Special Section Sponsored by Target Markets Program Administrators Association

Analysis of Market is Key to Program Creation

The trucking market is a big universe, full of niches that perform differently

By Bob Bloss

One of the key factors in determining whether a market is ripe for a program approach is whether there is sufficient premium and number of enterprises to support a program. Another key factor is whether the business is growing, and how rapidly.

Oftentimes where there is rapid growth, certain segments within the niche will have difficulties in finding a market, making it an excellent choice for a program administrator that understands the business and can underwrite it successfully. The trucking market indeed fits this bill.

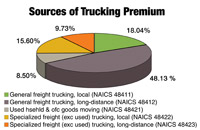

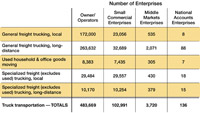

The more than 590,000 enterprises involved in truck transportation provide $5.19 billion in premium, of which $2.07 billion, or 40% of the total, comes from commercial auto, according to data compiled by MarketStance, Middletown, Connecticut. Long-distance general freight trucking represents the largest subgroup, with $2.5 billion in premium, or 48.1% of the total. Local general freight trucking is the next largest subgroup, with $937 million in premium (18.0%), followed by local specialized freight trucking with $810 million (15.6%); long-distance specialized freight trucking with $505 million (9.7%); and trucks used for moving used household and office goods with $441 million (8.5%).

MarketStance forecasts an annual growth rate of 1.8% for the years 2005 through 2009 throughout the United States. However, annual growth rates exceeding 4% are forecast for five states—Nevada (5.6%), Arizona (4.8%), and Delaware, Alaska and Arkansas all at 4.3%. While on the surface, the strong growth appears to be good news, a MarketStance study on the performance decline in commercial auto at the end of the last decade found that, in the trucking sector, extremely rapid growth often signals deteriorating loss experience. This appears to be the result of a lot of overtime hours and the use of inexperienced drivers to keep up with the rapid growth.

MarketStance goes on to point out that even states with high growth rates offer individual class and territory markets with “safer” opportunities. For example, in Nevada, non-employer size firms in all transportation classes except local general freight trucking are showing very high growth rates and are cause for concern. On the other hand, small commercial accounts in all trucking classes are growing at reasonable rates, as are long distance general freight trucking and movers of used household and office goods in the middle market accounts.

The key point is that, when deciding on a niche, a more granular look at a category can uncover opportunities that might otherwise be missed.

For more information on this niche or other niche market opportunities, contact MarketStance at (888) 777-2587 or e-mail info@marketstance.com. → |

|

| |

|

| |

Trucking growth forecast by state (click to enlarge).

|

| |

|

| |

Sources of trucking premium (click to enlarge). |

| |

|

| |

Number of enterprises (click to enlarge).

Data compiled by MarketStance. |

|