|

HOW ARE WE DOING? Active Retention survey helps Barney & Barney “listen” to customers By Elisabeth Boone, CPCU

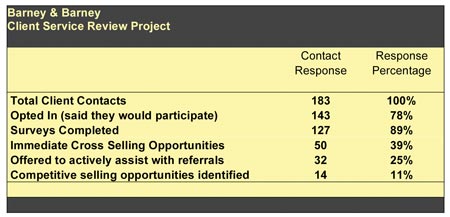

It’s almost a cliché for an insurance brokerage to say that its top priority is providing excellent customer service. At Barney & Barney, San Diego’s largest privately held insurance brokerage, founded in 1909, however, far more than lip service is paid to serving customers well. In fact, the tagline on the firm’s Web site is: “We Listen. To Insure Your Success™.” As one of the country’s top 40 privately held brokerages, Barney & Barney serves an impressive list of clients and has long-standing relationships with such groups as the San Diego County Bar Association, the San Diego Medical Society, the San Diego Employers Association, the California Hotel & Lodging Association, and the New Car Dealers Association of San Diego. An Assurex Global partner, Barney & Barney offers commercial property and casualty insurance, employee benefits, workers compensation claims advocacy and consulting, personal asset protection, and individual benefits. The firm’s Risk & Loss Advisers division provides consultative services to help businesses reduce and manage losses. Clearly, Barney & Barney stakes its reputation on its commitment to meeting and exceeding its clients’ expectations. Just as clearly, the firm needs to keep its finger firmly on the pulse of client attitudes and expectations. Recognizing that measuring customer satisfaction is a science as well as an art, Barney & Barney turned to Active Retention of Concord, Massachusetts, which created the Client Service Review™ to help agencies and other business entities obtain actionable feedback about service-related issues and other concerns. Before teaming up with Active Retention, what methods was Barney & Barney using to gauge—and improve—client satisfaction? “Each of our 19 owners is actively engaged in day-to-day management of client accounts,” says Kathy Ybarrondo, a 28-year veteran of the firm who is managing director of the employee benefits department. “We instituted a program under which the owners are responsible for managing the relationships with the clients on whose accounts they work. They initiate quarterly contact to ensure that each individual client’s needs are met.” This program is used for both commercial lines and employee benefits clients. “The program has been extremely effective, and our clients appreciate the attention they receive from our owners,” Ybarrondo observes. “Our retention has been excellent.” A new partnership With strong, successful programs in place to manage its client relationships, Barney & Barney clearly wasn’t struggling with serious problems in service or retention. There’s always room for improvement, however, so when Active Retention contacted the firm early last year, the principals were sufficiently intrigued by the Client Service Review concept that they wanted to explore it further. “One of the things I love about Barney & Barney,” Ybarrondo says, “is that even when we’re doing really well, we continually look for ways to improve.” Active Retention had done some work for one of Barney & Barney’s Assurex Global partners. “We’re very collaborative with our Assurex partners, so we agreed to have Active Retention visit us,” Ybarrondo explains. “Frankly, we weren’t sure we were ready to go ahead with the survey at that time, but when we found out what it could do and considered the cost, we decided it would be a worthwhile investment in securing our client base.” Barney & Barney, she adds, hadn’t conducted a client survey in some time, and as a result the firm was interested in trying the Active Retention system. Active Retention’s Web-based Client Service Review is designed to elicit candid client feedback. The company guarantees a minimum client response rate of 50% and immediately actionable survey results. Unlike some other customer satisfaction surveys, the Client Service Review uncovers concerns on a client-by-client basis rather than combining all responses to produce a single report that summarizes general trends. The Client Survey Review system is based on a predictive psychographic questionnaire that seeks to identify hidden cross-selling and referral opportunities as well as potential retention challenges. Results are analyzed to pinpoint five follow-up focus areas per client, which Active Retention calls Essential Service Factors™: service, referral, cross-selling, quality/satisfaction, and communication. For every 300 clients who participate in a survey, Active Retention promises these measurable results: six new A clients (referral); 20 current clients ready to buy more (cross-selling); six clients at the exit door saved (retention); and a minimum 300% first-year return on investment for the entire project (profit). Clients are invited to participate in the survey process in two steps. First, the client is asked to take 12 to 15 minutes to complete the questionnaire either online or on paper. Within 24 hours of survey completion, Active Retention delivers results and suggested follow-up actions to the firm via e-mail. The client then is asked to talk by phone or meet in person with his or her primary contact at the firm. This allows the contact person to discuss retention-related concerns with the client and/or to explore cross-selling and referral opportunities identified in the survey responses.  New business “gold mine” “When we made the decision to go ahead with the survey, we focused on those clients who generated a higher level of revenue,” Ybarrondo says. “We thought we had a pretty good handle on how these clients perceived us, but we wanted to make sure we weren’t so busy telling our clients how great they are that we weren’t listening to what they really want. To us, getting candid feedback from our most important clients is invaluable.” Barney & Barney and Active Retention launched the survey in November 2004 and wrapped up the project early this year. Before clients were contacted, Ybarrondo and her colleagues weren’t optimistic that the survey would generate meaningful feedback. “When we saw how long the survey was, we doubted that anyone would take the time to complete it,” she says. “We were also pretty skeptical about the guarantee of at least a 50% response rate.” To Ybarrondo’s surprise, over 78% of the clients who were contacted chose to participate. (See the graphic on page 43.) Of those, 89% completed and submitted the survey. Almost 40% of the clients who responded identified specific products they were interested in discussing within 30 days, and 25% of respondents offered to actively assist Barney & Barney with referrals within 30 days. The survey also identified 14 clients who were purchasing insurance products from competitors and were dissatisfied with those services, creating a selling opportunity for Barney & Barney. Because Barney & Barney had been planning to survey clients about technology issues, Active Retention allowed the firm to tweak the survey to include questions on that topic. “We received great feedback on that,” Ybarrondo says. “We also got great feedback on the performance of our account teams, and on how clients felt about carriers, pricing, claims handling, and so on. The best thing,” she continues, “is that clients ranked what was the most important thing to them, and in the same space they told us how we performed in that area. When I look at surveys, I always go to the section that says, ‘This is what’s important to us, and this is how you’re doing on it,’” Ybarrondo says.

Hidden issues In looking at the survey results, Ybarrondo says, “More times than not, our reaction was, ‘Great, we’re all on the same page.’ We generally tend to believe we’re doing a good job because our retention is so high, but there are always some issues smoldering under the surface, and a survey like this brings them to our attention.” A key benefit of asking clients to respond to the survey in writing, Ybarrondo notes, is that comments are likely to be more frank than they might be in a face-to-face encounter. “Sometimes people don’t say things to your face that they will say in writing or in a voice mail that they leave at eight o’clock at night,” she comments. Only 3% of the clients who responded needed immediate service attention, but one of these clients was flagged red, as imminently ready to leave. “One of our major clients was identified as ready to leave now,” Ybarrondo says. “When I saw that, I picked up the phone and called the client, and no doubt about it, she was ready to leave. She was planning to go to one of our biggest competitors in town. I begged for a meeting, and when I met with her, she told me all the aspects of service she was unhappy with. I asked for another meeting to bring out a new service team. Even though she was ready to kick us out the door, the client agreed to let us work on the account for the next 12 months,” Ybarrondo says. “A couple of months ago, I happened to sit next to her at a breakfast, and she was raving about our service team and saying, ‘I never want to leave Barney & Barney; I love them.’ She was one of our top clients, and saving that account was worth the entire price of our investment.” In this situation, Active Retention’s quick turnaround of survey responses saved the day. ActiveLink™ software was installed on Barney & Barney’s computer system, and within 24 hours of each client survey being completed, results were on Ybarrondo’s desktop with follow-up action steps identified. “In each case, we knew exactly who was responding and what that client’s concerns were,” she says. What’s more, she adds, “The clients knew that we were going to see their responses and that we would use the information in handling their accounts.” Active Retention’s Alan Blume makes an important point: “Price is not the main reason clients leave a firm. Your client service managers may have told you the reason is price; however, we have found that price is just an easy excuse for departing clients to use. In our confidential interviews, we’ve found numerous misunderstandings about everything under the sun—misunderstandings that had clients leaving when the situation could easily have been rectified.” What’s next? Having conducted the Client Service Review among its top clients, Barney & Barney next plans to survey additional clients. “Surveying our clients this way is something we want to continue, because relationships change,” Ybarrondo says. “We bring in new clients; the makeup of our teams changes; or there’s a change at the top management level. These new personalities can definitely affect client relationships, and we need ongoing feedback from them so we can continue to deliver the highest level of service.” * For more information: |

||||

|