|

Marketing

The four-step program

Finding and matching market opportunities with carrier appetites

By Jim Hearn

Several years ago, I sat in the regional office of a national carrier client and

listened to the problems that office had in meeting its growth goals. This

company had a home office-defined underwriting appetite and specified “in-appetite” SIC classes. As we studied the most likely causes for the region’s issues, we ranked the top 25 in-appetite SIC classes in several of the region’s states. What we discovered was that six of the top 25 classes were not even

available to write within the region. And, while other in-appetite SICs were

available, the region did not have the expertise on staff to support the

required underwriting process. Little wonder growth was proving difficult.

Whether it’s an agent/broker or a carrier, the key to success is properly matching market

opportunity to marketing appetites and underwriting criteria.

In contrast, however, the traditional approach of agents, brokers and carriers

that are focused on the small commercial to middle markets begins this way: 1)

Identify the geographic areas to be targeted; 2) Pick out some desirable

classes; 3) Select the targeted employee size; and 4) Have at it by ordering

some “leads” (which I’d argue are simply a listing of businesses and contact information rather than “targeted leads”).

Unfortunately, the traditional method is not very targeted, and not especially

effective. Happily, the more successful approach is not overly complex.

Step One: Match appetite to the actual available market opportunity.

There are two ways in which to match marketing appetite and underwriting

criteria to the general market opportunity.

Appetite orientation begins by identifying the desired marketing and underwriting attributes. Then

identify the geographic area that has the market opportunity that best supports

these goals. Not all geographic areas are created equal. Some will have a

richer, more robust selection of specific SIC or NAICS classes than will

others. It is critical to understand whether the targeted territory can support

your premium production goals, especially when you’re focused on a specific selection of industry classes. (For example, the

accompanying maps show the availability of SIC 8322, Individual and Family

Services, in San Mateo and Sunnyvale. Despite the fact that Sunnyvale is larger

than San Mateo, there are more entities in this class in the latter.)

The second method of selection uses a geographic orientation. In this method, you begin with the target territory and then work to identify

which classes and business sizes offer the best potential within that market.

Once this is established, you must then determine how well that opportunity

matches a carrier’s marketing appetite and underwriting criteria.

Too often the first step is not properly executed, whether by the carrier or by

the agent. There are vendors that can assist carriers and agencies with either

method, making step one quick and easy. This is an investment that will return

substantial benefits, because when your production efforts and resources are

aligned with the market opportunity, sales productivity improves.

It’s important to understand that market opportunity can vary within the same state

and even within the same county. A case in point: I was working with an agency

network that was having difficulty meeting its carrier production goals and

wanted to buy some leads. Rather than simply taking a list of states, classes

and business size and generating leads, we matched the opportunity available to

individual agencies with the carrier’s underwriting appetites. The resulting leads were based on both the carrier’s appetite and the specific market opportunity surrounding each agency, setting

up everyone for success.

Of note, as it was in this instance, it’s not uncommon that the mix of leads best suited to Agent A will be

substantially different from those best suited to Agent B. When the goal is to

target and submit business that is most likely to be written, shortcuts can

carry a very real opportunity cost for everyone.

Step Two: Get your production partner on board.

Carriers are always interested in improving their agents’ understanding of appetite because improving their hit ratio can lower acquisition costs and

have significant bottom-line benefits.

When agents truly understand and embrace the market opportunity within their

geographic areas, they can identify which carriers will be their best markets

and submit the business that each carrier will want to write. Imagine the

benefits.

The best course for both carriers and agencies is to develop a profile of the

optimal client and prospect. Identify the attributes of your best client or

prospect by location, industry, segment and predicted value. To do this, I

recommend approaching this task by generating two reports:

1. Profile what’s already on the books to initiate the evaluation of the “best client” profile. Interestingly, agency principals and carrier management often have a

strong command of their book in terms of composition, quality and

profitability. In many cases, however, they are surprised to see a

concentration of business they have declared “out-of-appetite,” or for which they don’t possess the experience to pursue profitably and efficiently. Carriers can take

this effort a step further to identify a best producer profile.

2. Get a report on the top 100 classes within your defined geographic area.

Frequently revealed from this type of effort is that agencies and carriers

alike will have a bias toward classes providing very poor market opportunity

while ignoring classes that represent excellent growth potential.

Market opportunity reports can be produced using a number of different criteria.

Typically, rankings are based on the number of accounts and growth rates for

the classes. Additional criteria reflecting specific marketing and underwriting

appetites can also be incorporated. With this information in hand, agents can

focus on targeting more businesses like their “best,” and invest their resources and lead-purchase funds where potential actually

exists. Just as important, the activity provides a starting point for highly

productive discussions between carrier and agency partners.

Carriers wanting to improve relations with agents would do well to make certain

that they are, in fact, communicating clearly what they want to write and what

they don’t want to write. Many a carrier will contend that its appetite and underwriting

criteria are well understood by their agent force, yet their agents will tell a

different story. Knowing and communicating what you want and don’t want is key.

Carriers may want to take the lead (no pun intended) in identifying the market

opportunity for each of their agents and then determine which classes within

that potential meet their appetite. Adding a clear outline of what is a “knock-out” from an underwriting perspective allows a carrier to provide individual

agencies with a realistic blueprint for what the carrier will write within the

agency’s territory. Doing so makes for a more constructive working relationship and

promotes efficiencies. These days, neither agents nor carriers can afford to

run things up the flagpole to see what will fly.

Step Three: Smart targeting of growing markets.

I have sat in front of both agents and carriers and had to work hard to get them

to include growth measurements as part of their market opportunity selection criteria.

Stagnant or shrinking market opportunity within targeted classes frequently

results in hard-to-close business and insureds with difficulty paying premiums.

Conversely, looking at employment growth is an effective means of identifying

true market growth and opportunity. If once you’ve identified in-appetite classes and business types, you further focus on the

subset of prospects that are growing, premium will grow—as will agency compensation.

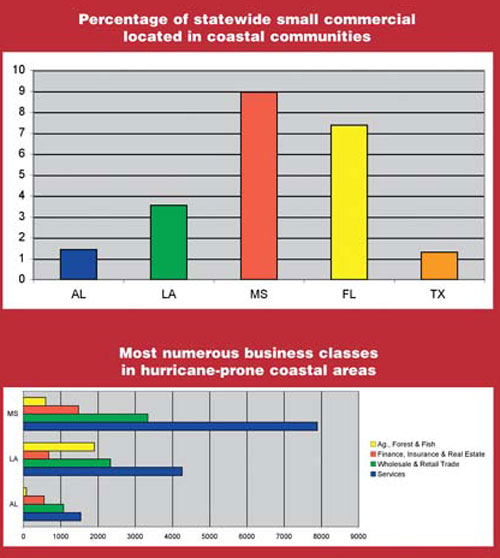

For example, I once had a carrier client that wrote in several CAT-prone coastal

states. Rather than reduce their production within those states, we helped them

identify classes that did not have property-heavy exposures and that were

growing. The carrier was then able to responsibly target a group of classes

experiencing a significant amount of growth to increase their writings in a

group of states where other insurers were cutting back. One important result

worth noting: The carrier improved its reputation with its distributors. (The

accompanying sidebar shows the analysis for coastal regions.)

Step Four: Be disciplined about planning and measurement.

What gets measured gets done, so it is critical to successful targeting

practices that you pre-define some action steps and success measures and

periodically assess if you are on track or need to make adjustments.

The key first step is to develop your market intelligence resources. Identify a

market information vendor partner and/or tap into available carrier resources.

Then integrate the information obtained from these sources with your internal

CRM systems and you’re on your way.

As you gain skill and experience in using your market intelligence assets, you’ll understand the value of adding such elements as links between prospect

databases, contact management systems and existing policyholders/clients to

eliminate duplicating efforts.

You’ll also see how you can be proactive, identifying and then developing new

products and services to meet the existing or changing needs of your target

market. For example, this may mean switching from SIC-driven targeting methods

to one based on NAICS codes, which better reflect the dominance of service

businesses in certain markets.

The first step, however, is the key. The better you understand the opportunity

in your specific market, the more effective, and successful, your production

efforts will be.

|

Coastal Opportunities

The coastal communities in the states below contain more than 170,000 businesses representing some $75 billion in sales. Clearly there are opportunities for insurance companies and agencies, particularly if they can avoid some of the serious CAT exposures that are prevalent in this area by focusing on businesses with lower than average property exposures. As the chart shows, entities providing services, which generally have less property exposure, represent the largest number in all three states most affected by Gulf Coast hurricanes. They are followed by wholesale and retail trade. Finance, insurance and real estate also are important sectors in each of these states and also represent, in most cases, businesses with smaller property exposure. |

| |

|

Jim Hearn is CEO of GeoLogix Solutions (www.geologixsolutions.com), a market

data and analytics firm specializing in insurance industry solutions. He has 30 years of experience in sales and

marketing management within the information/financial services industries while

spending the last 20 years working in the insurance industry.

|