|

Technology "Combined" interface effort takes "Quantum" leap MGA offers real-time capabilities to agents By John Chivvis

“It is critical that the industry take agency-company interfaces to the next level—to create a win-win result for both companies and agencies.…These interfaces will position agents to deliver a meaningful independent agent brand experience that meets consumer expectations for real-time response and 24/7 service. Most importantly, these innovative interfaces will free agencies from inefficient processing and servicing that currently saps critical time away from sales activity—sales activity that could be generating substantial growth for independent agency companies.” —Agents Council for Technology Talk about prophetic. Talk about hitting the nail on the head. Talk about the Combined Group. The Carrollton, Texas-based MGA and its IT subsidiary, Quantum Integrated Systems, are following ACT’s call and are providing a way for agents needing access to commercial insurance products to “win-win” through its QuoteExpress platform. “QuoteExpress has become an important resource for the small insurance agency,” says David Taylor, executive vice president and chief technology officer for Quantum. “Many small agencies aren’t able to meet the annual premium requirements for many carriers and therefore can’t get access to those markets. As the Combined Group we do have that access, so we are able to allow smaller agencies access to those markets and carriers.” Access to better markets and the ability to compete makes QuoteExpress an inviting means of doing business. “This is a much easier way for agents to do business,” says Stacy Shuman, commercial lines manager for Complete Insurance Services based in Cameron, Missouri, who’s been using the system for over a year. “With insurance companies, you have one that wants an ACORD form, one that wants their own form, and one that wants it done online,” says Shuman. “What makes QuoteExpress nice is that I can easily get to well-recognized companies and use them without having a direct contract.”

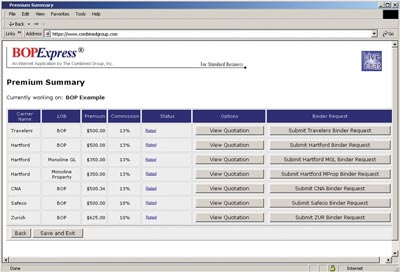

According to Michael Hardin, executive vice president of marketing for the Combined Group, carriers also “love” the system. “They love it when both systems are talking, because there is no ‘rogue underwriting’ going on,” he says. “The carrier’s own systems are actually being used within the QuoteExpress system, so we have carriers telling us, ‘We want to get on your system because you actually use our own system.’” While having someone or a system facilitating access to markets is good, the idea of working in real-time is of utmost importance to today’s agents. “We live in a ‘now’ society,” says Shuman. “Customers want a commercial quote over the phone, the same way they get personal quotes, and we have to be able to give it to them.” To be able to be “real-time” means developing a system that is as dynamic and variable as each individual. “Our QuoteExpress platform has more than 3,000 questions, so in order to have a true, dynamic question set, we had to make each one its own object in the coding,” says Taylor. This way, each object can be assigned attributes and used only when certain conditions set forth by the data being entered are met. Plus, “if we have five carriers and each one changes its rules or requirements every six months, we’re able to make the changes on the fly.” Edmund Dabrowski, chief underwriting officer for the Combined Group, says that there are more than 10,000 classifications coded into the system. “With this system of questions as objects, we are able to consolidate all of the questions that carriers ask into a single and consistent question set, so questions have to be asked only once,” he says. “It’s the function of need-to-know data versus nice-to-know data.” On the agent side, dynamic question sets and comprehensive coding mean better service for end customers. “You don’t know how often I hear, ‘I’ve called two or three other places and no one has called me back,’” says Shuman. “With QuoteExpress I can get three different quotes back almost immediately—from entering data in only once.” A different breed Not all aggregators and e-aggrega-tors are created equal, say Taylor and Hardin. “Some aggregators provide different twists on the process. Some don’t offer instant quoting; some do but it involves a number of extra steps,” says Taylor. “Some don’t offer access to nonstandard markets as they may be an aggregator for only standard markets.” “We’re different from other aggregators. We don’t have exclusive rights to renewals,” adds Hardin. “We feel that it’s the agent’s book of business, their work, so they should be able to keep it.” “For many e-aggregators, they don’t have the dynamic questioning,” Taylor continues. “They’ll either give you all of the questions or no specific questions or somewhere in between. As for us, we ask you for only what’s required for the quote.” Says Hardin, “Some systems are just elaborate forms that e-mail a submission. Behind the scenes it’s all manual so that turnaround time can be 24 to 48 hours. With ours, you fill it in and in as little as 25 seconds, you have a quote. Plus, since we don’t charge a subscription fee like other e-aggregators, agents aren’t out anything to use our system.” Dabrowski, Hardin, and Taylor each see how inefficient processing insurance information can be and see that QuoteExpress helps reinforce the ACT call for technologies that let agents get back to generating growth. “Agents can’t afford to touch the data more than once, especially on some of these small risks,” says Dabrowski. Hardin concurs. “It’s just too expensive to do this manually. You literally have small agencies scrambling to survive and make some money, and you have big agencies handling these risks because their clients make them dabble in it.” “As a smaller agency, we don’t have much support staff, and our time is very important,” explains Shuman. “We don’t have support staff to file or mail letters, so by the time you fill out ACORD forms, enter data for three quotes on one account, and fax cover pages, you’ve spent five to six hours—it really isn’t worth the time.” The idea of the importance of time—whether real-time or saving time—is not lost on the Combined Group. It’s even incorporated into the workflow of QuoteExpress—what Dabrowski calls “failing fast.” As the questioning process progresses, the system disqualifies markets based on the answers provided. “If there’s not a market, we’re going to say right there, ‘We don’t have a market’ and not waste five to fifteen minutes of extra time,” says Dabrowski. Besides the dynamic questioning, QuoteExpress also offers automatic completion of ACORD forms based on the quote and generation into PDFs. Applied Systems users will find the ability to prefill forms by clicking their Transformation Station icon an added time saver. And, there’s even a “Live Chat” feature which, depending on where in the process an agent is, they can talk to their specific Combined Group CSR with concerns or questions. Then and now This is a long way from QuoteEx-press’s beginnings in 1996—when it realized only a fraction of its capabilities as a multiple-carrier comparative workers comp rating diskette. Diskette problems, bugs, and confusion concerning the various versions available led Taylor and the developers at Quantum to wonder how the Internet could be used for distribution. They built and deployed an Internet-based version called CompExpress™ in 2000 where agents could request to bind a risk with the click of a button. With the success they enjoyed, the Combined Group began investing in other products for other markets where the CompExpress framework fit and saw it grow into the QuoteExpress platform. “For small and small/mid market it was a great fit,” says Taylor, “especially for risks where there were not a lot of complicated underwriting risk requirements.” And now in 2006, QuoteExpress is available in 31 states with online quoting available for a wide variety of insurance products. Echoing the mandates set forth by the ACT, the Combined Group is expanding its services that will aid agents. In one such initiative, Quantum is helping to bring automation to a number of regional carriers and their systems that will interact with QuoteExpress. Quantum is even licensing its technology to other e-aggregators. The near future for the Combined Group also will bring new features and new functionality to QuoteExpress. Dabrowski says that the ability to prequalify larger risks is on the way. Hardin says that based on agent feedback on the system, changes are being made to streamline the experience and make it easier to get to information. It’s this vision that makes it possible for agents like Shuman to succeed. “Without technology like QuoteExpress, we could not be competitive,” she says. “But, you also have to be open to new ways of doing things in order to take advantage of new technologies.” Whether it’s agents like Shuman, calls to action from the industry or simple business fundamentals, the Combined Group is continuing to strive to develop “innovative interfaces” that will “free agencies” to find growth and success. “The idea of being a platform organization comes from our seeing a need in smaller agencies that deserve a shot at the larger markets,” says Taylor. “We have the technology and the relationships with the carriers to do it.” * For more information: |

|||

|