—Eric Gewirtzman

President

SeaPass Solutions, Inc.

Technology

Making real-time connections

SeaPass Solutions lets carriers and agencies use existing technology to exchange info

By Nancy Doucette

|

“To benefit from the SeaPass solution, the only technology requirements for the agency are an agency management system and an Internet connection. As for carriers, the solution is platform independent.”

—Eric Gewirtzman |

In the movie, “The Wizard of Oz,” Dorothy’s dog, Toto, discovered what was going on behind the curtain in the Emerald City, which brought into use the phrase: “Pay no attention to that man behind the curtain.” For many agents, that’s their reaction to real-time technology. It doesn’t matter how it works, as long as it works. They reason that agents don’t need to pay attention to “that man behind the curtain”—in other words, the software that enables agencies to communicate electronically with carriers.

Or do they?

They do if they’re frustrated by having to re-key information into carrier Web sites in order to rate a homeowners, personal lines auto, BOP, or workers comp policy. The frustration is actually recognition of the time and money that are lost due to repetitive entry of information that already exists in the agency management system database, not to mention the errors that unfortunately result, and the time it takes to correct them.

Also important to consider are the technology challenges facing carriers. They’ve invested in the creation and development of Web sites to provide agents with a tremendous amount of information. Their legacy systems are still the workhorses they’ve always been, so there’s no urgency to replace them. Still, the carriers ought to meet the technology needs of their diverse agent population.

Carriers that respond to their agents’ needs will certainly be rewarded by their agencies. Growing numbers are choosing carriers based on how easy it is to do business with them electronically. In fact, technology was the top consideration for 27% of agencies when they were asked why they preferred one carrier over another in a recent survey conducted by Celent, a research and consulting firm focused on the application of information technology in the global financial services industry.

|

| “The SeaPass Gateway isn’t a rater. It’s a mediator between the carrier system and the agency system. The quote I receive is a bindable, issuable quote because it comes out of the carrier system.”

—Donna Monks |

Donna Monks, senior account manager for DiMatteo Insurance Service Center, based in Shelton, Connecticut, says technology is always a topic of discussion when carrier representatives visit the agency. She believes that carriers want to provide good technology solutions to their agents and says that carriers deserve credit for developing their information-rich Web sites.

Monks says one of the recent “positives” is The Hartford ExpressWaySM. ExpressWay enables Hartford agencies that have either an Applied Systems or AMS agency management system to get accurate, real-time personal auto and homeowners quotes. Additionally, ExpressWay provides policy issuance capabilities. “When I rate a policy through ExpressWay and then request that it be issued,” says Monks, “the policy comes in exactly as I rated it. I can work with confidence.” Her ability to rate with confidence is rooted in the fact that, unlike some carrier proprietary solutions, ExpressWay directly transfers customer data from the management system to The Hartford. There’s no re-keying of data. What’s more, there’s no need for a separate log-on ID or password, and training is virtually unnecessary.

Monks explains that The Hartford orders MVR and CLUE reports once it receives the agency’s request to issue. Should anything appear in those reports that would cause the rate to change, she says, ExpressWay alerts her immediately, which is preferable to finding out about the difference after requesting the reports herself and then having to re-rate the policy. ExpressWay streamlines this workflow for the agency by eliminating the need for the agent to rate, then request MVR or CLUE reports, and then re-rate should new information necessitate.

The man behind the curtain

The Hartford worked with SeaPass Solutions, based in New York City, to develop ExpressWay’s straight-through processing capabilities, but the SeaPass name is transparent to users of ExpressWay. Monks learned about SeaPass’s involvement when The Hartford representative asked the agency to pilot Expressway. “Using the SeaPass solution to bridge from our management system to The Hartford Web site makes so much sense,” she says. “We’re able to access it without another step and another workflow. It’s a win for The Hartford and the agency.”

Similarly, the SeaPass name doesn’t appear on the solution that Selective Insurance Group offers its agents who use AMS’s AfW or Sagitta agency management systems. In late January 2005, Selective announced its implementation of the SeaPass Gateway™ technology for its businessowners package and workers compensation lines of business. As with The Hartford solution, Selective’s integration pulls client information from the agency’s database. That data is then run through Selective’s business rules to capture information that is needed to prepare a quote, but that wasn’t included in the agency data. All that information is then sent to Selective’s commercial lines system which then produces the quote.

According to Eric Gewirtzman, co-founder and president of SeaPass, “Most users aren’t aware they’re using SeaPass Gateway technology.” That’s because the SeaPass marketing strategy is for carriers to take the Gateway technology, brand it with the company logo and colors, and offer it to agents. Both The Hartford and Selective used their agent publications to inform their agents of the part SeaPass played in their respective real-time capabilities but beyond that, SeaPass is invisible.

Gewirtzman notes that there’s much that makes SeaPass’s solution unique, but the fact that it doesn’t require any changes to existing systems at the agency or carrier speeds implementation. The only technology requirements for the agency are an agency management system and an Internet connection, he says. As for carriers, even if the carrier doesn’t have a Web site, SeaPass can connect directly to the carrier’s legacy backend. “The solution is platform independent, and supports different mainframe, legacy, UNIX, Windows, and Web-based systems,” he explains. “It also supports all available insurance data formats such as ACORD XML and ACORD AL3.”

|

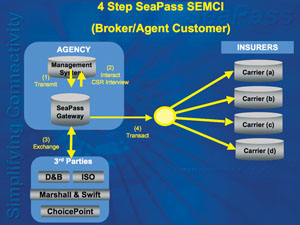

Gateway’s four-step process SeaPass Solutions President Eric Gewirtzman explains that the Gateway leverages existing agency and carrier systems to provide error-free data exchange and interaction between the systems using the following four-step approach: Step 1: Transmit Step 2: Interact Step 3: Exchange Step 4: Transact |

The SeaPass Gateway uses a four-step process (see sidebar on page 100) to enable agency and carrier systems to “talk” to each other. An important part of that interaction is the carrier’s analysis of incoming data. The Gateway makes it possible for carriers to electronically decide if an incoming quote request fits its underwriting guidelines and, if so, to address any missing or incorrect information. “Carriers are being bombarded with requests for middle market quotes,” Gewirtzman points out. “Carriers want their underwriters to spend their time in ways that best serve the agencies that represent them. SeaPass can help with that.”

When agencies need to move an account from one carrier to another, the former carrier’s coverages, limits or deductibles may not be acceptable to other carriers. Gewirtzman explains that with SeaPass’s data analysis capability, these considerations can be handled simply via the agency management system.

Monks describes one of her recent experiences where she was preparing to move a personal auto policy to a different carrier. “I started this activity in TAM—our Applied Systems agency management system. I clicked the export button which transmitted the data to the SeaPass Gateway installed at the carrier. The Gateway received the data and did a gap analysis on it. I was then informed what additional information was needed. Working in a real-time environment enables me to ask our customer for additional information while the customer is in our office or on the phone. A couple of seconds after I added the information, I received a quote. The Gateway isn’t a rater. It’s a mediator between the carrier system and the agency system. The quote I receive is a bindable, issuable quote because it comes out of the carrier system.”

While many agencies already have some real-time connectivity capabilities provided by their management system, Gewirtzman observes that those solutions address only part of the connectivity issues that agents face, albeit an important part. “Other real-time solutions are great for billing or claim inquiries,” he says. “But these aren’t complex transactions such as quotes, new business submissions, endorsement processing, or book of business transfers. SeaPass can help agencies and carriers handle all these types of transactions.”

He emphasizes, though, that SeaPass does not compete with the agency management system vendors. “SeaPass is not an agency management system,” he stresses. “We improve the connectivity capabilities that they provide their users, rather than compete. It doesn’t matter what technology the agency uses either. SeaPass is ambivalent. The agency can have a client-server solution, a Web-based system, or a hosted solution. And at the carrier, SeaPass is ambivalent there as well. Whatever they have, the Gateway can interface with it.”

Gewirtzman explains that when SeaPass sets up Gateway for a carrier, they “train” the Gateway for the lines of business for which the carrier wants to provide quotes, issue policies, or handle endorsements. He notes that some workers comp carriers choose to provide real-time quotes to agents but will not provide real-time issue capabilities, preferring instead to refer those requests to underwriters for handling. Nonetheless, no re-keying is needed.

Another benefit of working from the management system is that transactions generate activities that can be tracked. Gewirtzman explains, “If the customer asks: ‘Did you shop for me?’ the agency has a record of all the interviews with the various carriers. This will be increasingly helpful in the Spitzer environment.”

SEMCI grail

|

“The SeaPass solution takes the data from a variety of carriers and displays it to us in our agency management system. We don’t need to worry about where to find a particular piece of information on a particular carrier’s site.” —Tim Casey |

At Commerce Insurance Services (CIS), the insurance side of Commerce Bank, based in Cherry Hill, New Jersey, the industry’s long sought after goal of single entry, multi-company interface has been attained. Tim Casey, chief information officer for CIS, explains that the agency self-hosts the SeaPass Gateway and is currently able to rate BOP, commercial auto, and workers comp with three carriers—two national carriers and one regional carrier.

Casey says that the CIS users need to be familiar with only the AMS Sagitta system that the agency has. CIS has had SeaPass onsite for four years. “Part of what we continue to like about the SeaPass solution is that it takes all the data from a variety of carriers and displays it to us in a single view. Our people don’t need to worry about where they need to find a particular piece of information on a particular carrier’s site,” he explains.

In the case of small business, Casey says the agency needs to gather the specific details of the risk from the client and enter those details into the SeaPass Gateway. The Gateway is smart enough to know what other carrier-specific questions may be necessary. It also knows what risk appetite that carrier has—whether the nature of the risk, or the location, or the SIC code is within the underwriting parameters of certain carriers. Once the business is bound with a specific carrier, the data can be transferred into Sagitta or received via policy download.

If the system determines that this particular risk doesn’t qualify for some reason, he explains that the system will stop asking carrier-specific questions for that particular carrier because it knows already that that carrier has no appetite for that particular type of risk. For the remaining carriers, it then presents the carrier-specific questions on a dynamic basis.

Back to Toto

Thanks to Toto’s inquisitive nature, Dorothy and her companions uncovered some important lessons en route and once they arrived in Oz. Agents who are inquisitive about connectivity solutions such as SeaPass Gateway may find that they can share some important lessons with their carriers about how SeaPass Solutions enables agents to interact with carriers in a way that’s efficient for both parties. *

For more information:

SeaPass Solutions, Inc.

Web site: www.seapass.com