comp and group health by focusing on wellness. We just recently provided the assessment to one of our health care clients and found 16 undiagnosed diabetics. By managing their nutrition and wellness, we can definitely mitigate or eliminate future health care claims.

“The majority of risk isn’t insurable, but it is preventable,” Bill continues. “We decided that if we truly wanted to help our clients manage all their risks, we needed to provide much more than insurance. We’ve invested well over $2 million a year in salaries in those resource areas, but it’s working. Last year, we added $3.5 million in new earned revenue and are continuing to ramp up.”

Not surprisingly, this approach has led in some cases to alternative risk programs for clients. “We formed Captive Design, LLC, and launched a group captive in the Caymans for 23 Minnesota agricultural coopera-tives,” Bill says. “The captive has about $6 million in premium. We anticipate that there may be a need for other formations, which is why we formed the design company. We expect each one to be unique. We’ve also guided some of our middle market clients into the Assurex captives. (RJF is an Assurex Global Partner.) We recently put one of our manufacturing clients into the heterogeneous group captive. It took about three years to get them ready. When we took over the account three years ago, the company had a high debit mod and a loss ratio that ran in the 70% to 80% range. We brought them down to a credit mod and their loss ratio fell to below 10%.”

The agency focuses strictly on commercial lines and employee benefits and has specific target markets where “they know we are the best.” These include medical technology, construction, hospitality, manufacturing, nonprofit, and large retail, as well as national programs for a variety of risks, including several franchise operations and condo/town home associations. “Seventy-two percent of our new business comes from one of these areas,” Bill notes. “Our people have developed expertise in these disciplines and know the business and risk management needs for clients and prospects in these areas.”Above, one of RJF’s six Continuous Rapid Improvement Sales Process (CRISP) teams. At left, Risk Consultant Laura Moore (in red) and Producer Tim Bildsoe discuss a medical device manufacturer’s new facility with the client’s risk manager.

|

|

|---|---|

|

Above, one of RJF’s six Continuous Rapid Improvement Sales Process (CRISP) teams. At left, Risk Consultant Laura Moore (in red) and Producer Tim Bildsoe discuss a medical device manufacturer’s new facility with the client’s risk manager. |

A passionate approach

“We go into each client’s business with a passion. We know we can help solve their risk management needs but we still like to check out our results,” Bill points out. “We survey all our clients at the six-month mark. The first question we ask is, ‘Does RJF do what is expected?’”

The answer to that question is invariably “yes.” In fact, the latest survey found that 97% of clients say that “RJF people do what they promise when they promise it.” Only 1% of clients disagreed with that statement, while the balance was uncertain. Reaching that level of customer satisfaction did not come without some surprises and a change in procedure that served to make it clear to clients what they were receiving.

Bill explains: “We were meeting with the chief financial officer of a publicly traded company client. This was a client with which we had almost daily interaction. We were on the phone with one department or another helping them with safety, loss control, benefits, human resources, claims, or other matters. Unfortunately, that information hadn’t reached the CFO. Luckily, we had a very good relation with the CFO and he was only half kidding when he asked us, ‘What have you done for us lately?’ We had plenty of answers. However, we also recognized that we needed to improve our communications with clients. We instituted a formal stewardship program for larger clients under which we delineate exactly what the client can expect from us. It fit very well with one of my core philosophies: ‘Being proactive creates opportunity. Being reactive creates stress.’”

The program involves a calendar year plan that responds to each client’s desires. “We ask them what they want and develop the plan from there,” Bill says. “We try to be as closely planned as possible, including quarterly objectives for client service. This not only reassures the client, but also lets the service team know exactly what they have to do to live up to our promise.”

Bill adds that Assurex Global Partners and Assurex President Jim Hackbarth have been “enormously helpful. They were open to help us through some critical changes and shared information on compensation, trade downs (producers target clients with revenue in excess of $7,500), organizational structure and other matters that we faced. Most of the members are more mature than we are—by that, I mean the age of the agencies, not the people—and they were able to help us through some of the growing pains that they’d already experienced.”

|

|---|

| RJF’s Community Association Insurance Services (CAIS) team stands outside one of the condo complexes for which they have put together a risk management program. |

The Key Client program

The level of risk management service provided to customers does depend on the size of the account. Key Clients (those providing over $20,000 in revenue) have some risk management services included. Other customers can purchase services on a fee basis. The Key Clients represent 200 customers who provide 50% of the agency’s revenue.

The Key Client program provides a three-tiered approach that starts with assessment planning under which the agency and client determine and choose the level of service that is appropriate and that will help lower the cost of risk. The assessment includes an analysis of exposures by RJF and completion of a needs analysis for the client.

The second phase is determination of the service plan. RJF provides an annual commitment plan, which includes a summary of services and a timeline for execution of each requested service.

The third phase is the monitoring of performance and results. The summary of services provided is given to the client prior to renewal, but can be viewed at any time during the year. It includes completion dates for each service, as well as the names of individuals responsible for each action.

A learning organization

|

|---|

| Commercial Lines Manager Wendy Schmid, CISR, CIC, (seated left) appears with Jill Lowder and the Commercial Lines Service Team leaders. |

RJF is committed to growing from within. “We’re a learning organization where each employee is encouraged to pursue educational opportunities,” Bill says. In fact, each person is required to complete 40 hours per year of learning development. “We have numerous discussions with employees explaining that their success is a two-way street with both the employee and the agency benefiting. We have career mapping and gear each employee’s learning development along the path that he or she wishes to pursue.

“It’s imperative that we educate and develop leadership qualities in our employees,” Bill continues. “There will not be enough human capital available in this business unless we create it ourselves. I don’t want to look outside for people when I have the talent right in front of me.”

This approach has paid off many times. A former account executive is now the vice president of operations for the agency. A former receptionist is a million-dollar producer. “We always take the internal opportunity when available.”

And the learning is not just about insurance. “We’re constantly looking for ways to improve, and learning about new concepts and technology along the way.” Bill says. “We’re extremely high tech. We were paperless before it became a buzz word and have always tried to stay on the cutting edge. We are building a CRM system and a marketing-driven sales process that includes targeted communications to clients and prospects. In addition, we also educate ourselves about our markets by focusing on attending all of our target areas’ industry conferences.”

Quality people having fun

“In the final analysis,” Bill concludes, “it really comes down to the people. Egos cannot dominate our culture. We bring a team of as many as eight people to a prospect to discuss our approach. We have such a dynamic group of people committed to a common cause. They’re what makes this work. I can’t take credit for any of this. There’s a lot of humility and a lot of fun that has resulted in our shared success.

“My job is to help keep this a place where every person feels empowered and respected. They understand that they can try new things and make mistakes. Mistakes happen. That’s how you learn. You just have to admit them and establish guidelines so they will not recur.

“We use several consultants to work with our people throughout the year on leadership development and other areas of career development. I tell our people that I want them to enjoy being at work and if they aren’t fulfilled, then we’ve mutually failed. This is everything you would wish for your children—to wake up and go to work to share success with your best friends. That’s the way I feel every day and I hope everyone here feels the same way. This feeling is invaluable to building a culture focused on helping our clients achieve their business objectives and our employees achieve their career goals.”

|

|---|

| Some of the agency stockholders assemble in the reception area. On the table are the Twin Cities Business Journal awards that the agency has received in recognition of its being one of the “50 fastest growing private companies in Minnesota.” The agency has been recognized six times in the past seven years. |

Rough Notes is pleased to recognize RJF as our Marketing Agency of the Month for its unique approach to value-added services and its emphasis on creating an atmosphere of fun for its employees. *