IDM advancements

IDM advancements Making the case for IDM

Integrating WC, LTD, STD makes more than alphabet soup

By Michael J. Moody, MBA, ARM

Corporate America is continuing to struggle to gain control of its employee benefit programs. Retirement plan assumptions have been impacted by low interest rates and poor investment returns, and health care plans have been buffeted by double-digit inflation in the health care sector, despite a low inflation rate for the rest of the economy. As a result, employers of all sizes have been experimenting with cost control strategies for their employee benefit programs.

For most companies, employee health insurance is the largest part of the employee benefit package. However, most experts agree that if true costs savings are to be realized, the focus needs to be on all the programs. Employee benefit programs must be viewed from a more holistic perspective, with workers comp being included.

Many of these experts gathered in Orlando, Florida, last November to exchange views at the 2nd Annual Joint Forum on Health, Productivity & Absence Management. The Forum, titled “Maximizing Human Capital in a Changing Economy,” was presented jointly by the National Business Group on Health and the Integrated Benefits Institute (IBI). The primary goal of the Forum was to focus on improving the understanding of how engaged and healthy workers can help achieve business goals, while ensuring high employee satisfaction and making U.S. businesses more competitive in the global economy.

IDM advancements

IDM advancements

Over the past few years, some forward-looking employers have begun to integrate portions of their employee benefit plans in an attempt to better control costs. A common configuration of this integrated approach would include the integration of the claims adjudication features of short-term disability and long-term disability as well as workers compensation. Recently, however, some firms have taken the next step in the integrated disability management (IDM) strategy by including the employee health coverage in their integration efforts. The results of this effort have been encouraging.

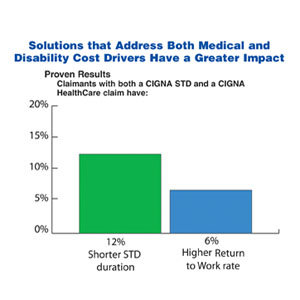

One example of the potential available from this movement was illustrated by a study of 60,000 claims by CIGNA. The primary purpose of the CIGNA study was to better understand the relationship between disability and medical outcomes, and determine if coordinated processes help reduce the length of disability and improve return-to-work results. Additionally, the study tried to identify other measures that might prevent illness and injury, and reduce time lost from work. In that regard, one of the primary findings from the study was that both the duration of a disability and the return-to-work rates improved for companies that coordinated disability and health coverage through the same provider. In fact, disability durations were reduced by 12%, while the return-to-work rates were 6% higher for employers that had a single provider for health and disability and coordinated case management. For an employer with just 3,000 employees, this single-point-of-contact approach can result in between $100,000 and $168,000 in direct disability savings annually and up to $500,000 in indirect savings annually.

Another significant finding confirmed a long-standing belief that chronic health issues represented a significant savings potential. The CIGNA study found that 26% of medical episodes that lead to a disability stemmed from chronic health problems such as heart disease, diabetes, or low back pain. Further, these chronic health issues accounted for 56% of short-term related medical costs. It’s clear, from reviewing the study results, that there are enormous opportunities for better control via an aggressive disease management program. The potential to better manage chronic disease is one of the most significant cost savings and health improvement options available to employers today. While the U.S. health system has been designed for acute care health situations, it’s the chronic health care problems that are the key driver in today’s health care landscape. The CIGNA study noted that in the review of their claimants, 20% of employees were responsible for 91% of the employee medical health costs. This study has shown that a broad-based, integrated disability management program that incorporates a proactive disease management element reduces medical costs, disability durations and incidents.

The missing link

The missing link

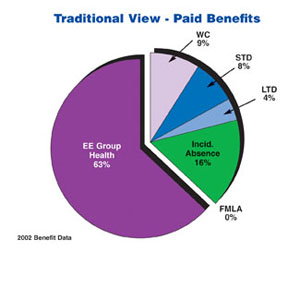

The Integrated Benefits Institute (IBI) has completed several studies that take a snapshot of employers’ current practices regarding employee benefit administration, and these were reviewed during the Forum. The most recent report contains some very interesting findings and will likely cause employers to rethink their approach to benefit cost containment. The report shows that employers are now beginning to understand the full financial impact of employee absences. In the past, employers frequently limited their benefit focus to a narrow view that included only out-of-pocket medical and wage replacement payments. The IBI report suggests that employers may be better served by considering health-related “Full-Costs” (includes direct costs of treatment and both the direct and indirect costs of disability). Their new Full-Cost Benchmarking Study indicates the importance of a complete recognition of all costs related to employee absences. The traditional view of these costs typically shows that group health costs are 63% of the total, while workers compensation is about 9% and incidental absences are 16%. But this is only part of the story.

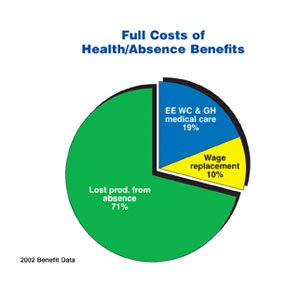

The benchmarking study shows that the full costs of absences can be many times higher than just the out-of-pocket health cost. As a result, IBI thinks it’s important to consider the productivity consequences of absences in order to properly view this important cost area. In fact, the IBI study suggests that this figure is more than four times the cost of health costs alone. When a company incorporates the productivity costs in the equation, the portion of employee benefits represented by medical payments and absence-related costs look much different. Under the full-cost approach, lost productivity represents 71% of the total, and the costs of medical care plus workers compensation account for only 19%. This approach also shows that wage replacement is about 10% of the total expenses. It’s recognition of this loss in productivity that has been the missing link in analyzing this critical cost area. Going forward, employers will need to alter their approach due to this fact.

Time to adjust your approach

Time to adjust your approach

Both of the presentations noted above provide employers with significant amounts of valuable data and benchmarking material. Armed with this new information, employers will be better able to properly portray the effects of employee absences and the related costs, as well as the overall effect on the company’s bottom line. “We are now entering a time where data are key,” notes Wendy Manners, assistant vice president of Specialty Risk Services and IBI board member. And she points out that this is because “the data will determine the solution.” Even though individual employers may not have their own data, Manners says, “Employers can move forward with solution-based data from benchmarked information.” The use of benchmarked data is a little like a “faith-based initiative,” and as Manners notes, it is similar “to hearing the music through the notes.”

While the benchmarked data may differ somewhat from their particular results, most of the risk factors will be similar. In general, Manners says, as a nation, we have an aging population that is overweight and has high blood pressure. She says that while “the standard deviation on individual benchmarked results may be broad, the risk factors are not unique.” This allows employers to “follow the lead of early adopters,” in planning their strategies to control these costs. The intensity of international competition has required employers to search for any potential productivity improvements, accord-ing to Manners. She says that “the differences between employee populations” worldwide will greatly affect our ability to successfully compete on a global stage.

Conclusion

Clearly, employers need to embrace the integrated disability management model. Additionally, they will need to fully understand the financial implications of this important area. They also need to understand the opportunities that exist for cost control and productivity improvements associated with the new, creative health and productivity initiatives now available. Those employers that grasp these important concepts and use them to gain a competitive advantage will be better positioned to face the challenges of international business. In the long run, they will have healthier, more productive employees that can help enhance the company’s bottom line. *