|

|

|

|

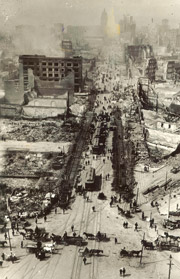

Coverage Concerns Earthquake loss An important risk management concern for commercial and personal lines By Roy C. McCormick Government aid provided primarily by the Federal Emergency Management Agency (FEMA) falls far short of providing sufficient funds for complete replacement of a dwelling totally destroyed by an earthquake. The limit on FEMA grants to a household is currently $26,660. The limit on loans is $150,000. These benefits are intended to provide immediate aid to help people get organized and locate temporary housing. Insurance is the only remedy for sound protection. Members of the insurance industry hope that last year’s 100th anniversary of the catastrophic San Francisco earthquake will spark a general awareness of the importance of earthquake insurance. Between 80% and 90% of California home owners do not have the protection. The peril is not confined to California, however. Earthquakes of a magnitude of about 5 have hit the Southeast United States. The New Madrid (Missouri) fault is considered by the U.S. Geological Survey to be a major threat for earthquake activity in the East. Such an event could affect large parts of Missouri, Illinois, Indiana, Kentucky and Tennessee. It is important to point out that homeowners policies, commercial property building and personal property coverage forms and businessowners policies basically do not provide coverage for property damage caused by earth movement, including earthquake. The exclusion for earth movement in commercial policies is similar to that in homeowners policies. Earthquake coverage usually is made available through endorsement. ISO’s Earthquake Form CP 10 40 can be used with basic, broad and special causes of loss forms applicable to commercial property. AAIS’s Endorsement ML-54 attaches to homeowners policies as an option. Where the exposure is greatest in certain areas of California, earthquake protection for high value properties would likely require the services of specialty companies and customized policies. The problem in adjustments over which coverage applies—earthquake or fire—has been minimized by the endorsement process. Determination of what part of a loss was caused by fire becomes of less concern when both perils are covered by the same insurer, in the same policy, for the same amount of insurance. Having one adjuster or claim office for a claim involving both earthquake and fire is a major factor in achieving a sound settlement relatively quickly, whether the earthquake peril is covered by endorsement or separately. The flood exclusion in basic property insurance is comparable to the earthquake exclusion in that, even though they occur only occasionally, each of the perils can cause enormous damage. Individual insurers and their agents and brokers, plus insurance industry organizations have been effective in informing insurance buyers of the flood insurance exclusion and the availability of insurance under the National Flood Insurance Program. Agents and brokers, in particular, can perform a great service by discussing with their insureds the potential for and the impact of earthquakes, as well as policy exclusions and coverage options. It is important to become familiar with the underwriting requirements of a particular insurer before discussing the inclusion of earthquake coverage by endorsement of a commercial property policy or a homeowners policy. Acquainting insureds with the earthquake exclusion creates a big plus for the counselor and enhances the image of the insurance industry in the vast areas of the country where the risk has not been a common concern. Many will not choose the additional coverage, but they will still respect the service the counselor provided. Remember, that in order to avoid future disputes, the counselor should request that the insured provide a written declination of coverage. Whether or not they accept coverage for the earthquake hazard, many homeowners insureds will be attracted by the option to schedule items or classes of valuable personal property. This option covers many perils not covered by the basic homeowners form, including earthquake. Scheduling is intended for property of high value such as jewelry, furs, cameras, musical instruments, silverware and goldware, golf equipment, fine arts, stamp collections and coin collections. Significantly, scheduling not only covers types of loss not included in basic coverage of a homeowners policy but does so for specified limits based on a current appraisal or on the item’s bill of sale. There is growing sentiment for development of a catastrophe reimbursement or backup plan by the federal government. But it is by no means certain, and would be resisted in the face of economic difficulties and the need for reduction in many government expenditures. Insurance buyers need sound coverage now. * The author |

|

|||||||||||||

| ||||||||||||||