Excess Flood Coverage

“It was not the weather event we expected.”

Isaac was only a Category 1 hurricane, but because of its slow movement, the water it produced caused much more damage than expected. The wind damage was minor, but there was major flood damage. The storm’s path moved through areas in the South where the ground was already so saturated that it could not hold any additional water. It then moved into the Midwest, which welcomed a possible drought-busting rainfall. However, the parched condition of the soil suggested that it might not be able to absorb the rain. This could lead to significant surface water flooding and flash flooding.

Flood claims from Isaac will be paid only if flood insurance is in place. The coverage available through the National Flood Insurance Program (NFIP) may be sufficient for some homeowners and businesses, but many others need protection beyond the program’s $250,000/$100,000 building/contents limits for residences and $500,000/$500,000 limits for commercial risks.

The private insurance market offers limits in excess of the maximum NFIP limits. It also offers coverage in excess of primary limits available in the private market. Many homeowners and business owners in Isaac’s path knew they might sustain flood damage. Those who had purchased excess flood coverage also knew they would have the funds to clean up, repair, or rebuild.

GROWTH POTENTIAL

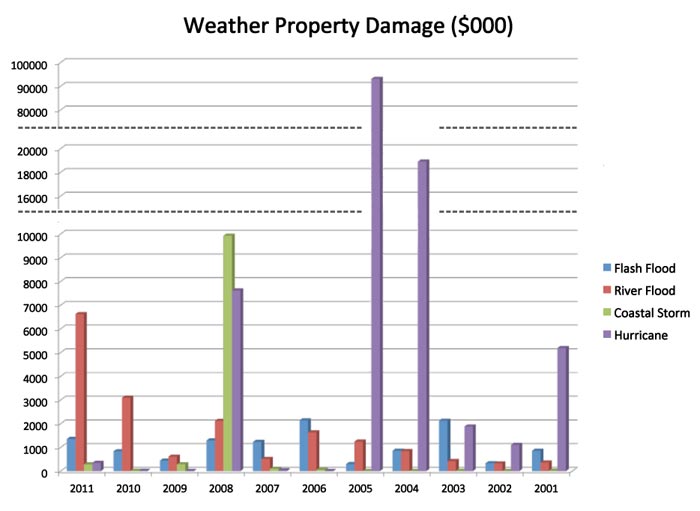

NOAA, National Weather Service

Office of Climate, Water, and Weather Services

www.nws.noaa.gov/om/hazstats.shtml

The information above reflects damage in the United States, Puerto Rico, Guam, and the Virgin Islands. Each year is current through at least the year following the event.

Flood damage occurs in all parts of the country. Flash floods can be particularly devastating because they often occur unexpectedly and in areas that do not appear to have much (or any) exposure to flooding. Between 2001 and 2011, the cost of inland flooding was almost $30 billion. During the same period, coastal storms (flood and wind) caused over $10 billion in property damage. Because of the $93 billion in damage that Katrina and other hurricanes caused in 2005, hurricane damage (flood and wind) was over $128 billion during the time period reflected in the chart.

STATING THE OBVIOUS

Commercial and residential property forms exclude flood damage. Primary flood coverage is available through the NFIP. However, it is available in only certain areas and is subject to a number of limitations and restrictions. Primary flood coverage is available through the private insurance market in areas not considered prone to flooding. Excess flood coverage is available in all areas, subject to each carrier’s underwriting criteria and underlying limits.

THE HEART OF THE MATTER

Here is an actual loss scenario:

Broad Ripple is a popular entertainment district in Indianapolis that is located close to the White River. A dam on the river diverts water to the White River Canal, which flows through Broad Ripple and into downtown Indianapolis. The canal serves many purposes but was built primarily for the purpose of flood control. Floodgates can be opened to relieve pressure from the White River and prevent flooding downstream. The gates are usually kept open.

In May of this year, heavy rain caused many of Broad Ripple’s streets to be flooded. At several intersections, vehicles could not get through the standing water. Many businesses had water in their basements and first floor areas, although there was no flooding in the rest of Indianapolis.

An investigation revealed that some of the floodgates were closed, which prevented water from flowing from the streets into the canal. Although most of the affected businesses were able to reopen within a few days, one was closed for months because of damage to its floors, walls, and furnishings.

THE MARKETPLACE RESPONDS

“Many private insurers offer excess flood protection, both for commercial and residential exposures. Carriers include Markel, Lloyd’s, Chubb, Lexington, Zurich, and Chartis. There is interest in the marketplace for both commercial and residential coverages,” according to Connie Masella, managing director, brokerage property, at Markel Corporation.

The underwriting appetite for excess flood varies significantly by carrier. Each has its own criteria and areas of interest.

Eric Nikodem, executive vice president and property division executive at Lexington, explains: “We evaluate the location-level information to determine the susceptibility to flood and establish a ‘normal loss expectancy’ (NLE). This includes identifying the location’s presence within or outside of a mapped flood area, in addition to examining location-level risk mitigation and preventive flood measures. These procedures are consistent for both commercial and residential flood underwriting.”

The Chubb Group of Insurance Companies writes excess flood coverage strictly for residential risks. Steven Berg, regional product manager for Chubb Personal Insurance, says: “To be eligible for our primary or excess flood policy, the insured must have a homeowners policy for the subject location written with us.”

The potential customer base for excess flood insurance is vast, Ms. Masella says. “Everyone whose asset values exceed the coverage available in the primary flood market should consider buying excess flood coverage. Almost everyone lives in a flood zone, and nearly a quarter of all flood claims are made in areas considered to be low or moderate in risk. In high-risk areas, there is a 25% chance of experiencing a flood during the term of a 30-year mortgage.”

The Biggert-Waters Flood Insurance Reform and Modernization Act was recently signed into law. It extends the NFIP for five years and makes some significant changes in the program. An example is how to adjust clean slab losses that could have been caused by either water or wind. We asked our experts how the new law will affect their excess flood writings.

Mr. Nikodem explains: “While we are cognizant of changes to the NFIP because the act impacts our clients, the process by which we underwrite excess flood is unchanged by revisions to the program.” He adds: “While the Biggert-Waters Act addresses how to apportion a loss deemed ‘indeterminate’ under the NFIP (i.e., whether the result of flood or wind, or the combination thereof), our policy contains a specific definition of flood, and a claim will be adjusted accordingly. Our underwriting of a given risk is specific to that risk’s attributes, and changes to the NFIP will not affect our policy or our underwriting of the peril of flood.”

“Excess flood carriers typically require insureds to purchase the maximum NFIP coverage available,” says Ms. Masella. “If there was no federal program, it would take some time for the primary market to respond and fill the gap. That would make purchasing excess flood more complicated. The wind/water slab claims criteria in the act serve to document what most insurers were likely already doing when claims were presented, where there was little or no evidence of what exactly caused a loss. When in doubt, the claim was split between applicable coverages/carriers, unless one of them clearly excluded concurrent causation. It is possible that markets will seek to enhance their concurrent causation language, though to date there does not seem to have been a movement in that direction.”

Read the complete article here

WHO WRITES EXCESS FLOOD COVERAGE?

|