|

Beyond Insurance

Brand identity

Customer loyalty…Can you define, measure and manage it?

By Scott Addis

Customer loyalty. Can you define it? Can you measure it? Can you manage it?

In today's challenging marketplace and unsettled business environment, it is essential that you develop the capacity to define, measure and manage customer loyalty. It is not enough to understand your retention and organic growth rates. You must dig deeper to understand why customers return, why they defect, why they buy and what they say about you.

AIC's research

Over the past eight years, Addis Intellectual Capital has been conducting a research study on organic agency growth. To date, AIC has administered more than 4,300 surveys of insurance agents and brokers across the United States. The survey evaluates key performance indicators, including prospect research and qualification, customer relationship management, cross-selling, carrier leveragability, reputation and brand, agency culture and the degree to which an agency's sales process is consultative and diagnostic.

|

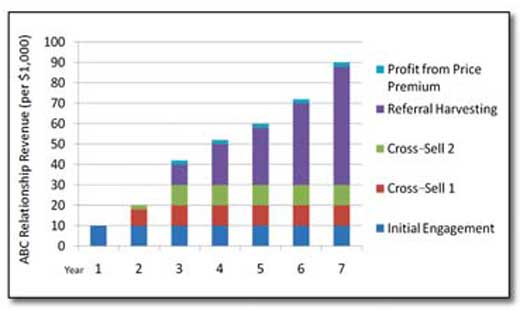

| Lifetime Value Profitability |

The most surprising survey finding surrounds customer relationship management. Over 80% of the survey respondents readily admitted that they lack a process to measure and benchmark customer intimacy, appreciation and loyalty. An additional 10% responded "uncertain." Thus, the survey revealed that only 10% of those surveyed (429 out of 4,307) have a strategy to measure and benchmark customer loyalty.

AIC concludes that most agency leaders are not equipped with the tools or resources to evaluate the lifetime value of a customer, perform customer relationship management or analyze the "loyalty effect."

The "loyalty effect"

Loyalty is commonly defined as faithfulness or devotion. Richard L. Oliver, the renowned consumer scientist and Vanderbilt University professor, referred to customer loyalty as "a deeply held commitment to re-buy or re-patronize a preferred product or service consistently in the future despite situational influences and marketing efforts having the potential to cause switching behavior." The loyalty effect is created when the consumer becomes an advocate and evangelist of a product or service. The impact of customer loyalty includes, but is not limited to, repeat purchases, brand loyalty and positive word of mouth.

Loyalty is the key to profitable growth. Fred Reichheld, director emeritus at Bain & Company and best-selling author of The Loyalty Effect (1996), Loyalty Rules (2001) and The Ultimate Question (2006) has documented research that evidences a 25% to 100% increase in profits from just a 5% increase in customer retention. Companies with the highest customer loyalty typically grow at more than double the rate of their competitors.

Customer loyalty is no longer a choice. It is the only way to build a sustainable competitive advantage. Easy? No way. It requires a dedication to, and focus on, the delivery of a customer experience that transcends price and product. At the core is an experience with the customer that is so tight that it wards off competition and entices word-of-mouth referrals.

The customer experience

The customer experience—the sum of all experiences a customer has with an organization—is the single most important determining factor of loyalty. The customer experience is comprised of actions and results which make the customer feel important, valued, understood, heard and respected. Every customer interaction molds and shapes the experience.

Building a memorable customer experience involves strategy, discipline, technology, relationship management, branding, leadership and commitment—all wrapped in a process to engage, surprise and delight. You can be sure that every one of the world's most admired companies—Apple, Google, Disney, Wal-Mart, Southwest Airlines, BMW, Nordstrom, to name a few—spends countless hours on how best to deliver a unique customer experience.

Customer loyalty can never be taken for granted. High-performance organizations are always tweaking, tinkering and, in some cases, reinventing themselves. Their goal is crystal clear—to deliver a remarkable experience.

Seth Godin, the bestselling author, teaches us in The Big Moo that, "You will grow as soon as you become remarkable—and do something about it. But you must know that remarkable isn't up to you. Remarkable is in the eyes of the consumer." Anticipating the needs and wants of the customer is rule number one in building the customer experience.

Lifetime value of a customer

The fact that only one in ten insurance agencies has a process in place to benchmark customer intimacy, appreciation, and loyalty indicates that most do not fully appreciate or recognize the lifetime value of a customer. In marketing terms, the lifetime value of a customer represents the net present value of the cash flows attributed to the relationship.

It is short-sighted to view the value of the relationship in terms of the revenue derived from the initial engagement. Rather, the following must be considered:

• Repeat purchases over the lifetime of the relationship

• Cross-purchasing of additional products and services

• Price premium due to the appreciation for the experience

• Positive word of mouth in terms of referrals

• Appreciation and enjoyment when interacting with staff

Many growth-oriented firms use acquisitions, aggressive pricing strategies, marketing campaigns and sales blitzes to improve performance. While these strategies give the organization a short-term boost, they are not long-term solutions. Customer engagement and loyalty is the most solid plan. Real growth occurs because there is a "love affair" between an agency and its customers. And, the customer can't wait to sing the agency's praises to friends and colleagues.

Let's use an example: ABC Company becomes a new client with revenues of $10,000 for its initial engagement with the Agency. Because of the agency's customer management relationship system (i.e., loyalty effect), ABC quickly becomes a "raving fan." ABC is an advocate because all expectations have been met or exceeded—illustrated in the Lifetime Value Profitability Chart. (shown above)

Over the course of the relationship, the following occurs:

• ABC continues its engagement on its initial product line yet becomes less price-sensitive.

• Because all expectations have been met or exceeded, ABC is pleased to expand its relationship through cross-sell initiatives.

• ABC becomes an advocate and a key referral source.

• The relationship is of such value that ABC is willing to pay a premium for the experience.

In the case of ABC, the net present value of its relationship is $350,000 over the seven-year term. For a $10,000 initial deposit—what a return!

The "Ultimate Question"

In the early 1980s, Fred Reichheld and his colleagues at Bain & Company began investigating the connection between loyalty and growth. The research confirmed that businesses cannot prosper without customer loyalty. Yet, there was no practical metric for relationship loyalty. Companies lacked a system for gauging the percentage of their customer relationships that was growing stronger and the percentage that was growing weaker.

Without the ability to gauge what people were thinking and feeling, corporate managers naturally focused on how much those customers were spending, a number that was easily measurable.

Reichheld and his team came up with 20 survey questions. Sample questions included: "How likely are you to continue buying Company X's products or services? How would you rate the overall quality of the products and services provided by Company X?" The goal was to find the one question—the Ultimate Question—that showed the strongest correlation with repeat purchase and referrals.

To the surprise of Reichheld, the one question—the Ultimate Question—that captured the essence of the research was, "How likely is it that you would recommend Company X to a friend or colleague?" Reflecting upon the findings, Reichheld and his Bain colleagues realized that this question made perfect sense because two conditions must be satisfied before consumers make a personal referral:

1. They must believe that the company offers superior value in terms of price, features, quality, functionality, ease of use and other practical factors.

2. They must believe that the company knows and understands them, values them, listens to them and shares their principles.

Today, this simple question is used by many of the most admired companies in the world through a metric that produces the Net Promoter® Score (NPS).

The Net Promoter Score divides a company's customers into three categories:

Promoters – Loyal enthusiasts who keep buying from a company and urge their friends to do the same

Passive – Satisfied but unenthusiastic customers who can be easily wooed by the competition

Detractor – Unhappy customers trapped in a bad relationship

The formula for the Net Promoter Score is the percentage of customers who are Promoters (P) minus the percentage who are Detractors (D). P-D = NPS.

How do legendary companies like Amazon.com, eBay, Costco and Vanguard stack up? They operate at an NPS between 50 and 80. But the average firm sputters along at an NPS of only 5 to 10. Many firms—and some entire industries—have negative Net Promoter Scores. To learn more about NPS, go to www.netpromoter.com.

Your ability to implement a customer relationship management system will significantly impact your bottom line. The loyalty effect is proven to be the most impactful strategy to achieve growth and profitability. Customer loyalty. Can you define, measure or manage it? You bet! n

The author

Scott Addis is the president and CEO of The Addis Group and Addis Intellectual Capital, LLC (AIC). AIC is a coaching and consulting company whose purpose is to transform the process that insurance agents, brokers and carriers use when working with their clients. Scott is a recognized industry leader who has been awarded the Inc. Magazine "Entrepreneur of the Year" award as well as the "25 Most Innovative Agents in America." To learn more about customer relationship management, you may contact Scott at saddis@beyondinsurance.com or (610) 945-1019 or go to www.beyondinsurance.com.

|