|

A better mousetrap Custom Insurance Solutions regularly adds new features to its MGA/wholesale broker-focused software By Nancy Doucette

As the hard market was swinging back to soft several years ago, Jim Mastowski, chief information officer for Jimcor Agencies, an excess and surplus lines wholesaler, based in Montvale, New Jersey, decided that with a softer market, Jimcor needed to be more proactive in its marketing and find better ways to meet customer needs. Mastowski concluded that the agency system that his firm had been using for the previous nine years could not respond to Jimcor’s needs in the softer market, so he began investigating other products. Mastowski had regularly attended the annual AAMGA Technology Conference. Over a period of years, he had gotten acquainted with most of the vendors—the products and the people behind the products—that serve the MGA market. During several of those meetings, he met with Eric Winch, founder of Custom Insurance Solutions (CIS), who developed the Agency Information Manager (AIM). Before developing AIM, Winch had been the head of IT for a Texas-based MGA. Part of his responsibilities included creating “work-arounds” for the system the firm was using, which was created primarily for retail agents, not MGAs. But at that point in time, there weren’t many software solutions available to MGAs. It was 1996 when Winch decided that he could build a better system himself. The AIM product is one of the first “from the ground, up” solutions built exclusively for the MGA/wholesale market. It’s a submission-based system, with integrated, real-time accounting, and bridges to well-recognized third-party products such as Docucorp, Rackley, ImageRight, and FinancePro. Winch still oversees the programming for the AIM product, but he has a team of programmers, trainers, and technical support people who make sure the software will continue to deliver on its promise of improved workflow and increased efficiency. CIS’s focus on the future influenced Mastowski’s selection of AIM almost as much as did the functionality of the software, he recalls. “Jimcor’s goal was to find a vendor that could handle our current software needs, but we also wanted a vendor that could respond to our future software needs as well. CIS and its people are positioned to do that,” he says. Patrick McCall, vice president of sales for CIS, notes that, like Jimcor, about 90% of the MGAs migrating to AIM are transitioning from some type of system—either a system they built themselves or one that was commercially available. He says AIM’s client/server technology, open architecture, SQL database, and management reporting capability set AIM apart from the competition. And because of Winch’s MGA background, McCall says, “AIM is logically written in terms of workflows and procedures. It mirrors the way that submissions flow into an MGA or wholesaler, and then are processed.” That’s something an MGA appreciates, Mastowski says—a product developed by someone with an insurance/MGA background; someone who understands how an MGA does business. Some highlights

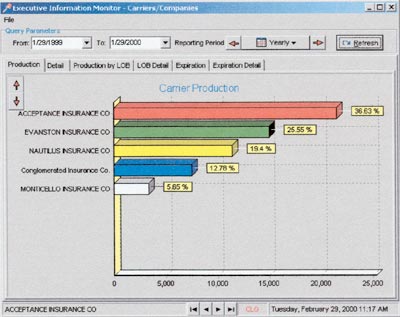

McCall says AIM’s management reporting capability helps the MGA understand where it stands with a particular company. “A lot of what MGAs need to do is report on their business: how many quote requests did they receive; how many did they quote; how many did they write? This is important information, especially when they meet with their market companies. So when they go to an AAMGA annual meeting or NAPSLO, for example, and they meet with their companies, they’ll have the specifics. Once the MGA understands why it’s not writing more business with a particular company, it can present that information to the company and perhaps changes can be made. “Additionally,” he continues, “the MGA will know what business came from which retail agents—what was good business, and what wasn’t. AIM’s reporting capability will tell the MGA that it received 20 submissions from the ABC Agency, for instance. And out of those 20, five were rejected because of claims history—there was no market for those submissions. Ten were bound, and the carrier will be listed. Five couldn’t be quoted because the application was incomplete. So AIM also helps the MGA gather important information about the retail agents it works with. “In short,” he says, “AIM allows the MGA to see statistically where it is with business being submitted, what agencies are writing the business for them, who at that retail agency is submitting the business, and more importantly, what markets are writing the business.” Mastowski says AIM’s flexibility makes his job easier. “Using Crystal ReportsTM, I am able to build some of my own reports, in addition to enhancing existing reports,” he notes. “One of the reports that I enhanced lets us evaluate the hit ratios of our agents—how many quotes are they sending us versus how many binders result. I added ‘past due, over 60 days.’ So when managers look at hit ratios, they can say: ‘Wow! Great hit ratio, but they’re slow pay.’ In the past we might have known that this agent gave us lots of business but we’d have to physically go to accounting to find out if they kept up with their bills. With AIM, we have all this information on one screen—past-due balances, recent activity, and hit ratio.”

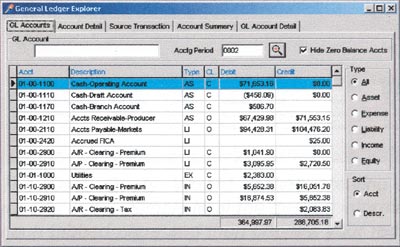

He says CIS and Jimcor did some custom report building before going live on AIM so that Jimcor could capture all the data that the London market requires. The result won Jimcor kudos from the London syndicates it deals with. “Every syndicate over there looks for something a bit different,” he explains. “We have 12 different contracts that require eight different reports. A couple of different syndicates have told me that we have the best reports coming over to them. We’re meeting all their needs and we’re making it easy for them to work with us, which is where you need to be strategically with Lloyd’s of London.” That flexibility also allows Mastowski to customize any of the quote letters, acknowledgement letters, or cancellation letters that are built into AIM. (There are some 60 documents included.) “My quote can look different from another MGA down the road using the same system,” he says. “We can customize every memo and document—every piece of paper that comes out of Jimcor. We can brand it to our company using AIM. You can’t do that with most of the agency systems in the MGA space.” Of course, not everyone in an organization needs to be able to change documents, so there is security so only designated people in the agency can make those changes. Once that document is sent via the system, it is date and time stamped, which provides additional E&O protection. McCall points out that AIM’s integrated, real-time accounting is another unique feature. That means there’s no end-of-day process, or end-of-month, or year-end, for that matter. “All data is retained on the system from the day you begin using the system,” he says. “With older systems, you have to run an update to get all the financials to hit your general ledger and accounting reports. It then clears the system of that data and it starts your new month for you. So, under that old system, if you wanted to get financial reports from six months ago, you’d have to track down the printed reports for that time frame. With AIM, you just select the dates and the system will produce the report just as it looked on that date six months ago.” In terms of being more proactive in its marketing and finding better ways to meet customer needs, Mastowski says that AIM has helped Jimcor head in the right direction to accomplish those goals. Jimcor’s Oasis is the agency’s 24/7 online system for providing quote indications for a number of product lines. Thanks to AIM’s open architecture, retail agents can complete a quote request online, and the data will upload into AIM, without anyone at Jimcor having to rekey data. “It’s that single entry goal the industry has been pursuing for such a long time,” he says. The rest of the story “Our trainers have more than just a software background; they also have insurance backgrounds,” McCall points out. “So when they go out to train on our software, they take a look at existing workflows and procedures. Utilizing their strong insurance background, they might make some suggestions of better, more efficient ways of doing things. Clients receive training and an element of consulting at the same time.” Most of the training is done on-site at the agency, with the exception of the system administration training, which deals with set-up and personalizing the system. McCall says that phase takes place at CIS headquarters in San Antonio. With this three-day training session occurring away from the agency, the distractions and interruptions of the day-to-day aren’t a consideration for the trainees. There are normally two or three agencies participating. “We’ve found that having several agencies involved provides more interaction—both during the session and afterwards,” he explains. “Having more trainees involved generates better questions. One agency may ask about something that another agency may not have considered. After a trainee leaves San Antonio, he or she has several agency contacts who are going through the same process.” Agencies migrating to AIM receive a timeline that includes contact information for the key people at CIS who are involved in the process: the implementation coordinator, the underwriting and accounting trainers, conversion support, etc. It all culminates with “live week,” when the trainers again return to the agency and the agency makes the formal transition from its old system to AIM. Of course a lot has gone on between that first trip to San Antonio and live week. McCall says one of the key processes is the data conversion. “To prevent surprises on live date, we convert the data for new clients twice—some of the insured records, some of the agent records, some of the company records. We convert it about 30-45 days before the live date in a sample format so the client can see exactly what they’ll be getting when the do go live. “By doing a test run, we see the red flags early on. So when we do the real conversion, the client gets exactly what they want.” For Jimcor, the CIS approach to training and conversion made the transition to a new system much easier. “We have 160 employees located in four states using AIM,” Mastowski points out. “We brought everybody into the Montvale location for their training. We had no class larger than 16 people, so we were training for several weeks. It was all hands-on training. “Marcia Grylls, CIS director of training, has 30 years of insurance experience,” he notes. “And she’s not shy about recommending more efficient processes. We were able to improve our workflows by moving to AIM.” To guarantee that AIM continues to evolve and keeps pace with market demands, CIS relies on a product advisory committee (PAC) to provide recommendations for features and enhancements. The committee is made up of several clients on the underwriting side and several clients on the accounting side. McCall explains that these individuals volunteer to be on the committee, and that the terms are for either one or two years, so fresh ideas are always part of the discussion. The PAC meets three times a year. During each meeting, one day is dedicated to underwriting features and enhancements. PAC members meet with CIS’s lead developer to discuss their top feature/enhancement requests. McCall explains that a definite solution isn’t produced that day but the CIS developer leaves with a blueprint regarding the direction that PAC wishes to move. The same process pertains to the AIM accounting software development. “These PAC meetings become the basis or origin for the next build of our AIM software,” McCall says. “One of the reasons our software is so good is because we constantly keep it moving forward. That’s a credit to our customers and to our product advisory committee.” The enhancements are automatically distributed to users. All core software updates are included in AIM’s monthly support fee. Last February, CIS became part of the Vertafore organization. “Joining the Vertafore family of comple-mentary products from AMS Services and AMS-Rackley uniquely positions us to offer the best possible solutions to the MGA and wholesale brokerage market for many years to come,” Winch says. * For more information: |

||||||

|