A MEXICAN AGENCY’S

INTERNATIONAL REACH

Staying close to customers when

your market is worldwide

By Thomas A. McCoy

|

“I operate under contract in Mexico as an extended arm of the in-house German brokers, sharing commissions with them.”

—Erich Vogt

“If they call my direct office line and I am not there, the call is forwarded to one of two cell phones, depending on whether I am in Europe or the U.S.”

—Peter Weber |

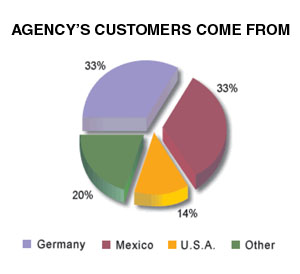

For many U.S. agents and brokers, the international insurance market is a new frontier—full of opportunities, largely unexplored. For Erich Vogt, the international market is something else. He heads Proteccion Dinamica (www.protecciondinamica.com), a Mexico City-based insurance brokerage firm with 55 employees that derives approximately two-thirds of its business from outside Mexico. He has been writing international insurance business for 50 years.

Proteccion Dinamica’s business plan requires its producers to do lots of travel, both to client companies and to partner brokers in other countries. “If you are not present, you are forgotten,” says Vogt.

Vogt was educated as a CPA and entered his family’s insurance agency in 1955, to help out his mother, who had inherited the agency from her brother. At that time the agency had only one other employee. Business consisted of “a small insurance portfolio,” Erich recalls. “I was paid 20 pesos a week.”

For a while after joining the agency, he maintained his CPA practice. “I did both auditing and insurance work for about 15 clients.” With other customers, too, the accounting background helped “because I could talk with finance directors or CFOs about fiscal situations,” Vogt says. He closed his CPA practice in 1967.

While the agency was getting started, Vogt turned to family members for help. His father, who had owned a jewelry store for 39 years, joined the agency in 1959, as did Erich’s wife, Guadalupe. “We concentrated on providing personal service and wrote business of people from both my generation and my father’s generation.”

In fact, it was family ties which first helped Vogt enter the international insurance market. “My ancestors were from Germany,” he explains. “They first came to Mexico in 1824. The German community in Mexico has always been a close-knit group, especially after World War II. When I was growing up in Mexico I went to a ‘German school’ (a 110-year-old school for children whose families had come from Germany).”

From an early age Vogt spoke German, Spanish and English. He continues to maintain contact with family members living in Germany and visits the offices of his agency’s customers in Germany at least twice a year. “In Germany we deal with ‘in-house brokers,’” he explains—individuals operating as a separate entity within an insured business. “The in-house brokers earn commissions from insurance companies, which are then consolidated on the financial statement of the insured business. I operate under contract in Mexico as an extended arm of the in-house German brokers, sharing commissions with them.”

Closer to home, Proteccion Dinamica shares commissions with U.S. brokers who need to handle the Mexican exposures of U.S. firms they insure. This includes insuring goods or raw materials that are shipped to Mexico to be processed at that country’s lower wage scales and returned to the United States—either as finished goods or partly finished goods.

The insuring of goods manufactured for export from Mexico is known as “in bond” business, or “maquiladoras,” Vogt says. He cites the auto industry as an example—auto manufacturers and related supplier companies. “The car companies from the U.S., Germany and Japan—GM, Ford, Daimler-Chrysler, Nissan and Volkswagen—all have operations here. The Chrysler PT Cruiser, the new Volkswagen Beetle and the Dodge Ram are all produced entirely in Mexico.”

Peter Weber joined Proteccion Dinamica six years ago to manage the agency’s International Department. Like Vogt, he is fluent in English, Spanish and German. His parents emigrated from Germany to South America in 1960, when his father was working for Daimler-Benz. The family eventually settled in Mexico.

Weber points to the relative imbalance between Mexico’s economy and the economies of the United States and Germany, and explains how that works both for and against Mexican brokers. “There is so much more business in the U.S. that the brokers there can concentrate on taking care of their local accounts,” he says. “What they need from Mexico is a partner broker to handle their clients’ foreign expansion. So we have been getting a lot of business from abroad—taking advantage of the maquiladoras.”

However, developing international business from Mexican-owned businesses is much more difficult. “There are few large Mexican companies with operations abroad—probably no more than 10 or 15,” Weber says. “Too many Mexican brokers are chasing those same businesses, and most of that business is controlled by personal relationships.”

Aside from visiting their clients in other countries, Vogt, Weber and two other producers at Proteccion Dinamica have international travel commitments to attend meetings of international broker organizations they belong to outside of Mexico. From these organizations come contacts resulting in commission sharing arrangements with brokers all over the world.

These organizations include the Worldwide Broker Network conference (see article on page 88) which had meetings last year in Barcelona, Spain, and in Oaxaca, Mexico; Globex, which met in New Orleans last October; Trust Risk Control, which met in Lago di Como, Italy last September; the World Federation of Insurance Intermediaries; the Washington, D.C.-based Council of Insurance Agents & Brokers, which meets every October in White Sulphur Springs, West Virginia; and two other groups of brokers whose business is derived from Latin America and Germany.

Proteccion Dinamica’s producers also travel extensively within Mexico—a country of 758,450 square miles, larger than Alaska and Texas, the two largest U.S. states, combined. “People in this country expect to see us in person,” Vogt says, “and we have clients throughout Mexico. We drive to visit them if we can get there and return by the next day, or we fly.”

The agency’s 750 commercial accounts include manufacturing and service businesses, financial institutions, construction and technology-related firms, and public entities. Its personal lines business consists of about 3,200 clients.

The personal lines business has been growing, but its potential is limited, Weber explains, because the majority of the Mexican public does not perceive the need for coverage. “In this country we have about 17 million cars driven in the streets daily on a nationwide basis, and only about 35% of them are insured.” Some coverage is required for financed vehicles, he says, but “what we mostly insure under auto insurance is not liability, but theft.”

In 1989 Mexico passed a law requiring that all insurance brokerage firms be established as corporations. Prior to that time, the owners of a brokerage firm could operate, and be taxed, as individuals. “To get the right to be a corporation, we had to show that we were providing ‘full service,’” Erich explains. “The government inspects our documents relating to the services we provide, including premium collection and claims.”

Proteccion Dinamica became the 10th brokerage firm in all of Mexico to be issued a corporation license.

The agency is proud of its retention record—half of its clients have been with the agency for at least 30 years. The other 50% have been acquired in the last 10 years. “Our customers know they can reach us 24 hours a day, 7 days a week even if we are traveling abroad,” says Weber. “If they call my direct office line and I am not there, the call is forwarded to one of two cell phones, depending on whether I am in Europe or the U.S. We also have a staff that will return messages from clients promptly. Even if they don’t have an immediate answer, they let clients know that they are working on the question, and will get them the needed information as soon as possible.”

During the 50 years that Proteccion Dinamica has gradually turned itself outward from Mexico so that its foreign business predominates, foreign-owned insurance companies have moved aggressively into the Mexican market. “When I started in the business, there were about 60 insurance companies,” Vogt recalls. “The government would allow only Mexican-owned companies to do business here. Today there are only four Mexican-owned insurance companies still in existence.”

Banks also have begun to play a major role in the delivery of insurance in Mexico, he points out—again, many of them foreign-owned. “For many years, there was the bank, the insurance company and the bond company—all separate companies. Today many banks in Mexico own and operate insurance companies.”

It is not hard to find forecasts of greater opportunities lying ahead in the international insurance market. But listening to Erich Vogt describe his journey into this market reminds us that no matter where one’s customers are located, it is dedication to customers’ needs—wherever they are located—hard work and a spirit of entrepreneurship that ultimately determine success.

Today, and 50 years ago, Vogt’s approach is the same: “We concentrate on providing good service to our customers.” *