|

|

|

|

Target Markets Program Administrators Association Carriers Premium potential a key factor Market penetration opportunities drive program development—umbrella and EPLI are two examples One of the key factors in determining whether a market is ripe for a program approach is whether there is sufficient premium and whether that premium is available to a competitive program. Certainly, one indicator that a program could succeed is the existence of a large pool of uninsureds or underinsureds. Such is the case with both the commercial umbrella market and the EPLI market. According to data compiled by MarketStance, Middletown, Connecticut, less than half of these markets have been penetrated. In both instances, it is small and mid-sized businesses that do not have these important coverages. Certainly, these market segments also have budget constraints, but an effective marketing campaign pointing out the need for these coverages in our increasingly litigious society would seem to be something that would bear fruit. We read almost daily of suits alleging improper treatment of employees, ranging from harassment, gender discrimination, racial discrimination, wrongful termination and so on. We also don’t need to look far to find cases where jury awards or settlements have surpassed the million-dollar mark by a wide margin. It is clear that small and mid-sized businesses cannot afford such a hit and yet many are playing Russian roulette by failing to procure coverages that are relatively economical, especially when one considers the potential losses. Attorney fees alone can cause serious problems for a small or mid-sized company. More than one company has gone under while paying for a successful defense of a lawsuit. Talk about a Pyrrhic victory.

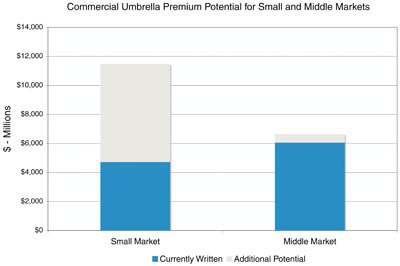

Premiums written in the commercial umbrella market totaled $17.6 billion in 2004, but there was an additional $7.3 billion in premium that hadn’t been written, nearly all of it in the small and middle market. Umbrella premiums written at $4.7 billion in the small commercial market represented only 41% of the market potential of $11.5 billion. There was an additional $600 million in premium available from middle market accounts that had insufficient or no coverage.

There was a similar picture in the EPLI marketplace, where written premiums totaled $3.2 billion, but an additional $3.3 billion remained unwritten. Again, almost all of that potential was in the small and mid-sized market. EPLI premiums written for small commercial accounts totaled only $177 million, with $2.21 billion in premium left on the table. The middle market had $983 million in premiums written, but an additional $1.13 billion in premium potential existed. * |

|

|||||||||||

| ||||||||||||