INSURANCE MARKETPLACE SOLUTIONS

Insurance Agents Errors and Omissions

This month, it’s all about you.

Insurance agents are not computers, order takers or golfing/fishing/shopping buddies. They are highly trained professionals who are responsible for working with a client in developing a comprehensive plan to protect vital assets.

There are many types of insurance products. There are many professional designations. There are many specialties and specialists. However, in the end all agents have one thing in common. When a loss occurs, the client is depending on them to have placed the promised coverage.

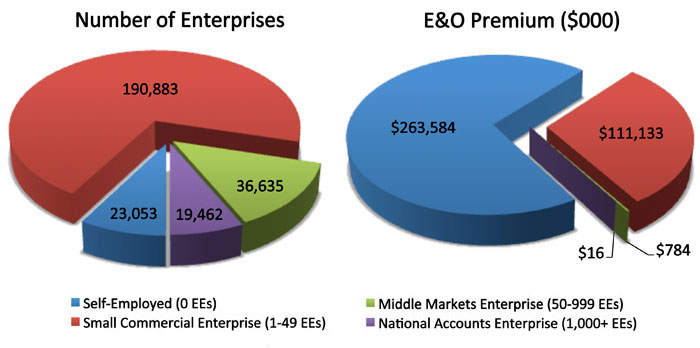

GROWTH POTENTIAL

The vast majority of insurance agents are small commercial enterprises. There are a number of self-employed agents, but most agents work with a larger enterprise and obtain their E&O coverage and many other services through that other enterprise. Over 70% of the E&O premium is paid by the small commercial enterprise.

For more information:

MarketStance website: www.marketstance.com

Email: info@marketstance.com

STATING THE OBVIOUS

The insurance agent is the conduit linking the insurance buyer to the insurance carrier. The agent is expected to be able to communicate in both the language of the client and the language of the carrier. Unfortunately, claims can happen because something is lost in translation.

The best way to avoid the communication problem is documentation. A checklist of recommended coverages can lead to discussions about coverages a client may not have considered in the past. The checklist also allows the client to clearly indicate when coverage is desired and when it is not desired.

A written procedure describing how your agency interacts with clients will help your staff be the professionals your clients deserve and also will prevent misunderstandings.

THE HEART OF THE MATTER

Here is a possible scenario:

Karina has written Paul's insurance for many years. She has his homeowners, auto, boat and umbrella coverages placed with one of her best carriers. When Paul married Sharon, he invited Karina to the wedding. Karina was the first to know that Paul had bought Sharon a car because she added it to his auto policy.

The marriage encountered some turbulence, and Sharon took the car and moved out.

Paul stopped by Karina's agency one day to talk. He explained the separation and his hope of reconciliation. Karina sympathized with Paul and wished him the best but never discussed or reviewed the insurance implications. Unfortunately, about four months after the separation, Sharon was in a car accident. She was badly injured, and the occupants of the car she struck were also injured.

Paul called Karina, who immediately notified the insurance carrier. The carrier did a thorough investigation and denied coverage because the policy listed only Paul as the named insured. Sharon had been away from the residence for over 90 days, so his auto policy no longer covered her.

Sharon and Paul did reconcile, and together they sued Karina because she had never recommended that Sharon be added to the auto policy as a named insured. They also recast the conversation in Karina's office as an insurance consultation, not a just a friendly chat, and they said that at that point Karina should have told Paul about the 90 days' residency requirement. Karina has no documentation to dispute their assertions.

Karina's insurance agents errors and omissions policy may be paying for all of the damages.

THE MARKETPLACE RESPONDS

The market for insurance agents errors and omissions coverage is robust. The Independent Insurance Agents & Brokers of America and the Professional Insurance Agents offer coverage through their state associations. Other insurance associations sponsor programs for their membership. However, these are not the only options.

Glenn W. Clark, CPCU, owner and president of Rockwood Programs, Inc., explains their unique approach to this coverage. “The market for agent E&O is always in flux. The programs offered by the large national agent associations tend to change carriers to keep members’ premiums from increasing too much. At Rockwood, that’s not our market. We target niches that aren’t served by association programs, like newly licensed agents, crop insurance agents, and agency clusters.”

The road less taken is also the approach of Innovative Risk Solutions. John Watt, ARM, vice president, says, “We arrange coverage for retail agencies, specialty wholesale and surplus lines brokers, MGAs and underwriting managers, and insurance consultants who operate on a fee for service basis rather than earning commissions on the sale of insurance products.”

Linda Blechman, assistant vice president-insurance agents’ professional liability at Lee & Mason Financial Services, Inc., explains that they take a slightly different approach. “Our policy is available to licensed property/casualty and life/health agents and brokers and to wholesalers, general agents, managing general agents, and program administrators. We can extend coverage to insurance consulting, premium financing, claims adjusting, loss control, and risk management services. Coverage also is available for the sale of variable life insurance, variable annuities, and mutual funds.”

There are both admitted and nonadmitted markets writing this coverage with some being placed in London

Mr. Clark explains that the coverage offered through Rockwood varies based on the services provided by the customer. They have four different types of coverage so that they can be as responsive as possible. As an example, “We have a program for newly licensed P/C agents with one to three years’ experience who offer only standard lines of business and generate less than $150,000 in gross commission revenue annually; the deductible is $5,000, and limits are $500,000/$500,000 or $1 million/$1 million. Agents insured under this program are eligible for the standard program after they have three years’ experience.”

Read the complete article here

WHO WRITES INSURANCE AGENTS ERRORS AND OMISSIONS COVERAGE?

MANAGING GENERAL AGENTS

PROGRAM ADMINISTRATOR

|