|

Everything marine

Britt/Paulk brings new technology to the oldest type of insurance coverage

By Dennis H. Pillsbury

Although the origins of insurance are shrouded in antiquity, most historians agree that the first form of insurance was a type of marine coverage that was written for Chinese merchants in 3000 B.C.

Terms and conditions have changed quite a bit since then. For one thing, the merchant no longer has to serve as a slave to the insurer until the debt is paid off, but the concept remains largely the same: The risk of loss is passed to someone with deep pockets in exchange for a premium.

Today, Britt/Paulk Insurance Agency, Inc., an MGA based in Carrollton, Georgia, is one of the intermediaries that has taken it upon itself to put together companies that are willing to assume the risk with owners of boats, ships and yachts desiring to transfer risk of loss.

Dene Schoerner, chief operating officer of the MGA, points out that it handles all aspects of marine coverage except claims. “We had been an inland marine MGA for many years,” Dene says, “providing land coverage for mobile equipment. Because of our careful underwriting in that area, one of our carriers asked us to build and manage an ocean cargo product.

“That product has been fully launched along with AXA Corporate Solutions, a world leader in marine cargo insurance, with policies written through AXA Insurance Company of New York, an admitted U.S. carrier.”

Dene continues, “They can write any conveyance internationally as long as the insured corporation is domiciled in the United States. The policy also can be extended to cover land transit and warehousing. We handle everything except claims, which is handled by an outside claims group.”

The program is handled out of Britt/Paulk’s Atlanta office with Lisa Finch serving as chief underwriting officer; Ron Wallace as program manager; and Alicia Woodstock as senior underwriter. Ron points out, “Ocean cargo is one of the most profitable lines of business and with the expertise we already have here, we are in a great position to really impact the ocean marine cargo world.” Although Ron is a recent arrival to Britt/Paulk, he brings with him some 32 years of experience with four national carriers.

One of the most exciting innovations that Britt/Paulk has introduced is OPUS (online policy underwriting system), which now is available for ocean marine cargo. “OPUS is brand new,” Ron continues. “It is designed to help retail agents reach the small ocean cargo risk, ones with 7 to 10 shipments, with limits under $250,000 for each shipment. The agent inputs the information for that particular reporting policy and he or she will get a quote. Additionally, the policy can be issued online.

“Anything over that is individually underwritten, as are risks for cargo going to certain countries,” Ron says. “We do cover a broad range of commodities; however, certain types still need to be underwritten individually or excluded. Coverage is all-risk and includes war.”

The Marine & Yacht division, which is handled out of the Stuart, Florida, office, handles coverages for most types of watercraft and companies that work in and around water. Products available include boat dealers, cargo, commercial watercraft, high-performance watercraft, marinas, marine construction, marine tradesmen, miscellaneous vessels, pleasure craft, watercraft rental, and vessel manufacturing. Stephen York heads up the division.

“I’ve been doing marine insurance for the last 30 years,” Steve says. “Our division provides coverage for nearly every type of brown-water marine exposure. We run the gamut from police and fireboats to recreational watercraft and yachts, from boat dealers to marine contractors.

“Because our specialty is marine contractors,” Steve continues, “the coverage we offer does not have the watercraft exclusion that is included on most equipment policies. Marine contracting is a tough line of business, and we are able to offer coverage that includes equipment so that cranes and other items needed for marine contract work are covered, whether operating from land or waterborne.”

Britt/Paulk represents a number of admitted and nonadmitted companies rated A- or better for its marine and yacht coverages.

“What’s more,” Steve says, “we also can provide stat act workers comp and/or federal longshoremens coverage where needed.”

He adds, “Because we represent a number of carriers, we can put together a complete package of coverages for any type of marine risk. For example, we can provide coverage for marinas that would cover moorage, storage, repair, fueling, hauling, campgrounds, cabin rental, restaurants, pools, ship stores, workers comp or any other coverage that may be needed by the individual client.”

The agency also handles difficult yacht and assorted marine coverages for fishing guides, dinner cruises, floating restaurants, sightseeing tours, rescue boats, charity events and other difficult-to-place marine risks.

For more information:

Britt/Paulk Insurance Agency, Inc.

Web site: www.brittpaulk.com.

|

|

| |

|

| |

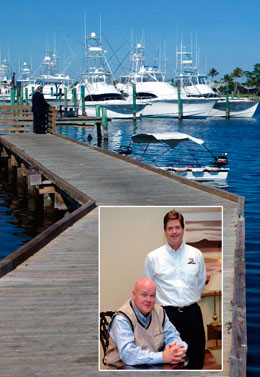

John Paulk Jr. (seated) is owner/CEO of Britt/Paulk Insurance Agency, Inc., based in Carrollton, Georgia; Dene Schoerner is Chief Operating Officer. |

| |

|

| |

Britt/Paulk's team in Stuart, Florida, is comprised of (from left): Steve York, National Marine Manager; Nancy Galiher, Technical Assistant; Phyllis Stirparo, Technical Assistant; Shari Trefil, Broker/Underwriter; and (not pictured) Jeannette Quijano, Underwriting Assistant. |

| |

|

| |

Steve York discusses opportunities with Richard Berube, President of R.J. Berube Insurance, who is one of Britt/Paulk's producers and an expert yachtsman. |

| |

|

| |

The Marine Cargo Team (from left): Alicia Woodstock, Senior Underwriter; Lisa Finch, Chief Underwriting Officer; and Ron Wallace, Marine Program Manager. |

|