INSURANCE MARKETPLACE SOLUTIONS

Children's Day Care Centers

Where are the children? Many are at day care…and usually that is a good thing. Well-run day care centers allow parents to pursue their careers without worrying about their children’s safety. They know their children are not only safe but are also playing and learning.

The day care industry offers parents many choices. Some centers accept babies, and some care for children with special needs. Some facilities provide care before and after school. Many are open only during standard business hours, and some have expanded to 24-hour facilities to accommodate third-shift workers.

The insurance industry knows that “one size fits all” programs don’t work for day care centers because this is not a “one size fits all” industry. There are many carriers and many options available. In underwriting this class, every carrier pays strict attention to detail because what the day care center does and how well it does it determines its acceptability and pricing.

GROWTH POTENTIAL

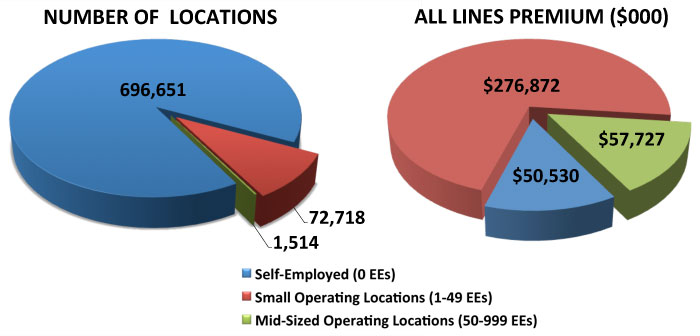

In-home operations continue to dominate the day care industry. The caregiver’s homeowners policy often can cover a home-based operation. In addition, there are over 70,000 small commercial operations that generate over $275 million in premium. It is anticipated that these small facilities will grow by at least 5.5% over the next two years and mid-sized operations will grow by a similar percentage.

For more information:

MarketStance website: www.marketstance.com

Email: info@marketstance.com

STATING THE OBVIOUS

Children must be protected, and they also need opportunities to learn and grow. Parents entrust their children to day care facilities expecting that the child not only will be safe but also will acquire new knowledge and learn valuable social skills. Babies demand constant care because they are vulnerable, and older children must be carefully supervised because they are active and curious.

THE HEART OF THE MATTER

Here is a possible scenario:

Mallory, a bright three-year-old, really enjoyed attending Premier Day Care Center. She loved her teachers, her classroom, and the playground equipment. There was a lot to do and constant activity.

Like most children, Mallory was very curious and liked to explore her surroundings. One day she went into the bathroom and decided to see what she could successfully flush down the toilet. She tried paper, but that was boring. Next she tried small blocks. Plastic soldiers and monkeys worked too. Her downfall was the stuffed bear. Despite multiple attempts to flush it, the bear just wouldn’t go down and the water kept pouring out.

Water flowed into the hallway and into two classrooms. Ken, a 70-year-old volunteer reader, slipped on the water in the hallway. His cries for help alerted Dawn, the director, who quickly responded. An ambulance took Ken to the hospital, and Mallory was put in a short time out where she considered her next experiment.

Dawn called her plumber. She then called her insurance agent to report serious water damage plus a bodily injury incident.

THE MARKETPLACE RESPONDS

The insurance market for child day care facilities is robust, but appetite varies by carrier. Some are interested only in in-home operations while others write only commercial facilities. Both admitted and non-admitted markets are available.

Carriers mentioned by our experts include Capitol, Essex, Great American, Landmark American, Northfield, Philadelphia, Scottsdale, USLI, West Bend, and Western World.

Dave Lehman, commercial underwriter at Roush Insurance Services, Inc., says, “We have binding authority for day care centers, in-home day care, before and after school programs, sick-child day care, and child care associated with hotels, clubs, YMCA/YWCAs, and churches. Operations that provide care for children with special needs can be considered on a submit basis. Drop-off centers at malls or other retail establishments can also be considered on a submit basis.”

“We provide coverage for licensed commercial child care centers, licensed centers located in schools, child care centers located in churches and at preschools, and before- and after-school programs,” says Cheryl Tamasitis, assistant vice president, commercial lines division at Philadelphia Insurance Companies. “We do not accept in-home child care centers, new ventures with no experience, drop-in only centers, babysitting services, or any unlicensed child care centers unless they are exempt from licensing, as are many facilities associated with religious organizations.”

Donna Brooks, commercial lines underwriter at Arlington/Roe & Co., Inc., says, “We consider anything from small in-home day care operations to large commercial day care centers. We’re willing to consider any facility as long as it meets our carriers’ criteria.”

Coverage for commercial day care centers is written primarily in package policies. For in-home operations, however, the liability coverage is monoline and property coverage is added to the homeowners policy.

Read the complete article here

WHO WRITES CHILDREN'S DAY CARE SERVICES?

|