|

Insurance Market Update COMMERCIAL PREMIUMS CONTINUE TO SOFTEN IN FIRST QUARTER

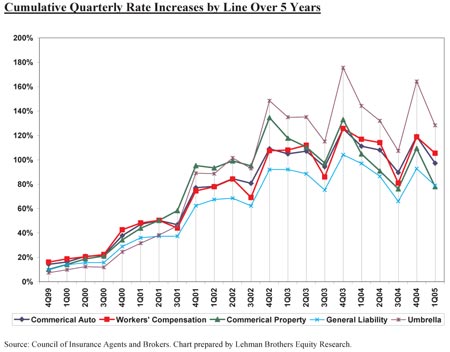

Commercial property/casualty premiums continued to soften during the first quarter of 2005, according to a survey by The Council of Insurance Agents & Brokers (CIAB). Average rates for all sizes of accounts reached their lowest levels since the commercial insurance market peaked in the fourth quarter of 2001. According to the an analysis of the survey results by Lehman Brothers Equity Research, almost 80% of large accounts saw premium reductions of more than 10% in the first quarter, resulting in an average rate reduction of 11.4% for large accounts. Small accounts saw a 6% reduction on average, and for medium accounts, the average decrease was 10.9%. The CIAB Market Index showed virtually all lines of commercial property/casualty insurance experiencing a decrease. However, segments of a few lines such as broker E&O, workers compensation, construction and medical malpractice experienced slight increases in premiums of from 1% to 10%, depending on the underlying risk. Even in those areas, however, more risks saw stable premiums or decreases. CIAB noted that, while there is still discipline in underwriting, carriers are beginning to show more flexibility in deductibles and terms and conditions as they seek new business. And a broker from the Southwest says, “Maverick carriers are driving premiums down on selected accounts, searching for market share. Here we go again.” ACE USA introduces ACE “named storm” insurance product ACE USA has introduced ACE Spectra, an admitted insurance product that provides coverage for property damage and business interruption resulting from a tropical storm or hurricane. The policy can cover losses from single or multiple hurricanes during the annual policy term. ACE Spectra insurance can be used to reduce windstorm deductibles in current property and business interruption policies while limiting the accumulation of losses from multiple storms in a season. “Following the difficult hurricane season of 2004, risk managers are increasingly concerned that large windstorm deductibles on their properties can accumulate to levels which can have severe financial consequences,” says Ed Zaccaria, president, ACE US International. “ACE Spectra provides a fixed premium alternative for customers where this is a concern.” GuideOne offers HO and auto products for churchgoers GuideOne is introducing FaithGuard™ auto and homeowners insurance, products specifically designed for people of all faiths. “The FaithGuard products provide enhanced protection for the church activities, travel and lifestyles of religious individuals, at no extra cost,” says Jim Wallace, GuideOne president and CEO. “These products also offer special discounts for church clergy, nondrinkers and nonsmokers.” FaithGuard auto insurance special features: If the insured is involved in an auto accident while driving directly to or from a church service, the deductible is waived. Church tithing or donations are covered if the insured suffers a loss of income from a disability caused by an accident in an insured auto. Medical limits are doubled if the insured is involved in an accident while volunteering to drive for a church-sponsored activity. Existing auto loan payments are paid if the insured suffers a loss of income from a disability caused by an accident in an insured auto while driving directly to or from a church activity. A memorial gift will be made to the insured’s church when the auto is involved in a car accident that results in the death of that person or a household family member. Pastors and nondrinkers are eligible for a premium discount. FaithGuard homeowners insurance special features: Nonsmokers are eligible for a 5% discount. The deductible is waived if there is a loss of personal property while located on church property. Church tithing or donations are paid if the insured suffers a loss of income from a disability caused by any accident at the insured’s residence. Medical limits for an injury are doubled if the policyholder hosts an activity at home on behalf of his or her church and an attendee is injured during the activity. Mortgage payments are made if the insured suffers a loss of income from a disability caused by an accident at his or her residence. Fireman’s Fund adds identity theft restoration to Prestige® Home Premier policyholders Fireman’s Fund Insurance Company will provide identity theft restoration services to policyholders who have Prestige Home Premier with Added Measure coverage. The service offers customers access to a personal counselor who can help identity theft victims with the legal and logistical burden of putting their lives back together. “Coverage for the expenses associated with identity theft has become a standard add-on to many homeowners insurance policies. But our new service addresses the real issues associated with identity theft—the hassle and headache of correcting the problems caused by fraud,” says Scott Garfield, vice president, sales and marketing of Fireman’s Personal Insurance division. “Identity theft not only is stressful for the victim, but can also prove costly and time consuming. We are happy to remove this burden from our policyholders and place it into the hands of an expert who will work as the victim’s advocate, handling every detail and addressing any reoccurring fraud issues.” Schinnerer offers management consultant E&O Victor O. Schinnerer and Company has introduced SpecialtyOne, an E&O insurance program for management consultants and staffing firms that will be written through Brit, a Lloyd’s syndicate. Target risks for the program include management consultants, marketing consultants, human resource consultants, public relations consultants and market research firms, and staffing firms such as employment agencies, temporary staffing firms and executive recruiting firms. The SpecialtyOne duty-to-defend policy also features defense coverage against allegations of criminal, dishonest, fraudulent or malicious errors and omissions and an innocent insured provision. Claims will be handled by a third-party administrator specializing in professional liability claims. SpecialtyOne is Schinnerer’s first enterprise with a Lloyd’s syndicate. Lexington property policy extends time element coverages to outsourcing facilities Lexington Insurance, an AIG company, is offering Outsourcing ProtectorSM as an endorsement to its multi-peril property policy. The endorsement extends property coverage to business interruption losses and extra expenses incurred as the result of a fire or other covered causes of loss that occur at outsourcing vendors’ facilities. In addition, when an insured has purchased terrorism and/or cyber-related coverages, the endorsement will indemnify such perils. Customers may also expand coverage to include business and personal property located at vendor locations. Gallagher forms captive practice group Arthur J. Gallagher & Co. has established Gallagher Captive Practice Group to coordinate the company’s domestic and international captive activities. Managing Director Peter Mullen, executive vice president of AJG (Bermuda), Ltd., has been charged with implementing a unified strategy for captive growth throughout Gallagher. At AJG (Bermuda), he also retains responsibilities for the day-to-day operations of both the intermediary and captive management units. The Gallagher Captive Practice Group provides captive products and services to single parent, group, and association captives, rent-a-captives, and risk retention groups in many offshore and onshore domiciles, including Bermuda, Grand Cayman, Hawaii, Vermont, and Washington, D.C. Sullivan & Strauss names AXIS to write recreational marine programs Sullivan & Strauss Agency, Inc., Lake Success, New York, announced that AXIS is now the carrier for its Ski-Safe™ and Sea-Safe™ programs for recreational marine insurance. The recreational marine insurance coverages offered through the Ski-Safe and Sea-Safe programs are underwritten on an admitted basis by AXIS Reinsurance Company, a New York-domiciled insurer licensed to transact property and casualty insurance and reinsurance throughout the United States and Puerto Rico. All of the AXIS insurance and reinsurance companies are rated “A” (Excellent) by A.M. Best and “A” (Strong) by Standard & Poor’s for claims-paying ability. Call (800) 225-6560 or e-mail info@skisafe.com for more information. St. Paul Travelers and Aon offer management liability for manufacturers St. Paul Travelers has launched a management liability insurance program for members of the National Association of Manufacturers (NAM). The program is administered exclusively by Aon Association Services, a division of Aon’s Affinity Insurance Services, Inc. The NAM-Sponsored Insurance Portfolio program provides management liability and crime coverage to manufacturers of all sizes. Exposures covered are directors and officers liability, employment practices and fiduciary liability, fidelity, and kidnap and ransom. Qualified insureds receive access to Risk Management PLUS+ OnlineSM, which helps employers manage and reduce their exposure to employment-related and/or fiduciary suits. For more information, go to www.nam-aon.com. MetLife Auto & Home offers personal package MetLife Auto & Home introduced GrandProtectSM, a package policy that provides auto, homeowners, and other coverages for individuals with complex needs. The policy has higher built-in limits for jewelry, silverware, and collectibles; worldwide liability coverage for rental cars; and identity theft coverage. For more information, go to www.metlife.com. ASPN, AmTrust offer small business comp Aon Specialty Product Network (ASPN) has formed a partnership with AmTrust Insurance Group, a privately held entity based in Cleveland, to offer independent agents and brokers a workers compensation product for their clients in the small to medium-sized markets. AMTrust focuses on high-volume, small-premium business (generating a premium between $500 and $50,000) for risks that have at least one full-time employee; fewer than 75 employees at a single location at the same time; and a loss ratio below 40% in the experience period. AmTrust can provide comp limits up to $100,000 and writes business in more than 30 states. For more information, go to www.askaspn.com/amtrust. * |

|

|