Building Equity Value

Don't sell yourself short

Bottom-line earnings determine your agency’s value, not top-line revenue

By Patrick T. Linnert & Daniel E. Skowronski

In the 1970s, independent agencies became fixed on the 1.5X revenue multiple as the standard calculation of value. The 1.5X revenue multiple is actually the expression of an earnings-based calculation. |

Most independent agency owners believe they have a pretty good idea as to the value of their firm. Principals will often cite 1.5X to 2.0X revenue, with some suggesting even higher multiples. When discussions turn to the agency’s method of calculating value, however, it becomes evident that many owners are uncertain as to how value is really determined.

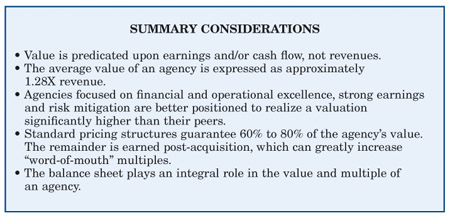

Of agencies that have sold externally for the highest price relative to revenues, virtually none of the owners focused on revenue multiples. All were well aware of their earnings and cash flow and its impact on value. These high-performing agencies understood 1.5X revenue to be a thing of the past and drove the total purchase consideration of their agency well beyond yesterday’s norm. This serves to confirm an opinion shared within our firm since its inception: The only agencies that sell for 1.5X are the ones that are worth less than that. The unenlightened buyer dwells upon the top line. The enlightened seller is driven by the bottom line.

The more you as an agency owner know about internal agency valuations and the merger and acquisition environment that drives sales price, the better positioned you will be in managing the value and sustainability of your agency.

The 1.5X revenue myth explained

|

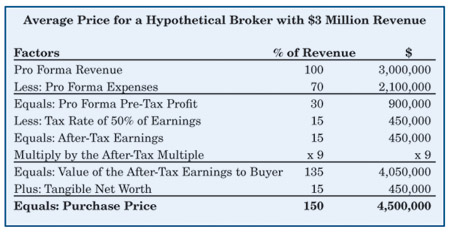

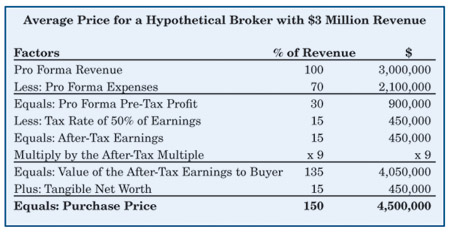

In the 1970s, independent agencies became fixed on the 1.5X revenue multiple as the standard calculation of value. The 1.5X revenue multiple is actually the expression of an earnings-based calculation. During that time, value in the public sector was pure earnings. Then, as today, when a stock is quoted in the market, there is no mention of tangible net worth (TNW) in the earnings multiple—everyone presumes it is already reflected in the earnings multiple being quoted. In the 1970s, the public insurance brokers were trading at roughly 10X after-tax earnings. However, included in this multiple was the inherent value of the balance sheet. The public brokers maintained average tangible net worth equal to about 15% of revenues. Thus, the true earnings multiple, excluding the balance sheet, was closer to 9.0X after-tax earnings. Based on these internal numbers, the public brokers preferred acquisition structure that looked something like the following:

This structure illustrates that if an agency could return 15% on an after-tax basis, was deemed average from a risk factor perspective (impacting the after-tax multiple), and maintained 15% of revenues as tangible net worth, then the agency was probably worth somewhere around 1.5X revenue. While this concept was sound, tax rates, average multiples and average agency earnings have all changed over time. The actual method of arriving at value was lost, but the 1.5X revenue multiple was ingrained in the minds of insurance agencies.

The point is this: While fair market value may be expressed as a multiple of revenue, it is calculated based on a multiple of earnings plus or minus the value of the balance sheet. It also should be noted that revenue multiples fail to take tangible net worth into account. Buyers will pay dollar for dollar for the balance sheet in a stock transaction; so tangible net worth should play an important role in the purchase price and is an important reason why not to use the revenue multiple method to calculate overall total value. The model shown in the chart above uses an after-tax earnings approach for valuation, an approach that can be applied to any size agency. Discounted cash flow and EBITDA (Earnings Before Interest Taxes Depreciation and Amortization) models can be used as well.

Fair market value vs. sales price

According to the IRS, fair market value is defined as the following:

“The price at which property would change hands between a willing buyer and a willing seller when the former is not under any compulsion to buy and the latter is not under any compulsion to sell, both parties having reasonable knowledge of relevant facts.” (Revenue Ruling 59-60: 1959-1, Cumulative Bulletin 237)

Many individuals will suggest that the value of an entity is whatever someone is willing to pay for it, which leads us to the difference between value and consideration. Value is what your agency would command in the general marketplace according to the definition above. This is how appraisers treat the valuation process. Consideration, however, is what you would receive in an actual sale, which can be influenced by compulsion (a buyer’s need to acquire earnings, an owner’s need to sell, etc.) or the structure of the transaction (guaranteed vs. earn-out).

Agency owners often rely on the sales consideration of other agencies in the marketplace to estimate the value of their own operation. This “me-too” scenario has permeated the industry and continues to inhibit the proper financial management of many independent agencies. Too many times, agency owners prepare to perpetuate the agency (whether internally or externally) and focus solely on the top line. Owners who have historically focused on maximizing earnings and mitigating the risk factors associated with the organization can indeed command and realize higher consideration than many of their peers when selling. Other owners, however, who focused primarily on maintaining revenue without regard to earnings and risk mitigation, will most likely realize less than their peers.

Here are three reasons not to correspond the value of your agency to the total consideration received by others in the marketplace:

Reason 1. Not all agencies are comparable. Each agency maintains unique characteristics relative to location, financial performance, accounts, producers, productivity, etc. A multitude of “hard facts” and intangible factors determines the proper comparables and, subse-quently, the specific value of an agency.

Reason 2. Average agency sales consideration may be higher than average fair market values. Hundreds of small agencies are purchased by local insurance agencies every year. Such activity drives industry consolidation. The total consideration for such acquisitions often exceeds the average fair market value of the operation depending upon the ability to roll it into an existing location, synergistic opportunities and earn-out structures of the specific buyer.

|

Financial institutions and public insurance brokers will at times pay premiums for strategic or financial reasons including the attainment of growth objectives, the penetration of a geographic location, diversification into alternative lines of business, or strategic cross-selling initiatives to name a few.

Also note that standard deal structures typically provide 60% to 80% of the purchase price as guaranteed consideration. The remainder has to be “earned” over a given period of time, subject to certain performance criteria. This earn-out, when combined with incentives, can increase the overall multiple of the transaction. Agencies that have positioned themselves for continued growth once a transaction is consummated are well positioned for maximizing such earn-out consideration.

Reason 3. Buyer competition. Competition for the highest quality agencies has caused a short-term spike in pricing for targeted acquisitions. In reviewing the types of agencies banks and brokers have acquired, both the quantitative and qualitative characteristics of the target are usually the best in a specific region. Therefore, multiple buyers are competing for a limited supply of quality sellers. This competition, however, has not caused a spike in the pricing for all agencies. Remember, banks and public brokers ultimately have to answer to their stockholders and as a general rule will not engage in acquisition activity that is dilutive to their earnings.

Risk factors

Agency owners often cite loyal employees, loyal customers, and top-notch service as reasons the agency warrants a higher-than-average multiple. The harsh reality is that these are reasons why the agency is still in business, not reasons why it is worth more than the average. Whether it be for a fair market value determination or a specific buyer’s analysis, every agency must be thoroughly analyzed to flush out the inherent strengths and weaknesses. It is the culmination of these factors that allows an appraiser or buyer to determine the overall risk in an operation, which will impact their choice of an appropriate multiple to apply to earnings.

Some of the factors that are considered in the valuation process and buyer pricing formula when analyzing a particular agency’s risk include: ages of key employees, dependency on large accounts, professionalism, pro forma assumption, quality of insurance carriers, non-compete/non-solicitation agreements, perpetuation preparedness, historical underwriting profitability, agency culture, location, diversified book of business, employee quality/productivity, historical growth rate, employee morale, sales orientation, technology proficiency, historical profitability, quality of facilities, sales management, dominance in the marketplace, receivables management, cash/asset management, reputation, and size.

Most sophisticated buyers will base any pricing models first and foremost upon an internal valuation model. Only then will they consider pricing alternatives/premiums based upon the financial or strategic nature of the acquisition.

Industry averages

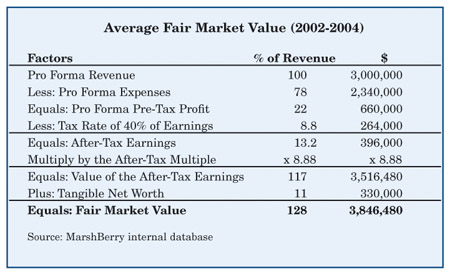

The current fair market value statistics of independent agencies indicate that the average fair market value for agencies is less than 1.5X revenues, primarily because average after-tax earnings fall below 15% of revenues and average tangible net worth is around 11% of revenue. The table below details the average fair market valuation statistics from more than 150 agencies across the country during the years 2002-2004. For illustrative purposes, we have included the actual dollar figures for a hypothetical agency with $3 million in revenue.

The illustration above shows that today’s average agency is valued at 1.17X revenue (or 8.88X after-tax earnings) plus tangible net worth. We should also point out that these statistics conform to the definition of fair market value discussed earlier and are more appropriate for internal sales. Due to the reasons outlined previously, many agencies, but not all, can indeed sell for prices higher than the average value shown. With a more consistent focus on earnings, however, agency owners across the board will be better positioned to maximize the value of their agency and position themselves for the future.

Conclusion

|

Whether your exit strategy is executed through internal perpetuation or an external sale, why settle for industry averages? A management strategy of financial and operational excellence, risk mitigation and proper balance sheet reinvestment can easily increase your returns beyond the norm. By understanding the components of value as well as the current M&A environment, your agency is armed with significant information. The next step is to determine how you will position your agency to realize the fruits of your labor.

This article is the first in a series dedicated to helping independent agencies understand and enhance the value of their operation through sound organizational practices and performance. We hope you find these articles insightful and beneficial in driving the value and performance of your agency. *

The authors

Patrick T. Linnert is vice president of Corporate Development at Marsh, Berry & Company, Inc., where he focuses on strategic, business development and consulting initiatives. Daniel E. Skowronski is a vice president at MarshBerry whose work involves agency valuations, acquisitions and mergers, compensation consulting and ownership perpetuation.