|

| |

Companies/Brokers/MGAs

Do you have a new product or enhancement?

Click here to submit your information

—OR—

call 1-800-428-4384 to speak to

Eric Hall Executive Vice President - Advertising, National Sales Director |

|

| |

| INSURANCE MARKETPLACE SOLUTIONS |

|

| |

|

|

Boats and Yachts

Like automobiles, boats and yachts are modes of transportation but the coverage required is quite different and more than just an auto policy on water. Boats and yachts can also substitute as residences but the coverage provided is different and does not match that provided by a homeowners policy. Instead of simply being an extension of standard personal lines coverages, boat and yacht coverages are extensions of ocean marine coverage forms. Where you start in explaining a coverage can have a major impact on how a customer remembers key elements of that coverage. Therefore, using a personal lines loss scenario to help a customer understand watercraft coverage can lead to false expectations and result in major conflicts when a loss occurs.

|

| |

|

|

| |

| The Boats and Yachts Marketplace |

| |

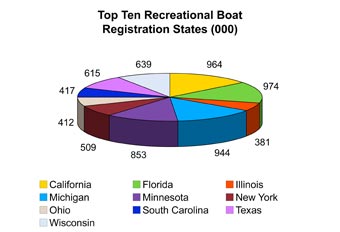

Source: National Marine Manufacturers Association |

According to the National Marine Manufacturers Association (NMMA), 13,060,000 registered recreational boats are in use in the United States. Over half of them are in the 10 states shown above. Four of these states are on the Atlantic Ocean or Gulf Coast and are exposed to periodic tropical storms and hurricanes.

NMMA points out an interesting fact. Boat registration is increasing in all categories longer than 16 feet and declining in those less than 16 feet long. Based on sale prices, NMMA suggests that boaters are buying larger and better equipped boats. Demographically, 69% of boat owners are married and their median age range is 45 to 49.

For more information on the National Marine Manufacturers Association,

visit their website at: www.nmma.org

For information about boating in general,

take a look at the NMMA website at: www.discoverboating.com

|

| |

|

| |

|

These statistics suggest that married, middle-age people own boats. This demographic wants fun and maybe some excitement, but they also want comfort and safety. Naturally, this combination adds up to larger and more expensive boats. Larger boats are more complex and may even require a crew. These yachts usually represent a significant part of a customer’s assets and many of his or her dreams. If an agent makes an error or mistake in properly insuring a client’s boat or yacht, it could lead to that client moving his or her entire insurance portfolio elsewhere. Remember, dreams must be properly protected.

|

| |

|

| |

|

To better understand the coverage concerns, consider this federal court case:

The Gypsy, owned by a Mr. Labarca, sank overnight while moored in its slip. Labarca sued for coverage, claiming that the loss was accidental and covered. The court disagreed and ruled in favor of the syndicate providing the coverage. On appeal, the higher court focused on the proximate cause of the loss and a key obligation held by parties covered by marine insurance.

The day before the loss, Labarca and a mechanic removed two of the Gypsy’s seawater cooled air conditioners in order to complete some interior painting. Before leaving the ship, the two men reinstalled the air conditioners and then turned all four of them on. Unfortunately, neither Labarca nor the mechanic remembered to cap the two hoses designed to return water to the sea after being used to cool the air conditioning units. Instead, the water was pumped back into the vessel and caused the Gypsy to sink.

The court ruled that Labarca's actions rendered the Gypsy unseaworthy and that this condition was the proximate cause of loss. The court was not persuaded by Labarca's argument that failing to seal the hoses was similar to a peril of the sea because it was accidental. The court considered an insured's duty to comply with the insurance contract's requirement of maintaining a seaworthy vessel to be absolute. Not sealing the hoses and then operating the air conditioners breached the obligation and the foreseeable consequences (inundation of water via the open hoses) caused the loss.

The lower court decision in favor of the insurer was affirmed.

Underwriters At Lloyd's, And The Cox Syndicate At Lloyd's,Plaintiff, Appellee, V. Carlos H. Labarca, Defendant, Appellant. U.S. 1st Circuit Court of Appeals, No. 00-2142, August 2, 2001. Affirmed.

|

| |

|

| |

Homeowners and auto policies may pay when an insured makes an innocent mistake but hull insurance is not so generous. The duty to maintain a seaworthy vessel in the case outlined above is just one of many examples of how an insured may be surprised to discover differences in coverages. There are many more!

When asked about potential coverage gaps, Matt Anderson, vice president of marketing of Global Marine Insurance Agency said it best. “There are different markets available to cover all the gaps, depending on the needs of the customer and the vessel. It is the specialty marine insurance agency’s responsibility to adequately assess the risk and locate the correct market.” What types of gaps might there be? Thomas Conroy, marine director of Markel American Insurance Company identified one. “Every boat owner should carry liability and pollution coverages at a minimum. If a boat catches fire and the owner is found legally liable for a large marine fire that burns several other boats, not only will he or she be responsible for third party damages, but also for pollution.” He went on to recommend that owners look for a carrier that provides a separate limit for pollution rather than including that coverage in the liability limits.

Cary Breese, president of Trafalgar Marine Insurance Services, Inc., identified the lack of crew liability coverage as a potential coverage. The crew working on a watercraft is protected under the provisions of the so-called Jones Act, which acts much like workers compensation law and creates a liability to the vessel owner for any injured crewman, much the way an employer has liability to an employee injured on the job. Another important issue of is that of navigational warranty. Many yacht policies are issued with warranties that limit how and where the vessel can operate. Coverage is voided if the insured violates these warranties. The navigational warranty is similar to attaching a rider to an auto policy that provides coverage while the insured is traveling between New York and Los Angeles through Texas, but voids coverage if he decides to travel through Colorado instead. Requiring that a vessel be operated only by a licensed captain, i.e., a Captain Warranty, can also play a role in voiding coverage, similar to providing auto coverage to a teenager only when a parent is in the vehicle.

Crew liability can be purchased as part of Protection and Indemnity (P&I) coverage, one of the minimum coverages recommended by Jake Hill, director of sales and marketing of Seahorse Underwriters. He also recommends hull coverage at agreed value, all risk, pollution, on-water towing, personal effects and medical payments along with uninsured/underinsured boater’s liability. Damon Pesce, marketing manager of Maritime General Agency adds fuel spill and environmental damage coverage to his basic list.

Click here for the complete article … |

| |

| WHO IS WRITING BOATS & YACHTS? |

|

|

| |

BROKERS

MANAGING GENERAL AGENTS

INSURANCE COMPANY MARKETS |

| |

| |

|

|

|

|

|

|

| |

| |

This message was sent by The Rough Notes Company, Inc.,

11690 Technology Drive, Carmel, Indiana, 46032

1-800-428-4384

|