|

Marketing Agency of the Month

Honey I shrunk the client base

Texas agency reduces number of clients, increases revenue

By Dennis H. Pillsbury

It certainly seems to be counterintuitive, but several insurance industry gurus are recommending that agencies “fire” some of their customers in order to concentrate their efforts on their “A” clients. Very rarely, however, do you find an agency that is willing to get rid of a large group of clients—and the concomitant commission income. Instead, you’ll hear about trading down business to a service center or some other accommodation that frees up producers to focus on the “A” clients, but the “B’s” and “C’s” remain firmly in place somewhere.

However, there always is an exception that proves the rule and such is the case with TCOR Insurance Management, which was formed in 2006 to take over the 210 commercial clients of Brooke Insurance Agency, Inc. The Brooke Insurance evolution began in 1972 when James Brooke bought into an existing agency in Beeville, Texas, that traced its roots back to 1898. By 1990, that agency was the dominant local agency in Bee County and its environs. James was joined at the agency by his sons, Brannon and Cory, who joined the agency in 1986 and 1992, respectively. Soon after the transition to TCOR, the personal lines accounts were put in a separate agency, Coastal Bend Insurors Group that was established for that purpose. And nearly 1,000 clients were sold off when the agency jettisoned a couple of branch offices and books of clients.

When TCOR was formed, Brannon and Cory, along with Rick Dudney and Jim Stark, bought out James Brooke. Rick had joined the agency five years earlier and Jim Stark had come on board when the Brookes and Rick formed a joint venture with Jim to open an agency in San Marcos, Texas, in order to tap into the high-growth Texas I-35 corridor. When TCOR was formed, it purchased the joint venture and Jim became a full partner in TCOR.

We talked to the four owners of TCOR about the decision to reduce the number of clients and focus all their efforts on the commercial business.

The value proposition

“We started brainstorming about expanding,” Cory, who is a risk reduction advisor with TCOR, says. “We realized that James had saturated the Beeville market and that we needed to concentrate our efforts from the San Marcos office. We quickly decided that we had to do a better job of differentiating ourselves through the services that we offered. The objective was to focus on bringing real value to those clients. Our advisors keep the number of clients they service low so that we can make this happen. Most have 30 or fewer clients.”

“This lets us get out there and work with clients,” adds Brannon, benefits advisor. “Our agency has always had a very simple philosophy of putting our clients’ interest before our own. This allows us to really enhance our ability to follow through on that philosophy.”

Jim Stark, sales manager, points out that the focus has resulted in a “very high retention rate. Our clients just don’t leave us. We write the entire account, including the benefits. Brannon leads our benefits division, which accounts for about 25% of our revenue. “In order to bring complete value to a new client, we expect to service the entire account.”

Peer-to-peer marketing

“It all starts with positioning,” adds Rick, managing partner. “We come in as a peer with the business owner by positioning ourselves as an advisor and manager of the insurance program. We don’t quote for non-clients. Once hired, we will market the insurance program if that is what our client agrees is in his best interest. In fact, we have a continuation strategy meeting where we sit down with clients and ask them what they would like to see for renewal. If they want to see their account bid out to a large number of insurance companies, we’ll do that for them. If they want to stick with the current company, we’ll negotiate the best possible value from the incumbent carrier. Whatever the client wants.” Cory posits, “We do a lot of pre-negotiation before renewal time so we know what the client expects and what we can expect from the market.”

Jim notes that the process starts “about six months before renewal. We have a thorough discussion with the client and advise them what to expect and whether it is worthwhile to market the insurance program. And that’s only one of at least five meetings a year that we have with our clients. We have a client relationship management program that places the advisors physically in front of clients at least five times a year. The clients are given an agenda before each meeting, and each meeting has a specific purpose to bring value to the client.”

Getting help from outside

These ideas did not simply spring from the head of Zeus. The owners looked to outside experts to supplement their efforts. They joined the Sitkins 100™ in 2003 and credit that move with supporting their idea to better target their markets. “Through the Sitkins 100 we have been able to exchange ideas with many innovative agencies and they have been a large part of our success,” Cory says.

“There really is no magic bullet,” Rick continues. “We’ve enjoyed good results by sticking to our service mantra and concentrating our efforts on key markets and target clients. We’ve actually doubled our books since joining Sitkins 100 and are on target to reach our goal of tripling revenue by 2010. Last year, we finished with over $3 million in revenue. We have a total of 27 employees, with 19 at TCOR, which is responsible for over $2.4 million of our revenue.”

“Another invaluable resource has been the Insurors Group, LLC,” states Rick. “Our membership in the Insurors Group, which includes eight other Texas agencies, has helped us tremendously with our carrier and broker relationships. The IG’s unified marketing initiatives such as its Partner Company and Partner Broker programs in 2003 - 2004, standards for carrier submissions, and quarterly underwriter meetings have been instrumental in our success. These initiatives have led us to consolidate our business and develop strong multi-level relationships with five to eight key carriers and three to five key brokers. The IG’s technology board and benefits board have also helped us stay ahead of our competition in many ways.”

Another important resource has been the Institute of WorkComp Advisors, according to Cory. “One of our areas of specialty is energy, and the two biggest areas of pain for employers in this industry are workers comp and benefits,” he explains. “By working with Preston Diamond and Frank Pannachio, we have been able to enhance the value that we bring to clients with our CompControl® program. This program involves managing our clients’ experience modifier and claims, and representing them at benefit review conferences; but we even go further to provide assistance and advice regarding return to work programs, human resource management, and their corporate culture.”

Rick adds: “We also offer a ContractCompliance® service where we review and manage our clients’ contracts to make certain their sub-contractors are in compliance with the insurance requirements of the contract. This is done on a fee basis and has been very successful for our clients.”

A complete service focus

“For an agency our size, it is extremely important that we manage our resources very carefully,” Cory continues. “We wanted to create a culture where everyone was involved in providing service to clients. We just recently decided that to accomplish this, we would outsource our back-office processes with ReSource Pro. Today, all our in-house staff, with the exception of the full-time IT person and the full-time accountant, is responsible for interacting with clients. That’s been very helpful at increasing production. We also have a full-time business development coordinator, a value-added services coordinator, and are in the process of hiring an in-house human resources consultant to make certain that we are always ahead of the curve in helping our clients alleviate their greatest sources of pain.”

Brannon adds, “Having all our staff committed to client interaction gives us advisors more time to get out there and meet personally with current clients, as well as work on bringing in new clients.”

“Of course, we support our staff with training and education,” Cory says. “We want this to be a career for each one of them, and we understand that means that we need to provide them with adequate training as well as supporting any continuing education they feel is necessary.”

Planning for success

“We are very deliberate about planning and communicating our plans to our staff,” states Rick. “We believe that it is crucial for everyone to understand our values, our mission, our business model, essentially everything that makes up our culture. We all need to be on the same page, striving for the same goals.”

“We also share our numbers with the staff. We have a ‘state of the agency’ meeting every six weeks where we discuss everything, including our bottom line. We want them to know how what they do affects the clients and the bottom line. We also have several other meetings, including daily huddles with support staff. Our vertical growth team meets twice a month, and our support staff holds department meetings twice a month. It’s been a real education for all of us,” Cory concludes.

“One piece of the puzzle that we feel is crucial to our continued success is our new TCOR Cohesion Program,” says Rick. “One weakness that our staff kept hounding us about was our lack of adequate training. Like many agencies, our training was basically: ‘there’s the computer, there’s the phone, take care of the client.’ Now we have a formal 9- to 12-week training program that focuses on three elements: (1) the industry, (2) our culture, and (3) department processes and customer service. No one starts the job until they have completed the training.”

Jim continues, “We have a Monday morning sales meeting where we go over the progress made in the previous week and look at what needs to be done to reach goals. We also have quarterly retreats with advisors where we look at the account acquisition pipeline, brainstorm and strategize. We also wrap up the year with an annual planning meeting. It’s been really positive.”

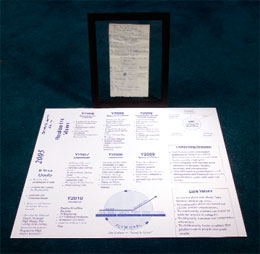

“Cory and I started the planning process to form TCOR when we were flying back from an Extreme Networking meeting in 2003,” Rick says. “We both had ideas about where we needed to go by 2010 and started jotting them down on the only piece of paper we had on the airplane—a barf bag. We still have that barf bag. It is framed and hangs in the office. When we attended another Extreme Networking meeting, TrueNorth Agency gave a presentation on planning and the need to map out the plan. That inspired us to come up with a complete seven-year map, if you will, at one of our annual off-sites that the agency has held since James Brooke started them back in the ’80s. We’ve already achieved about 90% of what we wanted to accomplish and are starting work on our next seven-year plan.”

TCOR has proven that it can achieve what it sets out to achieve. We at Rough Notes are convinced that whatever the next seven-year plan calls for will be reached and exceeded. We are pleased to recognize TCOR as this month’s Marketing Agency of the Month. * |

|

| |

|

| |

TCOR’s partners (seated from left) are: Brannon Brooke and Cory Brooke; standing from left are Rick Dudney, managing partner, and Jim Stark. |

| |

|

| |

TCOR’s advisors visit clients at least five times a year. Dan A. Hughes Company, is an oil and gas exploration services firm. |

| |

|

| |

They meet with Simpson Performance Products, a motor sports safety products company. |

| |

|

| |

Cory and Brannon Brooke stand behind their father, James Brooke, a consultant to the agency and president of the original Brooke Insurance Agency, Inc. |

| |

|

| |

| The account acquisition team includes (from left) Brian McKethan, Robert T. Doerr, Jim Stark, Valerie Powell and Lisa V. Tanksley. |

| |

|

| |

The agency’s culture stresses involvement of all employees in client service. |

| |

|

| |

Rick and Cory were traveling on a plane when they began mapping out the plans to form TCOR. They used the only paper available-an airline “barf bag,” (above), which is now framed in their office. The more polished version came later. |

|