Technology

An online research department

Advisen provides agencies of all sizes with big broker "smarts"

By Nancy Doucette

Juan C. Borda, CIC, says the adage “Don’t reinvent the wheel” comes to mind when he recalls his attempt to build a database of policy information. Part of his job as director of professional liability for USG Insurance Services, Inc., a wholesaler headquartered in Tampa with 10 offices throughout the United States, is to answer questions about policies, forms, insurance regulations or laws, or to compare policies from different carriers for colleagues or retail agents who work with USG.

“My ‘manual database’ wasn’t a perfect system,” Borda says. “I had folders upon folders with information on carriers and their latest forms. I would visit carriers’ Web sites trying to keep up-to-date on the markets that our retail agents wanted to use in order to keep my database current. This manual approach was time-consuming, especially since companies would routinely change their forms. Then I met with an Advisen representative and became convinced that Advisen had a model for doing what I wanted to do, and best of all, they’d keep it updated.”

One of the hallmarks of the Advisen Web-based service is its online benchmarking, according to Jeff Cohen, sales manager for Advisen Ltd. Late in 2006, the Advisen benchmark database reached 500,000 insurance programs. The benchmarking application compares current and historical premiums as well as limits and retentions to those of similar organizations—some 75,000 commercial insurance buyers.

“A half-million programs is an impressive milestone,” says Advisen CEO Tom Ruggieri. “Since the database is being continuously updated, it is nearly a real-time view of the constantly changing commercial insurance marketplace.”

Of those 500,000 programs, Cohen says that about 40% belong to companies that have less than $50 million in revenue.

Cohen explains that Advisen receives program data directly from buyers of insurance but the vast majority of the data comes from some 30 different retail brokers, agents, and wholesalers. “They pump their whole book of business into Advisen on a quarterly basis,” he says. “We’re becoming almost like a cooperative where we pool organizations’ books of business. We have over 1,000 forms in our library. We can break every form apart according to its provisions. It’s done in Microsoft Word, so you’re not trying to manage a PDF.”

“Advisen is a vast river of information,” notes Dick Clarke, CPCU, CIC, RPLU. Clarke is a senior vice president at J. Smith Lanier & Co., headquartered near Atlanta. The agency has more than 500 employees in 18 offices in the Southeast. Clarke joined the agency in early 2003. He was the first person the organization hired as a resource person in the executive liability area. “I’ve always been a fan of providing objective information to clients and prospects,” Clarke explains. “So one of the first things I did when I joined J. Smith Lanier was to ask my boss for a subscription to Advisen.

“Whether you’re an underwriter, risk manager, agent or broker, whether you’re in underwriting or marketing, or you’re buying commercial insurance, with Advisen, you’re subscribing to an information and analytic buffet,” Cohen says. “Only one person can be logged into it at a time, but the service can be shared across an entire office location.”

Clarke says J. Smith Lanier found so much value in the Advisen service that the organization bought a second subscription. He says he and about 100 of his associates begin each day with Advisen’s “Front Page News” which summarizes the key insurance industry and financial developments that have occurred in the last 24 hours. “Our executives, producers, and account managers have access to it,” Clarke explains. “But accessing the ‘Front Page News’ doesn’t entitle everyone in our organization to use the rest of the Advisen service. To use it, you need a password and a log-in name.”

At Moreton & Company, a regional agency headquartered in Salt Lake City with locations in Scottsdale, Denver, and Boise, Ken Canada, JD, uses Advisen’s “Front Page News” to find out if any of the organizations in his specialty area is in the news. “My specialty is D&O, financial professional E&O, EPL, and K&R,” he explains. If a news item does appear, Canada then taps other Advisen databases to get more details.

He also relies on Advisen when he’s preparing to visit a client by pulling down their most recent SEC filings. Additionally, he researches prospects using Advisen to find out who the key players are. “There are lots of sites we can go to on the Internet to gather this kind of information,” Canada says. “But Advisen has done a good job of aggregating that information. So it’s one stop, rather than countless stops.”

Prior to joining Moreton, Canada had been with one of the major brokers that had built its own research database. He says he finds that Advisen does a better job on benchmarking than what the major broker had to offer. “Advisen is more user friendly,” he says. “Their technology is more up-to-date, which enables the Advisen service to provide a more granular look at the information. The more you dig, the more you use it, and the easier it becomes.”

Juan Borda concurs. “After meeting with my Advisen representative, I could see how using this product would help me put our agents on par with the Aons, Willises or Marshes of the world. With Advisen, agents can tap into lots of brain power.”

However, Borda cautions that agents can’t depend on Advisen to do the thinking for them. Advisen’s online benchmarking will compare policies, but it doesn’t analyze those policies. “You have to know what you’re looking for and provide your client with the pros and cons.”

Using the policy comparison service, he extracts specific segments of a policy to discuss with a retail agent. What he extracts is based on conversations with the agent where he learns what the client’s or the prospect’s “hot button” issues are. Suppose the client asks about automatic coverage for a new company he or she is thinking about starting. Borda says he can compare three or four policies to see if any provides such coverage. “This gets the client out of the zone of judging a policy simply on price,” he says.

Borda recalls another instance where Advisen helped an agent serve the client better. The client was a large mortgage bank. The agent had been urging the client to increase the limits on the mortgage bond but had been unsuccessful. The agent shared his frustration with Borda, who in turn checked the Advisen online benchmarking tool to see what limits other mortgage banks with a similar asset size were carrying.

When Advisen receives data, the names of the clients are removed. All that remains is what might be used for underwriting such a risk. According to the Advisen database, the client’s limits were too low—just as the agent had been saying. However, what the agent now had was objective information. It was no longer the agent’s opinion that the client had to consider. The client now had information based on a measurable sample. Ultimately, the agent was able to persuade the bank to buy the higher limits.

Dick Clarke also relies on the objective information that Advisen enables him to provide clients and prospects. “Suppose your pharmaceutical customer asks you: ‘What limits should I have for D&O liability?’ Without an objective source to support your answer, then it’s just your opinion. The client thinks: ‘Well, yeah, you’re selling insurance. Of course you want me to buy a high limit.’ But if you could show what other pharmaceutical firms are buying in terms of limits and what they’re using in terms of per-claim retention amounts, that’s great information.

“The benchmarking information is invaluable when we meet with a risk manager or CFO,” Clarke continues. “We proactively provide it. When you can objectively say to a decision maker: ‘We’ve taken the liberty of giving you this objective source of information on limits and retention,’ they invariably buy higher limits.”

He says J. Smith Lanier’s top business groups are financial institutions, technology, property ownership/management, and hospitality. “Advisen has a huge database for these niches, and it’s constantly growing.”

Clarke says that for publicly traded companies, Advisen’s Corporate Governance Quotient is outstanding. By pulling data from a variety of public databases, Advisen compiles a report on how a particular company stacks up within its peer group and compared to all public companies. He acknowledges that he could get this type of information from other sources but it’s a lot of trouble. “The Advisen report is easy to read and to the point. It will say: ‘This organization does a good job with this and this, but it doesn’t do a good job with this and this. There’s not much diversity on the board of directors. There are no outsiders on the board of directors.’

“We can approach the client and say: ‘We’ve done some research on your CGQ and we see this, this and this. These are things that underwriters are going to be looking at when they underwrite your D&O and related coverages.’ That impresses the client.”

Clarke says this process also helps when it’s time to submit the account to the carrier. “By doing this research you discover some things about your customer or prospect that helps you create a good submission,” he says.

J. Smith Lanier also uses Advisen’s prospecting tool to enhance its marketing activities, Clarke points out—sorting prospects by industry type, sales type, and geographic location. Then it slices and dices that information in a variety of ways, obtaining company names, headquarters addresses, and names of company officers.

About four times a year, Clarke says he gets a call from the Advisen rep who says he’s going to be in the Atlanta area and would like to stop by. During that visit he uses the agency’s training room, which is set up with computers that have Internet access to provide a session to get more people involved with some of the special features of Advisen.

“We put everyone on a level playing field,” Jeff Cohen says. “How each agency uses Advisen is the differentiator.” He says that some clients have told him that using the online benchmarking tool has changed the way they negotiate with their markets. They are able to see more forms than just the ones from the carriers they represent. By doing so, they may learn that there’s better language in another carrier’s form. That gives them leverage with the incumbent carrier who can no longer say: “Language like that isn’t possible,” because it is—through another carrier.

Cohen adds that Advisen’s online benchmarking gives agents the ability to go to their clients and report that they’ve negotiated well on their behalf. He recalls that one of Advisen’s agent clients had put a lot of effort into the coverage he obtained for a water utility. But when he presented it to the management at the utility, they were “underwhelmed.” The agent followed up the presentation with the Advisen benchmarking output. “The client saw that the program it was being offered was priced better than 75% of all the comparable programs in the Advisen database,” Cohen says. “Sometimes you need to force the client to acknowledge the job you’re doing on their behalf.”

Advisen takes pride in the validity of the programs in its benchmarking database, Cohen explains. “The only way an organization is going to see its program listed in the Advisen online benchmarking database is for us to have a copy of that program. We’re not interested in simply offering applications. We want to see the actual program.”

And there must be at least five programs in a particular category to generate a benchmark. Otherwise, Cohen points out, Advisen would be betraying an organization’s anonymity.

But should you get stuck trying to get benchmark information, or be uncertain about how to obtain information on a particular niche, Cohen encourages Advisen clients to pick up the phone. “We want you to call us,” he says. “Describe the situation you have. For instance, ‘I have a meeting with a prospect who’s involved in airfreight logistics. I need to become very smart about airfreight logistics. What are the industry issues? What do these organizations pay for their coverage?’ We have the answers and we can help you find them.”

Cohen concludes, “Until Advisen, only the giants of the giant had this type of data at their fingertips. Agents need to know everything about everything. Advisen provides agents one more tool to help them leverage their own knowledge of the marketplace.” *

What’s included

According to Advisen, it provides insurance professionals with “an integrated analytics and information platform” so that member firms may do research on 500,000 program transactions representing 75,000 companies, 375,000 claims, 80 industries, 1.7 million companies and organizations, and 36,000 commercial insurance professionals. According to Advisen, it provides insurance professionals with “an integrated analytics and information platform” so that member firms may do research on 500,000 program transactions representing 75,000 companies, 375,000 claims, 80 industries, 1.7 million companies and organizations, and 36,000 commercial insurance professionals.

Advisen market and business intelligence includes:

• Full financial information for all public companies globally and summary information for hundreds of thousands of private companies

• Up-to-the-minute news from thousands of newspapers and professional journals from around the world

• Case law from all U.S. federal and state courts, as well as full docket information on litigation for U.S. federal courts

• All SEC filings, and specific focus on 10Ks, 10Qs and DEF14As

• Regulatory violation data from United States and Canada, e.g., the SEC, FDA, OSHA, etc.

• Insurance market information for virtually every country in the world

• Insurance market benchmarking data on premiums, retentions, amounts of insurance and demographics

• Key insurance-related legislation and regulation

• Large loss statistics

• Direct access to hundreds of insurance-related Web sites

• Policy comparisons for major commercial insurance lines

• Proprietary Advisen analysis of important insurance industry issues

|

For more information

Advisen Ltd.

Phone: (212) 897-4800

Web site: www.advisen.com |

|

Click on image for enlargement |

|

| |

Total cost of risk benchmarking |

| |

|

| |

General liability rate per $ million for retail companies (less than $25 million in revenue). |

| |

|

| |

ADVx, Advisen’s premium index, showing domestic property macro trends. |

| |

|

| |

Umbrella limits for construction/contractors (less than $100 million in revenue). |

| |

|

| |

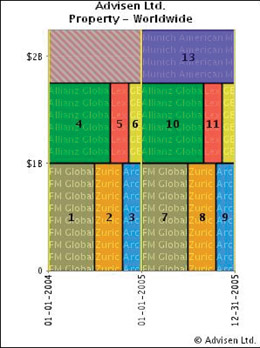

Tower chart showing two years of a property program. |

| |

|

| |

Side-by-side policy form comparison showing two environmental forms. |

|