|

Technology

What d'ya know?

New service tests insurance knowledge & skills

By Nancy Doucette

It’s a wise person who acknowledges: “I don’t know what I don’t know.” But for the benefit of everyone in the agency, it’s good for the agency owner or manager of the agency’s personal lines, commercial lines, or benefits department, to know what staff members don’t know about their supposed area of expertise.

Karen Snedeker, director of education and business information for the Oswald Companies, headquartered in Cleveland, Ohio, reports that several members of the agency staff helped beta test a new service designed to gauge the insurance knowledge of prospective and current employees. The service is named “Hiring in Insurance Testing Service (HITS).” It was developed by management and technology consultant Virginia M. Bates, co-founder of VMB Associates, Inc., based in Melrose, Massachusetts. Bates rolled out VMBhits in April 2006.

In assembling the staff members who would test the test, Snedeker says she chose individuals with varying degrees of expertise. The group included a non-insurance person who had just passed the licensing exam, an individual with 10 years of experience, and a 30-year insurance veteran. Snedeker, who also has extensive experience in the insurance business, took the test as well. “The results were interesting,” she recalls. “With a limited number of questions, the scores came back exactly where you’d expect them to be for people who are at those levels of their development within the industry. The test was right on target.”

However, she continues, “Even our most seasoned person didn’t get 100%.”

“Not everyone will get 100%,” Virginia Bates points out. “Each question is meant to represent the information range of an experienced insurance professional who has been in the insurance industry for at least a few years. Each test has information that is gauged from fairly straightforward to a senior level of difficulty. The intent is to represent the range of ease and difficulty that makes up what is a ‘normal’ day in insurance.”

Like many long-established agencies, Oswald Companies has had to formalize procedures as the organization grew. When Snedeker joined the agency six years ago, there were 65 employees. Today there are 195 employees and multiple locations. “As an organization, Oswald Companies is committed to development, growth, and self-examination,” she explains. “As the organization grows, we have to find tools that help us continue to instill these values in our staff. We’re looking to VMBhits to help us continue to foster that part of our culture that looks toward self-development and self-improvement for the benefit of ourselves and the benefit of our clients.”

With the kind of growth that Oswald Companies has experienced in the recent past, developing skilled insurance people has become a priority. To facilitate that, the organization created its Professional Associates Program. “It’s a two-year intensive training program,” Snedeker says. “We recruit young professionals at the start of their careers who have an interest in our industry. To understand our company and the insurance business, they do a series of quarterly rotations in our various practices—Small Business, Nonprofit, Specialty Risk, Construction, to name a few. Additionally, they complete self-study courses for personal and commercial lines, obtain their licenses, and execute a series of management level projects. The VMBhits exam—which we intend to use throughout all our P&C practices and the Professional Associates Program—will tell us whether this fast-track education program we have is effective in educating our new hires quickly.”

For now, Oswald Companies plans on using VMBhits as an assessment tool for existing employees. However, more hiring will undoubtedly be necessary in the coming months, so Snedeker foresees using the service as a placement tool for prospective new hires. “Let’s suppose we have someone who scores well on the test we give that assesses their intellectual capabilities, and their personality profile indicates they’d be a good fit for Oswald Companies, but their insurance experience is limited. VMBhits will help us identify where we might best place this person—assuming we have several positions available.”

Snedeker anticipates that the VMBhits exams will also help confirm that candidates are as knowledgeable as they claim to be. Additionally, she expects that the exams will identify an area of weakness in an otherwise qualified candidate. In instances like that, Snedeker says the practice leader will be able to develop an appropriate growth plan for that individual that might include everything from an internal mentor who is well versed in that particular coverage area to an Internet-based self study course or an outside class. “We’re going to be flexible in how we approach the educational process,” she says. “One size does not fit all.”

At Milne & BNC Insurance Services, Inc., based in Phoenix, Arizona, Margaret Harman heard about VMBhits from a co-worker. “I’ve been to Virginia’s seminars. I was familiar with her depth of knowledge. So anything with her name attached to it would have to be good,” Harman says. “We were in a hiring phase when I first learned about this product, so we began using it right away.”

Milne & BNC has 12 offices in five states. The majority of the agency’s business is commercial lines. Harman, who is director of operations, explains that she’s used VMBhits exams to test several candidates whom she’s interviewed for commercial lines account manager positions as well as applicants for assistant positions. During the interview she explains to the applicants that they will be administered a test that will measure the level of their insurance knowledge. She reassures the candidates that it’s not a pass/fail exam but rather, “it’s just to gauge the level of their insurance knowledge.”

Candidates are able to take the test without coming into the Phoenix office. Harman provides them a link to the VMBhits Web site where the timed exam is available. “There’s adequate time to finish if you know your subject,” Harman notes. “However, there’s not enough time to research answers.” For the most part, though, she prefers that candidates come to the office for a face-to-face interview. She has a room set up where applicants can take the test. “By the time they come back to my office to tell me they’re finished, I have the results of the exam,” she says.

Not only does Harman receive the individual’s score by area, but she also receives the candidate’s answers in addition to the correct answer should the candidate have answered incorrectly. This is helpful, she explains, because it helps her evaluate the candidate’s judgment and problem-solving skills.

“Overall, this is a great tool to assess a candidate’s insurance knowledge, experience, and common sense,” she says, adding that she’s used the VMBhits Multiline - commercial test as well as the E&O Safety and Best Practices test. By using both tests she says she was able to learn about the candidates’ technical knowledge in addition to their understanding of procedures.

At the Charles L. Crane Agency, headquartered in St. Louis, Missouri, Jane M. Scott, PHR, plans to use VMBhits in addition to other online assessment tools that the agency uses when considering potential new hires. Scott says once she’s reviewed a candidate’s resume, she follows up with a phone interview to assess the person’s attitude, personality, and phone skills. If it appears that the candidate will be a good fit, Scott e-mails an employment application and other pertinent forms. She also includes a link to the Omnia site so the candidate can complete the Omnia® Profile which identifies an individual’s tendencies in the workplace.

When it’s time for the face-to-face interview, then, Scott has a good amount of information to discuss with the candidate—the results of the Omnia Profile in addition to her standard 14 questions which range from “What is your greatest strength?” to “What did you learn from your first job?” Following that, she administers the VMBhits exam. As of this writing, she’s used the VMBhits Benefits exam and one of the personal lines exams. “You can do behavioral interviews, but if a new hire doesn’t understand insurance, then you’re putting a good person in a bad situation, setting them up for a struggle. No one enjoys coming to work under those circumstances,” she says.

As Karen Snedeker noted earlier, agencies that are in a growth mode need to have a variety of tools to properly assess current and prospective staff. “VMBhits is a creative, innovative approach to a challenge that we all face in our business,” she says. *

The nitty gritty about VMBhits

As of August 2006, VMBhits offers exams in personal lines, commercial lines, agency management including E&O safety, office productivity, and benefits/life & health. “There are numerous tests for single lines of insurance. The popular Personal and Commercial Multiline tests are actually a series of exams with different questions in random order,” Virginia Bates explains. Should an individual need to repeat a test, she says, “the odds are high that a repeat test taker will be assigned a different version of the test.”

Bates chose MWare, Inc., based in Quincy, Massachusetts, to develop the VMBhits exams and Web site. Additionally, MWare provides support for the site and processes payments. Jeff Matherly, who has more than 25 years of experience in a variety of technology and consulting roles, is one of the founding principals of MWare. He describes the VMBhits testing site as straightforward. “The real value is the ease of use from the administrator’s perspective,” he says. “The administrator can quickly order up a test and be able to see the results quickly after the test has been scored.” Communication on the site is secure via its SSL certificate.

Matherly says the test questions aren’t tricky, nor are the exams tiered for beginners or advanced insurance practitioners. “Junior people in the industry who have had training will get about 70% of the questions correct. More senior people will get 80% to 100%,” he says.

He goes on to say that VMBhits recently introduced tests that will verify basic competency in Microsoft Word and Excel. “It can be very disruptive when people can’t use these tools correctly,” he notes.

Cross links are in place at both the Omnia and the VMBhits Web sites making it simple for visitors to either site to access information about the other.

The following exams are available:

Commercial Lines

• Commercial auto and professional coverages

• Commercial liability

• Commercial property

• Workers compensation

• Umbrella and excess

• Multiline - commercial

Personal Lines

• Homeowners

• Massachusetts automobile

• Personal automobile

• Condo and dwelling fire

• Umbrella and excess

• Multiline - personal

Agency Management

• E&O safety and best practices

• Agency system use and management

• Agency accounting and bookkeeping

Office Productivity

•Microsoft Office Word

•Microsoft Office Excel

Benefits/Life & Health

• Benefits |

For more information:

VMBhits

Web site: www.vmbincins.com |

|

Click on image for enlargement |

|

| |

Carmen Edgehouse (seated) and Kate O’Donnell view a sample question at the VMBhits Web site. Edgehouse and O’Donnell are participants in the Oswald Companies’ Professional Associates Program—a fast-track education experience.

|

| |

|

| |

David C. Jacobs, Executive Vice President (left), and Karen Brown Snedeker, CPCU, Director of Education and Business Information, both with the Oswald Companies, discuss additional ways to use VMBhits to foster the agency’s culture of self-development and self-improvement. |

| |

|

| |

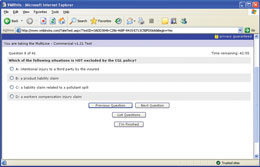

One of the questions from the Multiline - commercial test. Note that the time remaining to complete the test appears at the right of the screen.

|

| |

|

| |

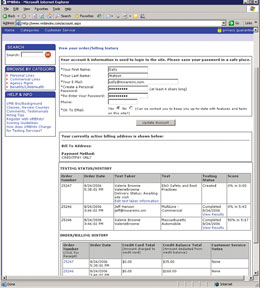

| This screen capture illustrates how a test administrator can view testing history and status, as well as order and billing information. |

|