|

|

|

|

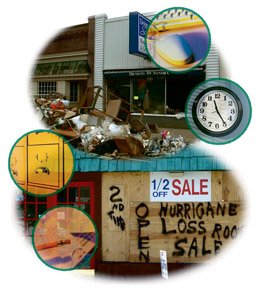

Helping clients stay open for business Disaster planning tool guides agents and insureds in preparing for the worst By Dave Willis “Acommunity cannot survive a disaster unless its small businesses survive.” That’s how Harvey Ryland, former FEMA deputy director and current Institute for Business & Home Safety (IBHS) president and CEO, opened a session at his organization’s annual conference in Orlando in November, 2006. Despite recent attention, disasters don’t always carry names. They can be as simple as a computer crash or power outage or as severe as a hazardous spill. They can occur regionally or nationwide. That’s part of the message IBHS, a charitable nonprofit working to make disaster safety a public value, is trying to get out. In carrying out its charge, IBHS has brought to market a detailed disaster planning tool—actually, two tools. Helping businesses plan According to Diana McClure, vice president and director of business protection, IBHS recently launched two versions of its new Open for BusinessSM disaster planning resource. Open for Business—available as an interactive online tool or as a stand-alone booklet—can help businesses reduce the likelihood of loss and recover more quickly if disaster hits. McClure says business owners are busy enough just managing their operations. “Many smaller businesses aren’t prepared to handle disaster-related risks on their own,” she says. Plus, she notes, they don’t have deep pockets to pay a consultant to generate a from-scratch business continuity and property protection plan. The tool helps users focus on issues related to people, physical resources and business operations. By using the tool—online or paper—owners or managers can identify which hazardous events could affect them, how to reduce exposures, and ways to prepare so they can resume essential business operations more quickly. The static, online PDF version is available for general use. IBHS members and associate members can co-brand it for distribution to employees, agents, clients and other stakeholders. Participating IBHS members can co-brand and offer the interactive tool, according to McClure. Tools gain traction Open for Business has been well received in the business community. The Las Vegas Chamber of Commerce used the guide as part of a drive to prepare businesses for a potential pandemic outbreak of avian flu, which could lead to high absenteeism, supply shortages and possible disruptions to infrastructure and communication systems. The Tulsa (Oklahoma) Metro Chamber used Open for Business as the centerpiece of a seminar on disaster preparedness and business continuity planning. The Western Association of Chamber Executives printed and distributed a copy to all of its members. And the Association of Contingency Planners, a national organization with some 40 chapters, uses Open for Business to help educate and encourage small to mid-sized businesses to develop comprehensive property protection and business continuity plans. Their goal: to help entire communities become more educated about disaster preparedness. Insurance carriers have run with the program, too. OneBeacon, for instance, did a promotional mailing to nearly 20,000 small commercial policyholders, announcing the availability and benefits of Open for Business. Delaware-based Wilmington Insurance Company, a small regional commercial P-C insurer, partnered with a coastal business organization, the state insurance department and emergency preparedness officials to host a one-day Open for Business session that drew hundreds of attendees. So far, some two dozen IBHS insurance company members are offering the interactive version to employees, agents and policyholders. Liberty Mutual’s independent agency companies are among these. Agencies add value Tammy Pillsbury, account executive in the Rochester, New York, branch office of Marshall & Sterling Insurance Agency, was quick to sign on when Peerless, a Liberty Mutual Agency Markets company, launched its interactive version. “We were very enthusiastic when we learned about it,” she recalls. “Our agency has been working to implement value-added services. We have a proprietary risk management system we offer our clients, and the tool Peerless brought to the table works very nicely with that.” According to Pillsbury, the tool has heightened client awareness of the physical perils and risk management tools they need to consider. “It defines the relevant exposures and shows how to manage them by either avoiding or minimizing the risks,” she explains. After completing a basic general assessment, users embark on a more focused examination of perils specific to their businesses and locales. One challenge for firms in Pillsbury’s region is the effect of freezing weather. So Open for Business automatically, based on ZIP code, presents her policy holders specific questions—then recommendations—about losses that result from freezing temperatures. What’s more, it offers an inter-active checklist, with instructions. For freeze exposures, it recommends use of moisture barriers, placement of insulation and effective piping protection. As businesses implement the recommendations, they’re checked off and removed from the to-do list. “It’s quite detailed,” Pillsbury says. But detailed doesn’t mean difficult, something she explains as part of her sales pitch. “You can recommend it to the owner of a small or medium-sized business who might not be particularly computer literate,” she says. “It’s very easy to use. Plus, it doesn’t have to be done in a day. You can leave it for a while, then pick up right where you left off.” Dual-purpose tool That’s exactly what Marshall & Sterling is doing as it implements Open for Business within the agency. Various departments are brought into the process, which Pillsbury spearheads. For instance, she notes, when a vendor list is being created, the accounting staff is called on. When employee information is being gathered for a post-event call list, the office manager steps in. Pillsbury says the timing for Open for Business is just right. “Peerless has introduced this at a really opportune time,” she says. “I think we’re seeing a more sophisticated client these days. They’re more aware of issues such as global warming, terrorism and, of course, natural disasters. And they’re more aware of physical losses that might result from them.” Couple this heightened awareness with the ease of using the Web site, and you have a ready-made problem and easy solution converging. “It’s not such an ordeal as it might have been ten or even five years ago, when you’d have a big manual and lots of photocopying, and the expense that went with it,” Pillsbury says. McClure points to the importance of agencies using the tool for their own operations. “It really makes sense for them to have their own business continuity plan, so they can be up and running immediately after an event,” she says. “The agents need to be meeting the needs of the policyholders. They’re one of the first people businesses call after the catastrophe. In order for businesses to get moving on their recovery and filing their insurance claim, their agencies need to be available.” * The author For more information: |

|

|||||||||||||||||||||||||

|

||||||||||||||||||||||||||